THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

It’s much easier than you think.

Let me rephrase that, it takes a lot less work to become a stock market millionaire than you think.

In fact, the most work you do is at the beginning of the process.

Once you have your foundation laid, you can pretty much put things on auto-pilot.

How great is that?

If you take about an hour or two of your time now to lay the groundwork, you are 95% of the way to becoming a stock market millionaire.

What do I mean when I say laying your foundation?

I am talking about creating your investing strategy. You can’t be jumping in and out of the market, chasing returns and trying to pick the best time to buy or sell.

You have to have a strategy and stick to it, in both good times and bad times.

So what exactly do you need to know to become a stock market millionaire?

I’ve outlined all the steps below to help you build your wealth in the stock market.

If you are strapped for time, you can also jump to the quick summary of the steps at the end of the post.

Table of Contents

Becoming A Stock Market Millionaire | Your How-To Guide

Step #1: Create A Plan

If you don’t have a plan, how do you know where you are going?

Better yet, how do you know you even succeeded?

You don’t.

When it comes to investing, having a plan is crucial.

Most investors jump around from investment to investment. They never see any real increase in their portfolio values so they give up investing.

They think the stock market is rigged against them.

What most of these investors fail to have is a plan. If they had a plan to follow and they followed it, they would be successful.

By having a plan, you can assess if you are on track to meet your investment goals.

If you find you are not on track, an investment plan helps you to make changes along the way.

Here are the questions you should ask yourself when putting together your investment plan.

Don’t worry, creating your plan isn’t difficult to do.

Why Are You Investing?

The first question you need to ask is why you are investing your money.

Is it for a house, a vacation, a wedding, early retirement, a child’s college education, etc.?

If you plan on investing for more than one goal, this is OK. Write down the various goals but keep them separate and answer the following questions.

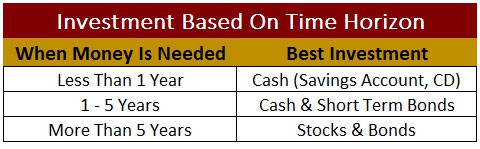

What Is Your Time Horizon?

In other words, how long will it be until you need the money you are planning to invest?

For retirement, you would tend to have a long time horizon, up to 40 years depending on your age.

But for a house or vacation, your time frame is going to be much less.

The general rule of thumb is to invest in stocks for any goal that is more than 5 years away.

Any goal shorter than this should have your money invested in bonds or in a savings account or certificates of deposit.

Below is a chart for you to follow so you know where you should invest your money.

It is based on when you will need the money you are saving.

What Is Your Risk Tolerance?

You have your goal and you know when you need the money.

Now you have to figure out how to invest it.

I mentioned above that if your time frame is greater than 5 years, you should invest in stocks. But just how much of your portfolio should be in stocks?

This is where you have to be honest with yourself.

You want to find an allocation that helps you reach your goal, but one that you are comfortable with as well.

We all want to sleep at night, right?

If you aren’t sure what your allocation should be, I suggest you check out this questionnaire from Vanguard that will help determine your risk tolerance.

One note about taking a risk tolerance questionnaire.

Make sure you focus more on the amount of money you could lose versus the amount you can gain.

We all will take more risk to earn extra money. But we discount how we will feel if we lose money.

When the stock market drops, we freak out because we didn’t assess our risk tolerance correctly.

This is why you need to be honest with yourself.

There are no wrong answers when it comes to your risk tolerance.

You will find most of you should be investing in a 60% stock and 40% bond portfolio.

This allocation will allow you to earn a good rate of return on your investments. It will also allow you to sleep at night.

Should you find that 60% of your money in stocks is too risky, then reduce that to a 40% stock and 60% bond portfolio.

You don’t want to go much lower than this if you are young.

The reason is because over the long term, bonds will not offer the return you need to reach your goals.

How Much Do You Need?

Of course, you need to know how much money you need to save if you ever want to reach your goal.

For a house or a vacation, the amount you need to save is easy to determine. You know how much a vacation will cost you or how much of a down payment you need for a house.

For retirement, it’s a little bit harder.

Here is a rough calculation for you to perform that will give you an idea of how much money you need to save:

- Figure out how much you spend on a monthly basis

- Multiply this number by 12 to get your annual spending amount

- Multiply this number by 25

The answer you get is the amount of money you need to have saved for retirement.

For example, if you are spending $5,000 a month, you multiply this by 12 to get an annual spending amount of $60,000.

Next you multiply $60,000 by 25 and you end up with $1,500,000. You need $1.5 million saved in order to afford retirement.

Again, this is not an exact number as some expenses you have today you might not have when you are retired. But it is a solid estimate nonetheless.

How Much Can You Save?

Once you know how much you need to save, you need to figure out how much you can save each month.

Don’t give up or become frustrated if you realize you can’t save as much as you need to save to meet your goal.

You have time on your side.

Regardless if you can save enough each month or not, you should make it a priority to create and follow a budget.

I know some of you hate the idea of a budget, but hear me out.

By creating a budget, you can see where all your money is going. This can be a real eye-opener for most people.

When we created our budget, we were amazed at how much we were spending eating out.

We enjoy eating out, but didn’t realize just how much we were spending until we created a budget.

After you create and follow your budget, you can better assess your spending and saving.

Who knows, you might even be able to save more money! More on this below.

Now, how do you get started with a budget?

You have 2 main options, a manual approach with spreadsheets or using apps to automate the process.

There are advantages and drawbacks of each so it is important that you look into both options to find the one that fits best with your goals.

Once your budget is set up and you see where your money is going, you can start looking for ways to save more.

In my build wealth section of the site, you will learn priceless tips that cover the following topics:

- How to slash your spending by at least $1,000 a month

- Over 100 simple tricks to save money

- The ultimate guide to earning large raises every year

- Over 50 ideas to easily make money on the side

The bottom line is, there is no reason why you cannot live within your means and still live a wealthy life.

How Much Should You Save?

Since the amount of money you need for your goals will differ greatly from person to person, you should save yourself the headaches and just strive to save a set amount of money each year.

For most people saving for retirement, your savings amount should be roughly 15% of your income.

Saving this amount this is a solid number to help you to reach your long term goals.

For shorter term goals, you can just take the amount you need to save and divide that by the number of years until you need the money.

Then divide that number by 12 to get a rough idea of how much you need to save each month.

For example, if you need $25,000 for a down payment in 6 years, you need to save $4,167 a year or $347 a month.

This calculation works best for goals less than 5 years away.

Creating An Investment Plan: Real Life Example

Here is a step by step example of how creating an investment plan would work.

Why Are You Investing? Bob wants to save for retirement. He dreams of not having to go to a job every day and instead spend his days woodworking and volunteering at the library.

What Is Your Time Horizon? Bob will need the money in 30 years. He would like to retire sooner, but after thinking things over, 30 years allows him to save and invest comfortably.

What Is Your Risk Tolerance? Bob is a middle of the road type of guy. He doesn’t like a lot of risk. As such, he is investing in a portfolio of 60% stocks and 40% bonds.

How Much Do You Need? Bob estimates his monthly expenses are $3,000. Multiplied by 12, his annual expenses are $36,000. When he multiples this by 25, he sees that he needs $900,000 saved for retirement.

Finally, Bob has to determine how much he should save.

Because he is saving for retirement, he will save 15% of his income each year.

As his retirement balance grows, he updates his progress in his retirement plan to see is progress and make any adjustments along the way.

That’s all there is to it.

Once his plan is set up, all he has to do going forward is review it once or twice a year and make any adjustments.

Notes When Creating Your Investment Plan

The example I gave above is simplified so you can follow along. When you sit down to figure out your plan, many won’t know where to start.

Ask yourself, “why is money important to me?” and write down your answers. If your answers are “freedom” or “flexibility”, you need to keep digging.

The reason is because you are only at the tip of the iceberg.

For example, you might say money offers you freedom, but what does that mean? Maybe it means quitting your job.

But why do you want to quit your job? Is it because you want to start your own business? Or maybe it is so you can start a family?

These are the real answers about why money offers you freedom.

Be sure to take the time to dig down to get to these answers.

The more specific you are with your investment plan, the greater the success you will achieve because you are aware of your motivation to meet your financial goals.

For my wife and me, freedom means that we can be more involved in our children’s lives. We won’t be stuck behind a computer at work until 8pm every night.

Also, when it comes to picking investments, you can’t jump right into figuring out what you should invest in.

You first have to ask yourself the above questions.

For some reason, when it comes to investing, we want an answer without taking into account the question.

Would you be OK with a mechanic working on your car before you even tell them why you are there?

No! You want to tell them why you are there first so they can ensure your car gets fixed and is safe and reliable to drive.

The same holds true with investing. You can’t just start picking investments and think all will be fine.

You have to first figure out your goals and create a plan.

Take the time to figure out your goals so you can put your money where it makes the most sense and in a way that aligns with your plan.

Step #2: Open Your Account

I know, it’s basic, but we need to cover it.

You have all sorts of options when it comes to investment accounts.

In fact, just looking at the many online brokers can be overwhelming.

To keep things simple for you, I narrowed the list down to 3. These are the brokers I have found my readers love the most and find are the best to deal with.

Charles Schwab

This is the perfect broker if you have some investing experience.

You have the ability to create your own portfolios and you don’t have to worry about high investment fees.

They offer every type of investment you would want:

- Stocks

- Bonds

- Mutual funds

- Exchange traded funds

They make investing simple and straightforward with an easy to use website.

Betterment

For the majority of readers, Betterment is the #1 choice.

The reason is simple. They make investing effortless.

In just 10 minutes you can have a customized portfolio built for your goals and all you have to do going forward is invest more money.

And they have you automate this task, meaning there is zero work for you to do.

Many readers swear by Betterment and I am confident you will love them too.

You can click here to open your account today.

M1 Finance

M1 Finance is a new player to the broker world, but they are definitely unique.

They allow you to choose a pre-built portfolio or a 100% customized low cost portfolio of ETFs to invest in.

And they offer this without any trading commissions. With M1, you invest for free.

Because M1 allows you to invest in individual stocks, if you are considering investing in dividend stocks, then M1 is hands down your best option.

Click here to get started with M1 Finance.

Step #3: Set Up Automatic Transfers

Once you have your account open, you need to set up an automatic transfer into your account each month.

All the brokers I listed above allow for ongoing transfers.

If you want to become a stock market millionaire, you need to invest in the stock market on a regular basis.

You can’t just invest $1 and wait for it to become $1 million.

I say that because if you invest $1 and it grows at 8% annually, it will take 180 years until you become a stock market millionaire.

I hope you see the problem with that.

But, if you invest $100 every month and earn 8% annually, it will take you just 54 years to become a stock market millionaire.

Now we are talking!

The great thing is that I can show you how to reduce the time to become a stock market millionaire even more.

Do you want to know how to become a stock market millionaire in just 30 years?

Here’s how.

Save $667 per month and invest it in the stock market. Before you get overwhelmed with that number, hear me out.

The median U.S. income is $59,039 per year. If you make this amount and contribute 10% of your salary into your 401k, you are saving $491 each month.

That leaves you with just $176 to invest after tax.

Note I didn’t include employer matches in this since some people don’t get employer matches. If you do, then you’ll be a stock market millionaire in less than 30 years.

Set up an automatic transfer to your investment account monthly for $176.

That’s all there is to it.

If your salary differs and you want to do this yourself, here is your blueprint:

- You need to save $8,004 a year to become a millionaire in 30 years.

- First, save 15% of your income in a 401k plan. If you are not covered by a 401k plan, save 15% in an IRA.

- Next, take you annual salary and multiply it by 15%.

- Take this number and subtract it from $8,004. This is how much more money you need to save.

- Take this number and divide by 12 to get your monthly savings goal.

Here is example to drive this point home.

You make $35,000 a year. Set up your 401k plan to save 15% of your salary.

Now take the $35,000 and multiply it by 15% to get $5,250.

Take this number and subtract it from $8,004. The answer is $2,754.

Take this number and divide by 12 to see that you need to save $229 a month in either an IRA or some other investment account.

By doing this you are saving $8,004 a year, which will have you become a millionaire in 30 years.

But let’s say you want to know how to become a stock market millionaire in less than 30 years.

Here is a chart I created.

It shows you how much you need to save per month based on your current age to reach millionaire status at a given age.

Your current age is found down the left hand side of the chart and your desired retirement age is across the top.

Note the figures highlighted in green. I feel that these are attainable numbers if you invest 15-20% of your income.

The great thing is if you are disciplined with saving and investing when you are young, you are almost guaranteed to become a stock market millionaire!

The key takeaway from Step #3 is to invest as much as you can on a regular basis.

I would rather be a little less comfortable now and save a lot than not save anything now and end up having to work the rest of my life.

The more you invest, the quicker you will become a stock market millionaire.

And for those reading this who want to enjoy life now, but are a little short on extra money to invest, I encourage you to check out my build wealth section to learn simple ways to make more money.

Step #4: Pick Low Cost Investments

Many people don’t realize that they pay fees annually on their investments.

Every mutual fund and ETF that you invest in, you pay a fee on. You never see the bill for it because the fee comes out of the return of the fund itself.

For example, if your mutual fund charges a 1% management fee and your statement shows it returned 5% this year, it actually returned close to 6%.

You only earned 5% of that return because of fees.

You might be thinking 5% is good because you’re going to be a stock market millionaire based on Step #3 alone!

While this is true, you can get to millionaire status faster by picking low fee investments.

And you’ll end up with more money too.

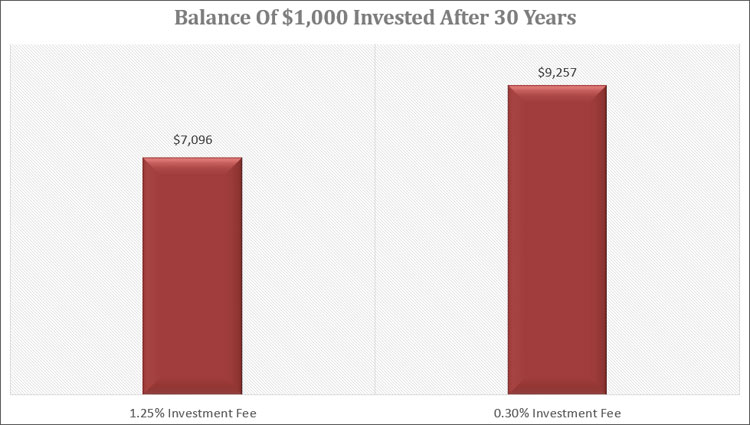

Here is an example of how costly investment fees are.

Let’s say you have $1,000 invested in a mutual fund that has a management fee of 1.25%. This is about the average for a stock mutual fund.

In 30 years after earning 8% annually, you will have paid just shy of $1,200 in fees.

In contrast, if you pay 0.30% in management fees, you will have paid about $350 in fees.

Some may be looking at the difference of $850 and not bat an eye.

While $850 on the surface might not seem like much, it is.

That $850 comes from your investment account. If you left that $850 invested, it would be able to compound upon itself and your balance would grow even faster.

Here is your investment balance after 30 years.

That $850 difference in fees ends up costing you over $2,000 in 30 years!

As your investment balance grows, so do the fees you pay.

If you have $50,000 invested, you are paying almost $60,000 in fees over 30 years by investing in a mutual fund that charges 1.25%.

If you instead invest with a fund that charges 0.30% over 30 years you will have paid just $17,000 in fees.

Here is what your investment balance looks like after 30 years.

By choosing an investment with a lower fee, you would have over $100,000 more in savings! This could mean you retire a few years sooner if you simply invest in low cost investments.

The bottom line is that fees matter.

On last point about fees.

Don’t fall for the idea that the higher fee you pay means a higher return. Investing doesn’t work this way.

Would you rather have someone wash your car for $10 or $5? Assume there was no guarantee that your car would be cleaner in either case, what would you say?

Many would still choose the $10 wash.

Why? Because they perceive an added value from the $10 car wash.

When it comes to investing, many investors make the same mistake.

They think a fund that charges a higher fee does so because it has a secret formula to earn a higher return.

It doesn’t.

There is zero in common between high fees and high returns. None. Zip. Zilch. Zero.

Save your hard earned money and pick investments with the lowest fees possible.

But what is considered a low fee?

You should not be paying over 1% in any circumstance for an investment. There are many low cost mutual funds and ETFs that you can invest in that will not cost you and arm and a leg.

Vanguard, M1 Finance, and Betterment are excellent when it comes to low fees. Schwab is good too if you pick the right investments.

This is your money. Don’t give it up so easily.

Now let’s talk about specific investments. You don’t need to go crazy and have investments that cover every sector of the stock market.

In fact, you can easily use just 3 funds and invest without issue.

If you decide to invest with Vanguard, Schwab, you will need to build your portfolio.

But with Betterment and M1 Finance, they will build your portfolio for you.

Step #5: Diversification

Risk and reward are related when it comes to investing.

The higher return you want to achieve, the more risk you are going to have to assume.

It’s the nature of the beast. By diversifying your investments, you take away some of the risk and still earn a good return.

Here is how diversification works.

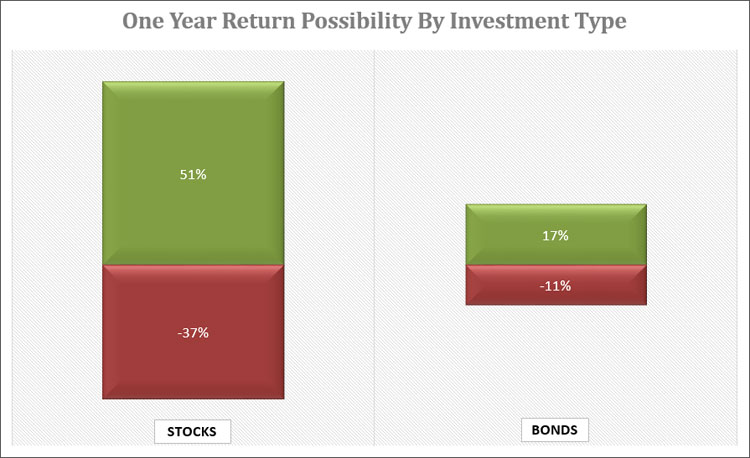

Stocks tend to earn a higher annual return than bonds and are also more volatile.

What this means is that stock prices tend to rise and fall quicker and in larger amounts than bond prices do.

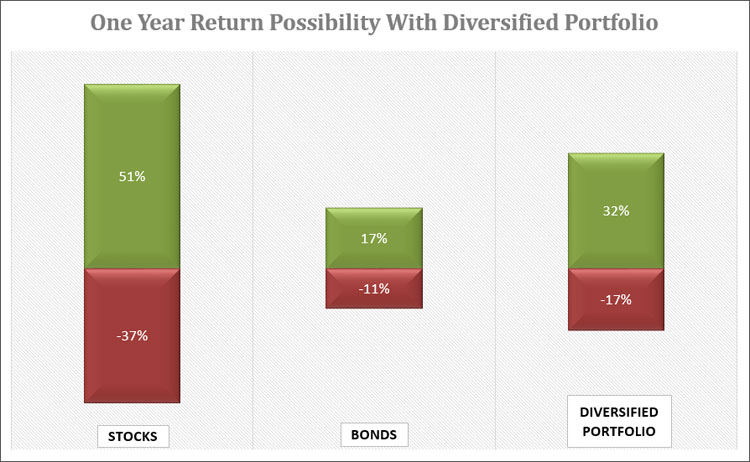

If you invested in just stocks, you could earn as much as 51% in one year or lose as much as 37% in one year.

With bonds, you could earn as much as 17% in one year or lose as much as 11% in one year.

Most investors wouldn’t like it if they had to choose between these two.

This is where diversification comes into play.

If you were to create a portfolio of 50% stocks and 50% bonds, your potential one year gain drops to 32% while your potential loss drops to a loss of 17%.

Of course, diversification doesn’t stop there.

There are all sorts of stocks you can invest in. Small cap, large cap, growth or value stocks, domestic or international, etc.

For bonds, you can invest in long-term or short-term bonds, government or corporate bonds, or even junk bonds.

All this diversification has an impact on your returns.

The goal of diversification is to allow you to earn the highest return with the least amount of risk.

Realize that there are limits to diversification. You can get to a point where you are too diversified.

Plus, you can’t diversify away 100% of the risk in the stock market. There will always be risk present.

But the bigger question is if you are already investing, how do you know if you are diversified right now?

And how do you go about making some changes to help you get to an ideal mix?

You have two options: an automated one and a manual one. Let’s look at the automated one first.

- Personal Capital. You create a free account and link up your investment accounts. You will get a chart that shows your current asset allocation.

In just a few minutes you will know what moves you have to make to become diversified. In addition, Personal Capital offers many other great benefits too, like fee analysis and a retirement planner all for free.

You can learn more here.

- Spreadsheet: When it comes to a manual approach, your best option is an excel spreadsheet. The downside it you have to take the time to create it and then update it every time you want to see your allocation.

Step #6: Don’t Chase Returns. Stay Invested.

Chasing returns doesn’t work. When you chase returns, you cost yourself money through commissions and trading fees.

At the end of the day, you end up in a worse position than you would be in had you just stayed invested.

This is why the average investor only earns a 2% return.

Chasing returns is akin to Wile E. Coyote chasing down the Road Runner.

He does every possible thing to catch the Road Runner and every time he comes up empty.

Same idea applies here.

If you want to be a stock market millionaire, you can’t chase returns.

Don’t be Wile E. Coyote.

Another reason why chasing returns doesn’t work is because we base investment decisions off of past performance, even though investment professionals tell us not to.

Back during the dot-com boom, I made this fatal mistake.

I invested in a tech mutual fund that earned over 60% in the prior year. The year I invested in it, the bubble burst and I lost close to 60% of my investment.

I never chased returns again.

For me, slow and steady always wins the race when it comes to investing.

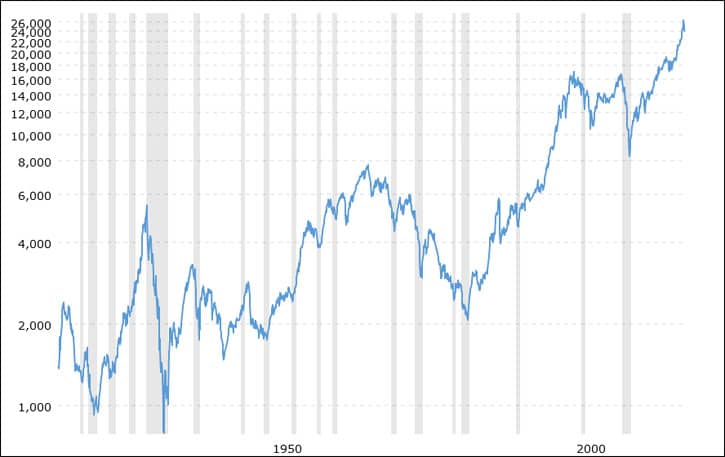

After the stock market collapse of 2008 many investors fled the stock market.

Some investors have come back into the market, but many investors have not come back at all.

Those that didn’t come back have missed out on one of the greatest bull markets ever.

The market is up over 300% as of this writing from the lows in 2009.

You would have made all your money back and a lot more had you just stayed invested.

When I was working for a financial planning firm, most of our client’s portfolios were back to pre-crash levels by 2012.

They were scared during the crash, but they knew they were better off staying in the market versus selling everything.

You have to stay invested in the market, in both good times and bad.

The market will drop. But it will also rise. Over the short-term, the market can be volatile.

Just look back to the summer of 2011.

I’ve never seen anything like that in my life. But over the long-term, the general trend of the market is positive.

Look at any chart for proof. The market pushes higher over time.

With that said, I know it can be hard to stay invested when it seems as though the sky is falling.

Especially when the media over-hypes the situation and makes it seem as though the world is coming to an end.

You have to do your best to keep your emotions in check and tune out the “noise” as I call it.

Turn off the television, don’t read the stories in the newspapers, magazines or online.

Remember that Wall Street makes money by making you trade. The more you trade, the more money they make.

Fear and greed are the two most dangerous things to an investor. You have to learn how to manage these if you want to be a stock market millionaire.

When you are feeling most worried, refer to your plan you created in Step #1. Review why you are investing the way you are and what your goal is.

For most people, it is a long-term goal, so don’t get upset over things happening in the short-term.

Finally, always remember we make things out worse in our head than they turn out to be.

The worst case scenario rarely becomes reality.

Step #7: Track Your Progress

Unless you track your progress, you will never know if you are on track for meeting your long-term goals.

Over time as the market moves, you might see that you are investing in more stocks than bonds.

This means you are taking on more risk than you are comfortable with. By tracking your investments, you can correct this so that you stay on track.

Likewise, maybe you now have more bonds than you planned on holding.

This too can be a problem since bonds tend to have a lower rate of return than stocks.

If you are investing too much in bonds, you run the risk of not earning the return you need to meet your goal.

To balance your holdings at the correct allocation, you will need to rebalance.

- Read now: Here is how to rebalance your portfolio

This means selling holdings that have grown in value and buying those that have decreased in value.

On the surface this might sound counter-intuitive.

After all, why sell the holdings that are making you money?

By rebalancing, you are guaranteeing that you buy low and sell high. You take the emotion out of investing and this is a major factor in your success with investing.

Here is a quick example of rebalancing.

Let’s say your ideal portfolio is 60% stocks and 40% bonds. At the end of the year you see you have 70% stocks and 30% bonds.

You would sell off 10% of your stock holdings and use the proceeds to buy more bonds.

Now, when it comes to your retirement accounts, you can buy and sell without worry. There are no tax consequences from placing trades within these accounts.

But things get tricky in taxable accounts since you have to pay taxes on any gains you realize when you sell.

Here are the guidelines I use to rebalance:

- I review my holdings twice a year, usually at the end of June and the end of November.

- I look for holdings out of balance by 5% or more. This means if my 60/40 portfolio is 62/38, I don’t bother rebalancing.

- For my retirement accounts, I buy and sell without question as taxes don’t factor in.

- For my taxable accounts the process is a little different. I skip the buying and selling and add new money to the assets that I need a higher proportion of. So, if my 60/40 portfolio was 70% stocks, 30% bonds, all new money I invest would go towards bonds. This is until I got my portfolio back to 60/40.

Finally, as time goes on, you may realize that you need more or less money that you originally calculated.

When it comes to tracking your investments, the easiest way to track is through Personal Capital.

Just link your accounts and you’ll get a detailed analysis from Personal Capital.

You will be able to quickly see your asset allocation, current balances, the fees you are paying on any of your investments, and more.

Personal Capital even allows you to customize a retirement plan and access a detailed review of your portfolio all for free.

You can get started with Personal Capital here.

Stock Market Millionaire Recap

I know this was a lot of information, so here are the steps quickly recapped and broken down for you.

- Step #1: Create A Plan. Take the time to figure out what your goals are and why you are investing the way you are. This will help you to stay invested for the long term.

- Step #2: Open An Account. There are a lot of brokers out there, for most people, Betterment, M1 Finance, and Schwab are your best options.

- Step #3: Set Up Automatic Transfers. By investing money on a regular basis, you take advantage of market dips and grow your wealth over time.

- Step #4: Pick Low Cost Investments. The fees you pay have a negative impact on your saving balance. Make sure you find the lowest cost investments so you keep more of your money invested.

- Step #5: Diversification. By not having all your money tied in one investment, you lower your risk while still earning a good return. Understand though that you cannot remove all risk from investing.

- Step #6: Don’t Chase Returns. Ignore returns and simply invest for the long term. A solidly built portfolio should earn you roughly 8% a year which is enough to allow you to reach your goals. When you try to chase returns, you end up costing yourself money.

- Step #7: Track Your Progress. Stay on top of how your investments are performing and rebalance as needed to ensure you earn the return you need to reach your goals. Use Personal Capital to make this easy.

If you can follow these steps, you will ensure you become a stock market millionaire!

If you want more details on these steps, be sure to check out my book, 7 Investing Steps That Will Make You Wealthy.

Final Thoughts

There is your step-by-step guide for how to become a stock market millionaire. I told you that it was easier than you thought!

If you follow these steps, you will be well on your way to investing success.

I know that there was a lot of information here, so don’t feel like you need to cover everything at once.

I know that investing can be overwhelming for many people. Everyone is telling you something different.

What I can tell you is that all these tips, when used together, work.

It’s the same philosophy we used at an investment firm that I worked for. And these people had millions to invest.

I use all these tips and it has allowed my wife and me to have great success when it comes to investing.

If you feel overwhelmed, but want to start investing, I encourage you to look at Betterment. It is the easiest way to get started in the stock market and we all know getting started is the key.

As I mentioned earlier in this post, just take 10 minutes, pick a goal and monthly savings amount. That’s it. They will do everything else for you.

If you that want more detail on these steps, along with a few extra points, be sure to check out my eBook, 7 Investing Steps That Will Make You Wealthy.

By taking the time to understand how to invest, you will find success and reach your goals. You aren’t going to get anywhere without taking action.

Start investing today and become a stock market millionaire.

- Read now: Learn the difference between asset allocation vs. diversification

- Read now: Here are the pros and cons of small cap stocks

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Great article Jon! I think most people are having a hard time starting out, which is the most important part when it comes to investing, because of the fear that they would lose their money or thinking that it would require a lot of money just to start investing. Statements or beliefs that are definitely not true, right?

I just wish investing would be taught in school, so that the future generation would be more aware of its benefits, and they could have a much better financial life than those before them.

The only thing I can say to that fear is to just ignore when the media is talking about how “bad” the market is and keep investing money on a regular basis. It’s much easier said than done though. You have to remember that over the long-term, the trend of the market is up. SO don’t get scared of what happens in the day-to-day with the market. Remind yourself you are investing for the long-term. In 20 years, what happens today is just a hiccup.

Perfect! This article spells out the basics of investing and should be a must read for anyone interested in long term wealth!

Thanks Barbara!!

I’d love to become a millionaire through investing on the stock market. I’ve taken my first steps to at least making some returns, and I hope to have a long and successful journey.

Just keep investing regularly, stay invested for the long term and pay attention to fees and you will be fine.

Love this Jon! Anyone who starts in their 20s and follows the steps you laid out should be able to make that happen. That’s what I keep telling the high school students I teach. They are amazed when I run the numbers for them.

I loved when my professor would run the numbers when in high school. It was one of the things that started my interest in investing and finance. Thanks for the kind words.

On opening an account, may I suggest opening a IRA (if you are eligible) rather than a taxable account? This was one mistake I did when I started out that I regret to this day!

Having an IRA is important. But you should also have a taxable account as well so you can easily access your money before retirement without penalty. If you allocate your holdings right, you can minimize much of the tax consequences in the taxable account.

Staying invested is the key part. Once you try to start trying to get in and out when things are good or bad, you’ll just end up shooting yourself in the foot.

Exactly. No one can time the market. You might get lucky once or twice, but you can’t time the market over the long-term. You’re best bet is to bunker down when times get volatile and keep your focus on the long-term.

I am sorry, but the only person I know who is excellent at speculating with the market is Warren Buffet. He is the person you go to to talk about investing in the market, although theses tips are also excellent.

Great post!

I don’t think anyone should speculate in the market. If you create a well thought out plan and stick to that plan, you aren’t speculating at all. Just investing for the long-term.

Very well thought out and delivered Jon. A great starting point for ANYONE getting started in stock investing.

Thanks Marvin. Much appreciated.

Very simple, yet very true. Looks like your content is getting better and better. Keep up the great work 🙂

Thanks Jef!

The small chart in the middle of the post about the monthly investment needed to become a millionaire says it all!

The tips here make complete sense to me, and it will help anyone who doesn’t understand investing smarter. IF you do a combo of pretax 401K investing, and then some roth and after tax accounts, you will slowly increase net worth. I hope to reach a million one day, and consistently investing will get you towards that goal faster.

Excellent post.I was checking constantly this blog and I’m impressed!

Very helpful info particularly tthe last part 🙂 I care for such info

a lot. I was looking for this certain info for a very long time.

Thank you and best of luck.

Awesome article, I confess I was lost in the mean investment, this information was very helpful with plenty of value.

I think I can now get my investments! thanks

I appreciate your comments on risk tolerance, Jon. I’ve coached many people who are far away from their personal ideal risk tolerance – either too risky or too conservative. Too risky and they tend to bail out when the market corrects. Too conservative and they may not meet their long term goals. It can be a tough balancing act.

One other aspect of risk to consider, especially as our wealth grows, is understanding how much risk we NEED to take. For example, my natural risk tolerance (per various risk assessment tools) is about 70%/30%. But when considering historical returns, I should only need the return expected from a 60%/40% mix in order to meet my long term goals. So earlier this year I reduced my equity exposure. As they say, “when you win the game, stop playing!” I can’t say I’ve “won” the game fully (as, to me, that would imply moving virtually everything to cash or short term bonds), but I don’t have to play as risky of a game as I played in my earlier investing career.

Nice post!

John

Great article. Save, automate, keep it low cost, diversify and think long term. Everything that I preach.

Thx

AF

I totally agree with your premise of investing early and regularly.

However, you need to clarify the extreme risk of investing in bonds towards your retirement. The Federal Funds rate is at the lowest rate in this country’s history. You can’t go lower than zero percent. So interest rates are guaranteed to go up in the future. And when rates go up, the bonds drop in value.

Therefore, if you buy bonds with a maturity date beyond your retirement date, you are guaranteed not to get your principal back if you sell the bond at retirement and buy the bond today.

As an example, suppose you are 38 years old and you want to retire at age 55. If you buy a 20 year treasury bond, the yield is 2.27%. If rates on 20 year treasuries go up by just a couple percent, the bond will drop in value by approximately 24%. That drop is huge!

You mentioned that “With bonds, you could earn as much as 17% in one year or lose as much as 11% in one year.” I’m not sure where you got these figures but historically, there have been times when bonds dropped far more that 11% in one year.

Unfortunately, bond funds are even worse, because there is no yield to maturity. At least with individual bonds, you can hold out to the maturity date to get your principal back. But individual bonds are very hard to buy with small amount of money.

Any investor who wants to invest in bonds can’t lose by waiting, and is guaranteed to lose by investing now. If you invest in bonds now, any interest you receive will be more than offset by the loss on the bonds. By waiting, you get bonds at a lower price and you lock in a higher rate.

Wow Man…Very well thought out and delivered Jon. A great starting point for ANYONE getting started in stock investing. Thanks

Awesome article, I confess I was lost in the mean investment, this information was very helpful with plenty of value.

I think I can now get my investments! thanks

I love this post! It’s true that one can be a millionaire in the stock market but it takes a lot of knowledge and interest to become one. Read posts like this and you’ll find your way to millions!

Hi Jon,

You mentioned that investing just 1 dollar in stock and leaving it there will take a very long time to get to millionaire status. Totally agreed, therefore you have to contribute monthly, but it doesn’t make sense to me contributing it monthly, say 100 or 200 per month because of fees involved in every stock you buy and also 100 or 200 can only buy you so many shares. My question to you is, if you put in 100 or 200 to buy shares of a company, you will be charged fees with very purchase. What are the alternatives in terms of putting more money into your portfolio so that you only invest in stock to become millionaire status. Should I increase more shares every year over many years to have a annual compound effect similar to mutual funds? I would like to know what are you ideas on this. Thank you

You would get hit with trading fees if you invested in stocks. But if you invest in mutual funds or ETFs, you wouldn’t pay a trading fee. That assumes you invest in an ETF with a firm that offers commission free ETF trades. The only fee you would pay in this case is the management fee of the fund itself which if you invest in low cost funds can be less than 0.10%. On $1,000 invested a year that comes to $1 a year in fees.

Nice post! I think it’s a pity most people start investing pretty late in their life or not at all. There should be some kind of financial education obligated in school to teach children about the power of compounding intrest.

I’m 21 now, and it feels like I should have started way earlier. Can’t imagine how it would be to only start at for instance 45.

I agree about teaching personal finance in school. Without it, we learn from our parents. And hopefully they are smart with their money, otherwise we are going to make the same mistakes.

Wow this was a great read. I can only dream that I will become a millionaire one day, but unfortunately that seems like an eternity away. I’ll definitely follow your steps provided and see where they may get me, but I’ve been spending a lot of time trying to save money rather then risk it so who knows when that will be.

It may take a while but it is entirely possible if you save and invest for the long term. I think many people give up to quickly because they want to be a millionaire today. If you can learn to wait 20 years, it will be well worth it.

Very well detailed list. Lots of good things to look into. Thanks!

A plan as well as behavior is definitely important in investment. Plan acts as a direction to your investment journey and specifies your goal. Sometimes, when you lose a sense of direction, just think of your plan and you’ll realize the biggest picture.

Hi Jon

very indepth guide, I’ve always thought the hardest thing about investing is getting started.

the second hardest thing is stopping once you’ve picked your shares and just need to wait for them to grow.

Smart post and some great advice. So important to invest on your own time horizon, risk tolerance and return needs rather than just picking stocks based on what TV pundits are saying. Too many investors just spin their wheels trying to invest by making the bad investment decisions that end up losing a lot of their returns.

Diversify, make regular deposits but save money by investing only every few months, don’t use margin and max out those tax-advantaged retirement accounts.

Jon, this is a very helpful set of advice to starting investing in stock market. The hardest work must really come at the beginning, but the rest of it must come easier once you did good at the start. Now, I gotta start learning to invest as time matters in investment.

What a massive post! Great work! Thanks for being very detailed. I like how you want people to think about their goals for their money / life.

Thanks Matt. Without thinking about goals, you will just randomly invest and never make progress. It’s just like saving for retirement in general. Most people don’t do it because retirement is an abstract thing. Once you define it, you make it real and this helps people to start saving for it.

Dear Jon,

Thank you so much for writing this post and providing all the links.

I’m confident with my investment strategy now that the market is high but am worried about my ability to ride out the lows. I was invested during the bubble and the Great Depression but had just had Triplets so didn’t look at my money again until 2015. A blessing in disguise but I won’t be doing that again 😉

Have you ever written about what to do with cash? I’m in the process of selling my house (and renting) and would like to invest the money in bonds or GICs. Any direction would be greatly appreciated.

Besos, Sarah.

Nice one Jon. Unfortunately I think too many beginners lack the patience required to do the ‘donkey work’ at the start and just jump in to the deep end then pay for it later.

I love the age chart – it makes it so clear that the earlier that you start then the better your chances of achieving your goals. I also like that you’ve recommended index funds instead of individual stock picks. Picking individual stocks takes a lot more time and effort and isn’t for most people.

I’ll be booking marking this post to revist, good stuff!

What a comprehensive and well-written guide on investing in the stock market! The stock market can be very intimidating to the beginner investor. A guide like this gives them a little boost of confidence that they can do it and at least get started with roboadvisors such as Betterment and M1Finance.