THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

The most important step to financial freedom is understanding what that freedom looks like to you.

It might seem like an unnecessary question but too many people follow the drumbeat for financial independence only to give up in frustration.

If you set out on a road trip with no destination in mind, you’re going to run out of gas and get stranded!

Besides just defining that goal so you know in which direction to drive, a lot of people have a conception of financial freedom that may not be as good as they think.

For many people, the idea of Financial Independence, Retire Early (FIRE) is having enough money to quit their job and never work again.

OK, so you ditch the rat race and never work a day again…then what?

At best you become a sun-burnt alcoholic on some far-away beach.

That’s going to get old quick.

You need a purpose, something that gives your days and your life meaning.

For me, financial freedom was enough money that I could devote my time to developing my own business.

It was not worrying about money even when my online assets weren’t quite generating enough cash flow to pay all our bills.

Now that the business generates tens of thousands a month, financial freedom is doing what I love and never having to worry about money again.

Whether it’s being able to devote yourself to a charitable cause, running your own business, a hobby or whatever you choose, think about what financial freedom really means to you and about what you’ll do when you don’t HAVE to work for the money.

Knowing where that destination is, you can find it on the map and start planning your course.

I’ve found three roads to get you there.

Table of Contents

3 Smart Ways To Financial Freedom

Investing Your Way To FIRE

Once you’ve figured out where you want to go, it’s time to get in the car and drive. And there’s no way to FIRE that’s more popular than investing.

Investing is also the easiest road to your financial independence. The boom in investment apps has made it easy to open an account and put your money to work.

Note that I said the easiest road, not the shortest.

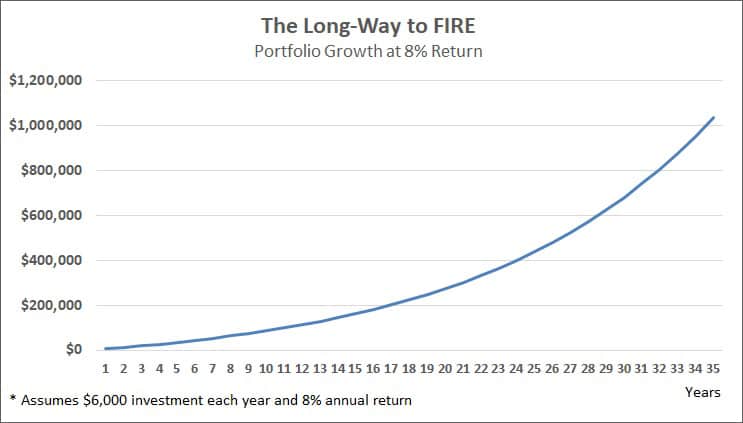

Investing $6,000 a year and earning the long-term market return of 8% annually, it will take you 35 years to reach that seven-figure payday.

Even if financial freedom means a slightly smaller bank account, investing is like driving to your financial independence in a ’92 Camry.

That doesn’t mean you should give up on stocks and dump all your money in the other two ideas we’ll talk about next.

Part of the beauty of the other ways to financial freedom is they don’t cost a lot (or anything) to get started. That means you can still put your savings in stocks to watch that slow-ride to financial success.

If you decide to invest that hard-earned cash, remember these ideas:

- Dividend stocks are a great way to get paid while you invest and eventually just the dividends from your portfolio might be enough to pay the bills. Make sure to pick dividend stocks from different sectors instead of just the classic dividend plays like utilities and consumer staples.

- Real estate investment trusts (REITs) are companies that own rental real estate and pass the cash flow through to investors. You’ll get higher yields than in traditional dividend stocks and exposure to another asset class to spread your risk a little.

- Bonds may not provide as high a return as stocks but having some of your money in the asset class is critical to smoothing out those stock market ups-and-downs. You can invest in bonds through exchange traded funds (ETFs) that trade just like stocks.

Find Financial Freedom In A Side Hustle

I truly believe that real financial freedom is getting paid to do something you enjoy.

I love growing my online business, talking about financial success and goals, and making that personal connection through the YouTube channel.

Now that doesn’t mean it’s all rainbows and unicorns.

I don’t always jump out of bed in the morning and there are some parts of the business that still feel like a ‘job’.

But it’s a whole lot better than the feeling of being stuck in a job I didn’t like, feeling like I had no control over my financial future and that my work didn’t matter.

In fact, I enjoy running my online business so much, I don’t really even think about retirement anymore. I can’t imagine not doing this at least for a few hours every day.

And it all started as a side hustle.

Trying to find your side hustle idea? Try these steps:

- Make a list of your hobbies, interests and what you always wanted to be growing up

- Browse through a college course catalog to see what subjects look interesting

- Take these ideas and do a search on Amazon and Udemy to see how people are making money on them.

- Consider starting a YouTube channel to build a community around your idea and use as a platform to sell products or coaching.

From consulting or freelancing to writing books, you can make money on any idea.

Don’t believe me?

There are 479 video courses on Udemy about solving a Rubik’s Cube.

That’s 479 people that are making money from talking about that infuriating puzzle-box of the ‘80s.

If investing is like driving to your financial destination in an old beater, creating a side hustle is like a Corvette.

You’ll still have to work on it and keep it running but it will get you there fast!

Creating Passive Income For Freedom From Work

Our third strategy to financial freedom, and the favorite for most, is creating streams of passive income.

If you need to get to your financial destination as fast as possible, passive income is like putting the pedal down on a Maserati!

Passive income is money you make without having to do anything after setting it up.

That doesn’t mean you never work again. It just means you have an income source producing cash flow while you devote your time to your side hustle or other tasks.

Be careful going after just any idea proposed as passive income though.

As much as I love blogging and creating videos for YouTube, these are pretty far from a passive income source.

The best passive sources are ones that take minimal upkeep or effort after launched.

A few of my favorite passive income ideas include:

- Self-publishing on Amazon – let the world’s largest ecommerce site do your work for you and drive people to your books.

- Online courses – Create a video lesson once and make money on it forever.

- Commercial real estate with a NNN-lease – OK, this one will take a while longer to build up the down payment but using what’s called a triple-net lease means your tenants manage the property themselves so you just sit back and collect the checks.

Final Thoughts

Financial freedom isn’t a destination you get to overnight.

If it were as easy as a leisurely Sunday drive, we all would have gone there years ago.

Figure out what that freedom really means to you, draw out your map and you’ll get there sooner than you think.

For many, simply knowing they’re on the right road to financial independence is all the motivation they need to keep driving.

Author Bio: Born and raised in Iowa, Joseph Hogue worked in corporate finance and real estate before starting a career in investment analysis. He has appeared on Bloomberg and CNBC and led a team of equity analysts for a venture capital research firm. He holds a master’s degree in business and the Chartered Financial Analyst (CFA) designation. Joseph left the corporate world in 2014 to build his online businesses, first through creating websites and later through YouTube. Booking just $792.41 in 2015 income, he’s grown his online assets to an income of $122,400 for the twelve-months to July 2019. He’s published 10 books and has grown the YouTube channel, Let’s Talk Money, to over 161,000 subscribers in less than two years.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.