THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Are you tired of earning close to nothing with your savings account?

You aren’t alone.

Many people work hard for their money and don’t have much to show for it thanks to low interest rates.

But there is hope.

You can earn a decent amount of interest on your savings and I am going to show you how.

I was in your shoes.

I had a nice savings cushion at my local bank. But it was earning 0.05% interest.

After a few months of not even earning a penny in interest, I knew I had to make a change.

I started researching various types of short term investments.

And I was amazed at the many types of short term investments that are available to everyone.

So today I am going to share with you the various investments for short term investors to park your money and earn a decent rate of return on.

This list will cover all the options out there, from low risk to high risk.

Because of this, there are some investments I list where you could lose money in the stock market.

But there are many others that are safe places to keep your money that won’t have you risk losing any of it.

Let’s get started looking at the many types of short term investments.

Table of Contents

The Best Types Of Short Term Investments For Your Money

#1. High Yield Savings Accounts

The safest place to put your money is a traditional savings account at your bank.

The problem with these accounts is they pay little to no interest.

Until now.

Say hello to CIT Bank.

This bank offers an online savings account with an interest rate that is one of the highest in the country.

And they consistently rank at the top of the list of highest interest paying accounts all the time.

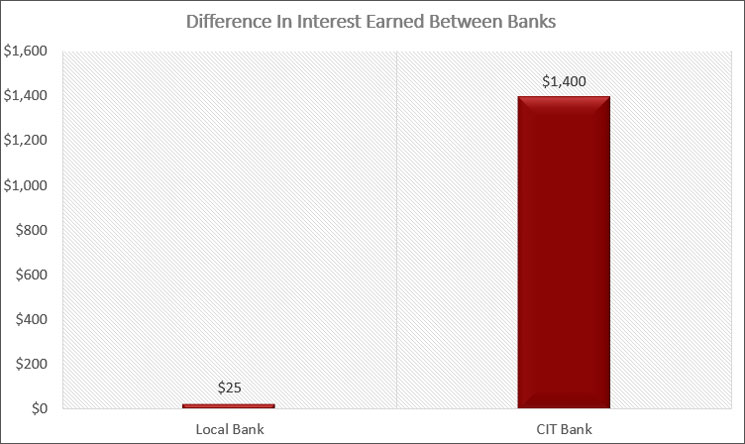

Just look at the difference putting your money into their online savings account makes.

Let’s say you have $5,000 and you keep it in your savings account for 10 years.

With CIT Bank, you will end up with close to $1,400 in interest.

Keep your money at your local bank and you’ll be lucky to earn $25.

#2. Bank CDs

Investing in a certificate of deposit (CD) is a great way to earn a higher interest rate on your money.

The difference with a CD as opposed to online savings accounts is the potential for higher interest, also known as yield.

In return for this higher yield you have to lock your money up for a period of time.

With a savings account, you are free to take your money out of the account whenever you want.

But with a CD, you have a period of time that you have to leave the money in the account.

You know the length of this period of time because you choose the term.

Most common CD terms are 6 months, 1 year, 18 months, 2 years and 5 years.

The longer you lock your money up, the higher the interest rate you will earn.

Of course, if you really need the money, you can still close the CD early and get your money back.

But by doing this, you will typically forfeit 3 months worth of interest payments.

Note that there are some CDs that offer no penalty if you close the CD early, but they pay a slightly lower interest rate because of this.

Finally, there are some CDs that offer the option to increase your interest rate one time during the term.

Since your interest rate is locked when you open the CD, you could lose out if interest rates rise with a typical CD.

By letting you increase your rate one time, you can lower the chances of this risk.

#3. Money Market Accounts

Money market accounts are a way for you to earn higher interest without locking your money up like with a certificate of deposit.

There are 2 types of money market accounts.

The first is virtually the same as a savings account.

The only real differences are that you tend to need a higher balance in the account, for example $25,000 or more and you can write checks on the account.

Banks will pay a higher interest rate on a money market account since you are depositing more money.

The second type of money market account is a money market mutual fund. These accounts invest in short-term bank instruments.

The underlying value of the fund stays at $1 (although back in 2008 after the housing collapse, some funds did “break the buck”).

Essentially, a money market mutual fund won’t lose money for you and you will earn a little more interest than a basic savings account.

#4. Savings Bonds

Savings bonds are another short term investment option.

Savings bonds are backed by the full faith and credit of the US Government and are therefore considered free of default risk.

Currently there are two types of savings bonds available for purchase, the EE Series and I Series.

The difference is how they pay interest.

- EE Series savings bonds pay a fixed rate of interest. The rate you earn is set when you purchase the bond, and remains constant for the life of the bond.

- I Bonds pay fixed rate of interest, plus an adjustable rate. The interest rate on an I Bond is made up of two components, a fixed rate component and a floating rate component. The fixed rate component on an I Bond is set when the bond is purchased and remains constant for the life of the bond. The floating rate component is reset every 6 months and is based on the current level of inflation.

The interest rate on an EE Series savings bonds is lower than what you will find with many of the other options listed here.

But there are some interesting things to consider.

First, if you keep your EE Bond for 20 years the government guarantees that it will at least double in value.

When you do the math, this comes out to a return of 3.5% over the life of the bond.

This works because if you cash in your bond after 20 years and it is not worth double the purchase price, the government will make an adjustment to the final value of the bond so it will be worth double what you paid.

The second interesting thing to consider is that while you will owe federal income tax on the interest you earn on the bond, you will not owe any state income tax.

Finally, you can avoid taxes altogether by using the bonds and the interest to pay for higher education.

The same tax benefits of the EE bonds are true for I bonds as well.

Finally, you can cash in a savings bond at any time after holding the bond for 1 year.

However, if you cash the savings bond in before holding it for 5 years, then you have to give up 3 months worth of interest.

After 5 years you can cash the bond in at any time without penalty.

Also keep in mind that an individual can purchase up to $10,000 worth of EE bonds and $10,000 worth of I bonds in any given year.

#5. Invest In Small Businesses

Before I told you how you can earn 192% more interest by opening a savings account with CIT Bank.

Here I will do you one better.

You can earn close to 200% more interest by purchasing Worthy Bonds.

What are Worthy Bonds?

It is an investment that has your investment loaned out to small businesses to fund their inventory needs.

Worthy charges a low interest rate to the small business and then Worthy turns around and gives you 5% on your investment.

By investing with Worthy Bonds, you earn 5% on your money.

The catch is there is some risk to your investment.

In fact, this is the first short term investment that does put your principal at risk.

Understand though that this risk is small.

Worthy is required to have a contingency fund of money in case a small business doesn’t pay back their loan.

In this case, Worthy would use the money in the contingency fund to pay you the 5% on your savings.

In other words, Worthy Bonds has an emergency fund to protect investors.

The odds of this happening however are slim since the company goes to great lengths to loan money out to high quality businesses.

Additionally, the loans are backed by the inventory of the small business.

You can get started with Worthy Bonds with as little as $10. You can even set up your account to invest your spare change.

This works by having Worthy round up your purchases to the nearest dollar and invest your spare change to buy more bonds.

If you average $500 in round ups a year, in 10 years you will have an additional $6,600!

#6. Short Term Bond Funds

The next short term investment to consider is short term bonds.

The main difference with short term bonds over the other ideas mentioned is that this is the first one that you have a higher risk losing principal.

In other words, if you invest $1,000 in short term bonds, you could end up with $900 or less.

However, understand that the risk of losing money is much less than with the next option on the list.

As far as the interest rate short term bonds pay, it all depends on overall interest rates and what the Federal Reserve is doing.

But before you run off to buy short term bonds, you have to understand how they work.

Without confusing you completely, know that when bond prices rise, interest rates fall.

And when bond prices fall, interest rates rise.

For example, take a bond that is selling for $100 and yielding 3%.

If interest rates rise to 3.25%, the price of the bond will drop below $100. While you lose principal, you do earn more interest.

The best way to invest in short term bonds is through ETFs and mutual funds.

- Read now: Click here to understand how ETFs and mutual funds differ

- Read now: Learn the basics of mutual funds

By investing through these vehicles, you buy a basket of bonds at various prices and interest rates, diversifying your risk.

You also buy bonds with various maturity dates.

This is a fancy way of saying when the bond ends and the investor gets their principal investment back.

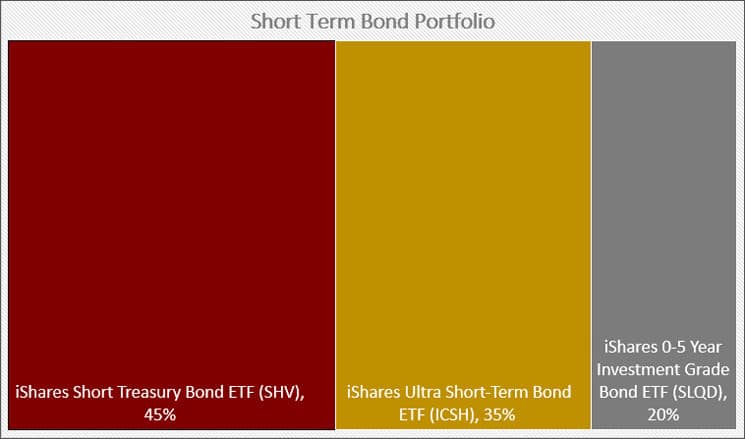

An ideal portfolio to invest in would consist of the following bonds funds:

- iShares Short Treasury Bond ETF (SHV)

- iShares Ultra Short-Term Bond ETF (ICSH)

- iShares 0-5 Year Investment Grade Bond ETF (SLQD)

By creating this portfolio of interest paying bonds, you would earn an OK yield and has the potential to offer growth of your principal as well.

If this portfolio sounds interesting to you, you can build it using M1 Finance.

M1 Finance is a robo-advisor that allows you to build your own custom portfolios for free.

They do not charge any trading fees or commissions, which is why I invest with them.

#7. Peer To Peer Lending

Another lower risk option is to looking into peer lending, or p2p lending.

This is where people who need money crowdfund their loan by skipping the bank.

Here is how it works.

Let’s say I need $10,000 for a car.

I go in Lending Club or Prosper and after doing a background check on me, these sites allow my loan to be posted for investment.

You see my loan and the interest rate you will be paid and decide to invest $200.

Assuming others invest enough to hit my $10,000 goal the loan is made.

Now every month for the next 5 years you will get a portion of your $200 investment back, plus interest.

The interest rate varies by loan and borrower and you can build a portfolio of investments by investing in a handful of loans.

#8. Short Term Stocks

The final type of short term investment to consider is stocks.

The catch here is you are at greater risk of losing money than all the other options listed.

As a result, you should not consider this option if your savings goal is less than 5 years away.

It is just too risky to invest in stocks and potentially lose money.

But, they offer better returns than the options previously listed.

If you are investing for more than 5 years, you can’t just pick any stocks.

You need to pick safe dividend paying stocks.

The reason for picking safe dividend paying stocks is because these stocks won’t have large price swings and because they pay a healthy dividend.

What are some safe dividend paying stocks to consider?

Most are in the defensive and utilities sectors of the stock market.

By investing in these stocks, you won’t get rich from share appreciation, but you will earn a healthy dividend.

Here is a short list of the best short term stocks to consider buying.

- Duke Energy (DUK)

- McCormick (MKC)

- Johnson & Johnson (JNJ)

- Chubb (CB)

- Sherwin Williams (SHW)

- Pfizer (PFE)

As with the short term bonds, you can build a customized portfolio of safe dividend paying stocks with M1 Finance.

Advantages And Drawbacks

Of course with any investment, there are advantages and drawbacks.

This is true with the types of short term investments I list above.

Advantages

Safe principal. In most cases, you won’t be risking your principal when you invest for the short term.

Easy to predict. Since your principal is safe and you know the interest rate you will earn, it is easy to do the math to see how much money you will end up with.

Flexibility. It’s easy to get your money when you need it, and not have it tied up long term.

Small investment. You can generally start putting money in these financial products with as little as $1.

Drawbacks

Lower returns. Because the investments tend to be safe, they pay lower returns.

Taxes. When it comes to bonds, you are paying ordinary income tax rates if you invest in a taxable account.

Many options. This is a benefit except if too many choices make sit harder for you to decide on one investment.

Short Term Investment Strategies

With all of the types of short term investments listed, you might be confused and a little overwhelmed as to what the best options are for you.

Luckily, I have you covered.

Here is a breakout of short term investment strategies you can use right now to earn more interest without much risk.

By following these strategies, you will know exactly how to invest your money.

#1. Start Off With A Savings Account

You need to have a cushion for emergencies and the best place for this money is a savings account.

While your needs may differ, I suggest keeping $10,000 in a savings account.

This allows for quick access to your money should you need it.

I realize saving $10,000 sounds intimidating, but you can do it.

Just break it out into smaller goals, like saving $1,000 at a time and you will get there faster than you think.

Again, I recommend going with CIT Bank since you will be earning a healthy amount of interest on your savings.

Of course, any of the online banks will do, as most tend to pay higher rate of interest than traditional brick and mortar banks.

You might even look into local credit unions as well.

Some pay decent rates, though online banks tend to do better.

#2. Create A CD Ladder

Once you have $10,000 in your savings account, you can begin to create a ladder of CDs.

This works by having you invest in certificates of deposit that have different maturity dates and various interest rates.

By doing this you limit the risk of rising interest rates while your money is locked up.

I suggest you invest your money in 4 CDs with the following maturities:

- 12 Month (1 year) CD: $1,500

- 18 Month (1 ½ year) CD: $1,500

- 24 Month (2 year) CD: $1,500

- 60 Month (5 year) CD: $1,500

In total you are investing $5,500 in bank CDs. When each CD matures, you simply reinvest the money for the same term in a new CD.

#2a. Invest In Worthy Bonds

As an alternative to building a ladder with certificates of deposit, you can invest in Worthy Bonds.

I encourage you to take advantage of their round up feature to help you speed up the process of saving money.

#3. Create A I Bond Portfolio

You now have $15,500 invested between a savings account and bank CDs or Worthy Bonds.

Your next step is investing in I bonds.

To do this you go to TreasuryDirect.com and create an account.

Then buy bonds either in bulk or on a monthly basis.

The reason I suggest I bonds is because you can defer the taxes on the monthly income the bond earns until you sell it.

And you can sell your bonds after 12 months, though you will pay a penalty of 3 months worth of interest.

An alternative is to invest in short term bond funds.

To do this, you open your free account at M1 Finance and buy the following bonds:

- iShares Short Treasury Bond ETF: (SHV)

- iShares Ultra Short-Term Bond ETF: (ICSH)

- iShares 0-5 Year Investment Grade Bond ETF: (SLQD)

You want to make sure you have the following percentage of each in your investment portfolio:

- 45% – iShares Short Treasury Bond ETF (SHV)

- 35% – iShares Ultra Short-Term Bond ETF (ICSH)

- 20% – iShares 0-5 Year Investment Grade Bond ETF (SLQD)

This will diversify you nicely and provide you with a nice monthly income stream.

The downside to this is every month your monthly income is getting taxed at ordinary income rates, which is higher than investment taxes.

So before you do this, review your financial situation to make sure it makes sense for you.

Short Term Trading Strategies Recap

Here is your strategy for short term savings:

#1. Open a savings account and fund it with $10,000

#2. Create a CD ladder with your next $5,500

#2a. Alternatively, you can skip the CD ladder and put the $5,500 into Worth Bonds

#3. Invest in I Bonds or create a short term bond portfolio with the rest of your money

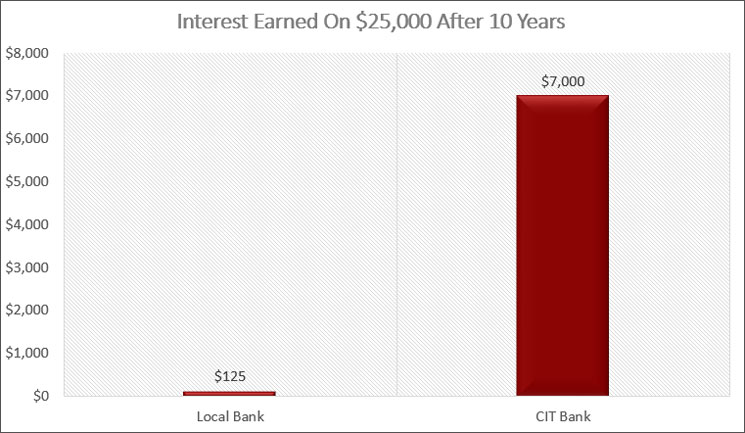

Let’s say you follow this short term trading strategy for 10 years with $25,000.

At the end of the 10 years you will have over $32,000.

This means you earned over $7,000 in interest.

If you instead keep this money in your bank account that is paying you virtually no interest, you will have earned $125 in interest.

The answer to what you should do is simple.

Frequently Asked Questions

There is a lot of confusion and some mystery surrounding the many types of short term investments.

I created this FAQ section to help you understand exactly what you are getting into when investing in these investment types.

When should I invest in short term investments?

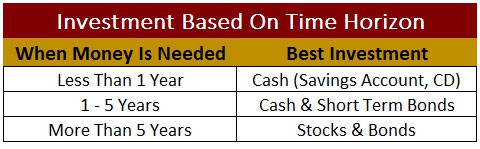

When it comes to investing, your time horizon plays a huge role into what you actually invest in.

Without taking into account your time frame, you could end up investing in an asset that is too risky or one that carries too little risk and therefore won’t provide the return you need.

Therefore, you need to make sure you pick the right investment based on your time horizon, financial goals, and risk tolerance.

- Read now: Click here to learn your risk tolerance

Below is a chart for your reference.

From the chart you can see that if you have a short time horizon, such as needing your money in less than 5 years, then you should be investing in cash and/or bonds.

Investing in stocks or equities at this point is not advised since you would risk losing your principal in return for a higher rate of return.

This risk is simply too great and you should stick with cash and/or bonds.

Are short term investments safe?

The next question I get asked about the different types of short term investments is are they safe.

For the most part, they are safe.

Of course, if you listen to talk radio, there will be ads touting all sorts of safe investments, many of which are nowhere near safe and others even I haven’t heard of.

Aside from these outliers, short term investments are safe to invest in.

Is my principal is safe?

The overwhelming majority of times when investing in checking, savings, and certificates of deposits, the principal you invest is safe 99.99% of the time.

The only way you will lose your principal is if the bank where the investment is held at goes under and it wasn’t covered by FDIC insurance.

Additionally, if you had more invested than the FDIC coverage amount allows, your extra savings could be at risk.

When do I risk losing money?

Even though these are safe investments in the sense you will never lose principal, depending on the interest rate you are earning, you still risk losing money to inflation.

I’ve talked before about inflation, but too many investors ignore it.

Over time, inflation eats away at the purchasing power of your money.

We see this all the time.

I remember as a kid a pack of gum costing me $0.50. Now it costs $1.99.

This is the effect inflation has on prices. It causes prices to rise over time.

Historically, inflation runs between 2-3% annually.

If your savings account earns you 1% per year, you are losing out to inflation.

Let’s look at the numbers to see this in action.

Let’s say you have $1,000 and want to use it buy a home theater system that also costs $1,000.

But you don’t want to buy it now, you want to buy it in 1 year after you have your new house.

You decide to invest your money in a savings account earning 1% annually.

During this time, inflation is running at 3% annually.

After one year, you earned $10 in interest, making your savings worth $1,010.

Because of inflation, the home theater system that cost $1,000 at the beginning of the year now costs $1,030 at the end of the year.

Your savings account a safe type of investment because you didn’t lose your original $1,000. But your savings account is not a safe investment because inflation is outpacing your return.

While you earned $10 in interest, the cost of the home theater system rose by $30, thus you “lost” $20.

This is the danger of safe types of investments.

You sleep at night because you are not losing the money you saved or invested.

But you are losing purchasing power and as a result, need to save more money every year.

This is why they call inflation the silent killer. It slowly destroys your finances behind the scenes.

The good news is that by earning an interest rate in the 2-3% range, you keep pace with inflation and it doesn’t have a negative impact on your wealth.

What are high yielding safe short term investments?

Unfortunately, there is no such thing, regardless of what the man on the radio or late night television is trying to sell you.

Always remember that risk and return are related.

The higher the risk, the higher the potential return you can expect. The lower the risk, the lower the potential return you can expect.

As of now, the highest yield you can expect to earn and still have your money safe in terms of not losing money is with Worthy Bonds or CIT Bank.

In my opinion, they are the best short term investments you can make and this is where I put my money.

Where is the best place to invest my money for 1 year?

If you need your savings within 1 year, the best short term investing options are an online savings account or a bank CD.

The ultimate answer will be the interest rate.

I would first consider an online bank since they pay higher interest rates.

Pick a few and see which one offers the best rates.

From there, I would look at a few different banks for their rate on a 1 year CD.

If the rate is higher than the savings account at CIT Bank, invest in the CD.

If the rate is lower, then put your money into a savings account with CIT Bank.

If I follow your short term trading strategy, what do I do with the money as I am saving for the additional steps?

I would put everything you save into your CIT Bank account.

Once you have enough to start buying CDs, then take the money out and buy the certificates of deposit.

Then start savings in your bank account again until you have enough invest in either I bonds or short term bonds.

Is a Roth IRA a good short term investment?

A Roth IRA is a good place for a short term investment since you can withdraw your contributions without and tax consequences or penalties.

You just have to make certain you only are taking out as much as you invested.

This is because while earnings are tax free if you are over 59 ½ they are subject to taxes and penalties if you withdraw them before you turn 59 ½.

Also, be sure to only invest in the right investment vehicles.

This means no stocks if you expect to need the money in less than 5 years.

Final Thoughts

Overall, when it comes to the types of short term investments, you have a handful of choices.

Just pick the right investment strategy for you goals and you should be all set.

Remember not to fall victim of taking on more risk just for a higher return if you need the money in less than 5 years.

Trust me, the risk is not worth it.

Accept that you are earning less interest and be done with it.

As you saw from the many options I listed, you can still earn a decent return without taking on the added risk.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Jon,

Great overview – I especially like how you recap things and remind folks not to chase yield if their time horizon is less than five years. So many folks get this wrong and end up creating major problems for themselves.

I try to keep as little as possible in these short-term investments because of the poor interest rate they give me. Instead I put spare cash I don’t need into long-term investments like dividend stocks, especially those yielding above 5%.

From all of these, I think I prefer bond investment. Yes, there’s a possibility of losing your principal, but just like you said, as long as you keep it until it matures, it would be the best option.

I have some of my emergency fund money in bonds. Most is in cash, but I take the “excess” and put it into bonds for a higher return.