THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Every few months I would take my change to the bank and deposit into my savings account.

It always blew my mind how much money my spare change added up to.

Thanks to technology, there is a novel new way to benefit from your spare change.

You can use it to help pay off debt.

It’s called Qoins.

With the Qoins app, your purchases are rounded up and the money is then transferred to help you pay off your debt faster.

It really is this simple.

In this post, I am going to walk you through the Qoins app so you can see just how powerful it is.

Summary Qoins is a spare change app that helps you pay off your debt fast. In fact, by using the app, users report paying off their debts 2 years faster. And in total, Qoins users have paid off over $4.5 million worth of debt! Because of how easy Qoins is to use, I highly recommend Qoins. Click here to start using Qoins and get out of debt faster!Qoins App Review

Table of Contents

My Qoins Review | The Best Spare Change App To Pay Off Debt

What Is Qoins?

Qoins is a clever app that lets anyone use their spare change to pay down their debt faster.

It’s actually a smaller version of the debt snowball plan many use to get out of debt.

The app was created by Christian Zimmerman to help people get out of debt so they can start building wealth.

He saw the power behind other micro saving apps to help people save money, but didn’t see anything to help people pay off debt.

So he created Qoins.

Here is a short video overview of how the Qoins app works.

By allowing you to pay extra on any debt you have, you can get out of debt faster and save money on interest.

And with the levels of debt Americans have, this is a good thing.

To date, Qoins users have paid off over $4.5 million worth of debt.

This alone confirms the app does what it is intended to do.

How To Get Started With Qoins

There are four simple steps to get started with the Qoins app, each one taking about 2 minutes to complete.

#1. Download the app by clicking here. Then enter your personal information to create your account.

#2. Connect your bank account to the app. This is where round ups or Smart Savings will be transferred from and over to Qoins.

#3. Add your round up accounts. These are the accounts Qoins will look for round up opportunities.

#4. Add your debt accounts. These are the accounts you want your round ups or Smart Savings to be applied to.

After set up is complete, you let Qoins work its magic and round up your purchases or save smartly.

In fact, many users say they forget about Qoins rounding up their purchases because the amounts are so small.

But they do notice their debt balances dropping faster.

How Qoins Works

Depending on the saving option you choose, Qoins will work on saving your money and applying the savings to your debt.

Smart Savings

With the Smart Savings option, you let Qoins save a random, small amount from your bank account every few days.

You choose the level of savings you want Qoins to take, from aggressive to conservative and you can change this level as often as you want.

The benefit of using Smart Savings is users tend to save more money using this feature versus the round up feature.

Round Ups

With rounds ups turned on, Qoins will look for round up opportunities every time you spend using a linked card.

For example, you pay for groceries using your credit card and the total comes to $66.18.

Since you set up your credit card as a round up account in the Qoins app, Qoins sees this transaction and rounds up the purchase to $67.00.

Qoins then transfers the $0.82 into your Qoins savings account.

Once your Qoins balance reaches the amount limit you set, a payment is made to the debt of your choice.

Note that Qoins will not make a transfer every time you make a purchase.

Once your round ups total $5, only then will Qoins transfer money from your bank funding account to your Qoins savings account.

Withdrawal And Payment Rules

The app has two basic methods for you to choose from in terms of rules for sending out payments to your creditors.

Threshold Rule

The threshold rule has the app send a check to a selected creditor every time you reach a money-level threshold in your Qoins account.

If the threshold is $15, then Qoins will send out a payment every time you accumulate $15 in your Qoins savings account.

Lump Sum Rule

The lump sum rule has Qoins send a payment every month, no matter how much your accumulated savings from rounded up transactions are.

You simply pick a day of the month, and when that day rolls around, Qoins sends your creditor a check for whatever amount you’ve saved up to that point.

Note that the lump sum rule is the default rule used by Qoins.

It is also important to note that there are fees when you pay a creditor, so you need to take that into account when determine which payment rule to use.

Qoins Fees

Qoins does charge a fee for using their service.

However, the fee is only charged when a payment is made to one of your debts.

The cost to send a payment is $1.99.

For example, if you saved $50 through round ups, then Qoins will deduct $1.99 and send $48.01.

The fee always comes from your rounded up savings, not your checking account.

And when you try out Qoins, your very first payment is free. Therefore there is zero risk for you to try it out.

Advantages And Drawbacks

There are both great advantages to using Qoins and some drawbacks.

Here are the biggest of each.

Advantages

Simple to use. You download and start using Qoins in less than 10 minutes.

Effortless debt repayment. You won’t even realize your spare change is being transferred to your Qoins account but you will see your debt balances drop.

Unlimited creditors. Many of the creditors you have debt with will have their information in the app.

In the rare case your creditor is not, you can manually add them.

Always innovating. The app is always working to improve its offerings.

For example, it is working on allowing more than one person to round up and pay down one debt.

This would be great for couples or family members looking to help each other to pay down debt

Flexibility. You choose the debt you want to pay with your round ups and you choose if you want to only save round ups or have Qoins auto save random amounts throughout the month.

Drawbacks

No interest. When your round ups are deposited into your Qoins saving account, you do not earn interest.

With this said, since you are using this money to pay off debt, it doesn’t have a chance to earn a lot of interest anyways.

Paper checks. When Qoins pays one of your creditors, it sends a paper check, which takes between 7-10 days to get credited to your account.

As annoying as this can be, by paying with a check, it allows Qoins to pay virtually any creditor.

Limited customer service. Because Qoins is a small company, you cannot call customer service.

However, you can email and chat if you have any issues.

Frequently Asked Questions

Below are the common questions I get asked about the Qoins app.

If you are short on time, this is a good place to get answers to most questions about the app.

Is Qoins app safe?

The app uses 256-bit encryption and meets all industry standards with regard to security tech.

In addition, the accounts in which Qoins stores your accumulated funds is FDIC insured.

Finally, if any of your Qoins payments are not processed correctly, Qoins will refund the payment amount back to your Qoins account at no charge to you.

What is required to start using Qoins?

In order to open a Qoins account, you need to be at least 18 years old and have a US based checking account to link to the app.

How much does Qoins cost?

Fees, which are directly deducted from your funding account you set up on day one, vary by usage.

The fee charged for a transfer of your savings to one of your debts is $1.99. This fee is charged for each monthly transfer you make.

So if you choose the lump sum payment rule, Qoins will make one payment a month, totaling $1.99.

Over the course of a year, using Qoins will cost you $23.88.

If you choose the threshold payment rule, you can potentially make more than one payment a month. Each of these payments will cost you $1.99.

So if Qoins makes 2 payments to your creditors a month, it will cost you $3.98. Over the course of a year, using Qoins will cost you $47.76.

What kind of debt can I pay down?

You can pay down any kind of debt you choose.

Select from credit cards, medical bills, personal loans, auto loans, student loans and any of hundreds of other kinds of debts.

All the app needs is the correct account number and address so it can send the payments to the right place and the correct account.

Can I pause activity with Qoins?

Yes.

When you pause a payment in the app, you also pause the roundups as well. This pause feature lasts for 30 days and then resumes.

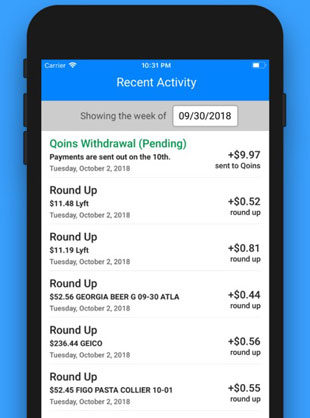

Can I track my payment history?

The app is very user-friendly when it comes to tracking your data.

You can see every rounding transaction and date, the amount in your account, how much has been paid out, who the payments went to, when the checks were deposited and more.

In essence, whatever monetary parameter you want is included on your data page within the app.

There’s no guessing because you know exactly how much was rounded, saved and eventually sent to creditors.

You’ll also see all the fees, down to the penny, that Qoins has charged you for their services.

How do I delete my Qoins account?

Deleting your Qoins account is easy.

First, you need to cancel any upcoming payments. After this any money in your Qoins account will be refunded to your linked checking account.

Finally, contact customer service and let them know you want to deactivate your account.

The closing process can take up to 2 weeks depending on any transfers that need to be canceled.

Who is Qoins a perfect fit for?

If you are the kind of person who likes to pay your debt down painlessly, the Qoins app is for you.

There is no technical expertise required for setup.

All you do is decide what accounts to link to Qoins and your payment method and let Qoins get to work.

Below is a short success video of one Qoins user.

By simply taking advantage of her spare change, Janice paid off an extra $1,500 on her debt!

How much money can Qoins save me?

The amount of money Qoins saves you depends a lot on your debt and interest rates.

But I will give you an example so you can get an idea of how much money using this app can save you.

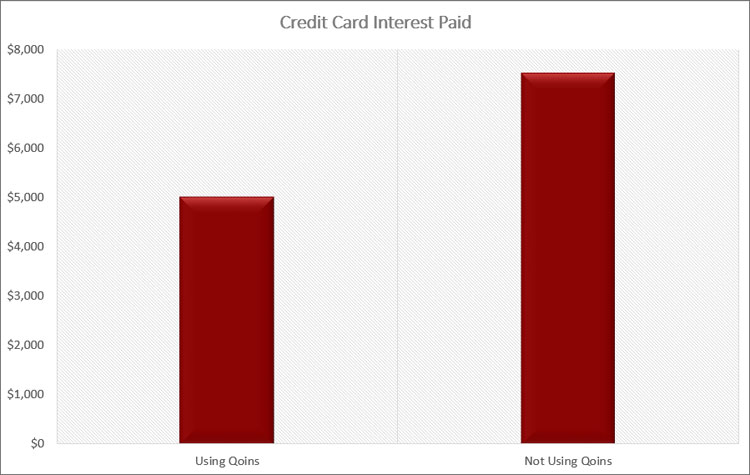

Let’s say you have a credit card with a balance of $10,000 and 17% interest.

If you pay $200 a month on this debt, it will take you over 7 years to pay off this debt and you will pay over $7,500 in interest.

This means you will have paid over $17,500 in total!

But let’s say you use Qoins.

Your monthly Qoins payment is $50 and after they take their fee, your actual payment is $48.01.

With a $247.01 monthly payment, it will take you roughly 5 years to pay off this debt and you will pay less than $5,000 worth of interest.

By using Qoins, you are out of debt over 2 years faster and you saved more than $2,500 in interest!

This is why Qoins works.

Getting out of debt is a long, and at times difficult process.

With the help of Qoins, you stay motivated throughout the process, increasing your chances of being debt free.

Alternatives To Qoins

There are some alternatives to Qoins.

However most micro savings apps are designed to save you money, not help you pay down your debt.

Because of this, there is only one true competitor to Qoins.

Qoins vs. ChangeED

ChangeED works very similar to Qoins.

The main differences are ChangeED only works on paying down student loan debt.

Also, ChangeED makes payments when your round ups total $100 and the fee for the payment is $1.00.

Final Thoughts

Qoins is a great option for those looking to pay off their debt faster.

On the surface, it doesn’t sound like rounding up your spare change will make a difference, but it does.

The average Qoins user pays off an extra $600 annually on their debt.

This means getting out of debt faster and saving money by paying less interest.

And most Qoins users don’t even realize the app is working for them.

This is because of the small withdraws it takes from your checking account.

If you are serious about debt and finally breaking free, Qoins is a smart option to try.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.