THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

I know that many people, regardless of age, are scared to invest in the stock market.

For younger investors, their fear of investing is from the Great Recession.

They lost most of their savings when the markets tanked in 2008.

The older generation is scared because of the frequent crashes we’ve been experiencing recently.

But I am here to put all this into perspective so that you can overcome your fear of the markets.

In this post, you will learn how to overcome your fear when you are too scared to invest.

I’ll also share with you some tips to help you better understand your fear as well as some investment options to choose from.

Table of Contents

How To Overcome Being Too Scared To Invest

Understanding Fear

Before we get into the ways to overcome your fears, we first need to get a better understanding of fear.

If we try to skip this step, it can make the process of beating this emotion longer and harder.

So what is fear?

The definition is an emotion caused by the belief that something or someone is dangerous and will cause us pain.

In other words, it is our human self-defense that warns us from possibly getting hurt.

The good news is that we can teach ourselves to not fear many things in life.

And this starts with four steps to overcome fear.

4 Steps To Overcoming Fear

#1. Understand Your Fear By Noting Where And Why It Entered Your Life

Take some time to think of when you developed your fear of the market.

Was it in 2008 when the markets fell?

Or maybe your parents had a bad experience investing and they made it a point to remind you of it over and over.

Spend a few minutes identifying when the fear started, then move on to the next step.

#2. Understand The Impact The Fear Has On You

You need to take some time to see the impact fear has on your life.

For example, if you avoid investing in the stock market, one of the impacts is that you don’t earn a higher return on your money, forcing you to scale back your long term financial goals.

Spend a few minutes thinking about how the fear is holding you back.

#3. Understand The Potential Outcomes Of The Fear

Next, understand what could happen because of or in spite of the fear.

If you invest, you could lose money.

But you could also make money.

Come up with all the possible outcomes of your investment decisions, both good and bad.

#4. Work On Overcoming The Fear

The final step is working to beat your fear.

There are a handful of ways to do this, which I outline below.

The key here is to first go through these four steps so you are open and willing to push your fear aside.

10 Steps To Overcome Being Too Scared To Invest

#1. Educate Yourself

The best way to beat fear is to know more about the thing that scares you.

This means researching how the stock market works, what are some of the potential outcomes, etc.

The good news is you don’t need an advanced degree on the topic.

In fact, investing is pretty easy to understand.

- Read now: Here are the investing basics for long term success

- Read now: Learn these important investment terms

The hard part is keeping your emotions in check.

So take the time to learn more about investing.

You can listen to podcasts, what videos online, read books, blogs or magazines and more.

Just find something that you enjoy and learn from it.

#2. Create An Investment Plan

Your first step after educating yourself is to create a plan.

You have to write out specific goals and plans for your money, what you are investing in and why you are investing it.

When you have your investment strategy laid out, you have a resource to look back on when the market drops.

It helps to remind you why you are investing in the first place and this will help you to stay invested.

By skipping this step, you actually set yourself up for failure.

This is because when the market does drop, you will get scared and sell.

If you had your investment plan, you could have referred to it and used it as a guide to keep you invested.

#3. Assess Your Risk Tolerance

Once you have your plan with detailed goals, you have to figure out your own risk tolerance.

This is simply a way to understand how much investment risk you are willing to take.

Doing this will allow you to invest in the stock market and still sleep at night when the market drops.

And it is going to drop. It’s the nature of the beast.

Some days will be good days and some days will be bad days.

But remember, over the long-term, the general trend of the stock market is positive.

If it wasn’t, we’d all have lost everything a long time ago.

The most important part about this step I have found is to use numbers and not percentages.

For example, if you have $100,000 invested and I ask if you are comfortable with a 30% market decline, you might say yes.

But if I ask the same question only this time use $30,000 instead of 30%, you might now say no.

Always use dollar amounts as this has a more meaningful impact on your decision making.

#4. Spread Out Your Money

Another way to make investing less scary is to spread your money out in various investments.

The last thing you want to do is have everything in one stock.

If that stock misses earnings or has a scandal, you are going to lose a lot of money.

By having a diversified portfolio, you lower your overall risk.

Here is a simple way to look at this.

You are throwing a party and you only have one type of wine to drink.

You are taking a big risk that everyone coming to your party will drink wine.

Chances are, some people won’t want wine and will be upset.

If you instead have wine, water, coffee, tea, and more, then there is high probability everyone will find something to drink.

You just lowered your risk of people being unhappy at your party.

The same is true with investing.

Invest in mutual funds and bonds to spread your risk out.

- Read now: Here are the pros and cons of investing in stocks

- Read now: Learn the pros and cons of mutual funds

#5. Focus On A Long Term Time Horizon

You need to stay invested both in good times and bad.

This means having a long-term approach and sticking with the same investments and not jumping from one mutual fund to another.

You can’t sell everything and run when the market drops and then come back when it goes back up.

You have to stay invested.

In other words, you cannot time the market.

No one knows when the market will drop or when it will rise on a daily basis.

The only thing that we can say is that over time, the market will rise.

Look at any stock market chart for proof.

Yes, there are drops or bumps along the way, but the long-term trend is positive.

For example, look back to the Great Recession.

Many investors fled the market and sat on the sidelines for years, too scared of the stock market.

But if you had stayed invested, you would have seen your money grow to more than what you had before the Great Recession.

I can attest to this.

I have much more than I did before the Great Recession.

In fact, I worked for a financial planner around this time.

We kept most of our clients in the market during this entire crisis.

Most of them earned back what they lost by late 2011.

You have to stay invested if you want to see meaningful returns even during stock market crashes.

In 10 years, most likely the stock market will be higher than it is today.

If you pull out of the market and sit waiting, you are only hurting yourself.

This is some short-term pain.

But the over the long-term, you will be rewarded for staying invested.

#6. Keep Things In Perspective

Instead of watching the news and getting caught up in fear, keep things in perspective.

Look at how things are doing, economically.

Look at everything.

Are companies are hiring? Are people are buying houses? Is the economy is strengthening?

If so, things are not bad.

This means that there is a good chance the drop in the market is just a normal thing.

It is not a sign of a continued drop that many fear mongers are claiming.

And in the event the economy is slowing down, then this simply means you need to get yourself mentally prepared for some swings in the stock market.

It doesn’t mean the market will drop to zero, it just means a rough patch is coming and you need to prepare.

Just like you do for a major snowstorm or a hurricane.

You take some basic steps and ride it out.

#7. Invest Small Amounts

If investing makes causes you much fear, a great solution is to start small.

Don’t put every last cent you have into the stock market.

Instead, invest a little bit of money, say $25 a month and slowly get comfortable with investing.

- Read now: See the power of dollar cost averaging

- Read now: Learn how to invest $250 a month

You will experience the ups and downs of the market and not be too worried if the market falls since you don’t have that much money invested.

While you do this, work on educating yourself more about the markets so that as your account balance grows and the market swings, you are OK with it.

#8. Tune Out The Craziness

When stock prices are dropping, the media hypes the stories because they know people will tune in.

The more people they have watching their programs, the more money they charge advertisers and the more money they make.

It is important to understand this cycle because if you get sucked in, it is hard to get out.

Here are some tips to help you navigate these trying times.

- Ignore the news:They are trying to get you to react. Turn the channel. Watch something else. Or just turn off the television and go outside.

- Stop listening to “experts”:Many of the “experts” you see telling you the market is dropping to 200 or even rising to 100,000 have about as much of a clue as you or I. In fact, most of them are making the prediction to get your attention. They want you to buy their book or pay to attend their seminar.

- Stop checking your balances: Don’t check your account balances every day, especially on days the market drops. Make it a point to look a few times a year. For me, I tend to look after the market rises a lot in a day. I find I focus on how much I made that day. Seeing the gains for the day excites me and helps to keep me invested.

#9. Find The Positive

Another good idea is to try to spin market events into a positive.

I do this with everything in life.

It can be hard sometimes, but the payoff is huge as I rarely worry about things.

In fact, you will notice this throughout this post.

When the market drops, look at it as an opportunity to buy more.

Or you can use this image to help you get through troubled times.

Picture a boat going past as you are on a raft in the water.

After it passes, the waves are huge and you get knocked around on your raft.

But as you follow the wake of the boat further back, you see the waves become smaller and smaller. Your ride becomes much smoother.

This is stock market volatility.

In the short term, the waves are big and scary and the ride is rough.

But as you ride it out, the waters calm down and the ride is easier to handle.

#10. Build Cash Reserves

Related to the point above, you should work on building up a cash reserve outside the stock market.

You can keep this money in a separate savings account for when you need it.

The time you will need it is when the market is falling.

When investors are running from the market, you want to take this extra cash and buy more.

I know this sounds crazy, but remember, when prices are down you can buy more shares at lower prices.

Then when the market turns and starts rising, which it will, you will earn an even bigger return.

Once you use all your cash reserves, work on building it back up again to take advantage of the next pullback.

Key Things To Understand About The Stock Market

The following points are here to help you better understand and educate you on the stock market.

While you will still have to put in some more work, reading the following should help to put some of your fear at ease.

#1. Losses Hurt More Than Gains Feel Good

It is human nature to focus on the negative.

It has been scientifically shown that losing $100 hurts more than winning $100.

It is more memorable to us than winning $100 too.

So it is only natural that many people are still stuck on the losses they incurred back in 2008.

I remember working for a financial services company and seeing my 401k plan tank on a daily basis.

But instead of being scared, I was OK with it.

Yes, it was disappointing to see the value of my 401k plan drop in half over the course of the year.

But I knew that the market was going to come back in time.

I stayed invested and kept putting more money into the market throughout 2008.

By 2011 I had all my money back and more.

Because I understand how the market works and that it rises more than it falls, I was not afraid of the stock market.

I don’t focus on those losses from 2008, but rather I focus on how much money I have made since then.

It wasn’t always this way, but I educated myself about investing.

You just have to educate yourself about investing too.

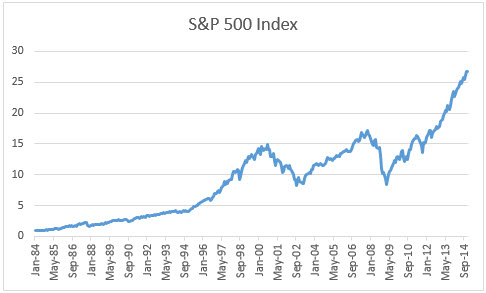

Look at the chart above.

The stock market has had a positive return 73% of the time since 1928 and a negative return just 27% of the time.

Stop focusing on the down years and focus on the years with gains.

#2. Corrections Happen All Of The Time

A correction is when the stock market falls 10% and they happen all the time.

In fact, these drops happen on average of once a year.

Since we tend to focus on the immediate future and past, we might not realize how often they actually occur.

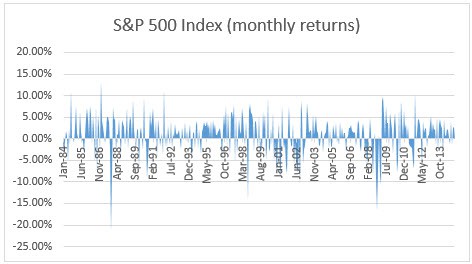

Below is a chart showing you the frequency of drops in the stock market historically.

So before you get scared thinking that the sky is falling, just remember this.

Pullbacks are a routine thing that happens all the time in the market.

It also helps to look at them in a positive light.

Pullbacks are a good thing because they put stock prices back in line so the overall market can continue going higher.

#3. Don’t Overreact To Volatility

I want you to look at the graph below.

Notice the huge decline in the early 2000’s (internet bubble bust).

Then again in 2007 (housing market bubble bust).

Both times the market came back.

And it will the next time too.

Now I want you to look at 1987 on the graph as well as 1990.

Notice those two big drops in the dark blue line?

Those were the stock market crash in 1987 and the recession in 1990.

At the time, they were big events.

But, they weren’t that bad and they don’t look that bad on this chart either.

I have two more charts for you to look at.

Which one looks scarier to you?

Most readers will say that the first one is scarier than the second.

The catch is that they are both of the S&P 500 Index from January 1984 to September 2014.

The only difference is the first chart is looking at monthly returns.

The second is looking at annual returns.

In other words, when you look at the short term, you see volatility, which is scary looking.

But when you look at investing from a long term investing perspective, it doesn’t look that bad.

That is your goal, to look at investing through long-term eyes.

Granted, short-term volatility is tough to stomach.

Especially when it’s the big story on the news and everyone is scared.

But this is the perfect time to buy.

Think about it.

When you go shopping, don’t you get excited when items are on sale?

Of course you do.

So why not get excited when the stock market drops?

Stocks are on sale.

As mentioned earlier, put a positive spin on the market drop and you will be able to deal with it better.

#4. A Good Offense Is Your Best Defense

Lastly, your best defense against a correction or any drop in the stock market is to have a good offense.

What does this mean?

It means that you need to take the time to assess your risk aversion.

Build an investment portfolio that allows you to sleep at night, even when the market drops.

If you do this, drops like these will be much easier to handle.

Just make sure you understand that risk and reward are related.

Often, when we do something to avoid one risk, we open ourselves up to another risk.

When it comes to investing, many people avoid investing because of the risk related to it.

This is called risk aversion.

You would rather preserve your money than risk it for a higher return.

But when you keep your money in cash, you open yourself up to another risk, reduced purchasing power.

While your money will be safe, you will have less purchasing power due to the impact of inflation.

For example, if you put $10,000 in the bank you will always have $10,000.

But your money won’t be growing and as a result, you won’t have enough money to survive in the coming years.

This is because the cost of the things you buy only increases in time.

The point is, don’t think that there is no risk with avoiding the stock market.

There is great risk with just keeping your money in cash.

The money you saved will be worth less and less each year because of inflation.

Best Investments For Fearful Investors

Now that you know how to overcome your fear of the stock market, I want to share some investment ideas with you.

These are designed to help you get used to investing and the ups and downs of the market without putting up a lot of risk.

#1. Heavy Bond Weighted Portfolio

When you first start out, invest the majority of your money in bonds.

I would suggest a mix of 80% bonds and 20% stocks.

As you begin investing, you will start to see how the market works.

You will realize that the media hypes both the good times and the bad times.

You will need to learn to tune these out.

As you learn more about the markets, you will become more comfortable with how it works.

Each year after you start investing, you should change your allocation 5-10%.

- Read now: Here is how to rebalance your portfolio

Lower your bond allocation and increase your stock allocation.

Do this by investing more money into equities like individual stocks, mutual funds, and exchange traded funds.

You can see what I suggest in the box below.

In time, you will get to and keep your allocation somewhere between 60-80% for stocks and 20-40% for bonds.

This mix will allow you to earn a return so that you will have enough for retirement while keeping an eye on risk.

One note about this process.

Be sure to gauge your comfort level as you raise your stock allocation.

I suggest you raise it each year, but that is just a suggestion.

If it takes you an extra year to go from 40% stocks to 50% stocks, that is OK.

At the end of the day, you have to do what is most comfortable for you.

But with that said, you do want to get to at least 60% stocks and 40% bonds.

This portfolio will give you the growth your savings needs and still protect it when the market drops.

#2. Invest Your Spare Change

Another great way new investors can get comfortable investing is to invest a very small amount of money.

In this case, I am talking about your spare change.

With the app Acorns, you invest your change when you make a purchase.

Acorns will round up your purchase to the next dollar and then invest it for you.

By investing this way, you don’t risk a lot of money and learn at the same time.

New users of Acorns get $5 when they sigh up too!

Acorns changed the game when they allowed you to start investing your spare change. With a simple to use app and effortless ways to invest, Acorns is a solid choice for many investors just starting out without a lot of money to invest.

#3. Real Estate

An alternative to earn higher returns on your money while you learn about stock investing is to invest in real estate.

Historically, returns average between 3-5% annually.

And there are many ways you can get started with real estate.

You can buy rental properties and manage them.

You could invest in real estate investment trusts, or REITs, which are traded on the stock exchange.

You could use crowdfunding real estate apps like Arrived Home as well.

Looking for an easy way to get started investing in real estate without a lot of money? Look into Arrived Homes. Pick the single family houses in the parts of the country you want to invest in and earn passive income.

No matter what you choose, the return you earn will be better than keeping your money in a bank savings account.

#4. I Bonds

Another option is to consider I bonds.

These carry less risk than the stock market and are designed to keep up with inflation.

They do this by having two interest rates.

A fixed rate that stays with the bond until you redeem it, and a variable rate that changes based on the level of inflation.

To purchase these bonds, you have to visit TreasuryDirect, which is the government site that sells them.

While they are great to get started with investing, you still want to get comfortable with the idea of putting money into stocks as well.

This isn’t an option in place of the stock market.

#5. Worthy Bonds

Worthy Bonds are an interesting option that a lot of people might not know about.

They offer bonds to investors that pay a fixed 5% interest rate.

The way they work is Worthy loans money to small businesses to fund their inventory needs.

The interest Worthy earns is divided by you and Worthy.

You get 5% and Worthy keeps the rest.

I’ve had great personal experience investing in them and highly recommend them as an alternative to a savings account.

Looking to safely earn a higher return on your money? Worthy Bonds offers 5% 7% interest on your money. Invest in small businesses and earn a return for doing so. New users get a $10 bonus when purchase your first bond.

#6. Use A Financial Advisor

A final option for you is to hire a financial advisor or go with a robo-advisor.

Yes, they cost money, but the expense is well worth it.

- Read now: Learn why you should hire a financial planner

- Read now: Here is a guide to help you find the best online broker

They will help to put you into a portfolio that matches your risk tolerance.

They will also be a rational hand to hold onto when the market drops.

When you get scared and want to sell, they will be the peace of mind you need to stay calm and not give into your emotions.

They will help to keep you invested over the long run so you can benefit from investing in the stock market.

Too many times we look at things that cost money and dismiss it simply because it costs money.

But you have to look at the benefits here.

If paying $1,000 means you grow your wealth to $100,000 or more, then this fee is more than worth it.

Final Thoughts

At the end of the day, you need to overcome your fear of investing in the stock market.

You stop being too scared to invest by understanding why you are scared and then put this fear into perspective.

From there, you have to educate yourself about the stock market and investing in general.

Realize that corrections and volatility are what happens in the stock market.

It is part of the process.

The stock market will never rise all the time.

It has to pull back and drop now and then.

The key is to make sure you prepare for this by creating an investment plan and portfolio for your needs and goals.

When you do this, any drops in the market will be easier to stomach.

- Read now: Here are John Bogle’s investing rules to follow

- Read now: Discover the best investing quotes of all time

- Read now: Learn why you should ignore Dave Ramsey’s investing advice

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

My RSP is invested in the market and it does keep going down, but apparently the whole market isn’t doing amazingly right now. I have a medium risk portfolio, but that does make me nervous sometimes.

The market isn’t doing too much right now. Over the long term, stocks are a good investment. You have to try to tune out the short term volatility and stay focused on the long term.

I’m a big fan of the stock market, so for me (a relatively young guy) I’m investing almost entirely in stocks and real estate. But I totally agree that wading into the stock market is better than sitting on the sidelines for the rest of your life!

Great to hear you are comfortable with stocks. Over the long term, they are the way to go.

It’s so important to determine your investing strategy before you invest. Understand your risk tolerance and why you’re investing. If you can do this when you’re level headed (ie, not in panic mode like many right now!), you’re much more likely to stay the course. And that really is the key: don’t jump out of the market when it goes down. If anything, you should rebalance your portfolio and buy stocks when they’re on sale!

Don’t let your emotions determine your investments. Have a plan. Stick to it.

Great post. Thanks for sharing it!

John

I used to have fear about investing, but I started to overcome it when I study and learn how investment really works. It’s really about getting out of our comfort zone and this requires a heck of a lot of work. But I tell you it’s really worth the effort.

Honestly, im looking to get into stocks this year which is new to me and it scares the crap out of me. I understand the volatility and its not really that. What scares me is jumping in now while we are at the top of a 7 year bull run.

It just seems like the worst possible timing to get in. I just dont see how it can keep going up. Which leads me to want to invest in commodities and wait out the bull run.

Buy cheap, sell high!

I conquered my fear when I got started and learn it. The only way to conquer fear is to confront it and begin. I remember that I bought my first stock of a favorite company as I well know it was run. From then on, I felt I was conquering my fear at investment.

Reading can take those fear away. When I was a beginner at investment, I just read and read. One book that helped me a lot is that by Alex Frey. His book is really for beginner and I learned so much good investment practices from the book.

Great article. It is interesting to note that the day it was published, was one of the all time lows for this year. The S&P has increased by 7% since that day. The best thing to do is dollar cost average and avoid reading or listening to the news.

The one thing I disagree with in the article is investing in bonds. Interest rates have no place to go but up, which means that bonds have no place to go but down.

What has really helped me when market volatility strikes is having an investment plan that I’m confident in. In 2008, it was a different story. I had a mix & match of individual stocks and ETFs that I probably hadn’t done enough research on. Now, I have a specific plan and all my allocations are pre-determined when new money gets added. It doesn’t take away all the emotion when markets move lower, but it definitely helps. It also makes me less likely to make a bad decision at precisely the wrong time. Its always a work-in-progress, but that’s what has helped me.

I used to be scared of the stock market and those numbers, and I am just glad that I conquered this challenge as now I know the investment strategies and can know the right time to invest.

Worth reading this educative guide! Nicely described how to invest when someone is scared of the stock market. Stock exchange market is very risky and if you’re not an expert doing investment in stock market it’s a dead end for you. By knowing the key factors of investing in stock market here provided people will actually get huge benefits indeed.