THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

There is risk with anything in life. When we get into our car to drive to work, there is a risk of an accident. When we play sports, we risk getting hurt. And when we invest, we risk losing money. Because there is risk involved, we have to understand what our risk tolerance is before we decide to do anything.

Talking specifically about investing, it is critical that you understand how you handle risk if you want to be a successful investor. If you ignore this step of the investing process, you will lose money and think the system is rigged against you.

So today we are going to get a complete picture of risk tolerance so you can make smarter investing decisions based on how much volatility you can handle. In the end, this will help you on your path to becoming a successful investor.

Table of Contents

Definition Of Risk Tolerance

Risk tolerance is defined as the amount of variability in investment returns that you are able to withstand. In other words, it’s how much wild swings in the stock market you can handle without staying up all night, biting your fingernails and worrying. Or worse, selling everything and stashing it under your mattress. It is important to accurately determine your risk tolerance because if you don’t, you risk not meeting your investment goals.

For example, let’s say you take on too much risk. This could mean you invest too heavily in stocks or that you simply chose more volatile stocks to invest in. In this case, your portfolio swings wildly up and down with the market. If you cannot handle this, it will take its toll on you emotionally and possibly even physically.

As a result, you are going to sell out of the market, most likely at exactly the wrong time. You will be jaded about the stock market and will not re-enter until the market swings back to the top or worse, never invest again.

On the flip side, you might take on too little risk for your tolerance. This could mean you invest too little of your money in stocks. As a result, you won’t be earning the returns you need. Over time, you will realize that your portfolio is not growing as it should and the end result will be not having enough money for a secure retirement.

When faced with this situation, instead of slowly changing your allocation to a more aggressive one over time, too many investors overreact and take gambles they should not in order to make up for lost time. This again leads to bad experiences with the stock market. If you are curious to see what type of investor you are, click here to find out.

Keeping Risk In Perspective

One flaw that most investors have is letting their emotions make decisions for them. This happens when we don’t put risk into perspective. For example, many investors fled the stock market back in 2008 after the collapse. Many have not returned.

- Read now: Click here to learn investing basics

They are too scared, thinking they will just lose money again. While there is a good chance you will lose money over the short term, over the long term, the picture changes.

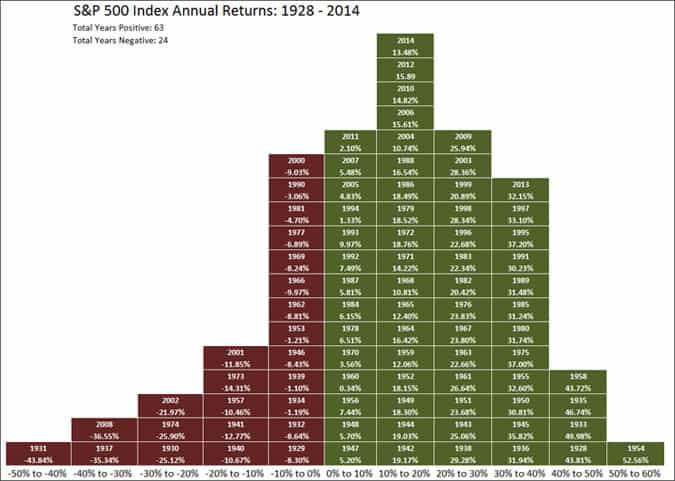

In the picture below, you see the annual returns of the S&P 500 Index since 1928. The green boxes are the years of a positive return, and the red boxes are negative returns. Notice how the green boxes outweigh the red?

In fact, 65 times the market had a positive return in those 89 years. That is a 73% chance of making money. But too many investors focus on the recent past.

We need to put things into perspective. Too many times we fear things we shouldn’t and don’t fear things we should. For instance, many people fear flying. But you have a 1 in 7,000 chance of being in a plane accident. On the flip side, we don’t fear driving. But you have a 1 in 303 chance of being in a car accident.

Many people still get married every year even though close to 50% of marriages end in divorce. So why do we not fear risky things but fear things that are not risky?

There are a few reasons.

- Emotion over fact: Our emotions are powerful. All too often, we discount risk or overestimate it simply because of emotions. This is why so many fear flying even though it is safer than driving. And it is why people who were burnt investing back in 2008 are afraid to invest again.

- Short-term pleasure too good:If the short term pleasure is great enough, we ignore the risky behavior. This is why people kept buying houses in 2007. They thought it was an easy way to get rich fast, ignoring the risk involved.

- Perception: Based on our perception of things, we discount risk. For example, if I told you there was a 40% chance of snow today in both Denver and Dallas, you believe that you will more likely see snow in Denver, simply because it is perceived as a place that gets snow more often.

Luckily there are some ways for us to put our investing risk tolerance into focus so that we make better choices based on the risks involved.

The Importance Of Risk Tolerance Questionnaires

Before you enter into an investment, your advisor should provide you with a risk tolerance questionnaire. This short multiple-choice document will assist you in determining your correct risk tolerance. Therefore, it is extremely important that you answer the questions truthfully and take your time to fully understand them.

If you handle your investments on your own, you should still seek out a risk tolerance questionnaire to complete so that you know how you should be investing.

Vanguard offers an excellent risk tolerance questionnaire for you to use. As you take the quiz, you will see that many factors go into determining your risk tolerance. If you answered the questionnaire honestly, you should be left with a risk tolerance that allows you to meet your long-term goals while at the same time allows you to sleep at night.

The Problem With Risk Tolerance Questionnaires

While the idea of risk tolerance questionnaires is great in theory, many of them fall short. Too many of them rely on time horizon as the deciding factor. For example, if you answer the majority of the questions by choosing the least risky answer but say you have 20 years to invest, most will default to giving you a portfolio that is too risky for your risk tolerance.

Ideally, these questionnaires should more heavily weigh the likelihood of you moving your positions to cash when the market drops. This is a good indicator of the level of risk you will tolerate.

Additionally, investors tend to focus on losses more than gains. This is because no one wants to lose money. My advice when filling out a questionnaire is to focus more on the questions that ask about your tolerance for losing money. After all, everyone would love to have a 25% gain, but are you willing to lose 15% for the opportunity to do so?

Just so we are clear, I played with the Vanguard questionnaire that I linked to above and found that it does a good job at weighing all factors equally, which is why I am recommending it.

Some investment sites, like Betterment, avoid the questionnaire altogether because they feel investors don’t answer based on their true risk tolerance. With Betterment, you pick your goal and they select the asset allocation for you.

You can always adjust it if you like, but they are good at choosing the right allocation for you. If you are into a more hands off approach when it comes to investing, you should definitely look into Betterment.

Final Thoughts

No matter how comfortable you are with risk, you will still be tempted at times to pull out of the market because of the volatility. Understand though that this volatility occurs over the short-term and that by riding it out and not overreacting by selling out of your holdings is the best solution.

Do whatever you need to do to turn your attention away from the market. At the very least, pull out your investment plan and your risk tolerance questionnaire to remind yourself why you are investing in the first place. Doing this will help you to avoid making the common investing mistake of not buying and holding for the long term.

If you want some more help with investing, check out my ebook, 7 Investing Steps That Will Make You Wealthy.

- Read now: Learn the pros and cons of large cap stocks

- Read now: See the difference between asset allocation vs. diversification

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Good post. If everyone knew their risk tolerance they would probably be able to save a ton of money because they would not pull their money out all the time.

I think many people have a low risk tolerance because they will buy into the market when it is doing well and sell out when it is doing poorly. This defeats the whole purpose of making money when they buy high and sell low. They loose tons of money. If you want to create money it is important that you purchase low and sell high.

This is why I linked to my other post at the end of this post showing the average investor over the last 20 years has returned 2%. They jump in and out instead of picking an allocation that they are comfortable with and staying invested over the long-term.

Good post! I am always amazed at how many pay no attention to their risk tolerance. They’re either afraid of the market and way too conservative, or throw everything they’ve got in the market with no research to back them up. I’ve seen the Vanguard questionnaire before and think it’s a great one to use to help formalize what your risk tolerance would be.

That’s why so many people get burned when investing. They see a stock rising in value and everyone talking about it, so they jump in not knowing anything about it. They lose their shirt and get made at the idea of investing when it’s their own fault they didn’t understand what they were doing in the first place.

I know that my risk tolerance is supposed to be high, being that I’m young, but it’s really not. I’d love to say that it is, because that’s how you can make the most money, but It’s really quite low.

Just because you are young doesn’t mean you have a high risk tolerance. The level of risk you are comfortable with is specific to just you and too many of the quizzes out there overweight time horizon.

This is another reason to focus on fundamentals. If a company is fundamentally sound it can likely withstand market volatility. Sure, it’s stock price might jump around like an ADHD kid on a trampoline, but it will be producing steady cash flow and hopefully paying out regular dividends. That’s really what matters in the end.

In my experience it takes years and a lot of hard lessons learned to master your risk tolerance. I personally got burnt out on taking risk and enjoy low risk investments to help me sleep better at night.

A good number of people overestimate their risk tolerance and get burnt. You make a good point that should you realize your risk level is too high, you should take the necessary steps to lower it.

I always looked at it like this, “in the event of such and such happening, would it cause me to lose sleep at night?” If so, then I would bring it down from there until I could rest comfortable. It really is true that everyone’s risk tolerance is different. There’s no shame in being averse to risk. Just make sure huge swings in the market don’t cause unnecessary stress and heart pain. If that’s the case, adjustments NEED to be made!