THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

I talk all the time about the easiest way to save a lot of money fast is by switching your auto insurance policy.

But traditionally, shopping for insurance quotes has been hard to do.

You either had to call up each insurance company, get a quote, add it to a spreadsheet, and repeat until you had enough to make a good comparison.

Or you enlisted the help of independent auto insurance brokers.

But this took time too.

There had to be a better way.

Well there is.

It is called Insurify.

Insurify is the leading online insurance marketplace that offers you personalized quotes in a streamlined process that makes things easy.

In this post, I will explain what they offer and why you should use them to shop for auto insurance quotes.

Table of Contents

Insurify | Car Insurance Comparison Marketplace

Who Is Insurify?

Insurify is the top-rated insurance comparison marketplace online.

To date, it has won over 20 awards and recognition by various agencies.

It was founded in 2013 by Snejina Zacharia after she was in an auto accident and her car insurance rates skyrocketed.

Trying to save money, she decided to get quotes from other insurance companies for a similar policy.

Insurify Review

- Insurance Options

- Pricing And Fees

- Ease of Use

- Customer Service

Summary

Are you looking for a quick way to compare multiple auto insurance quotes at once? Say hello to Insurify. In less than 15 minutes you can compare insurance quotes, switch policies, and save money. The average customer saves close to $500 a year. Click here to see how much money you will save.

But she encountered the same problem many other people looking to save money on auto insurance encounter.

She had to make numerous phone calls to try to get quotes.

And for the few that she was able to get a quote from online, her inbox became uncontrollable from all the emails.

She knew there had to be a better way, with the end result being Insurify.

How Does Insurify Work?

Simply visit the Insurify website to get started.

Enter in your zip code and the artificial intelligence will walk you step by step to getting multiple insurance quotes.

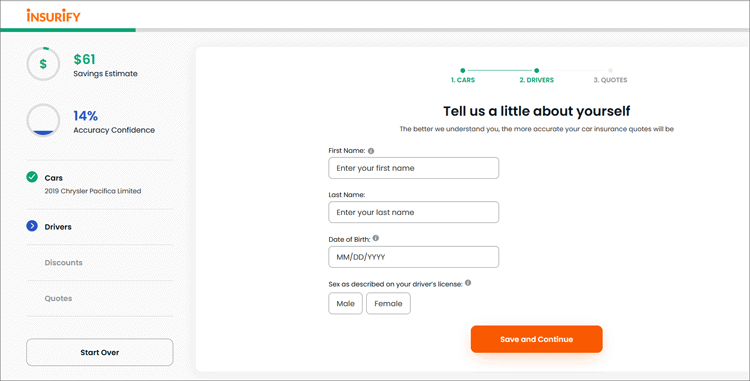

You will enter details about your vehicle, like make and model, miles driven, and how you use your vehicle.

Then you enter in personal information, including your name, date of birth, and gender.

They will also ask you for your email address to help you find previous quotes if you need to stop in the middle of the process.

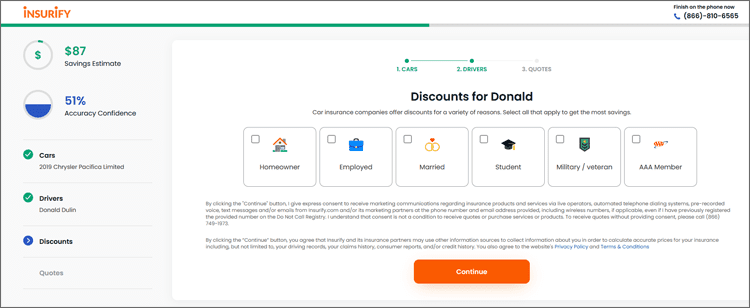

The next step is seeing if you qualify for any discounts, like military veteran, AAA member, employer discounts, and more.

The final step is to report any accidents, tickets, or insurance claims in the last 5 years.

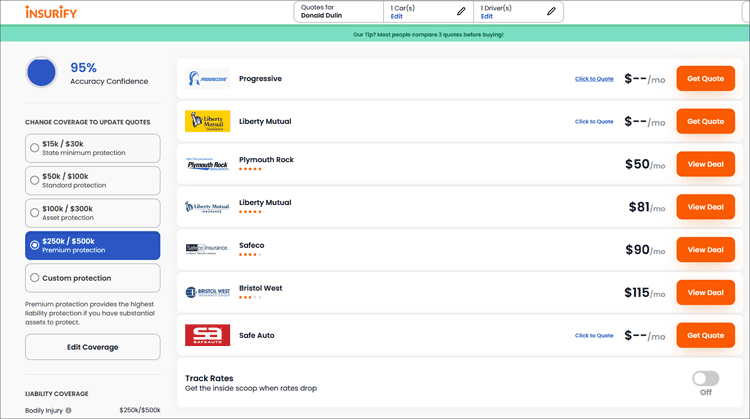

After that, you will be presented with a handful of quotes you can choose from.

The nice thing here is you can customize coverage options to fit your needs best.

You can see quotes for state minimum coverage, standard protection, asset protection, and premium protection.

You can also customize your quote even more if you want.

After reviewing the quotes, you can either purchase the insurance online, call an Insurify agent, or use their secure chat feature.

In less than 15 minutes, Insurify saves the average user up to $489 a year on car insurance.

With Insurify, you get multiple insurance quotes, fast and easy. The average savings is close to $500 a year. Click the link below to see how much money you will save with Insurify!

How Does Insurify Make Money?

Insurify is free for you to use.

The company makes money from the insurance company if you choose to switch your policy over to them.

For example, let’s say Company ABC quotes you $250 a year through Insurify and you switch coverage to them.

After you switch, Company ABC pays Insurify a fee for the new customer it gained.

Understand this doesn’t mean you are paying a higher insurance premium if you use Insurify versus calling the insurance company on your own.

The fee does not impact the price you pay for insurance coverage.

Reviews From Customers

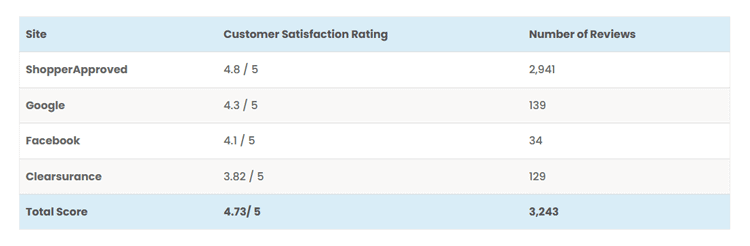

To help you save some time, I searched online for Insurify reviews.

Overall, Insurify averages a 4.7 review out of 5 from major review sites.

Below are links to some of these sites so you can read the positive and negative reviews for yourself.

Advantages And Drawbacks

If you are short on time, here are the main pros and cons to Insurify to help you decide if it is a fit for you.

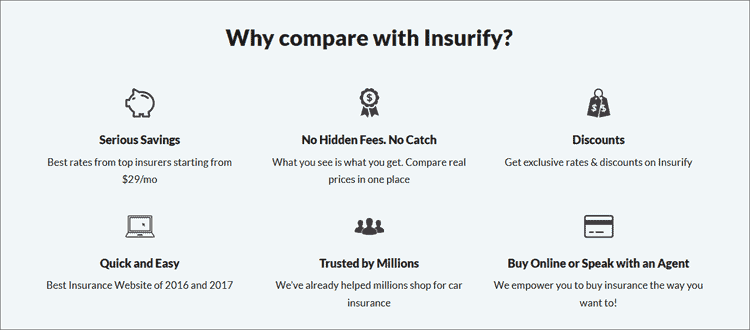

Advantages

Fast. You get multiple quotes in under 15 minutes, making it a quick way to save a serious amount of money.

No pressure. Once you get your quotes, there is no pressure to switch. If you want to switch you can, but you aren’t forced to.

Customizable. Once you get your quotes, you can change your coverage up on the fly and get updated insurance premiums quotes.

Bundling. You can bundle your auto insurance, homeowners insurance, and life insurance for maximum savings.

Savings. Speaking of savings, customers save an average of $489 a year on car insurance when they use Insurify.

Licensed in all 50 states. No matter where you live in the United States, you can use Insurify to get a quote.

Drawbacks

Not an auto insurance company. Not a huge drawback, but something to be aware of is that Insurify is not an insurance provider. They are simply helping you find quotes. If you do switch, you will be dealing with that insurance company, not Insurify.

More insurance companies. While you get a number of free quotes with Insurify, there are other insurance companies out there. There is not an insurance marketplace that offers quotes from every single insurance company.

Alternatives To Insurify

There are a few insurance comparison websites to get accurate quotes from.

Here are two of the more popular ones compared to Insurify.

The Zebra

The Zebra offers a fast way to get multiple insurance quotes at once.

The main difference is that with Insurify, you can bundle auto insurance, home insurance, and life insurance to save the most money.

With The Zebra, you cannot bundle life insurance into the mix.

Also, the Zebra bundles its quotes into level of coverage, like Minimal, Basic, Better, and Best and show syou the basic coverage options first.

Finally, you can’t customize your coverage on the fly either.

With Insurify, you get quotes that reflect the same coverage you currently have and you can customize your coverage too.

Gabi

Gabi is very similar to both Insurify and The Zebra.

A key difference is Gabi works best by having you connect your current policy to Gabi.

- Read now: Click here to learn more about Gabi

This means logging into your insurance account and linking it to Gabi.

If you don’t want to do that, you can upload a copy of your current insurance policy, but this could delay the quote process by a few days.

With Insurify, you get multiple insurance quotes, fast and easy. The average savings is close to $500 a year. Click the link below to see how much money you will save with Insurify!

Frequently Asked Questions

I get asked a lot of questions about Insurify.

Here are the answers to the most common ones.

With Insurify, you get multiple insurance quotes, fast and easy. The average savings is close to $500 a year. Click the link below to see how much money you will save with Insurify!

Final Thoughts

Switching your auto insurance policy is a simple way to save a lot of money.

Sadly, most people don’t do it because of the time it takes.

Insurify solves this problem.

You get multiple quotes and can make the switch online, with a phone call, or via secure chat.

The entire process takes less than 15 minutes.

And the average customer saves close to $500 a year.

The bottom line is, you have nothing to lose other than your overpriced auto insurance policy.

With Insurify, you get multiple insurance quotes, fast and easy. The average savings is close to $500 a year. Click the link below to see how much money you will save with Insurify!

- Read now: Here is your complete guide to understanding insurance

- Read now: Learn how to never have a car payment again

- Read now: See why hybrids don’t save you money

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.