THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Are you living paycheck to paycheck, struggling to get a handle on your monthly expenses?

Do you have nothing at the end of the month and wonder where all your money went?

Has the thought of ways to reduce monthly expenses ever crossed your mind?

Reducing expenses is one part of the wealth building equation and this is what we are going to focus on in this post.

By reducing or even eliminating some of your monthly bills, you will free up money to pay off debt or save.

And by getting out of debt and building wealth, you can achieve financial freedom.

Today, I am going to share with you an action plan that will allow you to start cutting expenses to the bone and save $7,000 a year.

Let’s get started with the ways to save money.

Table of Contents

The Best Ways To Start Cutting Expenses To The Bone

The Best Approach To Cutting Costs

There are a lot of ways to reduce your monthly expenses.

Many people just dive in and cut everyday household expenses.

And most everyone will start off with their focus on trying to cut spending on smaller expenses first.

They will go through their household budget looking here and there for little everyday expenses to cut to free up cash flow.

But the reality is, there is a better way to go about cutting expenses that aren’t so time consuming.

I like to attack the big expenses first.

The reason I do it this way is that with large expenses, you tend to get a better return for the time you spend.

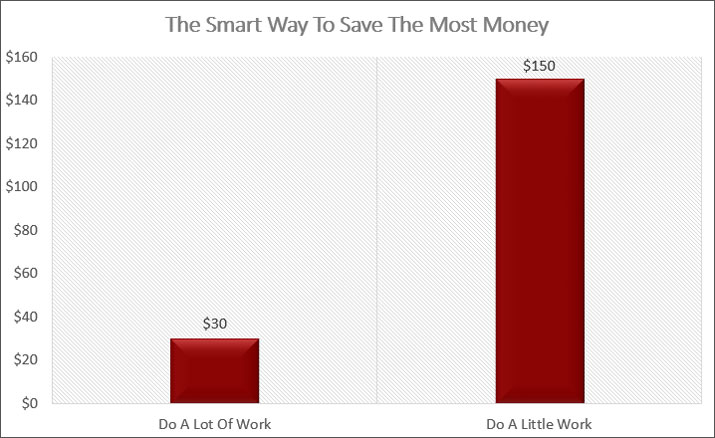

For example, if you choose to cut your daily coffee from your budget, you are saving $3 the day you don’t buy coffee.

In order to save more money, you need to choose to skip coffee again and again.

In other words, you have to completely change your spending habits.

- Read now: Learn the benefits of saving money

While you might be strong and skip coffee a handful of times during the month, eventually your motivation will fade and you will start buying coffee again.

The end result is you saved $30, assuming you skipped buying coffee Monday through Friday for two weeks.

That’s a lot of work and willpower to save $30!

On the other hand, say you decide to lower your insurance premium.

This process takes you 30 minutes and you end up saving $150, which is highly possible.

You spent 30 minutes, one time, and saved $150 for an entire year.

That is 50 days without coffee or 10 workweeks of no coffee.

Which option sounds better to you?

Doing something one time and saving $150 or doing something 50 times to save the same amount?

This is why I like to focus on the large expenses in your life first.

By tackling these first, you will drastically cut expenses easily.

This doesn’t mean we won’t tackle the small expenses.

We will look to cut everyday expenses too.

By the end of the post, you will have an outline of things to do in order to start cutting expenses from your budget, freeing up more money than you thought possible.

In fact, many of you should be able to save over $7,000 just by following the tips I outline in this post.

How To Drastically Cut Your Biggest Expenses

Most of us have just a few large expenses in our budget.

These are the living expenses to cut from your budget first.

They include the following:

- Mortgage/Rent

- Insurance

- Cable

- Debt

- Taxes

We want to spend our time working to reduce spending in these categories first since we will achieve a higher level of savings with very little work.

Let’s get started.

Mortgage

Cutting monthly household expenses when it comes to your mortgage isn’t too difficult of a task.

One common option is to refinance for a lower interest rate than you are currently paying.

But, there are traps with refinancing.

You could be charged an absurd amount in fees, negating the savings.

Or you could even get tricked into extending the length of the loan, causing you to spend more money in the long run.

Make certain you understand your goal when it comes to refinancing before talking with anyone.

Do you want to pay less interest over the course of the loan or are you more interested in cutting the monthly loan payments so you can free up some cash?

Once you answer this question, then you will be able to sit down with someone and figure out the best route for your situation.

You could save a few hundred dollars per month by refinancing.

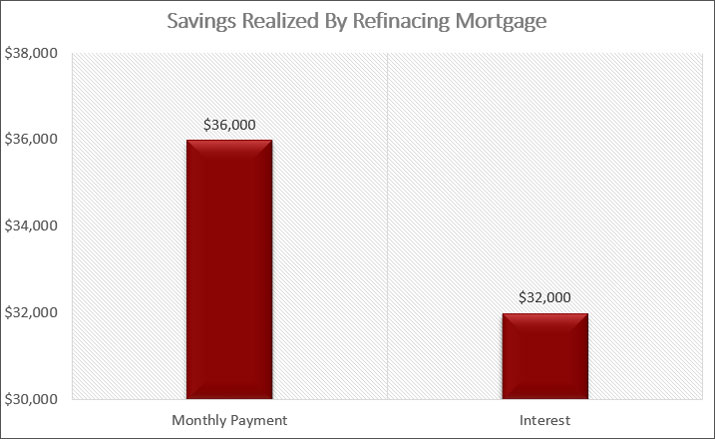

For example, if you have a mortgage of $200,000 at 4.75%, refinancing to a loan with a 4.00% interest rate will reduce your monthly payment by close to $100.

You just saved yourself $1,200 a year and nearly $32,000 in interest!

You just have to be smart about the refinance process and take your time to make sure you understand everything.

What if it turns out that refinancing isn’t an option for you?

Are you stuck with your current payment? Yes and no.

While you won’t be able to easily reduce your current payment, you can take steps to greatly reduce your mortgage balance.

By lowering your overall balance, you could then refinance and save a boatload of money.

For example, let’s again say you have a loan of $200,000 at 4.75%.

You opt to pay extra on this loan and quickly drop it to $125,000.

You then refinance at 4.00%. Because you are financing a much lower amount, you end up lowering your monthly expense by close to $500!

Some mortgage companies will even recast your loan once you paid down a significant balance on your loan.

The bottom line is to spend some time seeing how you can lower the cost of your mortgage and free up a lot of money.

Rent

When it comes to renting, there are a few things you can do today to radically reduce this monthly bill.

The first thing you can do today is bringing in a roommate.

Not only will this radically reduce your rent, but by having a roommate you will instantly slash many of your household bills in half as well.

Before you shut the door on this idea because you enjoy living alone, I encourage you to at least consider it.

You don’t have to do this, but at least give it some thought.

Run the numbers to see how much money you can potentially save.

And remember, you don’t have to live with someone forever.

Do it for 2-3 years to improve your financial situation and then you can go from there.

- Read now: Here is how to become financially stable

If you decide to not have a roommate, there are others things you can do that will free up money in the coming months.

First, you can start the process of looking for another place to live that is cheaper.

This might mean moving to another area of the city.

Next, you can try to negotiate with your current landlord.

While there is no guarantee they will agree to negotiate, you never know unless you ask.

To improve your chances of a yes, be sure to highlight all of the great things you bring to the table.

- You pay on time

- You don’t complain/are a great tenant

- You keep the unit well maintained

- You will to continue renting for a few more years

These are just a couple of examples you could argue as to why you deserve a lower rent payment.

The reason this works is that at the end of the day some landlords would rather have a great tenant that is paying a little less than the market rate instead of having a horrible tenant that doesn’t pay at all.

You’ll never know which landlord you have unless you ask.

For me, I didn’t raise the rent on my tenant because she was a great tenant.

I never had any issues with her and the rent was always on time.

I would rather forego an extra $50 a month, and have zero stress than have that extra money along with added stress.

In addition to this, if she leaves, then I have zero rental income while I am looking for new tenants.

And I have to spend my time and money trying to find new tenants.

Finally, there is the risk that the new tenants trash the place, are late with their rent, or don’t pay at all.

It wasn’t worth it to me. I’ll take $600 less per year and have zero worries.

When going this route, just be open and honest with your landlord and see what happens.

Insurance

Insurance is another area where cutting expenses will let you realize a nice amount of savings.

In fact, I would argue that saving money on insurance is 100 times easier than with your mortgage.

Most companies offer free quotes on insurance.

Just spend 10 minutes filling out the information and you’ll have a free, no-obligation quote.

As great as this sounds, there is the issue of time.

In order to truly know if you are getting a good deal, you have to reach out to multiple insurance agencies to get quotes.

By the time you are done, you could have easily spent half a day getting quotes.

Luckily there is Insurify.

Insurify is an automated insurance quote tool designed to make shopping for car insurance easy.

Simply answer a few questions and Insurify does the rest.

In a few seconds, you will see a number of quotes you can choose from.

On average, people who use Insurify to compare quotes save on average $500 a year on their insurance premiums!

That is a huge savings!

Click the link below to see how much money you will save.

With Insurify, you get multiple insurance quotes, fast and easy. The average savings is close to $500 a year. Click the link below to see how much money you will save with Insurify!

Understand you should be shopping around and getting car and homeowners insurance quotes annually.

Just because you are a great customer doesn’t mean you are getting a great rate.

It all has to do with how the company is doing overall.

Also, new studies have found that people who stay with the same insurance company actually pay more over time than they should.

I used an insurance company that I thought was offering me the best price.

Then one year, my premiums jumped 10% without warning.

I did nothing to cause this spike.

It turned out that the insurance company suffered huge losses after a major hurricane and needed to replenish its balance sheet.

This meant rate increases for everyone, regardless if they were affected by the storm or not.

I refused to be charged more, so I shopped around and found a great insurance company that ended up charging me $250 less.

I stayed with them for 2 years and then shopped around and found another company that charged me $150 less than what I was paying at the time.

The bottom line is that you need to shop around for insurance coverage.

It takes less than 5 minutes and is completely free.

By not doing anything, you could potentially be paying hundreds more than you should be.

Again, it takes a few minutes and there is no obligation to buy.

In either case, just knowing that you aren’t being overcharged for coverage should be reason enough to get a free quote.

Taxes

Most of us don’t think about taxes when it comes to trying to cut expenses.

But taxes are a big deal.

When you add them up, more of your money than you think is going towards taxes.

For example, here are some common taxes your pay.

- Federal income tax

- State income tax

- Property tax if you own a house

- Sales tax

- Gas tax when you fill up your car

And don’t get me started with the taxes on cell phone services.

These are just the taxes that came to mind as I was writing this. There are plenty more I’m not thinking of.

When you add these all up, chances are you are paying close to 50% of your income in taxes!

While you cannot legally avoid all taxes, there are a handful of simple ways you can reduce your taxes and save money in the process.

#1. Contribute To Your 401k

The money you contribute to your 401k comes out of your paycheck pre-tax.

This means that you are paying less money in taxes on the amount you actually have deposited into your checking account.

In other words, if you get paid $1,000 and don’t make any 401k contributions, you owe $200 in taxes, assuming you are in the 20% tax bracket and other factors aren’t taken into account.

But if you contribute $100 to your 401k, you will only be taxed on the remaining $900, which is $180 (20% x $900).

You just saved yourself $20 in taxes.

If you are paid every other week, you will save $520 annually.

- Read now: Learn the pros and cons of 401k plans

#2. Appeal Your Property Taxes

If your property taxes have gone, maybe it is time to appeal them.

In many cases, a real estate attorney will do all of the work for a small fee.

When we did this, we knocked $1,100 off our annual property tax bill.

Over the next 20 years, we will save over $20,000!

The attorney got $500 for doing all of the work.

This was the most we would have had to pay, as his fee was capped. If he didn’t get us a reduction, there was no fee.

Of course there is the chance that your taxes will go up.

But a good attorney will look at things and give you an idea of what to expect before you agree to challenge the amount.

#3. Put Money Into An HSA or FSA

These are accounts you put money into to help pay for medical expenses.

The main difference between the two is that with an FSA, you have to use the money you save in the account during the calendar year.

With an HSA, you don’t have to do this.

You can save and invest your contributions and pay for medical expenses years later, tax free.

The other benefit of an HSA is that you typically have a lower health insurance premium as well, saving you money every month.

Below is a 60 second video that explains the differences really well.

The advantage of saving money in either account is the same as the 401k option above.

Your savings are pre-tax, helping you to save money in taxes.

If you put $50 per paycheck into your health savings account, you are saving yourself $10 in taxes every time you are paid.

This comes to another $260 in savings.

#4. Change Your Withholding

If you get a large tax refund, look into changing your withholding.

Most people don’t do this because they are scared that they will not get a refund at tax time.

The reality is that if you are getting a large refund you can easily change your withholding and get a fatter paycheck and still get a small refund.

You can use this free tool from the IRS to help you do the math.

On the off chance you like getting the lump sum from the IRS, make sure you put the money to work for you, meaning you put most it towards debt or savings so you can get ahead financially.

#5. Invest Wisely

Make sure you have a tax efficient strategy when it comes to investing your money.

By simply placing certain assets in your retirement accounts and others in your taxable account, you will save yourself thousands in taxes.

By simply following a few of these tips, you will reduce your taxes and save a lot of money.

Debt

Chances are you have some debt.

Regardless if it is credit card debt, student loan debt, a car loan or a personal loan, these monthly payments add up.

By taking action to reduce these costs, you will free up a lot of money.

And the good news is it isn’t hard at all.

Here are some cost cutting actions to help you save money by eliminating your credit card bills.

#1. Have A Plan

When it comes to your credit cards, set up a payoff plan.

When you have a plan in place, you will get excited and motivated to pay off the debt.

By following a detailed plan, you will see faster progress in getting out of debt than you would if you didn’t follow one.

But simply having a plan isn’t your only option for lowering these expenses.

There is still more you can do.

#2. Transfer Balances

Once you have a plan in place, you can start looking for ways to lower your monthly payment and the interest rate you are charged.

One option is to transfer your balances to another card.

Many times you can find credit cards with a 0% balance transfer offer.

Here is a link to help you find the best balance transfer offers.

How will this help you cut expenses?

If you move your balance over to this new card, you can avoid paying any interest for a set amount of time.

There are two catches here.

The first is that there is a fee you will be charged. Try to keep it to 3% or less of the amount you transfer.

Second, you have to make sure you pay off this card before the promotional interest rate goes away.

To do this, take the balance on the card and divide by the promotional period.

For example, let’s say your balance is $3,000 and you have 0% interest for 12 months.

Divide $3,000 by 12 and you need to pay $250 every month.

The trick here is to not transfer your entire credit card debt.

Only transfer the amount you know you can pay off during the promotional period.

#3. Debt Consolidation Or Refinance

Another option, and a better one than balance transfers is to consolidate debt or refinance it.

There are two great ways this works in your favor.

For credit card debt, you can consolidate all of these into one personal loan.

By doing this, you only have to worry about one bill a month and you will have a lower interest rate.

And unlike the balance transfer option, the lower interest rate is with you until you pay off the debt.

For student loans, you can refinance your debt into one loan. Again, you make life easier by only have one student loan payment to make every month.

And you save money by having a lower interest rate.

For example, let’s say you have $50,000 in student loan debt at 6.8% interest.

Over 20 years you are going to pay $380 a month and a total of $41,600 in interest.

But if you refinance to a loan with 4% interest, your monthly payment drops to $302 and you save close to $20,000 in interest.

All it takes is 10 minutes to save $80 every month. There is no reason not to.

When I refinanced my student loans to a lower interest rate, I went from paying $400 a month to $200.

It was amazing to have that extra $200 a month.

At the end of the day, getting out of debt will free up a significant amount of money for most people.

Cable TV

Cable TV is a huge monthly cost and the price only goes up every year.

I used to call up Comcast every few months to get a new promotion, but as an existing customer, they have changed the game.

But this doesn’t mean you are stuck paying outrageously high cable prices.

There are many things you can still do to have a lower cost.

But first, I have to warn you of a trick you will run into.

It’s the more channels, same price trick.

This seems to be cable companies go-to option. Here is how it works.

You call asking for a better rate. The representative puts you on hold and comes back with an offer.

They offer you a handful of new channels that you don’t get and will keep your monthly price the same as what you are paying now.

To many, this sounds like a great deal. You are getting upgraded at no additional cost to you.

The problem is you aren’t accomplishing your goal of cutting expenses because you are paying the same price for more channels.

You are just getting more channels.

And when the deal expires, you will pass out when you see how much you are now getting charged for all of those “free” channels that got added.

Your goal of cutting monthly expenses has turned into you paying more.

This is what happened to my Mom.

She kept calling for a lower rate and every time she fell for more channels, the same price deal.

The result was she had every single channel the cable company offered.

Had I known this, I would have moved back home!

But when the deal finally ended, her cable bill skyrocketed to $425 a month!

Remember when you call your goal is a lower price than what it is now, not to increase services.

Now that the warning is out of the way, let’s look at a handful of options for you to lower your cable bill.

#1. Switch Providers

Some readers might live in an area where there are multiple cable options.

For me, I have Verizon FiOS and Comcast.

Switching between the two, or even threatening to switch can result in a better deal because the best deals are reserved for new customers.

If you switch every three years, you will be seen as a new customer.

The result is drastically cutting expenses for cable by 75%.

#2. Use Rocket Money

Rocket Money is a free service that will negotiate your cable bill for you.

They are pretty good at getting you a discount.

In fact, they have over 3.4 million members and have saved users over $245 million.

See how much you can save with Rocket Money by clicking the link below.

Rocket Money is your assistant to help you find and cancel subscriptions, track your spending, create a budget, and more. Join the other 80% of people saving money thanks to Rocket Money.

#3. Cancel Your Cable

If you are fed up with the service, you have the option of cutting the cord.

Before you think this isn’t an option for you, pause for a minute.

There are a lot of free channels you can get and all you need is an HD antenna.

The good news is they won’t set you back a lot.

In fact, here is an excellent option that costs less than $50.

If you are close to a large city, you can get a ton of channels.

In my area, I can get close to 60 channels over the air for free.

#4. Stream TV

Another option to consider is using a streaming service.

Not only is it lowered priced, but you have more control over channel packages too.

My favorites are Hulu for most people and PureFlix for families.

Right now, Hulu offers free trials to new users.

You can click the link below to try SlingTV for free.

Hulu is one of the best streaming services out there. Customize your package with the channels you want, including live TV. Bundle with Disney+ and ESPN+ to save even more. Get started today and save money.

#5. Create Your Own Bundle

A final option is to create your own bundle.

For example, you could sign up for Netflix and HBO and have 99% of the shows you typically watch for less than $50 a month.

All you have to do is a little work to see which bundling of services works best for you.

The catch here is you need to know what you watch.

With more and more streaming options coming out, it is easy to subscribe to them all and end up paying more than cable.

Just be certain you don’t loose track of the costs.

If you subscribe to too many bundles, you could end up paying too much money, and not saving anything.

Lastly, here is a trick I use if a popular show comes out on a service I don’t have.

I make it a point to clear a weekend on my schedule and then subscribe to the service.

Then I binge watch the season in a weekend and cancel my subscription.

Sure it costs me money to sign up for the month, but it is a lot cheaper than paying every month and not watching it.

Groceries

Groceries are one of the monthly household expenses that can quickly get out of control.

For example, the average family of four spends close to $900 per month on groceries, which is more than some people spend on their mortgage or rent!

If you find your food costs to be too high, what can you do to save some money?

The first thing you should do is smarter grocery shopping.

If you have multiple grocery stores in your area, find the one that offers the best prices.

This will take a little work, but you can make it easy on yourself.

Next, stick with the basics.

What do you buy every week? Make note of these and then price compare.

As time goes by, price check other items as well.

In some cases, you might find that you have to shop at two different stores.

This is what happened to me.

Our family does most of our shopping at one store and then we go to another grocery store to buy our produce since it is cheaper there.

Once you know where to shop, learn to buy things that are on sale.

Be sure to read all of the circulars you get in the mail as you never know when they might have a great deal.

For example, one store I don’t shop at had a sale of frozen vegetables for $0.75 a bag, so I bought ten bags.

By meal planning around what is on sale, you can save a lot of money.

To curb last-minute eating out habits, cook ahead of time by meal planning here as well.

My wife and I would get tired or lazy by the end of the week and not feel like cooking.

This led us to eat out a lot on Thursdays and Fridays.

Now we take some time on Sunday and cook meals for the week.

All we have to do is just reheat them and we have dinner ready in 5 minutes.

In addition to this, learn to make some simple meals that only take 20 minutes to make.

There are thousands out there, just take a few minutes to search around.

Finally, consider shopping at a warehouse club like Costco.

Bulk buying certain things will help lower your food costs.

If you take the time to do these three things you could easily end up saving a few hundred or even thousands of dollars a year or more on your grocery bill.

Big Expenses Summary

The reason I like to cut monthly expenses like these first is because it is one and done.

I refinance and I never have to do anything else to save money.

The savings happens automatically every month.

Here is a quick recap of the average savings you can expect when you drastically cut spending the expenses I listed above.

Mortgage/Rent: $1,200

Car Insurance: $500

Taxes: $1,270

Debt: $250

Cable: $350

Grocery Budget: $1,200

By just tackling these large expenses, you will easily save close to $5,000 a year or more.

But you will save even more money by looking at your small expenses too.

Cut Costs On Small Expenses

Now that we have covered your big monthly household expenses, it’s time to start focusing our time to drastically cut household expenses that are small in size.

There are thousands of small household costs that everyone has.

Because of this, I am not going to cover all of the various ways you can stop spending money on small things.

Instead, I am going to highlight a few of the more common ways to reduce expenses to the bone.

Hopefully this will spark a curiosity in you to tackle spending in other housing costs and other expenses as well.

Electric

Energy costs can easily get out of hand.

And for some of you, this monthly bill is one of your biggest.

I actually debated putting this into the big expense category above as there are many things you can do once and save money for months or years.

But even though it is large in size, I am putting it in this section because lowering it can take more time than the other ideas listed above.

With that said, here are some ways to lower your utility costs.

#1. Shop For Electricity

I am lucky that I live in a state that offers electricity deregulation.

This means that I can choose my electric distributor and potentially lower my utility bill.

This should be your first option.

For me, the cost of electric from my utility is $0.08 per Kw.

But I use a third party company and am charged $0.05 per Kw.

One time I found a price of $0.04 per Kw!

The catch is I have to research and switch companies every 6 to 12 months.

Luckily it doesn’t take me long to do the research as there are websites comparing my options.

To switch, all I have to do is fill out a short online form.

If you don’t live in a state that offers this, there are still many options for lowering your utility bill.

All you have to do is pay attention more.

#2. Spend Money Upfront On LED Light Bulbs

LED light bulbs cost more to buy compared to incandescent bulbs, but they are much more energy efficient and last a lot longer.

And you don’t have to replace all your lights at once. Start with the most used ones.

This means the kitchen and main bedrooms and bathrooms.

From there, wait until you can find some sales and then buy some more.

When we did this in just our main living areas, we saw an immediate drop in our bill by $20.

I was blown away. Here are the bulbs we like the most.

#3. Buy A Programmable Thermostat

Your HVAC is probably the biggest contributor to high electric bills, so focus on ways to have it run less often.

We use a programmable thermostat and have it set up so that the house isn’t heated or cooled when we aren’t around.

We’ve seen a nice drop in our electricity as a result.

By using a programmable thermostat, we are able to better control this cost.

In addition, close doors and vents in rooms you rarely use. There is no point in heating or cooling these spaces.

#4. Buy Ceiling Fans

This is another great way to lower utility bills.

It will cost you upfront to get and install them, but they will save you money.

We used to keep our house 5 degrees cooler in the summer before ceiling fans.

Now with them, we are able to keep the house warmer because of the cool air the fans blow on us.

#5. Unplug Electronics

Many electronics still draw power when turned off.

This includes your phone and tablet chargers as well as flat screen TVs.

Pull the plug on these when not in use and watch your electric bill drop.

If you aren’t sure which electronics are secretly sucking money from your wallet, spend $20 on a Kill A Watt.

It will pay for itself almost immediately.

Alternatively, you can get smart power strips that turn off electronics from using electricity while in standby mode.

#6. Check Doors And Windows

You can do this on a Saturday afternoon, preferably in the winter.

Go around the trim on all of your windows and see if you feel a draft of cold air.

If you do, get a caulk gun and seal the gaps.

For doors, check to see if you can see any light around the edges of the door.

If you can, you should replace the insulation.

In most doors, this simply means pulling out the old strip of insulation and snapping a new piece in.

This is just the tip of the iceberg when it comes to lowering your energy bills.

But you don’t have to go crazy.

By using the tips I outlined above, we drastically cut our electric costs by close to $100 a month on average.

Gas

There are some simple things you can do to increase your fuel mileage and as a result, cut expenses when it comes to fueling up your car.

#1. Slow Down

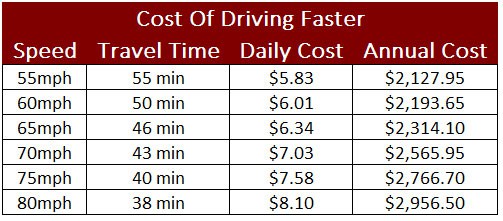

First, learn to drive slower.

This isn’t to say drive like you are out for a Sunday drive.

Just slow down a little bit. The faster you go, the more fuel you use.

Don’t believe me?

Let’s say you drive 50 miles to commute to and from work every day.

Your car averages 30 mpg and gas costs $3.50 a gallon.

If you reduce your speed from 80mph to 70mph, you save $400 a year on gas and only add 5 minutes to your commute.

During this extra 5 minutes you can listen to your favorite song or talk show on the radio!

#2. Learn How To Drive

Additionally, learn how to accelerate and stop.

When you punch the gas at a green light or slam on the brakes at a red light, you are wasting fuel.

- Read now: Click here to learn how to get free gas

Accelerate slowly and anticipate red lights and stop signs by coasting to them.

#3. Inflate Tires

From there, keep your tires properly inflated and keep your trunk empty.

Underinflated tires and added weight in your trunk will kill your gas mileage.

#4. Shop For Gas

Next, pay attention to gas prices.

Find the station around you that has the lowest prices.

There are apps you can use to accomplish this, or just make mental notes when you drive around town.

I like the Upside app.

It gives me a discount on every gallon of gas I buy.

In the past year, I’ve saved over $100 on gas as a result.

You can download the free app by clicking on the link below.

Upside is the #1 app for saving money on gas. Save $0.25 per gallon on your first fill up. Be sure to use the promo code AFF25 to get this bonus. And when you dine out, be sure to use Upside and get up to 25% cash back on your bill.

Just make sure you are comparing prices on the same day.

Prices fluctuate by day, so be on the lookout!

Finally, don’t think the solution to saving money is to buy a hybrid car.

In many cases, hybrids aren’t worth the price.

You are better off learning how to drive smarter in order to cut your fuel costs.

By simply using these simple tips, you will drastically cut expenses related to gas, saving you money.

Gym Membership

Most people don’t get their money’s worth out of a gym.

You don’t need to join a gym to be healthy and get in shape.

You can do something as simple as buy an activity monitor.

I have been wearing a Fitbit activity tracker and love it.

I sit at my desk all day and have read the horror stories about how bad sitting all day is for you.

It helps me be motivated to get up and move so I reach my daily step goal.

I also like how it vibrates after sitting for a while.

This gentle nudge is what I need to get me to stand up and move around for a couple minutes.

You can get your Fitbit here.

If you are interested more vigorous exercise routines, you can still skip the gym.

Body weight exercises all you need.

Just doing a 30 minute routine will change your life. Here is the best one I’ve found.

The bottom line is you can cut your budget by canceling your gym membership and save money instead.

Cell Phone

How much does your cell phone plan cost you?

My guess is $100 a month or more.

Do you want to know how to slash this monthly expense by 75%?

Thanks to resellers, you can get the same great service for much less.

For example, you can use Cricket Wireless.

For $35 a month, you get unlimited calls and texts and have 10 GB of data.

Your coverage is the same as if you were with AT&T since Cricket uses AT&T towers, plus they are owned by AT&T.

This same plan with AT&T would run me $90.

This is just one cell phone carrier out there.

Some others include Boost Mobile, Republic Wireless, Tello Mobile and more.

But they all work the same, saving you a boatload of money on your cell plan.

Shop Online

When you shop online, you can typically use coupon codes to save money.

But you can also use a shopping portal like Rakuten.

When you shop online through Rakuten, you get cash back.

Most times it is between 1% and 25% but sometimes they offer double cash back.

Over the course of the past few months, my wife has earned over $100 cash back from Rakuten on purchases she was going to make anyway.

It was free money that we ended up putting into our savings account.

Click the link below to get $10 for free just for joining.

Want to earn cash back shopping online? Look no further than Rakuten. Earn up to 25% on your online shopping. New users get $30 when you spend $30 in the first 90 days!

And here is a bonus trick.

Sign up for a free Swagbucks account too.

With Swagbucks you will do the same thing as with Rakuten by saving money on your online purchases.

Before I buy anything online, I compare the two sites to see which one offers more cash back and shop through that site.

Swagbucks is free to join and they will give you $5 for signing up!

Looking to make money online? Look into Swagbucks. Earn money for completing surveys, playing games, watching videos, and more! Get a $10 bonus for signing up!

You can save hundreds of dollars each year simply by using these shopping portals.

Cancel Subscriptions

How many subscriptions or memberships are you paying for but never use?

You can use Rocket Money to help cut these out.

They will look over your checking account, identify recurring charges that you may be able to cancel, and help you with canceling them.

Rocket Money is your assistant to help you find and cancel subscriptions, track your spending, create a budget, and more. Join the other 80% of people saving money thanks to Rocket Money.

Delay Purchases

This is one of the easy ways to save on everyday expenses.

Before you buy something, wait a couple of days to see if you really need it.

Many times when we want to buy something, it is purely emotional.

Later, when we see the item, we have regret for having bought it.

This is when the thinking side of our brain catches up to the emotional side.

If you can learn to limit impulse buys, you will save yourself a ton of money.

- Read now: See how advertisers trick you to spend

- Read now: Learn how to easily stop buying things

Think Through Unnecessary Expenses

Spending money on little things adds up over time.

As a result, you can’t completely ignore these costs.

I don’t suggest you eliminate this spending as you won’t enjoy life.

What I do suggest is you use a trick to cut expenses on the things that don’t matter to you.

Before you buy something in the moment, stop for a minute and ask yourself how will this item improve your life or benefit you.

Then ask yourself if you would rather have the money or the item

Going through this process can help you stop spending on unnecessary things.

- Read now: Learn how to stop lifestyle creep

Small Expense Summary

There is decent list of small expenses for you to attack.

I am certain there are more things you can do cut back, but this gives you a good starting point.

And with just the ones I listed, you can save close to $2,500 a year.

Electric: $600

Gas: $200

Gym: $300

Cell Phone: $450

Online Shopping: $200

Cancel Subscriptions: $100

Delay Purchases: $350

More Ideas To Cut Expenses To The Bone

As I mentioned before, everyone’s situation is different, so you will have many other expenses than what I list here.

Because of this, it is critical that you run through all of your expenses so you will save the most money.

To do this, you need to track where your money goes.

You can create a monthly budget manually by writing down every time you spend money.

The post referenced above will show you the best ones to start with.

Another option is to use Tiller Money.

This is a budgeting app that will automatically pull all your transactions into one place.

All you have to do is edit the category and you are set.

In less than 5 minutes you will see where all of your money is going and can start taking action to save money.

Tiller Money makes spreadsheet budgeting simple and fast. Use their pre-made budget and let Tiller automatically import your transactions. All you do is categorize them and you are done. No risk 30 day free trial.

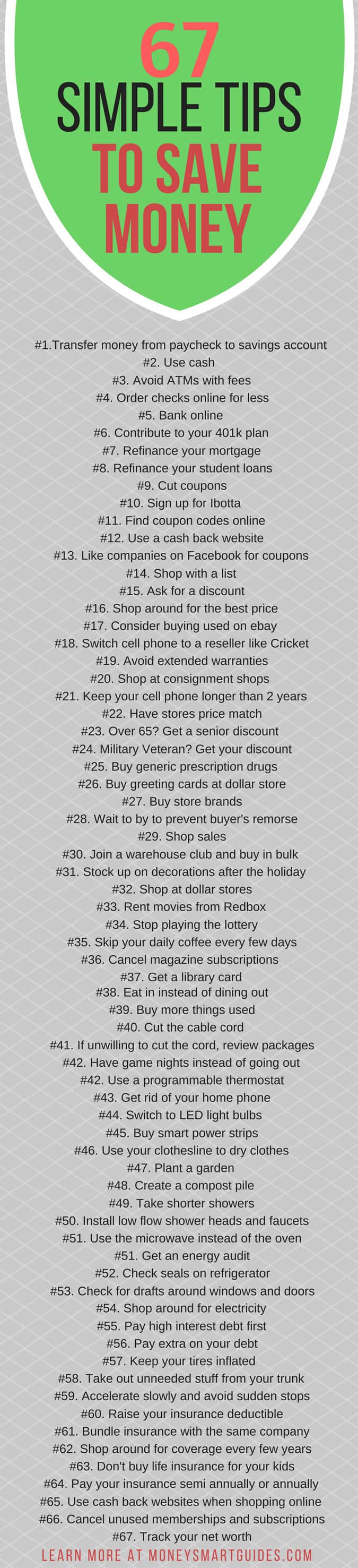

Finally, here is a chart of 67 things you can do to save money.

Some have been mentioned in this post already, but the goal is to get you thinking about how you spend your money and where you can easily reduce expenses.

And if you want even more ideas when it comes to saving money, I have you covered.

At the end of the day, you will have a solid list of ways to cut expenses and free up money.

Recapping Best Ways To Cut Costs

This was a lot of information and you might be feeling a little overwhelmed right now.

To help you start taking action right now, I’ve summarized everything here for you.

#1. Refinance your debt to free up money and save on interest.

#2. Get a free auto insurance quote and save up to $850 a year.

#3. Review your property taxes and appeal if too high.

#4. Contribute to your 401k plan to lower your taxes.

#5. Use Rocket Money to cut your bills and cancel subscriptions.

#6. Review your small expenses and work on one at a time.

Start with this process and then repeat step 6 after you reduce an expense.

By following this plan and the things I outlined in the post, you will potentially save $7,000 a year.

Add in some cases, some of you will save even more.

All you have to do is take the first step and you will drastically cut expenses.

What To Do With Your Savings?

Now that you’ve taken action to cut costs, you are going to have to figure out what to do with the money you’ve saved.

Here is a clue: spending it should not be an option!

All kidding aside, you need to have financial goals for your money.

Think about what you want your future to look like and this will help guide you.

With that said, here are the best ideas for how to use your new found savings from cutting expenses to the bone first.

#1. Focus On Debt Repayments

If you have credit card, student loan, auto loan, or other types of personal debt, you should use the money you save to rid yourself of these debts.

Doing so will free up money for you to save every month.

Look at it this way.

Let’s say you have a car loan that is costing you $400 a month.

You cut your budget using some of the tips in this post and free up an additional $300 a month.

By taking this extra $300 and putting towards your car loan, you will pay this loan off faster.

Now instead of having $300 extra every month, you have $700 extra.

Put the extra money you save towards your lowest balance debts so you can save even more money every month.

You might even consider debt consolidation to speed this process up as well.

Not only will it free up money in your budget, but you won’t have the added weight debt adds to your life.

#2. Build An Emergency Fund

The next option for your saved money is to make sure you have enough money for emergencies and other expenses you will encounter in life.

I like to have around 9 months of expenses in my emergency fund.

This gives me the peace of mind knowing I have more than enough money should the water heater break or someone loses their job.

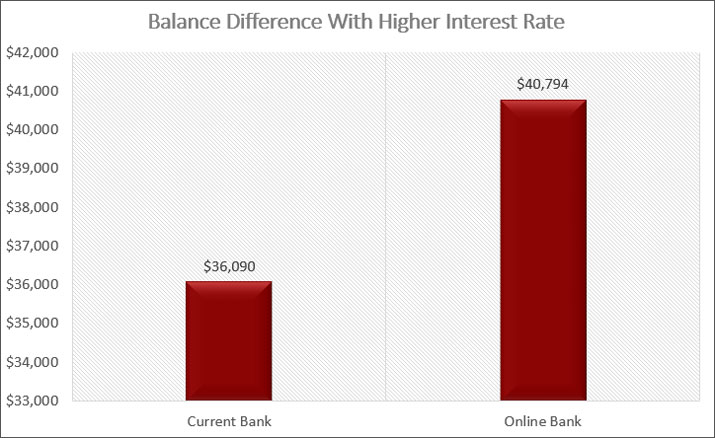

The best place to park your cash is with CIT Bank.

They offer a free savings account that doesn’t charge any fees and pays a higher interest rate than most brick and mortar banks.

With one of the highest paying interest rates in the U.S. CIT Bank stands out as the best high yield savings account. Add in ease of use and great customer service, and you have a clear winner.

Here is how important this is.

If you take your $300 savings each month and put it into a CIT Bank savings account instead of your local bank, in 10 years you will have close to $5,000 more!

You work hard for your money, so take the 5 minutes to make sure your money is working for you.

Final Thoughts

There is my step by step guide to cutting expenses to the bone.

While it can feel overwhelming at first, if you break down your spending into categories and tackle one at a time, you will make it easy to cut expenses.

I recommend you focus on your large living costs first, as you get the biggest return for your time here.

Then you can start to look at the smaller expenses.

In the end, you will have drastically cut living expenses and freed up a ton of money.

I know this process works, because I used it and have guided many others on it as well.

I am certain that if you take a few hours over the course of the month to save a little bit of money, that money will add up and you’ll be surprised at how much you will save.

Remember, don’t look at cutting expenses to the bone as going without or in a negative light, see this as a step towards allowing you the freedom to live a better life.

- Read now: Learn how to play the drugstore game and save thousands

- Read now: See the difference between income vs. net worth

- Read now: Follow these steps to become financially independent

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Wow, that’s a LOT of information in one post. Everyone has to do their own personal assessment, but I would personally not get rid of my gym membership. I use it every single day – and while it IS possible to stay in shape without one, I enjoy the use of the variety of machines and free weights as well as all the other things our facility gives us – basketball, racquetball, indoor track for those crappy days outside, etc. Now, if someone is in debt, and struggling to make ends meet, well, this should likely be one of the first things to get tossed!

I agree Brock. I canceled my gym membership and did P90X for a while. I really enjoyed the workouts, but I’ve always been a guy that loves to squat and deadlift at the gym. I like feeling of the bar in my hand, etc. But for those not like us, getting rid of the gym membership is a no-brainer.

Cell phone is a low hanging fruit for us. We’re about to switch plans and end up no-contract and 1/2 the cost. Same service and same phones. Sweet.

I was grandfathered in with super low texting and data packages that aren’t offered any longer. As a result, if I change plans, I lose the grandfathered price. For now, it makes sense for me to keep it as is and not change things up. But, cell phones are a biggie that I missed on my list.

Solid post Jon! We’ve cut pretty bare bones as there isn’t a whole lot we need and would rather have our money work for us as opposed to spend it. That said, I still can’t get over the grocery spending statistic. We spend less than half and have five in our family.

I agree John. I had to read it twice to make sure I wasn’t misreading things. That is a ton to spend on food in a month – and it doesn’t include eating out!!

We have cut our budget to as low as we can doing many of the things in this post. If you can save money, then why not? No need to pay more than you have to.

We did cut our gym membership and buy everything that we need for a home gym. The upfront cost is fairly expensive, but it’s something that we can use for years to come, and we don’t have to pay for the gas to get to the gym either.

That’s a good idea Michelle if you plan on using the gym equipment. I’m sure people know deep down if they are actually going to use the equipment for the long-term versus just have it be a passing fad.

On the little stuff, the simple art of tracking is key. I always tell all my friends to use Check or Mint (apps that track every dime coming in and out). A lot of times, it’s not the massive expenses hurting people in the long-run, it’s the small day to day stuff that we don’t need, like the drive through coffee, the bars, constant eating out, etc. Seeing all that stuff added up and categorized in an app makes a huge difference.

I use Power Wallet to track my spending. It really does open your eyes when you see just how much you spend each month on the little things.

I really should cancel my gym membership. I haven’t been there in the longest time. I guess I keep paying, hoping that eventually I’ll kick myself into gear and start going again.

I’d just cancel it. My wife was in the same boat. I eventually got her to cancel when she realized that the rate she was getting wasn’t some special rate. If she decided to join again in a few months, she’d get the exact same rate.

As part of an effort to eat better, my groceries have gone up because I am eating a ton of produce, which is more expensive but I cut my internet bill so that has helped.

That’s a good approach. It’s a lot like what I do with keeping check on clutter. Whenever I buy new cloths, I have to get rid of something I already have. It helps to keep things in balance.

All of those things certainly add up! I think we’ve gotten our expenses as low as we can get them without going crazy.

There is certainly a limit as to how much you can cut and still stay sane!

The good news is, I don’t have most of these expenses in the first place.

That is certainly a good thing!

One area that most people spend money whether they have it or not is travel. What many families don’t realize is that there are ways to cut thousands off your travel expenses via loyalty programs and incentives. I am one of the most conservative people you would meet and have zero debt yet have found creative ways to use selective credit card offers to save thousands off travel for my family and I. Some may say to just cut travel out all together until you have your debt paid off but I know people are going to travel anyway so you might as well do it cheaper.

Great post by the way, all good ideas and many are one’s I have utilized. Thanks!

Traveling is certainly expensive. My wife and I are planning on using airline miles and credit card rewards for covering much of the costs for our honeymoon.

Of all you mentioned above, one that I can sacrifice is gym membership. I gave it up more than a year and thought I made a good decision and made me exercise just at home, which I find better.

We got rid of our cable awhile back, for reasons other than saving money (we soon figured out). We save so much time without the cable service. So much more time is spent doing valuable things like being outside and doing fun, physical activities.

“automate your savings”

Can I respectfully disagree on this one? Saving money can become a real grind, but one of the fun parts is being able to manually transfer the money in from payday to payday. Maybe thats just me though.

I agree with what you said about the mortgage/rent though. Finding a cheaper place to live has got to be one of the easiest ways to free up a lot more cash for saving. This can be done even if you have a mortgage. Just rent your home out to someone else and then rent yourself in a cheaper place. Most of your mortgage should be covered by your tenant and you’ll be paying a cheap rent compared to what your mortgage once was.

Awesome tips!

We’ve also reduced many of our expenses over the last few years and, even though they don’t exactly add up to $1,000 a month, we still managed to save quite a lot in the long run!

Just by reducing some of our big expenses (like rent, insurance, monthly bills), we significantly lowered our regular “mandatory” spending!

I agree Adriana. Anything you can reduce adds up over time. Whether you put that “extra” money towards debt, investing or vacations, it adds up and helps you reach financial goals faster.

I always recommend going line by line through your bills/expenses and see how low I can go and this is revisited frequently throughout the year. I have 5 children and when they were all at home we spent an average of 75-90.00/ week ( 3 are home so family of 5 now and I still try to use that as my goal)! My favorite store here is the .99 cents only store where I can get fresh produce that actually is very good for .99 and I am known to be a gourmet cook.

The best thing we have done in being frugal all of these years is that we have paid of our house early and that is a feeling of freedom! It is such a burden lifted off your shoulders and it frees up a big chunk of money. We also put through 3 kids through college debt free, but have two more to go( youngest is 12 yo)! We lived off on one income for many years now.

So many good points in your column! Oh and my husband is a bodybuilder for the past 40 years and he built his gym ( in the garage) from people getting rid of their weights, equipment or buys them when gyms close down,etc.

The only thing I would have you look into is the property taxes you can appeal without spending 500. for a lawyer. Go to your newspaper or online or even to a local real estate agent and get FREE comps analysis for houses similar to yours in the same area that have sold for the past few months. We especially did this during the housing crash and I focused my stats on foreclosures thereby getting the cheapest stats! I sent the evidence and copies with a written letter requesting them to lower my property tax bill since the market reflected lower property values now. The County Tax Board sent me a revised bill saving me thousands and you can do this more than just one year. Cha-ching saved you from hiring a lawyer and saving money on your tax bill!

Lastly, I LOVE free- I look for FREE- I have received free computers, laptops, furniture ( and I have a nicely decorated house-not shabby- but clean, simple and visually pleasing), cars, much of my kids clothes were handed down from family and friends who had designer trends and often new with tags still on them,etc. I never said no ( if you don’t want it, give it away) and if I wanted to buy something or look for something I let friends and family know what I am looking for to have them look for sales when they are out and they can give me a bargain alert or more often than not they know someone getting rid of theirs or have one they never use and was going to toss so they give it to me FREE! At the very least someone finds a sale and I get a better price! One thing that I am resourceful is bc I hate to spend money if I don’t have to!

Oh in the above post the 75-90.00/ week was for groceries for a family of 6-7 at the time and now for a family of 5 at home ( 3 adults, one 17 yo and 12 yo boy). And made error, it should be “paid OFF” not “paid of” my house! The best thing we did was pay OFF our house and we have no debt whatsoever- no car debt- we buy Hondas or used cars and drive it to the ground- 3 past cars lasted over 300k but two were totaled in accidents at the 300k mark so time for a new car! My husband would have salvaged those cars if the insurance company would have let him lol!