THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

With mobile banking taking over the banking industry, fewer people are using bank branches to deposit and withdraw money.

And as mobile payment apps grow in popularity, the bank as we know it is changing.

In fact, many people don’t even have a bank.

Because of this, more financial services companies are creating their own bank products to make the lives of their customers easy.

This includes Betterment.

While Betterment is still one of the best robo-advisor investing firms out there, their new cash management option helps consumers keep their financial lives simple.

In this Betterment Everyday review, I will walk you through this cash management offering so you can better decide if it is the solution to your everyday money needs.

Betterment Everyday Review

- Features

- Ease of Use

- Customer Service

- Account Fees

Summary

Betterment Everyday is a new cash management option for those looking to un-bank. With a high interest paying savings account and zero account fees, Betterment Everyday is worth looking into. Click here to learn more.

Table of Contents

Betterment Everyday Review | The New Cash Management Option

What Is Betterment Everyday?

Betterment Everyday is the cash management system from Betterment, aimed to help customers better control their money and earn a competitive interest rate.

There are two parts to this system, Betterment Everyday Cash Reserve and Everyday Checking.

Below I go into detail about both.

But first, it is important to understand that Betterment is not a bank and your money is held at partner program banks, where it earns interest and is protected by FDIC insurance.

Betterment Everyday Cash Reserve

Betterment Everyday Cash Reserve is the savings account solution to help you reach your short term goals.

Even though this is not a traditional savings account, Betterment Everyday Cash Reserve will look like a savings account to you.

You will earn interest as usual and make all of your transfers using the Betterment mobile app.

When using the app, it will feel like a regular savings account. But behind the scenes, your money is held at various partner banks.

To get started, all you need is $10 to open your account.

Betterment Everyday Cash Reserve Features

There are two great features of the Everyday Cash Reserve account that I want to walk you through.

- Cash Analysis

- Two Way Sweep

Cash Analysis

Cash Analysis is a tool that helps you determine how much extra cash you have in your checking account.

The idea is that your extra cash is money that could be earning more if it were in a savings account.

And by limiting the amount of money in your checking account, you won’t be as tempted to spend it.

By organizing and predicting your spending needs, Cash Analysis tells you if you’re holding the right amount of cash.

Two-Way Sweep

Two-Way Sweep works together with Cash Analysis.

After you link your external checking account or Betterment Everyday Checking to Betterment Everyday Cash Reserve, Two-Way Sweep will move any extra money into savings for you.

If Cash Analysis notices your checking account balance running low, it will transfer money from savings over to your checking account.

You control the target balance for your checking account, and Betterment will send you an alert before making a sweep, which lets you cancel the transaction if you’d like.

Everyday Checking

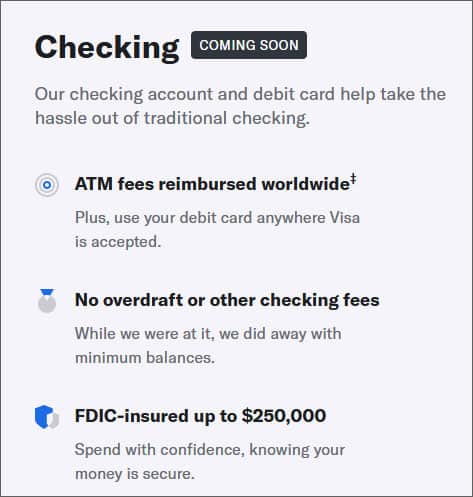

The Everyday Checking account is coming soon and you can join the wait list.

The plan for this account is similar to the Everyday Cash Reserve account, in that you earn a higher than average interest rate.

But with this account, you get a debit card to withdraw cash from ATMs worldwide.

Finally, there will be no fees on the Everyday Checking account, which includes no overdraft fees.

Advantages And Drawbacks

There are advantages and drawbacks to using Betterment Everyday.

Here are the main ones you need to know.

Advantages

High interest rate. Betterment Everyday offers one of the highest interest rates on savings accounts.

No fees. There are no minimum balance requirements and no account fees.

Unlimited transfers. Unlike traditional bank savings accounts, there is no limit on the number of withdraws you can make per month.

FDIC Insured. Just like with traditional savings accounts, your money is covered by FDIC Insurance.

However, the Everyday Cash Reserve has insurance coverage up to $1 million dollars.

ATM Fee Reimbursement. Use your ATM anywhere worldwide and any fees other banks charge you is reimbursed.

Drawbacks

No checking account. Betterment is in the process of offering a checking account, but for now, there is no checking account to use.

No branches. All transactions are done online.

No mobile check deposit. You can only make transfers between a linked bank account.

No joint accounts. At this time, you cannot open a joint account.

Frequently Asked Questions

Is Betterment Everyday safe?

Yes.

Betterment has been around since 2010 and their investment business has over $16 billion assets under management as of April 2019.

Betterment Everyday has your money held as partner banks that have been in business for many years.

Finally, your money is insured by FDIC.

What are the program banks Betterment uses?

As of this writing, there are 5 partner banks where your money is held:

- Barclays Bank Delaware

- Citibank

- Georgia Banking Company

- Seaside National Bank & Trust

- Valley National Bank

If you decide you do not want your money held at a certain bank, you can contact Betterment and they will make sure your money does not get deposited at that bank.

How does Betterment Everyday work?

Betterment Everyday Cash Reserve works by taking your money and depositing at various banks.

Betterment decides on the breakout and which banks get your money.

For example, if you have $100,000 in savings, your money might get broken up as follows:

- Barclays Bank Delaware: $25,000

- Citibank: $25,000

- Georgia Banking Company: $25,000

- Seaside National Bank & Trust: $25,000

You will earn the stated interest rate on this money and your money will be covered by FDIC insurance.

With Everyday Checking, your money is held at a partner bank, which is again FDIC insured. You will earn interest on this account as well.

What are the fees?

There are no fees on Betterment Everyday accounts.

How often can I withdraw money?

You can make unlimited withdraws with the Betterment Everyday Cash Reserve Account.

There are no limits on Everyday Checking either.

Alternatives To Betterment Everyday

There are some alternatives to the Betterment Everyday accounts. Here are the ones most people consider using.

They are all banks, but offer 100% online experience, which makes them a great stepping stone before making the leap to non-bank life.

CIT Bank

CIT Bank is an online only bank.

They offer both checking and savings accounts, without any fees, and one of the highest interest rates in the country.

You can open various types of accounts, including single and joint accounts.

Overall, if the idea of not having a true bank concerns you, CIT Bank is a great choice.

Capital One 360

Similar to CIT Bank, Capital One 360 offers a complete banking experience online.

They make banking simple and efficient and offer a competitive interest rate on both their checking and savings accounts.

As bonus, new users get a $25 bonus when they open a new account.

Ally Bank

Ally Bank is another great option for your banking needs.

With great customer service and a variety of accounts types, Ally has quickly become one of the favorite online banks.

It also helps that they pay competitive interest rates on their accounts as well.

Final Thoughts

Overall, the Betterment Everyday cash management system is a great option for those looking to break up with their bank.

They offer a great interest rate along with FDIC protection on your money.

The only downside right now is a lack of direct deposit and depositing of checks. However, once the Everyday Checking account is available, this will no longer be an issue.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.