THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

One of the biggest areas where this holds true is investing.

The wealthy are able to invest in hedge funds, allowing them to achieve higher returns on their money and at the same time limit risk by using advanced tools.

This has been a growing complaint of many investors for years as they too want access to better investment vehicles.

Unfortunately, no one had been listening.

Until now.

Titan Invest is a mobile investing app built like a hedge fund for the masses. You don’t need to be a multi-millionaire to invest with Titan.

You can get started with as little as $500 and have access to a similar investing strategy/experience as the wealthy, while potentially protecting yourself against downside risk.

In this post, I am going to show you what Titan Invest does.

Table of Contents

My Titan Invest Review

Who Is Titan Invest?

Titan was founded in 2017 by former hedge fund investors.

As they were investing the money for ultra high net worth investors, they realized that these investors had access to advanced tools and investment vehicles that the average investor did not.

Seeing a need for change, they set out and created Titan Invest.

Now average investors have the opportunity to invest their money similarly to the ultra wealthy.

By investing with Titan, the company has two goals for you.

First, to grow your invested capital at a high rate of return for the long term. And second, to make you a better investor through education.

How Titan Invests Your Money

Titan uses proprietary software to analyze the holdings of the top ~5% of hedge funds.

Through this analysis, they look for investments with the following characteristics:

- Strong cash flows

- Strong management team

- High return of capital

- Industry leaders

- Long term growth

Based on these criteria, your money will be invested equally across 20 stocks.

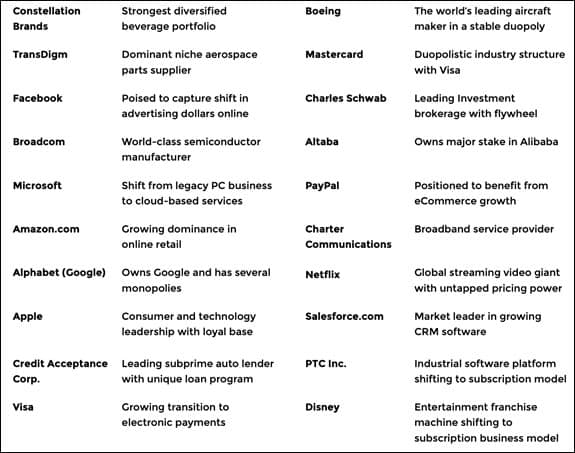

For example, below is a breakdown of their portfolio holdings as of the first quarter in 2019.

Then depending on your risk tolerance, anywhere from 0% to 20% of your money will be invested in a “hedge” security which aims to mitigate losses by effectively betting against the market in a downturn.

I go into detail on how the hedge product works in the next section.

Your Titan portfolio is reviewed quarterly and some investments may change.

However, there will not be a complete turnover of your portfolio as Titan believes in long-term investing.

To open your account with Titan, click here.

How The Hedge Feature Works

It is important that you understand how the hedge feature Titan offers works.

Not fully understanding when it is activated and when it is not can make the difference in your level of satisfaction with your experience on Titan.

The most important thing to understand is that the hedge feature is not applied equally to all clients all of the time. It is applied dynamically based on your personal risk tolerance.

Titan makes it clear that neither they, nor anyone, can successfully time the market.

As a result, it makes no sense for the hedge feature to be fully sized all of the time for all clients, independent of their personal financial situation.

The hedge feature works like this.

First, it is an inverse S&P 500 ETF (ticker: SH) which is designed to move opposite the S&P 500 each day.

During account signup, Titan asks you a handful of questions to gauge your risk tolerance.

The level of hedge that is eventually applied to your Titan portfolio depends on:

1. your personal risk tolerance and

2. whether or not your Titan portfolio is in a “portfolio downturn” as Titan defines it.

Titan defines a “portfolio downturn” as a period in which the trailing 12-month return of the Titan composite falls below the S&P 500’s average cumulative return over the trailing 12-month period.

This downturn measure is evaluated on the final calendar day of each month.

Clients with an Aggressive risk profile will be hedged 0% when their portfolios are not in a downturn.

When their portfolios do enter a downturn, 5% of their stock holdings are sold (in equal weights) and reallocated to the hedge.

In other words, the hedge dynamically shifts from 0% to 5% of the clients’ capital.

When the downturn ends, the hedging level shifts back to its original 0% level and the funds are reallocated back to the Titan composite stocks in equal weights.

Clients with a Moderate or Conservative risk profile are hedged 5% and 10%, respectively, when their portfolios are not in a downturn.

When their portfolios do enter a downturn, the hedge automatically becomes 10% and 20% of their investments, respectively.

When the downturn ends, the hedging levels shift back to their original 5% and 10% levels, respectively.

If the Titan composite and overall market are performing normally – say, they both rise for a few days and then decline for a day or two – the Titan composite will likely not enter a “downturn” in that time frame.

Hence the hedge will likely not become fully active for all clients.

Instead, the hedge would be applied 0%/5%/10% for Aggressive/Moderate/Conservative clients.

You could experience potential losses in your portfolio in this scenario, just as you could when the hedge is fully sized in a Titan downturn.

On the other hand, if we are seeing market conditions like the Great Recession or something similar, then a downturn is much more likely and hence the hedge is more likely to be fully sized for all Titan clients (5%/10%/20% for Aggressive/Moderate/Conservative clients).

The goal is for the higher hedging levels to better protect your capital from losses in this situation, though again you could still experience losses.

As I mentioned at the start, it is critical that you understand this.

The last thing you want is to start investing thinking that you are protected from losses all of the time.

Differentiators And Drawbacks

From my point of view, here is a quick rundown of Titan’s capabilities and the drawbacks it has.

Here is a breakdown of each.

Differentiators

Ability To Hedge

Titan believes that having the ability to hedge can protect investors during a bear market.

The hedge is designed to limit losses, decrease volatility of an investor’s portfolio, and help him or her to stay invested for the long term.

Access To How The Ultra Wealthy Invest

In order to invest in a hedge fund, you have to meet various criteria that average investors usually do not meet.

As a result, many ultra wealthy individuals are able to invest in a way that allows for exceptional long term growth and limits downside risk.

By investing with Titan, average investors now have access to a similar investing strategy/experience as the wealthy.

No Performance Fee

Many hedge funds charge a performance fee to investors that can be as high as 20%. Titan does not take any performance fee from its investors.

This means your money stays invested for the long term, and is able to compound upon itself – potentially growing into larger sums of money over time.

Low Cost To Start Investing

Most hedge funds require you invest $500,000 or more just to start investing.

Titan makes it easy to start and you can do so with as little as $500.

Zero Work For You

By investing with Titan, they do all the work.

Titan’s portfolio is created by analyzing the top hedge fund holdings.

Your investment holdings will be the Titan composite stocks with a hedge applied based on your risk tolerance.

Investor Education

To be a successful long-term investor, you need to understand how the stock market works.

This doesn’t mean you need to have a degree in finance or understand credit default swaps.

But by understanding the basics, you are more likely to stay invested over the long term, which is one of the keys to growing your wealth.

Titan helps you with this by offering videos that teach you the things you need to know about investing.

They also offer useful research articles on their website as well.

To get started investing with Titan, click here.

Drawbacks

As with anything in life, there are some drawbacks to Titan.

Account Types

As of this writing, you can only open a taxable account with Titan.

However, they are working on allowing you to invest using retirement accounts (e.g., IRAs) in the near future.

1% Advisory Fee

Titan charges investors an annual 1% advisory fee. When compared to investing with a hedge fund, this is a positive, as most charge 2%.

But other investment advisers allow you to invest for less than this.

With that said, the fee pays for Titan’s research of other hedge funds, actively investing your money, monitoring the market, and explaining everything to you along the way.

As a result, you are charged more for the added features they offer.

No Non-US investors

In order to invest with Titan, you have to be a United States resident.

They plan on expanding to international investors soon.

Potential For Short Term Capital Gains

The goal of Titan is to compound your capital for the long term.

However, depending on the holdings of the hedge funds Titan follows that creates the Titan composite and how your portfolio is adjusted due to your hedge, you could face short-term capital gains if a security in your portfolio was sold in less than one year.

This would mean a higher tax bill versus a long-term capital gain.

Frequently Asked Questions

As detailed as I try to make my reviews, there are always additional questions readers send in.

Because others have the same questions, I created a frequently asked questions section to save time.

Here you will find some common questions others are asking about Titan.

I also make it a point to update this section as new questions come in.

Is Titan a hedge fund?

No, but your portfolio is set up to mimic a hedge fund.

You will own 20 stocks that top hedge funds have identified as the best of the best and you will also have a hedge position.

Understand however that the hedge is sized at different levels based on your risk tolerance and whether the Titan composite is in a downturn or not.

For more information on the hedge position in your portfolio, I encourage you to read the details in the section earlier in this post.

Is Titan safe?

Yes.

Titan takes your personal security seriously by using the latest 256-bit encryption to keep your private information private.

Additionally, Titan is an SEC registered investment adviser.

Note that if you do perform a search on Titan, you may find results from independent advisors who have an investment firm named Titan.

These have no relation to Titan Invest.

Here is a link to the firm’s current ADV.

To ensure trades settle correctly, they use Apex Clearing as their clearing agent.

Finally, all accounts are insured by SIPC up to the standard $500,000.

How much does it cost to start investing?

To get started investing with Titan, all you need is $500.

This is significantly less than traditional hedge funds require and is in line with other online investment advisers out there.

What is the process to start investing with Titan?

You can click here to create your account.

From there, you transfer money to begin investing.

Titan will invest your money in a basket of 20 stocks and depending on your risk tolerance, will allocate anywhere from 0% up to 20% of your money into a hedge security (an inverse S&P 500 ETF).

From there, Titan will review your portfolio quarterly and make any changes.

What does the performance of Titan look like?

The performance of the Titan portfolio will change over time as the market fluctuates.

As of April 30, 2019, here is a chart comparing Titan to the S&P 500 over various time periods.

See full performance disclosures at the bottom of this review and on Titan’s website.

How liquid is my money?

Your money is as liquid as it would be with many other investments. You can get access to your money in a few business days, assuming it was invested.

Once you click “Transfer to Bank” inside the Titan app, you would typically receive your funds back at your bank in about 2-4 business days.

This is because it takes roughly 2 trading days for investment sales to settle and clear, plus another 1-2 business days for the settled funds to complete an ACH transfer.

What will my portfolio look like?

Your portfolio will hold a basket of 20 stocks, equally weighted.

Each quarter (roughly midway through the quarter when hedge funds’ quarterly holdings are published via 13F filings), Titan analyzes the holdings of top hedge funds.

Based on its analysis, some of Titan’s stocks may be sold and replaced by other stocks.

Additionally, depending on your risk tolerance, a portion of your portfolio, up to 20%, will be invested in a hedge security which aims to reduce losses during extreme downturns in your portfolio.

(Note that Conservative and Moderate clients are invested in the hedge security at all times. It is not guaranteed to avoid losses.

The level of hedge is what varies for clients based on whether the Titan composite is in a downturn or not. Aggressive clients have 0% hedge unless Titan is in a downturn.}

Can non-US investors invest with Titan?

At this time, only US-based investors can invest with Titan.

How long until I get my money back after I sell?

The typical turn-around time to get the proceeds from a sale is 2-4 business days depending on the settlement structure of the investment in question.

At this time, Titan does not offer instant settlement, however it is something they are working on and hope to offer soon.

What type of investor is the best fit for Titan?

The best type of investor for Titan is a person who wants access to a different type of investment strategy than what is currently available.

The investor is also the type that while OK with taking on risk, wants to protect his/her money at the same time.

Finally, Titan investors want an actively-managed portfolio that rebalances holdings and aims for long-term compounding.

Alternatives To Titan Invest

There are a lot of other online investment advisers and brokers out there.

Most offer you a customized portfolio of exchange traded funds based on your risk tolerance.

From there, you invest additional money and the advisor invests the money, rebalances your account and reinvests dividends.

Titan differentiates itself from the others by building a portfolio by following the top hedge funds to see where they are putting their clients’ money.

With that said, there is another investment option you could consider as an alternative to Titan. This is M1 Finance.

M1 offers a portfolio based on the filings of certain hedge funds.

However, M1 simply mimics hedge funds’ reported holdings without screening for fundamental criteria like Titan does.

Hedge funds could have offsetting short positions or derivatives which M1’s portfolios don’t seem to account for.

Titan aims to only follow funds for which it thinks the 13F-tracking model makes sense: long-term, quality-focused funds with low turnover.

M1 also doesn’t offer the strategy that Titan does in terms of offering a hedge that aims to protect your money when the market drops.

Another difference is that M1 does not explain why funds are investing in their holdings, what their investment theses are, etc.

You’re left to figure all of that out on your own.

On the plus side, M1 does not charge any fees to investors, saving you money in that regard.

For the extra fee, Titan provides a more refined investment strategy of following hedge funds, along with deep investor education and engagement.

The bottom line is that it comes down to the different investment strategy, the hedge protection, and the investor education/engagement.

Final Thoughts

At the end of the day, you have many choices when it comes to where to invest your money.

Unfortunately, most offer the same thing, just packaged a little differently.

But I think Titan Invest offers something different as I have described above.

To get started with Titan, click here.

This article is a paid partnership with Titan Invest (“Titan”). All opinions are our own. This is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services. Titan uses a proprietary algorithmic strategy in selecting recommendations to advisory clients. Please see Titan’s website (https://www.titanvest.com/) and the Program Brochure (available on the website) for more information. Certain investments are not suitable for all investors. Before investing, consider your investment objectives and Titan’s fees. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested. Titan’s registration as an SEC registered investment adviser does not imply a certain level of skill or training and no inference to the contrary should be made. Nothing here should be considered as an offer, solicitation of an offer, or advice to buy or sell securities. The above content is for illustrative purposes only to demonstrate products, services and information available from Titan. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections, are hypothetical in nature and may not reflect actual future performance. All Titan performance results include the use of a personalized hedge for a hypothetical client with an “Aggressive” risk profile; clients with “Moderate” or “Conservative” risk profiles would have experienced lower returns.

Please visit https://support.titanvest.com/investment-process/hedging for full disclosures on our hedging process. 2019 YTD results are from 1/1/19 through 4/30/19. 2018 results are from Titan’s launch date of 2/20/18 through 12/31/18. Performance results are net of fees and include dividends and other adjustments. All-Time figures represent performance of a hypothetical account created on 2/20/18 using Titan’s investment process for an aggressive portfolio, not an actual account. See Titan’s website for full performance disclosures.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.