THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

But no one is giving you any guidance on how to invest your money.

Are you saving enough?

Is your money in good investments?

The questions go on and on.

Wouldn’t it be nice if there was a way to have someone hold your hand to make sure your 401k was at peak performance?

There is.

Blooom is a 401k account manager that helps take your retirement planning to the next level.

In this Blooom review, I will show you why working with Blooom will save you money in your 401k.

And by saving you money, you will increase the chances of reaching your retirement goals.

Blooom Review

- Features

- Services

- Fees

- Customer Service

Summary

Blooom helps you to get the most out of your 401k plan. By making sure you are invested in the right funds for your goals and the lowest cost funds, Blooom helps you to reach your financial goals. Click here to see how Blooom can help you maximize your 401k or other employer sponsored retirement plan.

Table of Contents

Blooom Review | The Smart Way To Manage Your 401k

Who Is Blooom?

Blooom was founded in 2013 to help average people manage their employer sponsored retirement plans.

The founders saw that most people ignored their retirement plan.

The reasons are because there is no one there to help you make smart investment decisions.

There isn’t even any help to make sure you are on track for retirement success.

So Blooom was born to address these issues.

Today, the company has over $3 billion in assets under management.

Here is a quick video if you are short on time.

How Does Blooom Work?

Blooom works by analyzing your 401k or employer sponsored retirement plan.

Their analysis will make sure it is set up for long term success.

They look at 3 major areas:

- Diversification

- Fees

- Asset Allocation

You can get your plan analyzed for free with no strings attached.

If you find value in their services, you can hire Blooom to manage your plan for you.

For a small monthly fee, Blooom will make sure you are in the best investments available to you.

They will also actively watch your plan to help you reach your financial goals.

Blooom Retirement Plan Analysis

Here is a more in depth look at the process Blooom takes with your employer sponsored retirement plan.

You begin the process by linking your current 401k account.

You then add your name, your age and the age you want to retire at.

The next step has you answering a few questions about how risk adverse you are.

Blooom will then analyze your answers and current 401k plan. Once complete, you will have your complete analysis.

This detailed analysis will show you your current asset allocation is and where it should be.

It will also show you how much extra you are paying in fees.

The summary page gives you the numbers of how much money Blooom can save you.

What Are Blooom Fees?

Blooom charges you about $10 a month.

Most investment managers charge you a percent of your investment value.

This means a you pay a hefty fee as your account grows.

But with Blooom, your monthly fee is always the same.

So regardless if your 401k plan has $500 or $500,000 in it, you will pay the same flat rate.

Advantages And Drawbacks

Advantages

Professional management. No one else is out there to manage your employer sponsored retirement plan.

Various retirement plans. In addition to analyzing 401k plans, you can also review any 401a, 403b, 457, or TSP plan.

Low cost for larger accounts. The flat fee is a steal for those with large account balances.

Works with many providers. Blooom works with virtually all plan providers, so chances are they can help you.

Multiple account support. Blooom only manages 401k plans and other employer sponsored retirement plans. But they can view your other accounts to make sure your asset allocation is set up perfect for you.

Drawbacks

Only works with employer plans. You cannot get help with your Roth or Traditional IRA or other investments.

High cost for small accounts. Having a flat fee is great, but if you have a small account balance, the annual cost is high.

Frequently Asked Questions

Here are the most common questions I get asked about Blooom.

Is Blooom legitimate?

Blooom is legit.

They are an SEC registered investment advisor who has been in business since 2013.

As of this writing, they have over $3 billion assets under management.

Here is a link to their Form ADV.

Is Blooom a fiduciary?

Yes, Blooom is a fiduciary.

What this means is that they are required to act in your best interest.

Put another way, they will invest your money in a way that makes the most sense for you and your long term goals.

How much does it cost to use Blooom?

Blooom charges as little as $10 a month to manage your account.

This is a flat fee, regardless of the size of your account.

Is Blooom secure?

Yes.

Blooom uses state of the art technology to keep your personal information safe.

They use 256-bit encryption to make sure data stays private. They also use secure servers and bank level security to keep hackers out.

Finally, they use third party verification to ensure you requested account changes.

How often does Blooom rebalance?

Blooom will rebalance your account every quarterly if necessary.

Will Blooom really save me money?

Yes.

By making sure you are investing in low cost investments, Blooom will save you money.

According to Blooom, they have saved their clients over $1 billion in hidden fees.

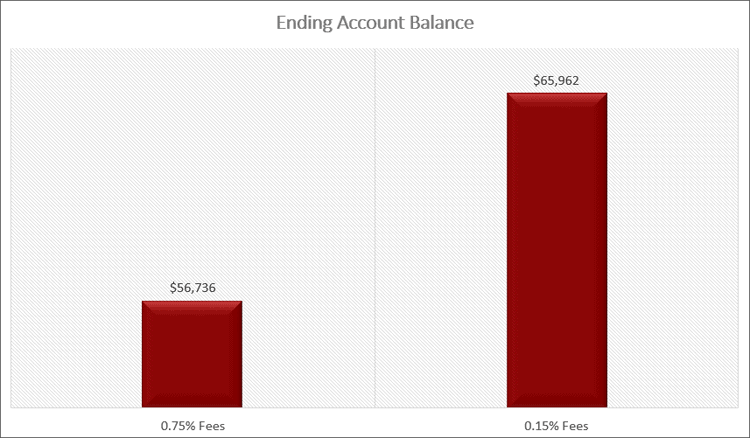

Here is a quick example showing you how this is possible.

Let’s say you have $10,000 in your 401k and it earns 8% annually for 25 years. You are paying 0.75% in mutual fund expenses.

Over the 25 years, you will pay over $5,000 in fees.

If you invested your $10,000 for 25 years in funds that charged you 0.15%, you would pay roughly $1,100 in fees.

The ending account balance is over $9,000 more.

The bottom line is fees eat away at your investments.

Why should I use Blooom?

As I just showed you, Blooom will save you thousands in investment fees.

But the benefits don’t end there.

By monitoring your account and making sure your allocation is perfect for your goals, you increase your investment earnings through the years.

Combine these two and you put your 401k in hyper drive and are more likely to reach your financial goals.

Alternatives To Blooom

There are no perfect alternatives to Blooom.

There are a couple reasons for this.

First, most plan providers only offer you guidelines.

These guidelines educate you how and why to invest your money.

From there, you are left on your own.

The plan provider will only answer general questions, not specific investment questions.

Second, most brokers are not a fiduciary.

As a result, they are unwilling to help oversee employer sponsored retirement plans.

While you could invest in a target date fund, that fund isn’t set up for your specific goals or risk tolerance.

No one is looking over your account to help make sure you are on track for retirement success.

Finally, you could find an advisor that is a fiduciary to help you with your account. But, you will pay much more than the fee Blooom charges.

Final Thoughts

At the end of the day, Blooom is an excellent option for those looking for some hand holding with their 401k plan.

For a low price, you can let them manage your 401k and improve your odds of financial success.

And seeing as how you can try Blooom for free by having your 401k plan analyzed, there is no reason not to try it out.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.