THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Receiving your hard-earned salary is surely your favorite time of the month! Getting paid for your hard work makes you feel content, and all the efforts seem to be worth it.

However, isn’t it annoying when you save what you can and earn only peanuts on your money in a savings account? Wouldn’t it be nice if there were a way that offered you a higher return and was fairly safe? Thanks to Worthy Bonds, there is an option!

Worthy Bonds offer you a 5% return on your money when you save with them.

You must be wondering how they’re able to offer this rate of return and how you can get started earning 5% on your money. Worry not! In this guide, I’ll tell you everything you need to know about Worthy Peer Capital, the bonds they offer, how the investment works, and how you can effortlessly save money with the Worthy Bonds app. I will also include a question-and-answer section with Sally Outlaw, the CEO and Founder of Worthy Financial.

Let’s get started learning all about Worthy Bonds!

Table of Contents

Worthy Financial Background

Worthy Financial (their subsidiary is Worthy Peer Capital) started in 2016 as a way for people to earn a higher return than traditional banks offered and have less risk than the stock market.

For many years, only those with a lot of money have had access to alternative investments like what Worthy offers. But now, Worthy Financial allows anyone to earn a higher return with little risk by investing in the bonds they offer!

Worthy Bonds Review

- Ease of Use

- Account Fees

- Features

- Customer Service

Summary

Worthy Bonds are an excellent way to earn 5% on your savings. With zero fees and the ability to round up your purchases to save more money, you are missing out if you aren't saving with Worthy. And getting started is as simple as clicking on this link and downloading the Worthy App.

How Worthy Bonds Work

Now that you know a little more about the company, let’s look in detail at how Worthy bonds work and how they can pay you 5% on your savings.

Worthy offers loans to small businesses to help them with inventory and purchase order financing. When you invest your money with it, you are supporting small American businesses to grow and thrive.

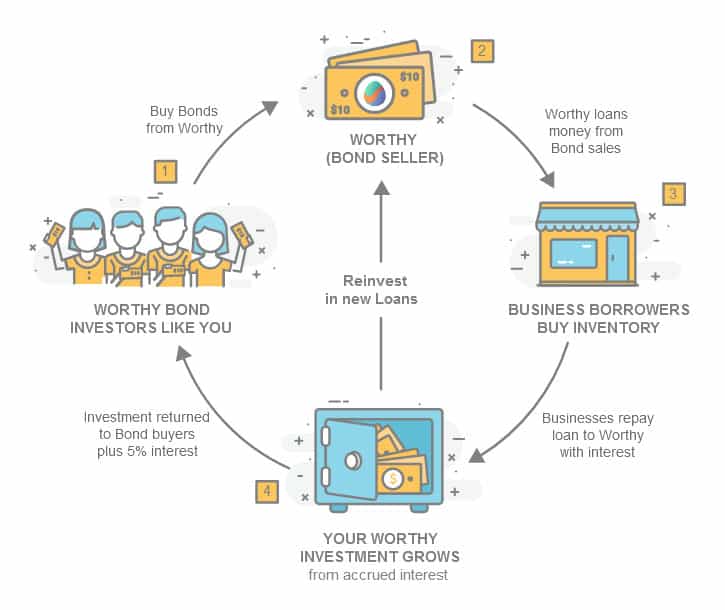

Here is an example of how the process works:

#1. You invest $10 with Worthy and they pay you 5% interest.

#2. Worthy turns around and funds a fully secured loan to a small business for a higher interest rate.

As the small business makes payments on the loan, Worthy takes a cut of the money they earn and pays it to you, including interest. When the loan is paid back in full, your initial investment is used to fund another loan to a small business.

Again, here is a great visual to understand the process.

The great thing about Worthy bonds is that you can withdraw your money any time! You are not locked into having your money invested in a bond for any specific amount of time.

How To Get Started?

The easiest way to start investing in Worthy bonds is doing it online.

Click here and open your account with as little as $10. They made the bonds with a small face value of $10, so anyone could invest. You can add more money whenever you like and continue to earn 5% on it.

Also, you can withdraw your money at any time. There are no early withdrawal fees or penalties. The only catch is you have to be a US citizen and 18 years or older.

Using the Worthy Bonds App

As great as it is to invest only $10 at a time, Worthy Financial offers another way to invest your money and earn 5% – the Worthy Bonds app.

The free app lets you link your debit and credit cards to it. When you spend money using these cards, Worthy will round up the spare change from your purchases to the nearest dollar. When your round-ups total $10, your money is invested in a bond, and you start earning interest.

For example, let’s say you eat lunch out and spend $12.40. Worthy will round this purchase up to $13 and will earmark the $0.60 to buy another Bond.

Note: You won’t buy a bond until you have $10 in round-ups.

Questions And Answers With Sally Outlaw

Sally Outlaw is the founder of Worthy Financial. I had the opportunity to ask her some questions about the company and saving with Worthy Bonds.

Why did you start Worthy Financial?

I started Worthy as I wanted to do what I could to help increase financial security for the “98%”.

I wanted to offer a way we could benefit from the higher returns that are generated in the world of “alternative finance” (basically anything outside the stock market and traditional “Wall Street” products).

I am also a big believer in community capital that we can all become stakeholders in our communities and support each other while growing our wealth. So we designed Worthy to be a win-win.

Bond buyers earn a robust 5% on their money, and the money from bond sales is lent out to help American companies grow.

If we want a different future than the big banks ruling the world, we have to create it!

Why should the average person invest their money in Worthy Bonds?

For several reasons:

#1. Because you deserve a better return than you can currently get on most investments open to you.

#2. We are an investment not tied to the volatility of the stock market. No matter what happens in the stock market, you are getting a stable 5% return from us.

#3. We designed Worthy to be a painless way to tuck money away via round-ups so even if you think you can’t save or invest, you are able to do it.

#4. If you care at all about helping community businesses thrive, then you can benefit from making this positive social impact along with benefiting from the positive financial return you are getting.

What is the biggest misconception of Worthy Bonds?

I worry that when people hear the word ‘bond,’ they will think their money is tied up for months or years as bonds traditionally have a multi-year maturation period.

But we designed our bond without those restrictions, so ours can be cashed in at any time with no fees or penalties with the click of the “withdraw” button, so it operates more like a savings account does.

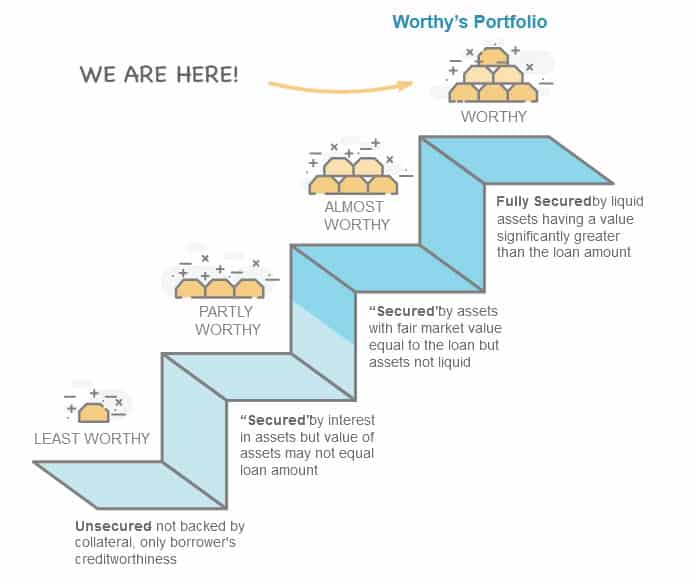

We hope people will not do that and will keep their money in their account to grow at 5% a year, but if they need their money, they can get it! Also, I think people may worry about giving loans to businesses, but we primarily lend against inventory, and we have the security interest in that collateral.

So, in the unlikely event of a borrower default, we are able to sell that inventory to recover our loan proceeds.

What does the future of Worthy Bonds look like? Can you share any features that you would like to see implemented?

It looks bright!

We are growing fast and putting our bond sale money to work, helping American companies get the support they deserve while helping thousands of people build their nest eggs.

A few features on the horizon include integrating a way for people to open a retirement account so they can save in a tax-advantaged way, and we plan to build a retail cashback feature where the places our customer’s shop will provide cash back into their Worthy investment account.

On a more personal level, can you share your greatest financial mistake and your greatest financial achievement?

My greatest financial mistake was not saving and investing earlier in my life.

That’s the sort of mistake that’s hard to recover from, as you can’t rewind the clock and make up for years of missing out on the growth that happens when your investments build over time with compound interest.

If only I could go back to my 20s and 30s and tuck even a little money away!

- Read now: Click here to learn how to build wealth in your 20s

- Read now: Learn how powerful compound interest is on your wealth

My greatest financial achievement really is Worthy.

It took me almost an entire year of working with the Securities and Exchange Commission to get this product qualified by them as I used some recently updated securities laws to create a bond “for the masses,” and it was something they were not used to seeing, so it was a bit of a challenge.

Advantages and Drawbacks

Here is a quick summary of the advantages and drawbacks of investing your money in Worthy Bonds.

Advantages

Advantages

No Fees. No early withdrawal fees, no transfer fees, no reinvestment fees, no penalty or fee of any kind.

Stable Income. With Worthy Bonds, you earn 5% regardless if interest rates are falling or rising.

Higher income. You can rely on a 5% return on your money all the time whereas if you put your money into a savings account, you are lucky to earn 2%.

Effortless saving. By taking advantage of round ups, you can save without lifting a finger.

Compound interest. When your interest you earn grows to $10m it is automatically used to buy another bond. Thus, you will earn compound interest on your savings.

IRA investment. If your IRA or HAS allows for alternative investments, you can buy Worthy Bonds in these accounts.

Drawbacks

Not FDIC Insured. The bonds are not a bank product, so they do not have FDIC Insurance. However, because of the asset backed nature of the bonds, the odds of losing your money are slim.

Limited Investment Amount. Investors with an annual income of $200,000 or more for the past two years (or a net worth of $1,000,000 or more) can buy up to $100,000 in Worthy Bonds. All other investors are limited to 10% of their annual income or net worth in bond purchases.

Worthy app. While the Worthy Bonds app allows you to do everything, including seeing interest earned, it is not as smooth as a traditional app experience.

Alternatives to Worthy Bonds

Worthy Financial is on the leading edge of offering this type of investment to all investors. As a result, there are many direct competitors to Worthy Bonds. Nonetheless, I will offer names of some closely related ways for you to save your money.

StreetShares

StreetShares is very similar to Worthy Bonds. The major difference is StreetShares invests in small businesses owned by military veterans. You also have to keep your money invested for a minimum of 1 year and if you withdraw your money before 3 years, you pay a 1% fee.

Click here to check their website.

CIT BANK

CIT Bank is an online bank that offers higher-than-average interest to savers. The main difference between them and Worthy Bonds is that since this is a bank account, your money is FDIC insured.

- Read now: Click here to learn more about CIT Bank

The interest you earn changes based on what the Federal Reserve does with interest rates.

You can click here to open your free account.

Acorns Investing

Acorns is a true investing app where you invest your money into a portfolio of exchange-traded funds.

Like Worthy Bonds, your money isn’t FDIC insured, but with Acorns, you are taking on more risk as you are putting your money into the stock market. Therefore. you could earn more than 5%, but you can also lose money. Historically, you can expect to earn 8% annually over the long term when you invest in the stock market.

One thing that Acorns offers similar to Worthy Bonds is the round-up feature. As you spend money, Acorns will round up your purchases and invest this money when it totals $5 or more.

However, Acorns charges $1 a month to invest your money, whereas Worthy Bonds are 100% free.

Click here to get to their website.

Final Thoughts

If you are looking to earn a higher return than traditional savings accounts, you cannot go wrong with Worthy Bonds! It is a simple, easy way to save and have your money grow.

I’ve been saving with Worthy for over a year and have no complaints. So if you want to start earning more on your money, click below to open your free account.

Frequently Asked Questions

Below are the questions I get asked about Worthy Peer Capital. This is a great place to understand the basics if you are short on time.

1. Are Worthy bonds legit?

Yes, Worthy Financial was founded in 2016, and the bonds they offer have been vetted by the Securities and Exchange Commission.

This is not some shady investment. This is a real investment that you can take part in. As of December 2019, the company has $35 million in bond sales with 34,000 registered users.

2. What are Worthy bonds?

Worthy Bonds are investments in the inventory of small businesses.

As a small business, inventory is your greatest challenge. You have to pay for the merchandise to sell and then wait until it sells to start earning money. While it sits on the sales floor or in the warehouse, you are paying for it, regardless of whether you made sales.

Worthy helps small businesses by offering them a loan to cover the cost of their inventory. Each month, the loan is repaid along with interest.

The loan that Worthy offers is at a lower interest rate than most banks, saving small businesses money.

3. Does Worthy offer compound interest?

Yes, Worthy offers compound interest on your money.

When the interest you earn grows to $10, you automatically buy another Worthy Bond. As you buy more bonds, you earn interest faster, buying more bonds from your earned interest.

4. What is their customer service like?

You can contact them at 833-WORTHY1 (833-967-8491) or get support on the website.

5. What are the risks involved?

Since it is considered an alternative investment, your money is not insured like it is with a bank. So you do risk losing your money. However, this risk is low.

For starters, Worthy invests in small businesses after doing a detailed review of them. If they don’t think the business will be able to repay the loan, an investment is not made. Second, Worthy Peer Capital keeps a reserve fund to cover any loan defaults, further reducing your risk.

To show you how secure the bonds are, here is the scale of debt that Worthy Bonds fund:

The odds of you losing money are slim, but it is possible.

If you have any questions or concerns, reach out at contact@moneysmartguides.com. Alternatively, you can find MoneySmartGuides on Facebook, Twitter, and Pinterest.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.