THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Saving for your retirement dreams is something on most people’s minds.

Some have a rough idea of how much money they need to fund their retirement, while others have a specific number.

While this is great, the problem is how do you know if you are on track to reach your retirement savings goals?

Many people turn to comparisons.

They try to see how others their same age are doing to determine if they are on track or not with retirement planning.

While this is better than nothing, comparing the average 401k balance by age is not the smartest.

In this post, I will show you the many drawbacks of this measurement and share a tool to see if you are on track to meet your retirement savings goals that are much better.

Table of Contents

The Average 401k Plan Balance By Age

Looking At Different Studies

To get a good idea of how much people have saved in their 401k plan, I gathered data from retirement-plan provider Fidelity Investments and Vanguard, arguably the two largest 401k plan companies.

Vanguard published its How America Saves report that the average retirement savings in a 401k plan were $129,157 in 2020.

- Read now: Here is a beginner’s guide to 401k plans

- Read now: Click here to learn the biggest 401k pros and cons

And according to Fidelity, the national average 401k balance was $126,083 as of the third quarter of 2021.

I will not go into detail about how these amounts have changed compared to the previous report as there are many factors at play.

This list of factors includes double-digit investment returns of the stock market and contribution amounts.

While having the average balance is great, it doesn’t give much information for comparing ourselves to others.

For example, age and income play a huge role in how much money you save.

If you earn $250,000 and I earn $50,000, the chances are good you will have more in your 401k than I do.

So let’s break these numbers down further.

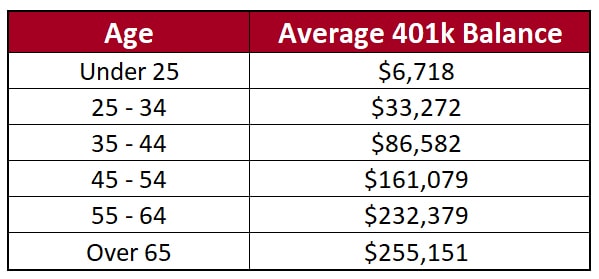

Average 401k Balance By Age

Here is the average 401k balance by age.

Unfortunately, no data breaks it down entirely by age, so we have to use an age range.

As you can see, the older you are, the more you tend to have saved.

Having more money saved for retirement as you age makes sense since you have earned more income, saved more, and took advantage of compounding interest.

As a result, Baby Boomers have a lot more saved than Generation X.

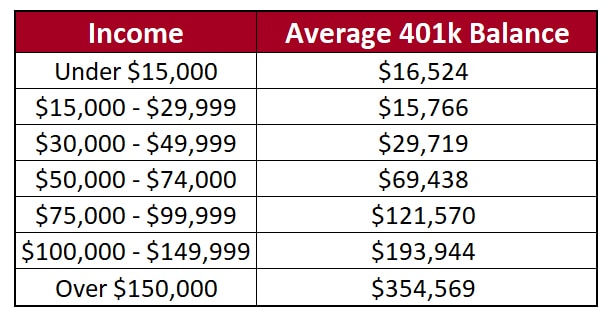

Average 401k Balance By Income

Here is the average 401k balance by income.

Again, the more you earn, the higher your contribution rate will likely be.

So it shouldn’t be a surprise that the average balance for those earning $150,000 or more in annual income is higher.

Again, the data groups income amounts to make the chart easier to read.

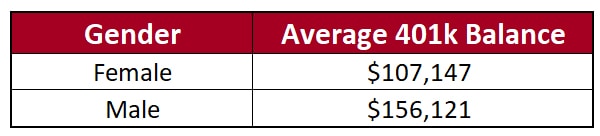

Average 401k Balance By Gender

Finally, here is a breakdown of 401k balance averages by gender.

Not surprisingly, the gender pay gap shows up in retirement savings.

The Problem With The Average 401k Balance Comparison

While it is great to look at these numbers for comparison, there is a significant issue with these numbers.

It is the fact that we’re using the average balance.

When we look at the median 401k balance using the Vanguard report, it is $33,472.

The median amount is very different than the average of $129,157.

So what gives?

To understand the drastic difference between the two, I need to give a brief refresher on average and median.

Average

When you compute the average of a set of numbers, you add them up and divide by the total amount of numbers used.

For example, you have $25,000, a friend has $10,000, and I have $5,000,000.

What is the average amount we have?

It’s $1,678,333 (25,000 + 10,000 + 5,000,000 = 5,035,000 and then 5,035,000/3).

As a result, the average can be misleading.

In the Vanguard report, there could be a handful of 401k plan accounts that have a substantial balance, while the rest have small balances.

These high balance plans can pull the average higher.

Median

The median looks at all of the numbers in a set and picks a number with 50% of the numbers above it and 50% below it.

Using our example above of $25,000, $10,000, and $5,000,000, the median is $25,000.

50% of the numbers are above, and 50% are below.

The median allows for a more accurate representation of the numbers than the average because a handful of large account balances doesn’t influence it.

While my example isn’t great since I only use three numbers, Vanguard uses millions of accounts, so the median is a better reflection.

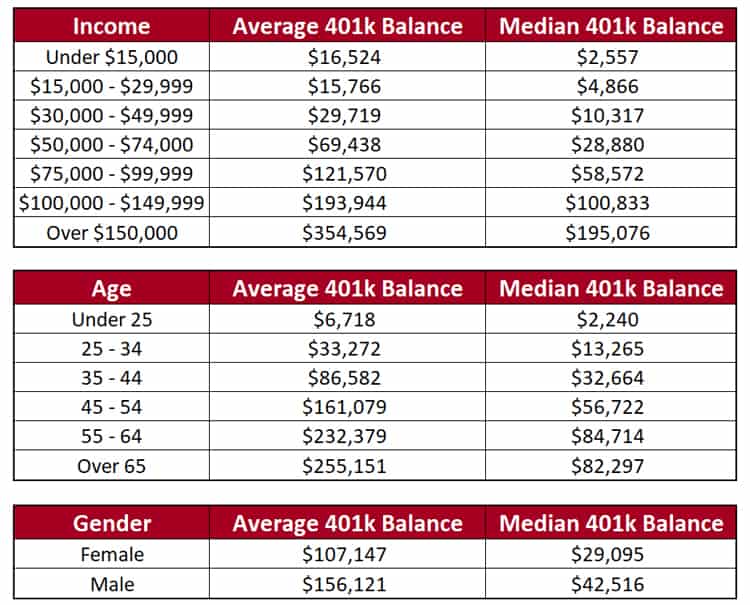

Let’s look at the same numbers again, comparing the average and median.

Average vs. Median 401k Balance

As you can see, the median retirement savings is much lower in every case.

Unfortunately, the median amount isn’t 100% accurate either.

Many factors can also skew the median.

For example, using the data above, we see that for those aged 45-54, the median 401k plan balance is just over $56,722.

But what if a person in this age group changed jobs a few times and thus has three 401k plans with balances of $10,000, $43,000, and $55,000?

The median here is $56,722, but in reality, this person has $108,000 saved for retirement.

Of course, the average doesn’t take this into account either.

The Problem With Comparing 401k Plan Balances

Now that we know the difference between average and median, we can better understand the median and average 401k plan balance by age group.

Unfortunately, though, getting a good comparison is tricky.

The amount you have saved for retirement depends on many variables.

First, as I mentioned, both the median and average can be skewed.

Second, all sorts of life factors enter into the picture.

Some people start working earlier than others. Some earn a larger annual salary than others.

Then there are life changes that affect plan balances.

Maybe one spouse stopped working to raise children, so they no longer contribute to a 401k plan.

Or they got disabled or divorced and had to reduce the number of their contributions.

Other factors can include the following:

- Higher employer matching contribution or profit-sharing contribution

- Having your own business and placing retirement funds in a SEP IRA

- Depending on a tax situation, a person may be taking advantage of growing their nest egg using different types of retirement accounts, like a Traditional IRA or a Roth IRA

- Paying off high-interest debt before saving for retirement

- Taking early withdrawals or using a 401k loan

The point is that none of these factors show up in a 401k retirement balance report.

So comparing average 401k plan balances by age is only reasonable to give you a very rough idea of how you compare to others.

Everyone has a life situation that dictates just how much they have saved.

Take, for example, a person who is 45 and has $125,000 saved for retirement.

If they have only worked low-end jobs earning less than $20 per hour, saving $125,000 is a huge accomplishment.

- Read now: Here is how much $20 an hour is annually

But if that same person was an investment banker who makes $250,000 annually, that amount saved for retirement might be considered a disappointment.

So what are we left to do?

We could use the numbers that Vanguard provided as a guide to get a rough idea of where we should be saving for retirement.

But the problem is that most people are not saving anywhere near enough for retirement.

For example, if you look at the 25 to 34-year-old age group, you see the average 401k balance is $33,272, and the median is $13,265.

These numbers are low, especially for those aged 30 to 34.

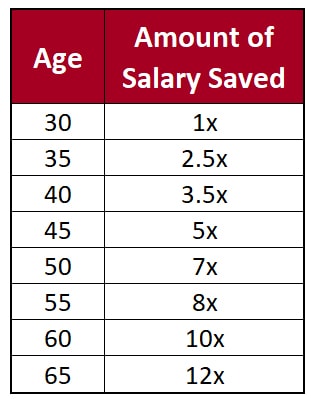

Because of this, our best option for determining where we should be with our 401k balance by age is to use this guide.

It works by finding your age and multiplying your salary by the number in the right column.

For example, if you are 35 and earning $40,000 per year, you should have close to $100,000 saved for retirement.

I go into more detail about this and other options to see just how much money you should have saved for retirement.

There you will find an estimate you can safely rely on.

The Best Way To Know You Are On Track With Retirement Savings

Since each of us has unique retirement goals and dreams, comparing our balance to someone else doesn’t make sense.

If your planned retirement age is 50, it is pointless to compare your savings to your peer group because they may not be saving as aggressively since early retirement doesn’t interest them.

Or you might be saving less because your retirement spending is much lower than the average person.

Finally, you might have a pension, meaning you have additional sources of retirement income, so you don’t have to save as much.

It’s like trying to lose weight and eating the same number of calories as someone else.

You need to figure out how many calories you need to eat to lose weight.

The solution then is to use a retirement calculator.

A good calculator lets you put in your income and expenses and your investments and does the math to see how much money you will have throughout your retirement.

Creating a retirement budget will also show you if you can afford everything you want out of your retirement.

There are a lot of calculators out there, but I’ve found a few that stand out.

Pick one from the post above and see if you are on track for a comfortable retirement.

How To Catch Up On Your Retirement Nest Egg

Don’t give up if you find you are behind on your retirement savings.

You can do a handful of simple things to build up your retirement account balances.

#1. Start Saving

First, you need to make it a priority to start saving now.

The sooner you start, the more compound interest can work for you.

Saying this is a fancy way of expressing that your money has more time to grow into more significant amounts.

And as your balances grow, the compounding happens faster.

This is why you see the examples of a person who starts to save early and ends up with more money than a person who starts saving later and makes bigger contributions.

- Read now: Learn the simplest way to become rich

#2. Take Advantage Of An Employer Match

Most employers offer a matching contribution when you put money into your 401k plan.

The company match amount varies by employer, but the most important thing is you are saving enough to get the entire match.

An employer match is essentially free money that you get, so make sure you take advantage of it.

#3. Use More Than One Retirement Account

In addition to your 401k plan, you should be taking advantage of a Traditional IRA or a Roth IRA.

Individual retirement accounts have lower contribution limits than your 401k, but they allow older adults to save more through a catch-up contribution.

By using more than one account, you get different tax benefits and can save money on fees.

- Read now: Here are the most popular retirement accounts

- Read now: Learn the pros and cons of a Roth IRA

#4. Review Your Retirement Plan

When was the last time you looked at your retirement plan?

Do you even have one?

It is important to set up a retirement plan to make sure you are hitting the financial goals that are specific to you.

To create a plan, you need to know your planned retirement age and your retirement income and expenses.

In other words, what does your retirement lifestyle look like to you?

Knowing all of this allows you to put your money in suitable investment vehicles based on your risk tolerance and investment time horizon.

#5. Be Open To Change

You might look at where you stand with your plan and see that the lifestyle you were hoping for isn’t going to be a reality.

Instead of completely throwing in the towel, a better idea of how you can change your plans so you can still enjoy your retirement years.

For example, maybe instead of an around-the-world trip, you pick out the 2-3 places you most want to visit.

Maybe you try to delay collecting Social Security benefits so the monthly income you receive is higher and can offset the smaller savings.

You can still retire comfortably by making small changes, just maybe not as lavish as you were hoping for.

#6. Make Smarter Financial Decisions

From this point forward, if you can start making better financial decisions, you might still be able to reach your retirement goals.

Maybe you take a new job with a higher annual income that allows you to save more.

Or you take a side hustle or two to help you pay off high-interest debt or other financial obligations you have.

You can put more money towards retirement savings by getting rid of these.

The Silent Killer Of 401k Plans

Finally, I want to talk about 401k plan fees briefly.

These are the silent killers of your retirement accounts.

You pay these fees without knowing it, as they are embedded in the plan itself.

Because you pay these fees, you have less money to invest, which forces you to save more.

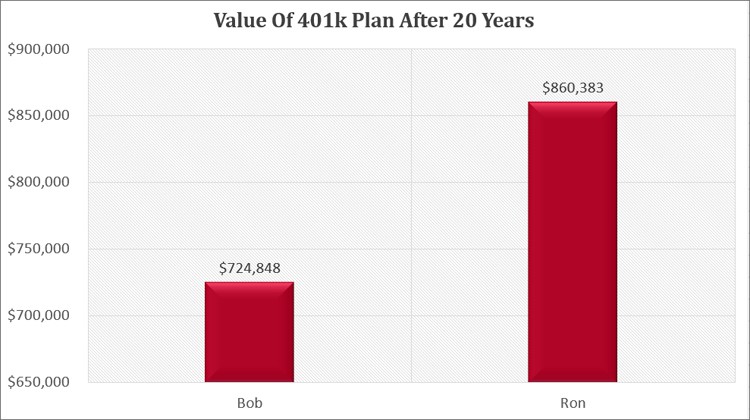

For example, let’s look at Bob and Ron.

Bob has a 401k plan with fees of 1.25%. Ron has a 401k plan with fees of 0.40%.

They are both 45 years old, have $200,000 in their account, and plan to retire at age 65.

They also both earn the same 8% annually.

We will assume they won’t add any more money into their plans for simplicity.

At age 65, here are their account balances.

With all factors being the same, Ron ends up with over $135,000 more than Bob.

His higher balance is due to the lower fees he is paying in his 401k plan.

Over the 20 years, Bob paid over $106,000 in fees while Ron only paid $37,000.

Because of the smaller amount paid in fees, Ron’s money was able to compound faster and grow larger than Bob’s.

The bottom line is that fees matter.

They make a massive difference in the long run.

If you have no idea how much fees cost you, you need to find out.

Luckily, you can easily do this with Personal Capital.

Want to know where your investments stand? Interested in a free financial plan to see if you are on track for retirement? Personal Capital has you covered. It's the best free tool for the average person to analyze their investments.

Link your 401k account, and they will tell you just how much money you are paying in fees.

They also provide an interactive graph that you can play with.

Here is a screenshot of how this looks.

I encourage you to check them out as the free tools are a great way to see if the financial planning you have been doing has you on track or not.

Final Thoughts

Wanting to see how your 401k balance compares to others is natural.

But it would be best if you weren’t comparing yourself to anyone because there are too many variables.

Trying to do so is simply a waste of time.

Instead, focus on saving early, trying to save the maximum amount you can, and comparing your savings to the calculation I provided.

If you are eligible, take advantage of catch-up contributions too.

Saving more money will put you on the right path to reaching your retirement savings goal.

- Read now: Should you invest in an annuity

- Read now: Learn how to save in a Roth IRA when you earn too much

- Read now: See how you can turn your HSA account into a Roth IRA

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Thanks for explaining the difference. I'll be more aware of how the study/survey measured the findings.

What is also staggering is that only about one tenth of one percent of 401K plans have a million dollar or higher balamce in spite of the huge number of boomers that are retiring having been in the plans for thirty or more years. That is tragic because it should have been possible for many more to have achieved that.

Ooof, wow. I am below average for both (though above the median for my age group!) but I sort of expected that, given that I rolled a former 401(k) over to an IRA when I left that job. I wonder if that accounts for some of it – not so many people staying in the same job for long these days, so unless people are rolling their old 401(k)s into their new ones, people could end up with their retirement money scattered into lots of places (including, sadly, a large number of people who cash theirs out upon leaving a job).

Exactly! When you roll an old 401k into an IRA, you skew your numbers when trying to compare them to the average 401k balance. This is why using a guide like this is a good reference point but shouldn’t be looked at as hard fact. Focus more on what you need to retire comfortably and work on saving that amount in various retirement accounts.