THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Sure having money for retirement is nice, but it sounds complicated and money is tight.

Should you invest in a 401k plan?

In this post, I highlight 10 important 401k pros and cons that you need to consider.

At the end, I give you my take on whether or not investing in a 401k retirement plan makes sense for your nest egg and why.

Table of Contents

10 Important 401k Pros And Cons You Need To Know

401k Pros

There are a lot of benefits to a 401k plan.

I am going to highlight the 5 that will have the biggest impact on your financial life.

#1. Lowers Taxable Income

One of the best things about a 401k plan is that your contribution is made with pretax dollars.

When you get paid, your 401k contributions are taken out of your paycheck first, followed by various other taxes and payroll deductions.

Because it gets taken out first, it lowers your taxable income, saving you money.

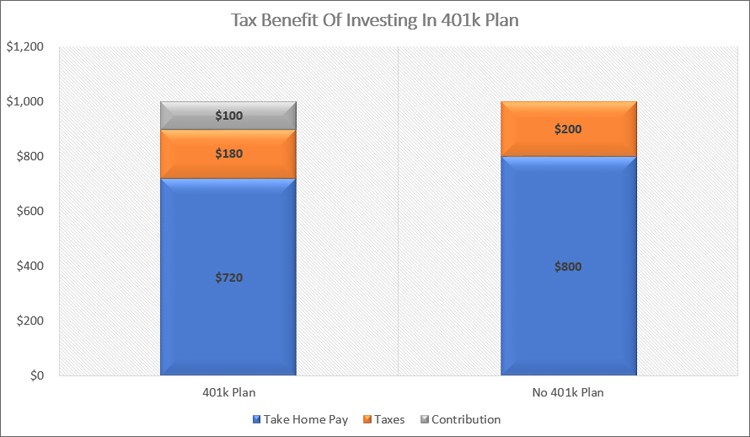

For example, let’s say you make $1,000 and are in the 20% tax bracket.

Assuming you don’t make a payroll contribution to your 401k, you pay $200 in Federal income tax and your net income for this pay period is $800.

Note we are ignoring other taxes and health insurance premiums to make it easy to follow along.

But let’s say you decide to contribute 10% to your 401k plan.

In this case, you make $1,000 and the 10% or $100 is taken from your pay and goes into your retirement plan.

You now get taxed on the remaining $900 of income.

At a 20% tax rate, you pay $180 in taxes and your take home pay is $720.

By contributing to your 401k plan, you save yourself $20 in taxes.

That might not seem like a lot, but remember, this is just one paycheck.

If you are paid 26 times a year, that means you reduce your taxable income and save over $500 in taxes!

And as your income and your contributions increase, the tax savings grows more.

#2. Grows Tax Deferred

Another major advantage of a 401k is that the money you are investing in your retirement account grows tax deferred.

In simple terms, this means you pay zero tax until you withdraw the money from the account.

This is huge because taxes eat away at a lot of your gains over the years.

Here is another example of how this benefits you.

Let’s say you have $50,000 saved for retirement and it grows at 8% for 40 years, tax deferred.

At the end of 40 years, your account is worth $1,035,903.

But if you had that same $50,000 invested in a non-retirement account and are in the 20% tax bracket, at the end of 40 years, you would have $597,909.

That is a difference of $437,994!

Can you figure out a good use of over $400K?

By deferring taxes on your investment earnings, it grows into a much larger amount.

#3. Automatically Increased Savings Amount

When you contribute to your 401k, it is done so in terms of a percent of salary.

So you would contribute 5% or 10% of your salary.

The benefit here is when you get a raise at work.

When this happens, you automatically increase the amount you are saving.

For example, if you make $35,000 and contribute 10% of your salary, you are putting $3,500 towards retirement.

If your salary is increased to $40,000 then you are putting $4,000 towards your retirement.

That’s an extra $500 and you didn’t have to do anything.

#4. Potential For Free Money

Many companies will offer a match to your contribution as part of your benefits package.

Usually employer contributions are a percent of what you contribute.

There are typically 2 types of employer matching.

- Match 100% of contributions up to a percent of your salary

- Match a percent of contributions up to a limit of your salary

For example, in the second scenario, an employer may match 50% of your contributions, up to 6% of your salary.

I know that sounds confusing, so here is what this means.

Let’s say you earn $35,000 a year and contribute 6% to your plan, or $2,100.

In this case, your employer will put $1,050 into your account, which is 50% of your contribution.

Understand this money is not coming from you or your paycheck.

It is 100% from your employer, which is why I call it free money.

The catch in this example is that you have to contribute 6% to get the $1,050 match.

If you only contribute 2%, or $700, then your employer match is $350.

And if you don’t contribute anything, you employer will give you nothing.

Basically, your employer match is dependent on the amount you contribute.

If you contribute more than the 6% in this example, your employer will only match the first 6%.

Finally, you will also see a vesting schedule.

What this means is your ownership of the employer match varies in the first few years.

A typical vesting schedule is 25% in year one, 50% in year two, 75% in year three, and 100% in year four.

Your vested account balance grows each year and after four years, 100% of the money your employer puts into your plan is yours.

Again, this only applies to the employer match.

What you contribute to your retirement plan is 100% yours, all the time.

#5. Easiest Way To Save For Retirement

Hands down, retirement saving is made easy with a 401k.

This is because it is part of your onboarding process when you start a new job.

Usually you just have to check a box, enter a contribution percent and sign the paper.

And with some employers, you don’t have to do this.

You are automatically enrolled regardless.

This makes the process simple.

With other retirement accounts, like a Traditional IRA or a Roth IRA, there is a lot more paperwork to fill out and you have to choose a broker to invest with.

401k Cons

There are a handful of drawbacks to 401k plans.

Here are 5 that I feel have the biggest impact on your money.

#1. Can’t Access Retirement Funds For A Long Time

The money you put into a 401k plan is intended for retirement and as a result, is stuck there until you reach age 55, previously age 59 1/2.

Of course there is a way to get to the money earlier, which is done by taking out a 401k loan.

However for most people, taking out loans against your retirement is a major mistake as you lose out on the power of compounding.

You might be wondering what happens if you leave your job before you turn 55 years old.

There are options for what you can do with your 401k in this case.

- Leave it with your former employer

- Transfer it to your new, current employer

- Roll over to an IRA

There are pros and cons to each, and I am not going into each in this post.

Just know you have options and you don’t lose this money.

It is 100% yours.

#2. Left On Your Own With Limited Investment Options

Probably the biggest drawback of a 401k plan is the fact you are on your own.

Your benefits department will help you if you have basic questions about your account or increasing or decreasing your contributions.

But there is no help for specific questions.

For example, if you have no clue what to invest in, no one is there to help you.

As a result, people can take on too much or too little risk if they pick wrong.

It should be noted that with some 401k plans, your company may bring in an outside financial advisor to help answer your questions.

But don’t just blindly accept with they say.

They most likely don’t understand your investment strategy, goals or risk tolerance.

With that said, they can at least point you in the right direction.

The best option for most people is to find a large cap stock fund and a bond fund and invest in these.

Put 60% into the large cap stock fund and 40% into the bond fund.

Note that this suggestion isn’t right for everyone and you need to determine your goals and risk tolerance.

#3. On Your Own To Monitor Investments

As with the point above about not having any help with picking investments, you also will not have help with the ongoing management either.

This gets tricky as years pass and your investments earn different amounts.

Over time, you could end up taking on a lot more risk than you are comfortable with.

This will show up when the market crashes and you lose a lot more money than you are OK with.

The solution here is to make it a point to rebalance your portfolio once a year.

Make a note on your phone or in your calendar every December to rebalance.

This is easily done when you log into your retirement account.

Most times you just have to check a box and you are done.

And with some plans, you can check a box to automatically rebalance every year going forward.

#4. Investments Can Charge High Fees

Most investors do not realize the impact fees have on their investments.

It is a lot like income tax that I explained above.

The investments in your 401k plan charge management fees, which are taken from the annual return.

You never get a bill for these fees, but you pay them as part of owning the fund.

And the more you pay in fees, the lower your potential return will be over the long term.

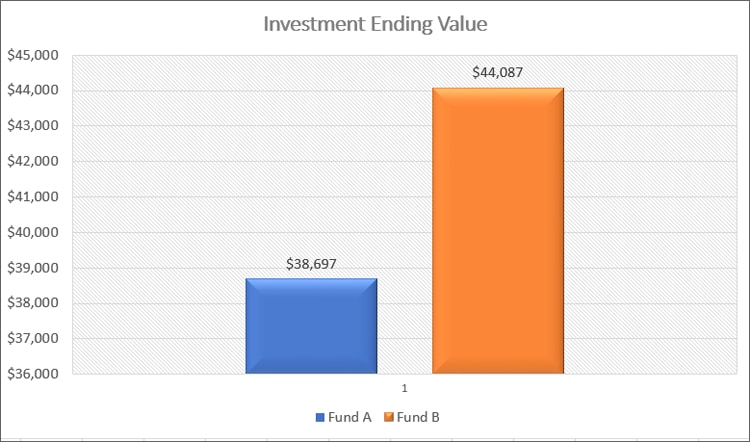

For example, let’s say Fund A charges a 1% fee and Fund B charges a 0.25% fee.

If $10,000 is invested in each fund and they both earn 8% a year for 20 years, here is their ending balances.

Fund A is worth $38,697 while Fund B is worth $44,087.

This is a difference of $5,390.

At the end of the day, the fees mutual funds charge adds up and costs you money.

You can find the fees the funds in your retirement plan by looking at each fund’s prospectus.

It should be right in the beginning and will be called a management fee or expense ratio.

The lower the number, the better.

#5. Limit To How Much You Can Save

Because the IRS knows the great benefits of a 401k plan, they put a contribution limit on how much you can save annually.

For 2021, anyone under age 50 can contribute $19,500.

If you are over age 55, you can save an additional $6,500 as a catch up contribution for a total contribution of $24,500.

Many people will look at this amount and wonder how they could ever afford to retire by being limited to this amount.

- Read now: Learn the average 401k balance by age

But the truth is if you can contribute the maximum for 30 years, you will be in fine shape when it is time for retirement.

And, a 401k is not the only option out there.

There are other retirement plans, like a Roth IRA or a Traditional IRA that you can invest in as well.

Final Thoughts

At the end of the day, a 401k plan is a great tool when saving for retirement.

And while there are cons to this type of account, the pros heavily outweigh them.

This is especially true for the tax savings and the free money in the form of an employer match.

The bottom line is if you are offered a 401k, take advantage of it.

If money is tight, contribute as much as you need to in order to get the full employer match.

This is usually between 5% and 6% of your salary.

And if money is not tight, set your contribution amount at 15% or more to save on taxes today and fund your retirement for tomorrow.

In either case, you will strengthen your financial security by choosing to invest in your 401k plan.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.