THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

For as long as I can remember, I wanted to be wealthy.

I didn’t want to have to worry about money.

So I started to look into how the rich became wealthy.

The most common ways are starting a business and investing in the stock market.

At the age of 18, I didn’t have any desire to start a business, let alone any ideas of what to start.

So I turned my attention to investing.

I started reading a lot of investing books.

In college, I took some classes on investing and I started to apply the knowledge I learned.

One of the most important things I learned was dollar cost averaging.

By learning how to dollar cost average, also called DCA, I have been able to grow my wealth to over seven figures.

And it all started with $25 a month.

In this post, I am going to show you how to start dollar cost averaging so you too can build your wealth.

Table of Contents

The Complete Guide To Dollar Cost Averaging

Lump Sum Investing vs. Dollar Cost Averaging

When it comes to investing your money, there are primarily two strategies you can use.

- Lump sum approach

- Dollar cost average

It important to understand both these investing strategies because they each come with advantages and disadvantages, which I detail below.

What Is Lump Sum Investing?

Lump sum investing is fairly straightforward.

You have a chunk of money to invest and you invest all of it at once.

So, if you have $10,000 you want to invest in the stock market, you do it on a given day.

The advantage of lump sum investing is that you are invested in the market.

You won’t be tempted to go out and buy things with the money, like a new car or smart phone, instead of investing it.

Another advantage is that over a long time period, you will grow your wealth.

This is because the market tends to move higher over time, so any investment you have will grow in value.

The disadvantage of lump sum investing is that you might invest all of your money when the market is at a peak.

If there is a stock market crash, you could end up spending some time, possibly years, waiting for the market to recover.

For example, imagine if you had invested the $10,000 right before the markets crashed in 2008.

You would have had to wait until 2011 at the earliest just to get back to your starting amount of $10,000.

To avoid the chance of this, you can elect to implement a dollar cost averaging approach instead.

What Is Dollar Cost Averaging?

Dollar cost averaging is simply taking your money and investing it at regular intervals over a period of time.

Using the example from above, if you had $10,000 to invest, you could use this strategy and invest $1,000 per month for ten months.

Or you could invest $500 a month for 20 months.

The amount of your periodic purchases you invest and duration is up to you.

The advantage of dollar cost averaging is that you are buying regardless if the market is rising or falling.

When the market is rising, you buy fewer shares. When the market is falling, you buy more shares.

When you combine the two, your overall purchase price can be lower, increasing you long term gains.

The disadvantage of this strategy is since you aren’t investing all your money at once, you might be tempted to spend it or not invest it, especially when the market is falling.

Another drawback is the potential for smaller gains.

If you invest all your money at once and the stock market races higher, you will have larger gains compared to investing smaller sums of money along the way.

The question you might have is how does this strategy work exactly?

Here is an example.

Dollar Cost Averaging Example

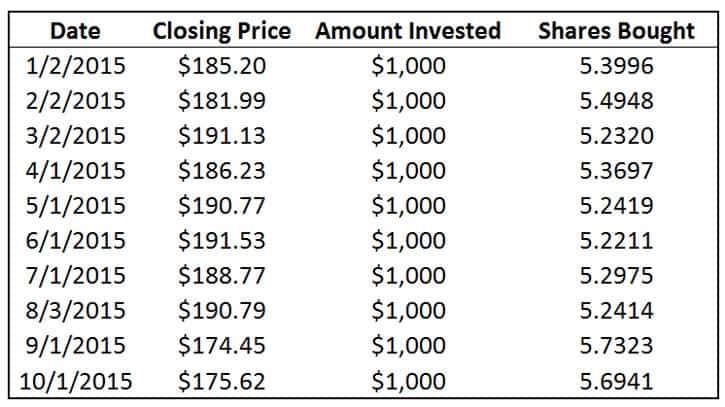

For this dollar cost averaging example, I am going to use real-life data.

I am going to use the Vanguard 500 Index Fund (VFINX) as the investment choice.

I am going to invest $1,000 each month for 10 months on the first business day of each month.

I will use January 2, 2015 as my starting date and invest $1,000 each month through October.

I will then look at the ending value as of June 17, 2016 which is when I calculated the data for this example.

In the chart below, you will see the ending daily value for VFINX as well as how many shares I was able to buy for $1,000.

I rounded the purchases to 4 decimal points as most mutual funds do.

After I make the final investment in October of 2015, I own a total of 53.9244 shares.

Fast forward now to June 17, 2016 and we see that the VFINX closed at $191.94.

By taking the number of shares I own and multiplying that by $191.94, my total investment is worth $10,350.25.

I ended up gaining $350 by dollar cost averaging.

Which Investing Strategy Is Better?

If you are curious, you probably want to know what would have happened if I had just went ahead with lump sum investing instead.

Here is what would have happened.

I would have invested all $10,000 into the VFINX on the first business day in January 2015 and owned 53.9957 shares as a result.

Fast forward to June 17, 2016 and my investment would be worth $10,363.93.

I gained $363 by using the lump sum investing strategy.

This strategy ended up earning me an additional $15 compared to dollar cost averaging.

So is dollar cost averaging worth it?

Should you just use lump sum investing all of the time?

The answer isn’t so simple.

Does Dollar Cost Averaging Work?

Based on the examples from above, you are probably thinking that using dollar cost averaging does not work and isn’t worth the hassle.

After all, you would have made more money by lump sum investing as opposed to dollar cost averaging.

But there are some key reasons as to why you should not completely rule out dollar cost averaging as a strategy for investors.

Benefits Of Dollar Cost Averaging

Goal of minimizing risk

When you use dollar cost averaging, you minimize risk by investing over a period of time.

You have no idea when the market is at a peak, so by systematically investing each month for a period of months, you lessen the risk of investing at the wrong time.

Buying low

Another reason to look into dollar cost averaging is to buy low.

Any decent investment book you read will tell you to buy low.

The problem is that when emotions and money interact, we rarely buy low.

We try to time the market and invest at precisely the right time.

But no one knows when the perfect time is to invest and market timing has never worked for anyone over a long period of time.

- Read now: Click here to learn why you are your greatest enemy when investing

- Read now: Discover the investing basics you need for success

We most likely buy high, when everyone is excited and making money hand over fist as seen in the graph below.

You should be investing at the opposite time, when the market is dropping.

You will buy more shares and will have a greater return when the market goes back up.

When you dollar cost average, you buy more shares when the price is low, and fewer shares when the price is high.

This helps to keep your average cost lower than if you simply invested everything at once.

It works

Finally, dollar cost averaging works, especially over the long term.

When I speak of the long term, I mean over 10 years or greater.

Yes, the lump sum strategy I pointed out works better here, but that is only over a period of roughly a year.

You need to look at long time horizons.

Many of the arguments against dollar cost averaging won’t look this far ahead.

They will point out one year or two years later how you would have been better off investing with a lump sum.

So should you use dollar cost averaging all of the time?

Unfortunately, the answer is still not so simple.

Type of market

Finally, another advantage to DCA is the stock market itself.

Is it a bull market? A bear market?

The truth is, you can never be sure what is going to happen next in the market.

By making monthly purchases, you don’t have to worry of think about the stock market.

You just invest and let your money work for you.

You invest more money

When you dollar cost average, you take a large amount of money and make a periodic investment.

But most times, you can keep investing a smaller amount every month afterwards.

For example, let’s say you came into $10,000 and chose to invest it over the course of 6 months.

Since you’ve been investing, you might decide to just start investing $100 a month going forward.

As a result, you will end up with more money over time.

Downsides Of Dollar Cost Averaging

So those are the reasons why you should consider dollar cost averaging but what are some downsides of dollar cost averaging?

High costs

You could run into commissions and fees depending on how you go about using DCA.

For instance, many brokers charge commissions on stock trades.

If yours does, a lump sum investment would save you money.

Of course, you could change to a no fee broker like M1 Finance.

If you invest in mutual funds, some brokers charge a fee here too.

You would be better served investing directly with the mutual fund company instead.

High minimums

With some brokers, you need a minimum amount to invest, especially when it comes to exchange traded funds.

You might need $100 or more, which could be more than you have to invest.

An alternative is to invest directly with a mutual fund company. Most allow you to auto invest for $25 a month.

You’re a worrier

If you are easily spooked when it comes to investing, a lump sum strategy might be better for you.

The reason is because you can invest once and be done.

With a dollar cost averaging strategy, you might get scared and skip an investment month here and there.

Or if the market is rising, you might have feelings of regret and try to time the market.

Doing this will hurt you tremendously, mainly because the most likely outcome is that you will end up with less money.

You’re stuck on an investment

Another reason to skip dollar cost averaging is if you are in love with a loser.

By this I mean a stock that is dropping each month.

You might get excited that you are buying low and owning more shares each month, but the truth is you are just throwing money away on a stock that is going nowhere.

An example of this would be Enron.

You can also read my experience with this when I was investing in Worldcom.

How To Start Dollar Cost Averaging

How do you get started with dollar cost averaging?

You need to decide on a few things.

#1. How much do you want to invest?

#2. How often do you want to invest?

#3. What do you want to invest in?

Once you answer these questions, you can set up your dollar cost averaging plan.

For most people, the easiest way is to start a DCA plan is to invest in your 401k plan at work.

Every time you are paid, a portion of your money is invested into your retirement plan, regardless if the market is up or down.

So if you have the option to invest in a 401k, then make sure you do.

From there, you have two options.

- Invest in stocks/exchange traded funds

- Invest in mutual funds

If you are interested in investing in stocks or exchange traded funds, I suggest you invest with M1 Finance.

You can build your own custom portfolio of just stocks, just exchange traded funds, or a combination of both.

Or you could pick a portfolio their experts built.

They charge zero fees and you can invest $25 a month.

It’s simple and easy. And it is my favorite way to invest for free.

You can click below to learn more and open your account.

If you are interested in investing in mutual funds, be smart about the broker you choose.

Many offer no fee mutual funds, but not all mutual fund families are included.

- Read now: Click here to learn mutual fund basics

- Read now: Click here to compare brokers and find your perfect fit

So if you have a specific fund family you want to invest in, make sure the broker you are looking at has a free option.

Otherwise, you will be better served investing directly with the mutual fund company.

How Dollar Cost Averaging Builds Wealth

At the beginning of this post, I told you how I grew my wealth by following a dollar cost averaging strategy.

Here is how I did it.

I started off with an index mutual fund that mimicked the S&P 500 Index.

Every month I invested $25.

And when I received money for my birthday or the holidays, I took a portion of the extra cash and invested it as well.

About a year later, I earned a raise at work.

Instead of just taking the bigger paycheck, I opened up another index mutual fund, this time one that tracked small cap stocks.

Every month I put $25 into this investment.

When I received extra money, I split it between my 2 investments.

A few years later, I was able to increase my monthly investment up to $50 each.

All during this time, I was also investing in my 401k plan.

At the beginning, it was $20 a paycheck.

But it increased every time I earned a raise.

I just kept this process on autopilot, investing every single month, not worrying what the stock market was doing.

In time, my investments grew to where they are today.

This is why I recommend you invest with a dollar cost averaging plan.

Most people allow their emotions to interfere with their decisions.

They get scared and stop investing and never start back up.

Or they intend to invest their tax refund but instead but the new smartphone.

By putting your investing on autopilot, you build wealth over time.

Final Thoughts

At the end of the day, a dollar cost averaging investment strategy is a great idea for most investors.

However, if you are the type of person that just wants to invest and get it over with, then go ahead and lump sum invest.

In the end, your investment return will not be drastically different.

And the ultimate goal is to be saving for your future.

So whichever way makes the most sense for you is the one you should be using.

If you want to learn more about how to become a successful investor, I recommend you read the posts below.

- Read now: Learn how to become a stock market millionaire

- Read now: Click here to understand risk tolerance

- Read now: Why you should ignore Dave Ramsey’s investment advice

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

I actually happen to have a lot of money in Israel and the dollar keeps getting weaker there. Because the money I left there is in shekels, I have gotten significantly richer simply by not converting my shekels into dollars. In 8 months, my net worth has gone up close to 4%. pretty cool how money markets work!

Good for you. I played around with Forex in a graduate school class and made a good bit of phantom money. I’ve considered getting into forex more, but I just don’t have the time needed to do so.

Good breakdown Jon! I generally tend towards the DCA myself as I’d rather have the advantage of getting in at lower prices. Though, with today’s market who knows?

Thanks. I use DCA myself because like I said in the post, it’s just easier to automate it.

I dollar cost average my 401k, because I’m not one to try to guess when an index fund will be undervalued.

For my stock portfolio, I invest in whatever happens to be undervalued at the time I have capital. I refuse to spend money on overvalued stocks.

I DCA my 401(k) as well, as I assume most everyone does. Good to hear that you make it a point to invest when you have the funds. Too many people put it off and then end up not investing at all.

I have been dollar cost averaging into the market for as long as I can remember.

We DCA monthly for retirement accounts. Doing this helps us maintain consistency in our investing. In other words, investing is not just something we do every once in a while. It’s a continual, lifelong process.

That’s a great way to say it Brian.

Dollar cost average such a good way for investing money, I had invested lump sum money in stock and forex market. I have checked your example that’s really impressed me & change my thinking as well, Dollar cost average retunes better then lump sum investment. Thanks for post this information with both situations.

I am a big fan of dollar cost averaging because the putting away money every month creates habit of saving. I believe consistency brings results. In order to get rich or wealthy, it is not about hitting the market that one time and becoming lucky. It is about doing the things that are correct like living below your means, saving money, dollar cost averaging that create wealth.

Excellent way to explain it Alex!

I’d just throw my money into an index-fund and be done with it. If there’s a business out there to invest it that I know, then I would take some out and invest, but the stock market: best just to go with it than to try to beat it.

I still prefer the dollar cost averaging as I am kinda scared to invest a great amount of money one time. And, dollar cost averaging is less risky and I am a less experienced investor so this one is perfect for me.

The nice thing about dollar cost averaging is that if the investment drops and eventually recovers, you make money, if the investment stays the same throughout the term, you don’t lose any money, and if the investment goes up, you of course make money.

If the dollar cost averaging is automated, it could actually be great for the worrier, as you tend to forget about a regular expenditure. Whereas for a lump sum, you may be constantly concerned about the effects of the ups and downs of the market on your huge lump sum investment.

Agreed with you on dollar cost averaging. I am not an experienced investor, I think dollar-cost averaging could be one of the best approaches and it is less risky compared with the lump sum investing.

I have gone with DCA due to the fact that i have not had a large lump sum of capital to invest at one particular time. But with the following statement that DCA works especially long term, are you saying that if you fell into a million dollars, you would dollar cost average it over 10 to 20 years?

“It works: finally, dollar cost averaging works, especially over the long term. When I speak of the long term, I mean over 10 years or greater. Yes, the lump sum strategy I pointed out works better here, but that is only over a period of roughly a year. You need to look long term.”

Also does your lump sum vs DCA example take the dividends from VTSAX into the calculation?

I’m not sure if i would have the nerve to lump sum invest a large windfall, but i don’t think i could let it sit unproductive for a long time while I DCA it into the market.

Love the examples and your thoughts on the psychological part of this over just the numbers. Thanks in advance for any feedback

Thanks for this great overview!

I’ll be the rabble rouser here. In my view, dollar cost averaging is nothing more than a marketing artifice invented by the financial services industry designed solely to induce more small investors to turn over their savings to Wall Street. Has any independent study demonstrated that dollar cost averaging produces greater returns than lump sum investing or some other strategy? Sincerely, I’d appreciate someone posting a citation if such a study exists.

When purchasing investments every pay, you are effectively investing as soon as the money is available to you, which is technically lump sum investing. I use a regular investing program given my current employer’s benefits. I automatically invest every paycheck to maximize the matching contribution my employer offer and I invest my bonus in a registered account the day I receive it to minimize taxes. Whether more profitable or not, your worst bet, over the long-term, is not being in the market at all. Automating your investments prevents you from forgetting to invest, and might be the perfect solution depending on your person.

I usually tend to do dollar cost averaging myself although I have been known to hang on to a loser hoping they will turn around. If it continues to underperform for 3 years, I drop it.