THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

The word ‘debt’ is enough to make us anxious! Many of us are in over our heads with an average debt of over $230,000! Once we are in such a situation, it is tough to get out of it. Heck, it’s even tough to admit we have a problem.

It affects more than just your finances. It has an impact on your relationships, your career, and even your health. The stress that comes along does nothing but harm every aspect of your life.

Take me as a perfect example. I still remember the shame I carried around when I was in debt. I remember hating to get the mail for fear of the next bill waiting in there! I also hated looking at my bank account, wondering how I would pay my credit card bill and still have money left to survive until I got paid again.

The fear got so intense that I avoided facing my situation. However, running away from problems is never a solution and makes things only worse – I never created a get-out-of-debt plan and kept taking stress.

In this article, I’ll help you learn how to get out of debt forever by teaching you important tips using my story as an example!

Table of Contents

My Debt Story

To help you fully understand how to get out of debt, I want you to hear my story.

Sophomore Year

I started to get into credit card debt in my sophomore year of college. Until then, I was great with paying my credit card bills each month. But sophomore year, I met a girl and began to go out to dinner more often and buy things – I ended my sophomore year with around $2,000 in debt.

I had a summer job like I usually did, but I did something different. In the past, my job earnings were for the upcoming school year. I would save my money all summer and use it throughout the school year on books, groceries, etc.

However, that summer, I decided to pay off my debt. How it created a problem? At the start of my junior year, I had hardly any money for books! So, while I took steps to get out of debt that summer, I ended up in more debt during my junior year.

I worked again during the summer between my junior and senior years, but I didn’t pay off my debt. I only made the minimum payments. I didn’t want to pay it all off only to get back into debt during my senior year. So I carried this debt with me until I graduated.

It was roughly $4,500 or so worth of credit card debt!

After Graduating With Big and Unrealistic Dreams

As a newly minted college graduate, the world was mine. I was expecting a six-figure job to land in my lap and be the company’s vice president in a few short years.

However, reality hit hard, and I couldn’t find a job. This wasn’t how I was expecting my life to be.

The outlet for my depression became shopping. I felt good buying clothes and electronics. The problem with this was two-fold:

- First, I was spending money I didn’t have

- Second, the “high” I was getting from buying things was wearing off faster and faster.

Throughout this time, I kept lying to myself that I didn’t have a problem. When it got to the point where I couldn’t lie to myself anymore, I decided to take action. I opened up a second credit card.

The theory was to transfer my current credit card debt to my new card since it offered a 0% balance transfer. I would stop spending and just work on paying off the debt and save money on interest charges simultaneously. It sounds simple enough, but it didn’t work!

I couldn’t manage to stop my out-of-control spending – now I had 2 credit cards with a balance!

I opened up a third credit card to transfer my balance to save money on interest and help myself out of this trap. Sadly, the cycle continued – my credit card debt ballooned to over $10,000.

My Light Bulb Moment

One day, I was in a store trying on a jacket. I was about to buy it when the proverbial light bulb went off in my head.

I thought to myself, “Why am I buying a jacket? I already have three, and I don’t even wear one. Buying this doesn’t make sense and is a waste of money.”

That moment will stay with me forever.

At that point, I was determined to get out of debt. I went home and rummaged through my closet and bureau, pulling out all the clothes I had bought. I piled them onto my bed and took a picture to carry as a reminder of how I wasted my money. I took pictures of the electronics too.

I also started to see a therapist to help me with my depression. Then came the time to create my get-out-of-debt plan. The steps to get out of debt were simple. I would cut back on my spending and put everything I could toward my debt.

I ended up getting a part-time job to start paying something towards my debt. I eventually got a full-time job and put my debt repayment into overdrive.

After all, I thought the path to getting out of debt was to put all my money towards it. But I put too much money into it.

What I mean by this is that I didn’t leave any money for me to enjoy life. I started resenting my debt and started to spend again. Luckily, I caught myself before it was too late!

I loosened up the strings on my budget, left some fun money to enjoy life, and put the rest towards my get-out-of-debt plan.

After a little over a year of following this plan, I was able to pay off my huge bill.

Everyone can get out of this grave situation. I did it, and many others have, and so can you!

- Read people’s debt payoff success here.

While we all had our ways of getting out of debt, one thing is true among all of us: we took the essential steps.

Laying the Foundation

Before you can start paying off your debt quickly, you have to get to the root cause of why you are in it. If you don’t do this, it won’t matter what steps you take. You are never going to be debt free.

Most likely you don’t have a spending problem but something else. For me it was low self-esteem and mental health issues. I was depressed that I didn’t have a job and that weighed on my self-esteem.

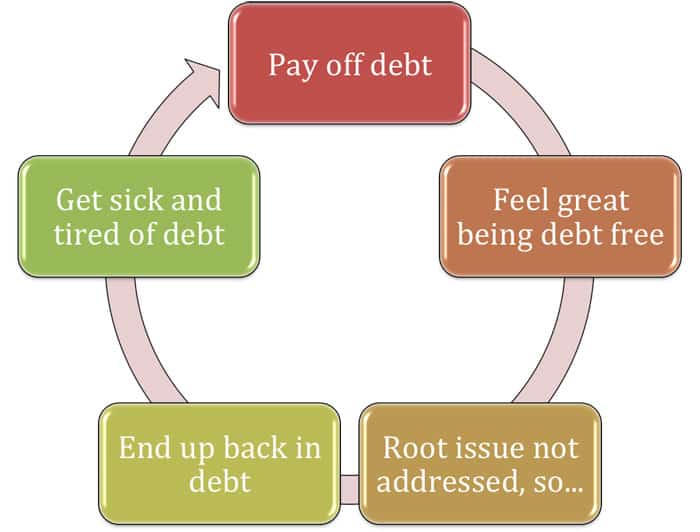

Instead of treating the symptom and not the disease, you need to figure out the real reason for your debt. Otherwise, you will go through an endless cycle of getting out of it, feeling great for accomplishing your goal, and then ending up in the same place again in the future.

You may have even experienced this already.

This is the dreaded cycle of debt so many are in. To avoid it, you need to start identifying and treating the cause of your debt.

Your habit of overspending is most likely a symptom and not the cause. Maybe you are like me, and it’s a lack of self-worth, and buying things makes you feel worthy. Or maybe it is something else.

Until you address this issue, you won’t be able to solve your problem.

Unfortunately, there is no quick fix or easy solution. It takes time, and most importantly, it takes you getting real with yourself.

To get real with yourself and get to the root cause of your debt, follow this five-step process.

Step 1: Define The Problem. In this case, the problem is debt. We spend more than we should.

Step 2: Collect Data. Here, you have to do a little detective work. How long has the problem of overspending been going on? What is the impact it has on you? What is the impact on friends and family or even your job?

Step 3: Identify Possible Causes. In this step, you have to do a little more detective work. What events lead you to start overspending? When do you typically overspend? What other problems are present when you overspend?

Step 4: Identify The Root Causes. Now we begin to solve the problem. You need to ask yourself why the problem exists.

Step 5: Find Possible Solutions. Finally, you figure out ways to overcome your problem.

Let’s take a quick look at my debt problem as we run through these 5 steps to clarify things for you:

- In the first step, I defined my problem, I was overspending and in debt

- In the second step, I looked back to see when my overspending started (sophomore year of college) and the impact it had on me and my relationships (a bad impact as I started to withdraw and be irritable).

- In the third step, I figured out what led me to overspend (getting a serious girlfriend and not being able to find a job after graduation).

- In the fourth step, I identified the root causes. (I had low self-esteem, which made me think I needed to “buy the love” of my girlfriend and I was depressed when I couldn’t find a job. In both cases, buying things made me feel worthy).

- In the fifth step, I addressed my low self-esteem and depression. (I read books on how to love myself and I began seeing a therapist).

5 Get-Out-of-Debt Plans

Now that we have gotten to the root issue, it’s time to learn how to get out of this situation. Before we start talking about this, I need to make two critical points:

First, remember you didn’t get into debt overnight, so thinking you will get out of it overnight is foolish and unrealistic. Also, don’t fall for late-night TV infomercials claiming to help you. They are just tapping into your emotions. Don’t fall for this trap!

Second, you most likely will fail at first, as most people do. This doesn’t mean you should give up; it just means you didn’t get to the root issue, and you need to go through the process I laid out above again.

The key is to keep pushing forward and getting to the root cause.

Solution #1: Try To Get Out Yourself

Too often, we seek outside help for our issues – sometimes it’s needed, sometimes it’s not. In this case, I encourage you to try to get out of debt on your own first. I feel this is the best way.

The reason is simple – you will learn a lot about your finances (which will help you tremendously down the line), and your accomplishments will empower you.

Think back to when you did something you didn’t think was possible. How did you feel? Pretty awesome right? The same thing is true here. You getting out of debt yourself will make you feel better than hitting the lottery.

- Read now: Try following Dave Ramsey’s Baby Steps

What Are the Steps?

First, you have to take the time to set up a budget. By understanding how much money you have coming in, going out, and where it is going, you can handle your money better to put as much as possible towards paying off your debt.

If you don’t know where to start when making a budget, I have five options for you to check out and try:

- Learn To Budget: If you’ve never made a budget before, read this post. It will walk you through the basics so you have a general idea of what is going on and the budgeting goal. Remember, it isn’t to restrict you but to step you up to a better financial life going forward.

- Excel Spreadsheets: If you are an excel nerd like me and like a 100% manual approach, this is the option for you. You can find a handful of free templates to try here. There are also some excel based automated options to make it less time-consuming.

- You Need a Budget: This is an automated option for budgeting. It’s an amazing and necessary software if you are serious about budgeting. It isn’t free, but it is worth the money. You can see it in action here.

- Trim: Not only will this app help you budget, but it will also help you free up some money by analyzing your expenses and helping you cancel subscriptions and other recurring expenses. You can try it for free by clicking here.

- Personal Capital: This option is a hybrid budget. You can set a couple of categories to track and open your eyes to where your money is going. Best of all, it is free.

Once you have a budget set up, it is time to start with a debt payoff plan.

You can read my detailed post on paying off your debt using the snowball method, which is the preferred method, here. This article will walk you through every step of paying off your debt yourself.

Those thinking of earning more money to get out of this misery must understand that you still have to go through the process of getting to the root issue. If you don’t, all your extra work will be wasted.

While not required, earning more income can help you get rid of your debt faster. You can learn different ways to earn more in the build wealth section of my site.

Two Tricks To Stay on Track

While paying off your debt, you will encounter some setbacks and be tempted to pause your goal. Here are two tricks to help push you through these times:

- Find an Accountability Partner: This can be a trusted friend or family member. Explain to them you are in debt and your payment process. This works wonders because they will ask you about your progress which helps keep you on track. It also motivates you to pay off your debt because you will want to share the exciting news with them about your progress.

- Set Mini Goals: Paying off a large debt can be overwhelming. When I was paying off my $10,000, making a $150 payment felt like I was making zero progress. So instead of focusing on the entire amount, I focused on a smaller number. My goal was to pay off $1,000. Focusing on a smaller number helped me stay motivated during the entire process.

Doing it yourself is the best way to get out of debt. You will learn so much about yourself and smart money management. I encourage you to try this plan first.

Solution #2: Do It Yourself With Some Help

If you want to pay off your debt yourself but need a little help, the best option is an app called Pay Off Debt.

You will still have to work through the root cause, but this app will take over from there. It will organize your debt for you and determine what payoff method is best for you. You will also be able to track your goals.

You can download it here. It is a one-time price of $4.99 and is worth every penny.

I also recommend another app called Qoins. It will round up your purchases to the next dollar and transfer that amount to a savings account. You then tell the app what debt you want to pay using your rounded-up savings.

It’s amazing how effectively this works. You don’t even notice the round-ups and end up paying extra on your debt! This helps you pay off faster.

You can get started with this app by clicking here.

Solution #3: Get Some Help By Consolidating

Some of you might be in a situation where your monthly debt payments are more than you can pay each month, and you feel a sense of urgency because your situation is getting out of control.

In this case, you can still mainly work to get out of debt yourself, but you need a way to make the payments more affordable.

I’ve found three options here:

- Negotiate With Your Creditors

- Peer-To-Peer Loans

- Debt Consolidation Firm

I. Calling up and negotiating with your creditors can work; it just isn’t effective 100% of the time. This is because you have no incentive to follow through and pay down your debt. However, it can still work, so it is worth a shot. Start by trying to get late charges waived, or your interest rate lowered.

II. When you go the peer-to-peer lending route, you get a personal loan funded by others. When they fund your loan, the company you go through (Prosper or Lending Club) gives you the money.

You then make monthly payments to the company, and they disburse them to the people who funded your loan. In a nutshell, it is a way to get a loan and bypass the bank.

III. With a debt consolidation firm, things get a little dicey. There are a lot of bad debt consolidation companies out there preying on consumers. Many run the late-night infomercials I talked about earlier in this post.

Fortunately, there are a few good ones out there. To know when you have found a good one, you need to ask questions. The good ones won’t make any promises or guarantees. They also won’t make the process so complicated that you don’t understand it.

In fact, if they can’t explain the process in a way that makes sense to you, you should leave immediately.

I know up until this point, I’ve been speaking of credit card debt; however, the same approach applies to student loans as well. Getting help with your student loan debt is a lot more straightforward.

I recommend you look at Credible. You can input your loan information, and it will give you a list of lenders you can refinance with and show you how much you can save each month. The service is completely free to use, and you are not obligated to refinance.

Solution #4: Get Help

If you are completely overwhelmed by your debt, there is help for you. It is called credit counseling. Again, as with personal loans noted above, this industry has some slimy cats. I’ll talk about how to avoid these guys shortly.

But for now, going with a credit counselor helps you by walking you through all the steps I highlighted in solution #1. This doesn’t mean they will do all the work for you and your life will be a breeze.

You still need to manage your finances and make sure you are paying your bills on time. They will sit down and work with you to determine your budget, help you set one up, look over your debt, and help you create a plan of attack.

Many will also help with the following:

- Negotiation on Your behalf: The credit counselor will negotiate with your creditors on your behalf. When they do so, they will ask you not to make further payments to the company, as the counselor will do all the negotiations on your behalf.

- Attempt To Lower the Interest Rates: Since most credit cards have outrageously high-interest rates, the credit counselor needs to lower those rates on your credit card accounts. The creditors will speak with the credit counselor and then lower the rates on your accounts to make it easier for you to repay your debt.

- Single Monthly Payments: After entering into a debt consolidation program, you can have a single monthly payment on your debt. You will make a single payment, and the counselor will use that money to pay back your debt each month.

- Waives Off Late Fees: If you have accumulated late fees and penalties due to mismanagement of your debt accounts, you can eliminate them through a debt consolidation program. The creditors will waive such fees and thereby lower the amount you owe by a little bit.

How To Avoid the Bad Guys

Your first step is to visit the National Foundation for Credit Counseling’s website. Here you can connect with a counselor who will truly help you rather than helping themselves on the pretext of helping you.

If you would rather seek your own counselor, look for a few things before proceeding with them:

- Seek out a certified debt counselor that will clearly explain their services and fee structure up front so that you have no surprises down the road.

- Also, ensure they can help you with the kind of debt you have and have experience with similar situations.

- If they ask for money upfront, it is a sign you need to leave immediately. Most legitimate counselors will offer you a free initial meeting to see if there is a fit and then charge you going forward when you go over your finances together and create a repayment plan.

Solution #5: Bankruptcy

Your last option is bankruptcy. Before you settle for this option, though, please make sure you try the other four options first.

Declaring bankruptcy is a big deal and will have a huge impact on your financial life now and in the years to come. When you declare bankruptcy, it will be hard to get a loan for a house, car, or even education for the next few years. So it truly is a last-ditch option.

This is true even when applying for a credit card. In most cases, you won’t be extended credit for many years, and if you are, you will be paying a sky-high interest rate.

If you decide on this option, you should know there are two main types of bankruptcy:

- Chapter 7: This is mainly known as “liquidation bankruptcy” because you will have to sell some of your assets to pay down your debt first and the rest of your debt will be written off. The first step in the process is to complete and pass a means test where your income and expenses will be looked over and verified by a court.

- Chapter 13: In this process, you won’t have to sell assets. Instead, the court will organize your debt and set you up with a payment plan to pay back your debt over time.

On the surface, bankruptcy might not seem so bad. But know these facts before jumping in:

- Not All Debts Will Be Discharged: Back taxes, child support, alimony, student loans, and fines and restitution will not be honored in bankruptcy. This means you will still have to pay these debts yourself. Bankruptcy will not remove them for you.

- Filing Is Public: This means it is public information that you declared bankruptcy, and anyone, at any time, can look this information up.

- Won’t Solve the Problem: If you think you can skip out on figuring out why you are in debt and just file for bankruptcy, you are setting yourself up for a bad future. This is because you will just continue with the debt cycle I discussed earlier.

If you decide to proceed with bankruptcy, you must find a good bankruptcy attorney. As with debt consolidation, a good place to start is with the NFCC.

Final Thoughts

I realize this is a lot of information to process, but getting out of debt and staying out of it is a big deal, so you want to make sure you take the time to do it right.

I hope this post was helpful in giving you the information you need. While there are various ways to get out of debt, I’ve laid out the plan for you. It’s now up to you to implement it and take control of your spending.

Take your time reading through the various solutions I listed and working to figure out which one makes the most sense for you. You should be able to easily disregard a couple of them based on your situation. Look at the pros and cons of each, and think about what you would be better off choosing.

Do you think you need or want someone to hold your hand, or you’d be able to do it on your own? Answering this question will help guide you in the right direction.

Remember, you can do this! I believe in you and am certain that members of your support group do too. It’s just a matter of you believing in yourself and starting to take action.

I’ll leave you with this thought: What is your ultimate goal? For me, it is to be financially independent. I can’t be financially independent if I am living beyond my means and spending money I don’t have. I also can’t be financially independent if I carry mountains of debt.

If your goal is to be financially free, here is your chance to start taking steps toward that goal!

If you need further motivation, watch this video:

FREE 7 DAY BEAT DEBT BOOT CAMP

Learn how to finally break free from your debt in 7 days! Includes a FREE debt snowball calculator!

I WANT TO BE DEBT FREE!

By signing up, you agree to our terms.

If you have any questions or concerns, reach out at contact@moneysmartguides.com. Alternatively, you can find MoneySmartGuides on Facebook, Twitter, and Pinterest.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Love this!

Awesome post! Not that the video was needed to get me thinking, but it certainly did not hurt haha.

Lucky for me, the moment I realized I had debt (yeah, signing the papers with the bank didn’t light up any emergency light bulbs in my head…) and actually had to pay it off “or else”, I became the most frugal person I know! Then I met my other half, also in debt, so we at least had eachother’s support while paying the bills 😀

We kept our frugal habits over the years and they’re definitely helping us move forward towards financial independence (one day, hopefully!)

I like excel spreadsheets as well because I can see the formulas. Thank you for such a comprehensive article.

Identifying the root cause of overspending is very valuable. I believe for a high percentage of people that get into debt, the root cause is low self-esteem . I believe through your story, you are telling the stories of many other people.

So many of us try to gain self-worth by acquiring material items. That never works because self-worth, self-esteem and self-love are internal. Thank you.