THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Are your investments diversified?

Chances are you have no idea.

While the term investment diversification sounds complicated, it is a simple concept that will help you lower your investment risk and also increase your returns over the long term.

In this post, I walk you through the idea of what investment diversification is and how you can make sure you are diversified to take advantage of it.

Table of Contents

How Investment Diversification Builds Wealth

Stock Market Risk

Before getting into portfolio diversification, we need to understand risk and market risk more importantly.

There are many risks when investing in the stock market.

Many are out of your control, like unsystematic risk.

Unsystematic risk is a risk that is for a company or an industry.

For example, if the economy goes into recession, people will travel less since they have less money.

Businesses in the travel industry will suffer, like hotels, airlines, resorts, etc.

You cannot avoid this type of risk.

You can limit it by investing less money in these stocks, but every company and every industry faces unsystematic risk.

In other words, you can’t avoid it.

Another type of risk is market risk, which is the risk of investing in the market.

You will sometimes hear it called systematic risk.

The good news is that you can control this risk based on investing your money.

And how you invest is all about diversifying your investments.

What Is Investment Diversification?

To understand this investing concept, we first need to define it.

You probably have heard people say, “don’t put all your eggs in one basket,” at some point.

This saying is a simple way of talking about diversification.

It is an investment mix in various asset classes to manage risk and improve returns.

Here is an example to drive the point home.

You go to the store and look at boxes of crayons.

There is a box of only red crayons, a box of only blue crayons, a box of rainbow colors, and a box of 64 different colors.

The box of red or box of blue crayons is not diversified.

You only get one color per box.

The other two boxes are diversified.

This example is diversification in action.

When it comes to investing, the red box of crayons could be stocks, and the blue box of crayons are bonds.

While you can choose to invest in only one or the other, you limit your potential returns and increase your portfolio risk.

If you took the rainbow color box, you would be owning both stocks and bonds and using diversification to your advantage.

Before we move on, I also want to point out a classic portfolio diversification mistake many investors make.

They buy individual stocks in two different companies and think they are diversified.

For example, they buy Walmart and Target.

While this might look like diversification, it isn’t because both are retail stocks.

This mistaken idea of diversification puts them at a higher risk of losing money.

If the economy goes south, both are going to get hit hard.

Proper diversification between stocks is having them be in different industries.

So you buy stock in Walmart and United Healthcare.

While there is potential for both to lose value in a down market, they likely won’t both get crushed.

Jay W. Rishel, CFP® of Overman Capital Management puts it this way.

“In the summer of 2019, if you accurately predicted that a global pandemic in 2020 would effectively shut down our world, work-from-home/remote technology companies like Zoom, Peleton, and DocuSign would see their stock performance rocket upward, and you shorted energy stocks then maybe you don’t need diversification in your portfolio.

However, diversification is a must in your investment portfolio for those of us who cannot predict the future. Diversification allows you to balance out your risk and thus balance out your portfolio’s returns. Take 2020 as an example. If you invested across various sectors of the economy, the 40% return in your technology sector holdings buoyed the 30% loss in your energy sector allocation.”

The Power Of Diversification

Now that we understand what diversifying your investments looks like let’s see how it can help you grow your wealth over time.

I want to play a little game with you.

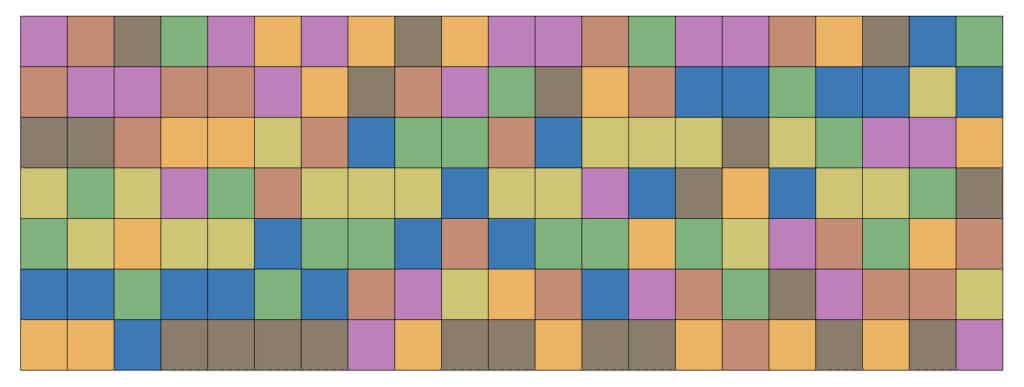

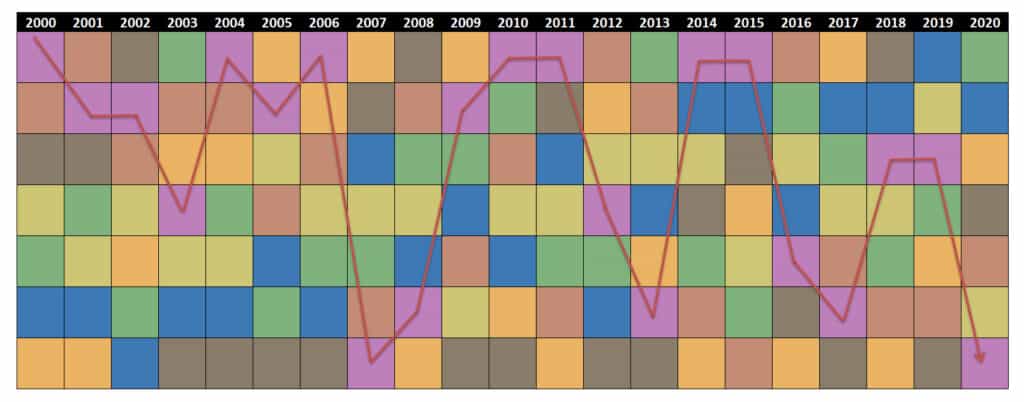

I’d like you to look at the picture below and see if you notice anything.

The picture isn’t a trick quiz where if you stare long enough, an image appears, and it’s not a Tetris map either.

Just see if you can spot a pattern.

My guess is that you did not see a pattern.

If you didn’t see a pattern, this is good because there is no pattern to be found.

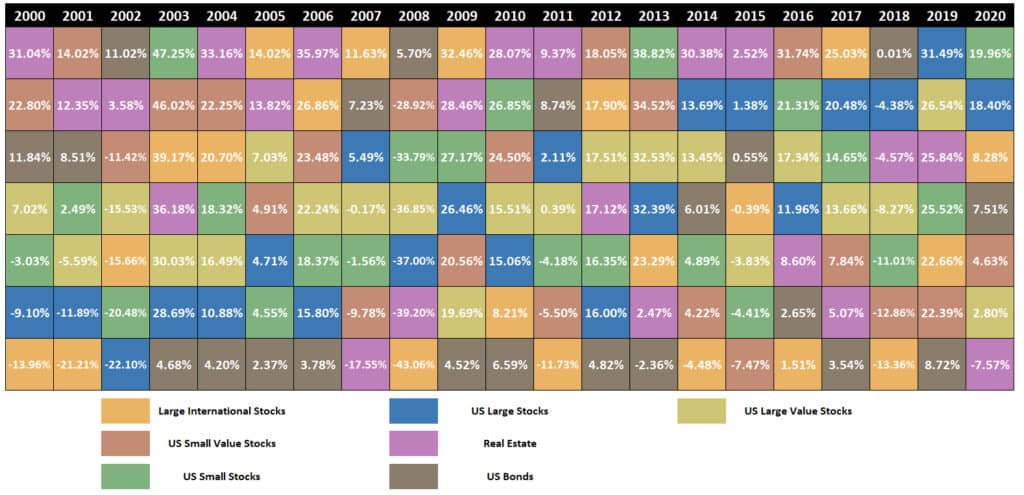

The colored boxes each indicate a market benchmark from 2000 through 2020, ranked by the best performing benchmark for a given year.

This chart in the investment industry is known as the periodic table of investment returns or an investment quilt.

Here is the same chart again, with labels for you to follow more easily.

As you can see, one benchmark does not dominate the top of the chart.

Each one is all over the map. Let’s look at a few examples more closely.

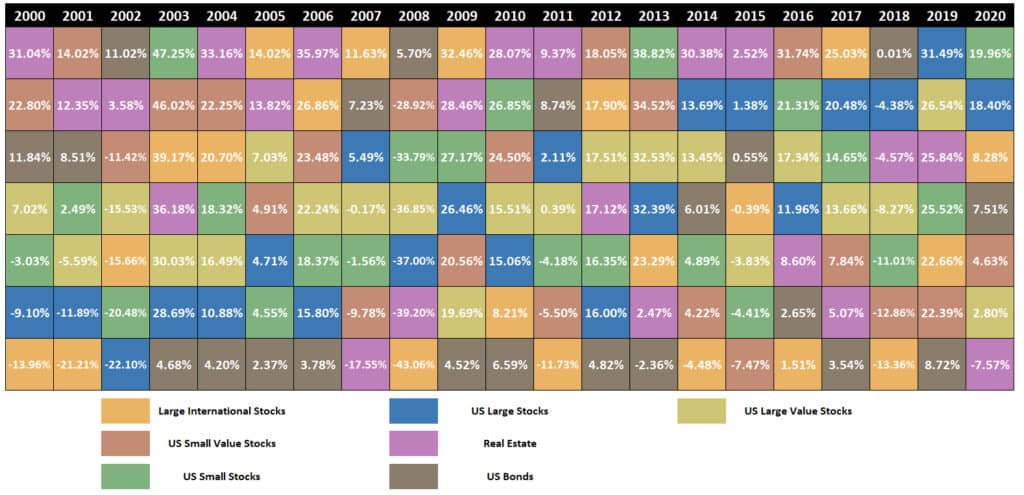

International Stocks

How has the asset class of international stocks done over the past 20 years?

Varied widely in returns is one way to put it.

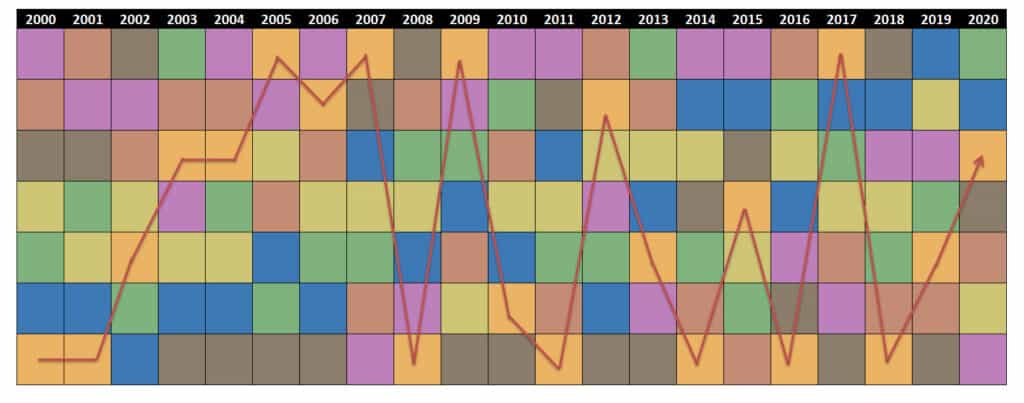

Here is the above chart again.

This time, I am highlighting the performance of international stocks by using the red arrow.

You will see that in 2000 international stocks were the worst performers.

But four years later, they were some of the best performers in the market.

Then they plummeted to the bottom, only to rise once again.

U.S. Stocks

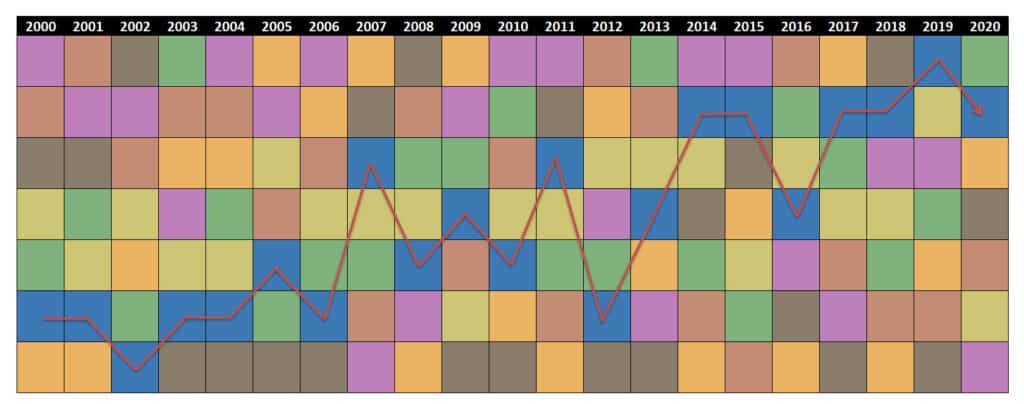

While international stocks tend to have more volatility associated with them, the asset class of large U.S. stocks is also all over the map.

Below is a chart of their performance over the past 20 years.

U.S. stocks were poor performers for many years until 2007.

After that, they tended to have average performance until 2014, when they outperformed other indices.

Real Estate

Here is one last example to show you.

Let’s look at real estate.

The historically typical return for this asset class is around 3% a year.

- Read now: Discover the pros and cons of investing in real estate

- Read now: See how to invest in real estate using the BRRRR method

When you hear people talking about getting rich in real estate, it typically happens by renting out the property and not price appreciation.

Understand prices do rise, but not as they have recently.

Looking at the chart below, this asset class is a strong performer from 2000 through 2006.

Then the bottom fell out in 2007.

But in 2009, it came roaring back for a short run, only to fall again.

The Need for Diversification

Riding the roller coaster of real estate or international stock returns that I just mentioned would be too much for many investors.

You wouldn’t be able to sleep at night with that much market volatility.

So what are you left with? Here are your options:

- Pick a different sector or benchmark

- Stay out of the market

- Invest in a broadly diversified portfolio

Let’s look at each of these individually to see if they can help you lower your risk and stabilize your overall return.

#1. Pick A Different Sector/Benchmark

If you are looking for a different sector or benchmark to invest in that is less volatile but still provides your needed rate of return, you are unfortunately out of luck.

As you can see from the chart, all benchmark returns vary widely from one year to the next.

Some might argue the case for bonds since they tend to be less volatile than stocks.

While it is nice to see only two years with negative returns, in most cases, bonds aren’t going to offer you the return you need over 40 years.

As a result, you would need to save a lot of money for retirement to reach your financial goals.

And even though there are few negative return years for bonds, it looks like we are entering a new period for stocks and bonds.

The Federal Reserve has been pumping money into the economy, keeping interest rates artificially low.

As they slow down this stimulus and stop it, the “bubble” that has formed in bonds will deflate.

This deflation could lead to either negative returns or close to zero returns.

#2. Stay Out Of The Market

Your next option would be to stay out of the market.

But staying out of the market is not a good option.

For one thing, you need the return on your money that the stock market provides to afford retirement.

If you just put your money under a mattress, you are losing out to inflation each year, meaning you need to save more and more money to get by.

- Read now: Learn how inflation destroys your wealth

Another reason this won’t work is that even if you are successful at staying out of the market for some time, one day, you will realize you have nowhere near enough money to retire.

Trying to make up for lost time, you will put everything into the market at either the exact wrong time or invest in assets that are way too risky for your risk tolerance and lose everything.

#3. Invest In A Broadly Diversified Portfolio

The first two options are not a winning strategy, but having well-diversified investments is.

The more diverse the areas of the market you invest in, the better off you will be.

A classic diversified investment portfolio example would be to split your investable money into two equal parts and invest half in stocks and the other half in bonds.

This strategy works over the long term because these two asset classes tend to move in opposite directions, limiting significant losses.

But diversification gets more detailed than just this.

There are many different asset classes for you to invest in, including the following:

- Large Cap Growth

- Large Cap Value

- Small Cap Growth

- Small Cap Value

- Emerging Markets

- International Stocks

This is just a small sample.

There are a lot more different types of investments out there.

You could break foreign stocks into growth and value and break small caps down into micro-cap stocks.

You could even do further diversification and put part of your portfolio into commodities, real estate funds, or other alternative investments.

While this sounds like a lot of work, you don’t need to over analyze things here.

Basic diversification will work wonders for you.

Basic diversification could mean investing in both large-cap stocks and small-cap stocks.

- Read now: Find out the pros and cons of blue chip stocks

- Read now: Here are the pros and cons of small cap stocks

The reason diversification works is because you are hedging your losses.

Not all sectors of the stock market are going to increase every year. Look at the chart again and 2000 in particular as an example.

International stocks, the orange boxes, performed poorly.

Even if you were diversified in U.S. Large Stocks, the blue box, and U.S. Small Stocks, the green box, you still lost money.

This trend carried on for the next two years.

As with investing, you need to look at diversification as a long term thing.

According to Matt Smith, CFA®, CFP®, CIMA®, CAIA® of Concert Financial Planning, “Many investors have probably felt the frustration of a “diversified” portfolio not seeming to do what it’s supposed to do in times of stress. For example, so far in 2022, global stocks and global bonds are both meaningfully down for the year. Traditional wisdom and advice would tell you that bonds should zig when stocks zag, providing a hedge and proving the worth of diversification. However, in times of stress, many asset classes begin to behave in a similar fashion, moving in the same direction and creating euphoria or disappointment. Diversification, like most things in investing, is a long-term strategy that works over time, as opposed to all the time.”

If had stayed invested in these sectors, beginning in 2003, you would have earned your money back and more.

Impact Of Diversification On Your Money

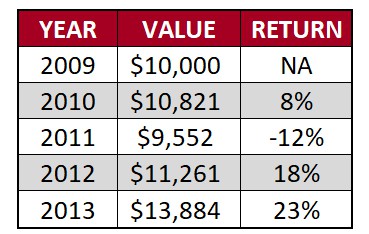

Let’s look at this in terms of your money.

You jump in and invest $10,000 at the end of 2009 in international stocks.

What happens to your $10,000?

By the end of 2011, your $10,000 is only worth $9,552.

If you have the guts to stay invested for another year, you would earn back some losses and end up with more than you started.

But the reality is some investors would have already bailed.

The bottom line is that you don’t know what will happen in the market.

Some might argue that you are robbing yourself of higher returns by following this strategy.

This belief is valid only in the case that you pick the winners every single year.

As it stands now, I know of no investor, not even Warren Buffett, who picks a winning stock every single year without fail.

Your best bet for successful investing is to invest a portion of your money into each sector equally so you can be diversified.

You guarantee you pick the winners every year by investing in an investment portfolio with various asset classes.

You will also pick the losers, but this is not bad.

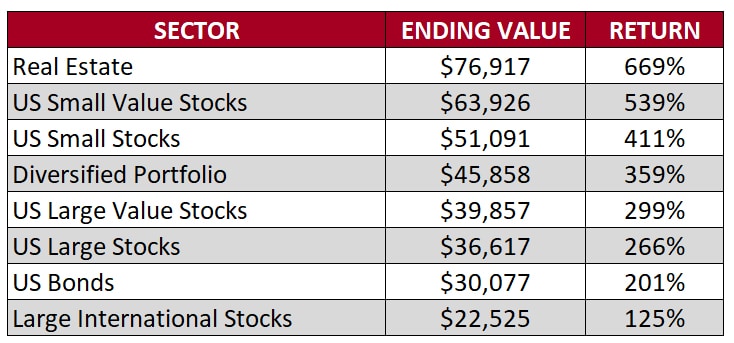

How would this strategy look, and what would your return be?

I’m glad you asked.

Let’s look at an example.

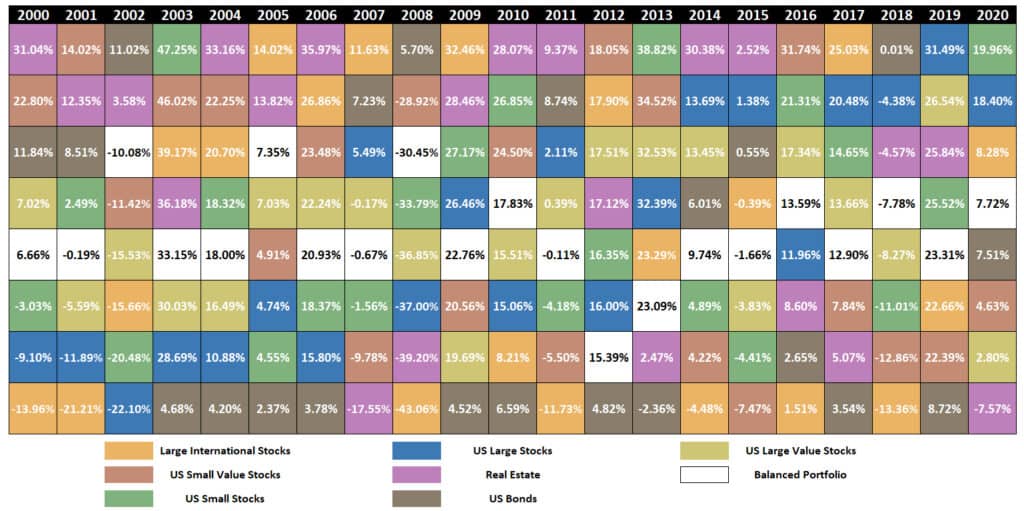

This balanced portfolio example takes 1/7th of your money and invests it in each sector listed.

The chart shows that an equally weighted portfolio, which is the white boxes in the chart, runs in the middle of the pack.

The portfolio has healthy returns and doesn’t require you to pick the winner each year.

You will be guaranteed to pick the winner each year since you will own a piece of each sector in the market.

You might look at the equally weighted portfolio and see that the annual returns vary greatly.

While this is true, the idea is that by investing in this type of portfolio, you are limiting your losses and thereby improving your average annual return.

Note that I said you are limiting your losses, not removing losses altogether.

You could lose money over the short term.

But you need to keep your focus on the long-term because the market’s long-term trend is up.

Here is how $10,000 invested in each sector would look at the end of 20 years.

In all cases, you would have grown your money nicely over the past 20 years.

Had you only invested your money in U.S. large stocks or large international stocks, you would not have earned as great of a return.

How Does Diversification Protect Investments?

Many of you might point out that the balanced portfolio ranks near the bottom of the pack, defeating the point of a diversification strategy.

While this is true, you have to remember that most investors allow emotions to make decisions for them.

In the real world, most investors sold out after 2008 and didn’t return until 2012 at the earliest.

Many never came back at all.

The market volatility scared them.

- Read now: Here is how to survive a volatile market

I point to this because when I was working at a high-net-worth planning firm, our new clients at the time were still not in the market and were only considering putting money back in.

So what would this look like?

Let’s say you invested $10,000 in 2000, sold what was left at the end of 2008, and invested that amount back into the market at the start of 2013 through 2020.

What does your return look like?

You would still have made money, but you would have much lower returns than if you stayed invested for the long-term.

Your Plan For Diversifying Your Investments

So what is the easiest way for you to become diversified?

While you could slice the various benchmarks as I did above, there are some more straightforward options.

Step #1: Know Where You Stand

Your first step is to determine how diversified your investment strategy is.

The best option here is to sign up for Personal Capital.

With your free account, they will show you how diversified you are, so you can take action now to limit risk and improve returns.

They will also create an investment plan for you, show you how much you are paying in investment fees, and help you see if you are on track for retirement.

Want to know where your investments stand? Interested in a free financial plan to see if you are on track for retirement? Personal Capital has you covered. It's the best free tool for the average person to analyze their investments.

I love how thorough and easy to use they make checking up on my investments.

My wife loves them because she isn’t a numbers person, and seeing how our savings relates to our future retirement makes it real for her.

On the other hand, if you want a more manual option, you can use Morningstar’s X-Ray Tool.

You will need to enter your holdings’ ticker symbols and the investment amount.

From there, Morningstar does the rest for you.

While this option is good, you will have to manually update the numbers regularly.

So unlike with Personal Capital, where everything is continually updated to the minute for you, with Morningstar, you will have to re-enter everything every time you want to review your asset allocation.

It is important you use these tools because many investors think they are diversified when they are not.

You might be investing in five mutual funds, but if they are all large cap funds, they are investing in the same underlying stocks.

Marcus Blanchard, CFP®, WMCP, ChFC of Focal Point Financial Planning sees this all the time.

“Just because you own several mutual funds, does not mean you are diversified. I can’t tell you how many times I take a “look under the hood” at people’s accounts only to find they own Microsoft and dozens of other companies 15+ times over.”

Step #2: Make Changes

Once you understand your asset allocation, your next step is to make any needed changes if you aren’t diversified enough.

Using either of the services above will show you where you need to add money to diversify your portfolio better.

But it doesn’t end there.

You need to make sure you stay diversified going forward as well.

My book, 7 Investing Steps That Will Make You Wealthy, helps you with this.

It will walk you through the steps to follow to ensure you are a successful investor.

The bottom line is, rebalancing your portfolio is easy, you just have to pick a strategy you want to follow and them make the changes as needed.

Now let’s say you understand the importance of diversification but don’t have the time or interest to do it yourself.

Luckily there is an option for you.

The best, in my opinion, is Betterment.

They are a robo-advisor that will invest your money in a fully diversified portfolio and reinvest dividends, rebalance, and tax-loss harvest your holdings.

What all that means is you can be completely hands-off, and they will do everything for you.

Betterment is one of the original robo-advisors out there. And they are still thriving thanks to their belief in always innovating. When you invest with Betterment, you know you are making a smart choice.

You can sit back and relax knowing you are in a diversified portfolio and are investing for the long term.

Of course, you can change your asset allocation yourself.

It’s not hard to do. You have to make sure you do it right. Otherwise, you can pay a lot in taxes on the gains.

Luckily, I wrote a post on the smartest and easiest ways to change your asset allocation for you.

What To Do If You Are Just Starting Investing?

If you are a new investor just starting, how can you build a diversified portfolio that limits overall risk without getting caught up in the details?

I encourage you to read the post I linked to above about changing your asset allocation.

Know that you don’t need to be in 100 different investments.

Simply buy index funds.

- Read now: Learn the pros and cons of index funds

It is up to you to own mutual funds or exchange-traded funds.

Pick an index fund for large cap stocks, another index fund for small cap stocks, and a total bond fund.

Then divide the money you put towards each based on your financial situation, overall risk tolerance, and long-term goals.

You could even get away with just two funds as well.

- Read now: See why VTSAX is a good investment

The point is, this isn’t rocket science.

You can keep it simple and still reap the rewards of diversifying your portfolio.

Final Thoughts

If you read the magazines dedicated to investing or even watch the 24-hour investment news channels, you will quickly become overwhelmed with investing options.

Investing doesn’t have to be complicated, and neither does portfolio diversification.

It’s very simple.

Invest in a well-diversified portfolio with low-cost investments, and stay invested for the long term.

We’ve covered the importance of diversification in this post, and I’ve spoken about fund expenses in my outrageous fees article.

- Read now: See how fees are eating away at your wealth

- Read now: Discover the benefits of buy and hold investing

As for the long-term, you need to stay invested in the same mutual fund or exchange-traded fund all the time for many years.

Investing doesn’t mean selling your entire portfolio when the market drops or your mechanic tells you about a hot new stock.

If you stay invested through the ups and downs, then over time, you will be in a good place financially.

Just think of your investments like a raft in the water and ride it out.

With diversification, the waves of market fluctuation will be much smaller than if you keep jumping in and out of the water, trying to time the waves.

- Read now: Discover the difference between asset allocation and diversification

- Read now: Learn how to invest a small amount of money

- Read now: Here are sample model portfolios to invest in

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Diversification is one of the most critical aspects of investing. You might lose out of some return during a bull market, but it will save you in a bear market or a down day if you are a trader.

Well said Sean!

This is what I am working hard on right now. I need to diversify my holdings, but also make sure I don’t react to what the market is doing. Hold for the long haul and you are bound to be better off.

You have it Grayson….diversify and stay invested for the long term.

Great stuff here Jon! I think you are right…people really over-complicate this issue. With the advent of index funds that clearly track the various asset classes in the market, it’s fairly easy to find what you need to achieve diversity. Even if you don’t like index funds you can still find what you need elsewhere. But you won’t really see the positive impact of your diversification unless you stay invested for the long term like you said.

I agree. With index funds, you can easily build a diversified portfolio with as little as 3 investments. Talk about easy!

Well written article, Jon…clear and to the point. Diversification is a key component to a solid investing strategy. Diversification can be useful in other areas of life too such as income streams. One area that you should NOT diversify though is with spouses/significant others. I don’t think they’d appreciate it too much! “But, honey, I met up with that other lady because I was just diversifying!”

That is definitely NOT an area to diversify!

The old saying “don’t put all your eggs in one basket” really applies to a lot of things, and this includes investments. Diversification of asset classes, and investments within classes, can be an important aspect of managing one’s portfolio. I’ve never understood how anyone could stomach the risk of going for broke by keeping everything in one investment or class of investments.

Me neither, but I think that is why people don’t earn decent returns. They take on too much risk and as a result, when the market drops, they get scared and pull out. If they invested with a risk level they could handle, the odds that they stay invested goes up.

How do you feel about just investing in index funds as a method of diversification?

Index funds are what I personally invest in and think most others should as well due to the low fees. But, you still need to hold index funds in various asset classes to that you can be fully diversified.

Because we can never be sure of what the market will do at any moment, we cannot forget the importance of a well-diversified portfolio (in any market condition. .Looking Back: With the luxury of hindsight, we can sit back and critique the gyrations and reactions of the markets as they began to stumble after the ’90s, and again in 2007. Diversification is not a new concept. We should remember that investing is an art form, not a knee-jerk reaction, so the time to practice disciplined investing with a diversified portfolio is before diversification becomes a necessity. By the time an average investor “reacts” to the market, 80% of the damage is done. Here, more than most places, a good offence is your best defence and in general, a well-diversified portfolio combined with an investment horizon of three to five years can weather most storms.

So true Eugene.

Jon, I diversify because if something bad happens to one of my investments, I have some other investments to depend on. Diversification is really important. Aside from diversification, what do you think is also important?

I think keeping costs low is huge. Most investors ignore the cost because they never get billed for them. But fees eat away at your return and future growth. I wrote a post on how the average investor can easily lose $75,000 because of fees. That is a serious amount of money.

Here is the link to check it out: https://www.moneysmartguides.com/outrageous-fees-paying

We are index fund and real estate investors. I like to “set it and forget it,” with my only responsibility being investing our money every month. It makes life easier and I truly believe we will achieve greater gains over time with this strategy!

Great stuff Holly. Keep costs low with index funds and be diversified as well. You are certainly on the right path!

I love all of your graphics. If that doesn’t make the case for a diversified portfolio, I don’t know what does. There is nothing like a picture to shake some sense into someone. Like Holly, we are index fund investors, plain and simple. The most effort we expend is finding ways to feed more money into the account. Then let it keep working away for us!

We are the same way – trying to figure out ways to get more money invested every month!

A great article on the benefits of diversification. The numbers on those graphs change each year, but the story and strategy remain the same.

So true Allan!

Diversification remains the best investment strategy and taking time to review and monitor your asset and know if anyone is deviating from your financial goals and how to allocate and align your investment to fit your financial goals again.