THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

I made some dumb mistakes with money when I was in my 20s.

Luckily I also made some really smart money moves as well.

The result is now that I am in my 40s, I have a solid financial footing and have surpassed having $1 million in net worth.

And if I could have avoided many of the financial mistakes in my 20s, who knows where I would be today.

This is where this post comes in.

Your 20s are the perfect time for you to start building wealth.

But too many 20 year olds overlook putting down a financial foundation because they are focused on other things in life.

If you can set aside some time now to great a wealth building plan, you will achieve financial freedom and have many opportunities.

Here is my guide to build wealth in your 20s.

I cover every aspect of your financial journey, including:

- Budgeting tips for 20 somethings

- How to save money in your 20s

- Building wealth in your 20s

- How to invest in your 20s

- Paying off student loans in your 20s

- Insurance you need in your 20s

Why do I cover everything?

Because you need to understand everything if you want to build wealth.

You can’t focus on investing and ignore your spending.

You have to take a holistic approach to your money so that one day you will become rich and have options in life.

And who doesn’t want to live a life where they have more opportunities and choices?

You can have just about everything you want, as long as you follow the financial guidance I outline.

So let’s get started!

Table of Contents

How To Build Wealth In Your 20s

I am breaking out each area of financial planning in your 20s into its own section so you can follow along easily.

Feel free to jump around and focus on the aspect of money that interests you the most.

Just be sure to look over every section.

At the end of the post, I will summarize everything for you if you are short on time.

I’ll also highlight the most critical financial moves to make in your 20s as well as give you a list of financial goals to achieve in your 20s.

Budget Tips For 20 Somethings

While making and following a budget doesn’t sound very exciting, it is an important step in how to manage money in your 20s.

I know you look at some people and see their luxury car or name brand clothes they wear and you want this too.

You can have these things, but not right now.

Here is why.

If you simply start spending your first paycheck on these things, you will create a bad habit.

You will always want the latest gadget, fashion, car, whatever.

You won’t save anything and in 20 years, you will wake up and wonder how you got to where you are.

There is a good chance you will be in credit card debt, have auto loans, and a huge mortgage.

As a result, you have to get up and work a job you may very well hate because you have to pay the bills.

I have a friend like this.

He graduated high school and started working. He bought a brand new car and was spending money as fast as it came in.

A few years later, he saw a different car he liked and bought that one. Then another one. And another.

He was also spending on other things too. He wasn’t saving anything.

Fast forward 15 years later to today.

He has an 8 year car loan and a payment of $800 a month because he kept refinancing his car loans into a new car loan.

He has a mortgage as well.

Money is so tight he barely has any left to enjoy life let alone save. In fact, he relies on overtime just to make ends meet.

He is stressed out and unhappy.

But he has to work as many hours as possible just to pay the bills.

You see, when you have mountains of debt, or debt of any amount, you aren’t working to pay yourself. You are working to pay someone else.

For example, if you are in credit card debt of $500 and you make $500 this week at work, you were working to pay the credit card company.

All the money you earned is going to them.

You have nothing to show for getting up at 5am, fighting traffic, dealing with people you dislike, fighting traffic again and going to bed.

All to repeat it again the next day.

But if you didn’t have that $500 in debt, the money you earned is yours.

You decide to spend it on a nice dinner out. Or you decide to save and invest it so you have more options in life.

Another friend graduated high school and started working right away. He didn’t buy a new car every few years.

He kept his car and only bought another one when it made sense. He also made it a point so save a little bit of money every month.

Fast forward 15 years and he is financially stable. He hasn’t made all the right money moves, but he was smart by staying out of debt.

As a result, he was able to quit a job he hated and take a lower paying one because he wasn’t handcuffed by debt.

This is why you need to budget.

By keeping track of how much you are spending, you avoid going into debt.

By managing your money and avoiding debt, you can grow your wealth and enjoy life more.

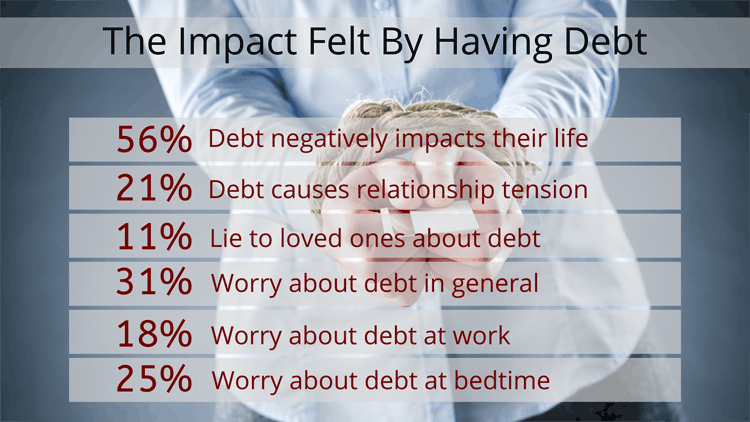

This is because debt has major negative consequences.

Here are some scary statistics conducted by Harris Poll.

Starting A Budget

How do you get started budgeting?

There are a few options out there for you. Here are my favorites:

- Spreadsheets.They offer you 100% control and customization. The downside is you need to know a little bit about Excel and need the time to manually update it. Here are 17 free templates for you to start with if spreadsheets sound like a match for you.

- Good Budget. This is a budgeting app that gives you the option to manually update it, or you can pay a small fee and it will be automatically updated for you. All you have to do is review it. You can learn more here.

- Tiller Money is a hybrid of both options. It is a spreadsheet, but it is automated so you just have to review it. But you also have control in making it look and act exactly how you want. You can try it out here.

- Qube Money. A new take on the cash envelope system, it allows you to follow this budget method even if you don’t use cash to pay for things. You can learn more here.

When it comes to setting up a budget for the first time, there are some guidelines you can use to follow to make sure your money is being spent wisely.

For example, some people swear by the 50/30/20 rule.

This rule has 50% of your income going towards survival.

Think food, housing, basic clothing, utilities, etc. for this category.

The important thing to remember here is the word survival.

Your money is only going towards the things you truly need, not want.

So buying an outfit for the weekend doesn’t qualify.

Next, you have 30% going towards lifestyle spending.

This includes vacations, cable, hobbies, and so on.

Finally you have 20% which is used for long term goals.

This means savings and paying off debts.

For most readers, I would stick to the 50/30/20 rule to get a handle on budgeting.

I would also use any of the free templates I linked to above as they have categories already filled out.

You just have to add in your numbers.

I know that some reading this will still refuse to budget even though it is important.

So I have one more option for you.

All you have to do pay yourself first and not overspend.

This means when you get paid, you immediately take 15% of your income and move it into savings.

After this, all you have to do is not overspend.

If you don’t use credit cards, this should be a cinch.

But as great as this option sounds, you do have to be disciplined with it.

If you don’t save first, or if you overspend, your finances will quickly spiral out of control.

And before you know it, you will wake up one day stressed because your finances are a mess.

How To Save Money In Your 20s

Now that we have budgeting down, you might notice that your monthly expenses are more than your income.

This means you need to find ways to cut back and save.

Even if this isn’t the case, it’s important you find ways to save.

- Read now: Here are the benefits of saving money

The more you do this now, the more saving money will become a habit, making it beneficial to you for the rest of your life.

So what are some ways to save money and how much should you be saving in your 20s?

Let’s look at ways to save first.

As I mentioned in the section above, you need to make it a point to pay yourself first.

This is by far, the most important financial move you ever make.

By saving cash from every paycheck, you build a cushion for when things go wrong.

And they will.

And as your cushion grows, you will have the money for other things, like taking vacations, a down payment on a house, or splurging on something you really want.

What are the best ways to lower your living expenses?

I like to tackle on big monthly expenses first.

This is because they have the biggest impact on your bottom line.

Think about it, what is going to net you the most savings with the least amount of work, skipping a coffee every few days or getting your auto insurance premium lowered?

The answer is your auto insurance.

By comparing quotes, you could save a few hundred dollars a year by doing 30 minutes worth of work.

With Insurify, you get multiple insurance quotes, fast and easy. The average savings is close to $500 a year. Click the link below to see how much money you will save with Insurify!

By skipping a coffee every few days, you have to proactively skip a coffee many times just to save $3 each time.

If you do the math, you’ll have to skip coffee over 66 times just to save the same $200 from getting a lower auto insurance premium.

And a lot more effort goes into skipping coffee all those times.

Here are my favorite big expenses to look into in order to save the most money with the least amount of effort.

- Keep your cable bill in check. By using the free service Rocket Money, they will negotiate your cable bill for you, ensuring you are never paying too much. On average they save users $30 a month! You can click here to try it out.

- Compare insurance quotes. Again, spending 30 minutes to get a lower premium can easily save you hundreds of dollars each year. I shop coverage every 2 years and regularly save $150 on average. I start my search using Insurify to get a handful of free quotes at once.

- Shop around for groceries. Pick two stores in your area and compare the prices to see who offers the best prices. And don’t afraid to buy store brands. They are less expensive and just as good. Finally, plan your meals around what is on sale and pay attention to the store sales cycles.

- Refinance student loans. I’ll get into your student loans in more detail below, but refinancing your loans can save you a few hundred dollars each month in lower payments and save you thousands in interest over the life of your loans.

- Review your energy bills. There are easy things you can do to lower the cost of electricity and other energy bills you have. Since these make up a large portion of your monthly budget, it makes sense to focus on these expenses early.

But you shouldn’t stop with big expenses when trying to save.

The little things add up over time and so you should put some effort into saving money here too.

Just don’t make it your main focus. Focus first on the large expenses you have, then the smaller ones.

Here are a few of my favorite ways to save the most money on the little things.

- Use cash. It’s amazing how much less you will spend when you pay with cash instead of credit. Try it out for a couple of weeks and see for yourself.

- Ask for a discount. When you are at the store, before you buy something, ask if there is a discount you could get. This could be a coupon or a discount for paying in cash. You’ll be surprised how often the clerk has a coupon they can apply to your purchase.

- Shop the dollar store. Not everything at the dollar store is worth your money, but there are some things you can buy and save a good amount of money on. For example, greeting cards. You can get them 2 for $1 versus paying $5 for a card anywhere else.

- Be smart when eating out. Try to split plates or only go out when there are specials for happy hour.

- Learn your values. When you know what you enjoy, you can spend money on these things and stop spending money on things that don’t fulfill you. Too many people buy things hoping to be happy and these things don’t add any value to their lives. Buying these things only holds them back financially because they are literally wasting money. By buying things that add value to your life, you can save a lot of money.

- Work on your money mindset. Having a positive attitude about money and attracting wealth is also an important thing to have. Too many people have a negative money mindset that makes it harder to get ahead financially. Take the time to read books about habits and goals, and also surround yourself with money minded friends who want to get ahead.

You might wonder why you should go to the trouble of using the tips above to save if money isn’t an issue for you.

The reason is simple.

The more you work to keep your expenses low, the more money you can save.

- Read now: Learn over 100 creative ways to start saving money

- Read now: Find out how to enjoy a money free weekend

For example, if you just pay yourself first, you might be able to afford a nice vacation once a year.

But if you use additional tips to keep your expenses low and save even more every month, you might be able to take 2 vacations a year.

Taken one step further, financial independence is when you can survive solely on your savings.

If your expenses are low, you can choose to quit working a lot earlier than you ever thought possible.

The point is, by making it a habit to save, you allow yourself to take advantage of opportunities in life.

For me, this came about when I was laid off.

For anyone without any savings, this would be a stressful time.

They would be scared about how to cover their bills and at the same time, scrambling to find a new job.

While I did have some stress about the situation, I wasn’t afraid.

My wife and I had a large savings to fall back on and eventually, we decided that I would start my own business.

I am excited to work every day and love what I do.

This wouldn’t have been possible if we didn’t make it a point to pay ourselves first and find additional ways to put a portion of our salary away.

One final note on saving money.

Don’t think I am telling you that you have to live a boring life now and save every cent in order to enjoy your future.

I want you to enjoy today to its fullest potential. But I also want your tomorrow to be better than you thought possible too.

This is done by simply being a smarter consumer today.

Don’t just give in and buy everything you see. Ask yourself if you really need it.

If you don’t, skip it and save your money.

In addition, take a few minutes every day to figure out how to save on the things you buy.

When you do this, you enjoy today and keep the door open for an amazing tomorrow.

Tips For Building Wealth In Your 20s

When it comes to growing wealth, there are two areas for you to earn the most money possible and get ahead financially.

Let’s look at each one separately.

Your Career

Let’s start with your career since for 99% of you reading this your career is your greatest asset.

What do I mean by this?

This is the thing that will earn you the most income over your lifetime.

Yes you will make money by investing in the stock market and saving money, but your career earnings will easily outpace this.

For example, let’s say you are starting off your career at age 23 earning $35,000 and you get a 3% raise each year until you retire at age 65.

You will earn a total of $2,753,215.

If you work smart, you can achieve a 5% raise or more and dramatically increase your lifetime earnings.

Using the same scenario above but with a 5% annual raise, you end up making $4,474,391 throughout your career.

That’s a difference of $1,721,176!

How do you earn a higher raise?

The answer is by becoming valuable to your employer.

If you make it a point to step outside of your job description, take on additional roles, learn new skills, and help out your manager, you can achieve a higher than average raise.

But it won’t happen overnight.

You have to work hard to make it happen.

But don’t make the mistake of thinking this means you will have to work 100 hours a week.

If you work smart, you can earn a higher raise without putting in the long hours.

I go into more detail about this process in my post on the simple steps to earning a larger raise.

One more point on career advice for 20 somethings.

Whether you are still looking or are happily employed now, you have to negotiate your starting salary.

By doing this, you can dramatically increase your lifetime earnings.

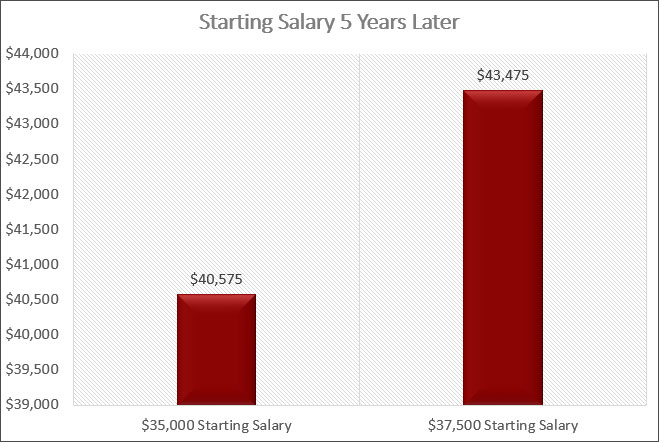

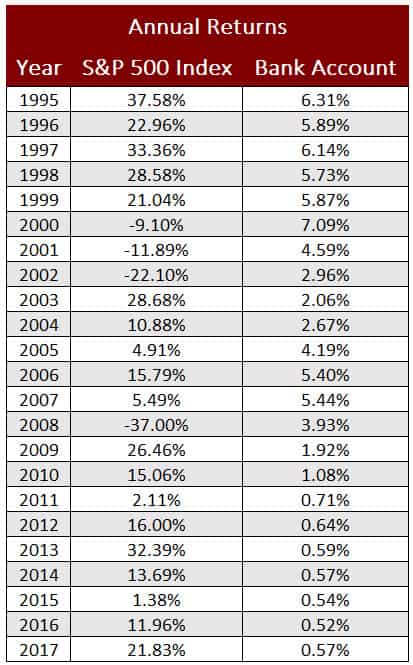

For example, let’s say you are offered a position making $35,000. You take this offer and earn a 3% raise each of the next 5 years.

Your ending annual salary is $40,575.

But let’s say you countered when offered $35,000 and started making $37,500 instead.

Assuming you earn 3% raises each year for 5 years, what does you salary look like?

You end up making $43,475 a year. That is $2,900 more income a year.

If you look closely, you will see an important thing here.

When you negotiated, you earned $2,500 more a year. But what about the other $400? Where does this come from?

With a higher starting salary, each of your raises are greater in amount as well.

See the chart below for a breakdown.

By starting off with a higher salary enjoy at least $75 more every year.

And this amount only gets bigger as compound interest takes over.

For example, in 20 years, by negotiating your salary at the start, you will be making over $4,500 more a year!

And over the course of those 20 years, you will have made a total of close to $72,000 more!

So if you are still looking for work, negotiate your salary.

If you are currently employed, negotiate your salary at your next job. It is critical to do this.

And employers expect you to negotiate. You just have to come back with a reasonable starting salary.

By negotiating your salary and becoming valuable at work, it will allow you to generate wealth in your 20s and set you up to earn even more in the future.

Side Hustles

Side hustles allow you to accumulate wealth at an even faster rate, allowing you more lifestyle freedom, earlier than you thought possible.

When I graduated college, making money on the side was called moonlighting.

But I like the term side hustle more.

Basically you are spending some time outside of your day job to earn additional money.

Some of you might think I am expecting you to head out and find part-time work at McDonald’s or Michael’s earning $7 an hour.

This is not the case.

I am talking about finding ways to make a lot more money per hour and working fewer hours.

Your goal should be to make roughly the hourly rate you are earning at your career, or more.

If you are making $25 per hour, then this is the goal.

- Read now: See how much $25 an hour is annually

- Read now: Here is how much you make per year earning $18 an hour

Now, some of the options to make money aren’t going to specifically have you work for an hour and make $25.

You might be working for 10 minutes and make $6.

At first glance, this $6 is a waste of your time since you need $25 per hour. But you have to remember you are only working for 10 minutes.

If we take $6 and do the math to turn it into an hourly wage, we get $36.

Since there are six 10 minute periods in one hour, simply multiple $6 by 6.

Doing this side gig earns you $36 per hour, which is more than your goal of $25.

When evaluating if a low paying side gig is worth your time, be sure to understand how long it takes you to complete it and then do the math to turn your earnings into an hourly wage.

So what are some good paying side hustles that I have found worth my time? Here are my favorites.

- When you take surveys online, you earn cash or free gift cards. It’s easy work that pays once you have a strategy and plan in place. I wrote a post on how how to earn up to $200 a month taking surveys.

- You can get paid to grocery shop for others. It’s easy work that pays well. You can click here to learn more.

- This website allows you to do a handful of things to earn cash or even gift cards. You can take surveys, play games, watch videos, surf the internet and more. You can even get cash back by shopping online through Swagbucks. New members get $5 when you sign up, and you can click here to get started!

- This is a cash back website that allows you to earn money when you shop through the Rakuten online portal. New users get $30 after your first purchase of $30 or more. You can get started here!

Here is how I use the above side hustles to earn some extra cash each month.

When it comes to surveys, I spend 30 minutes 5 nights a week before bed. I complete around 4 surveys per night and average $2 per survey.

This earns me $160 a month.

Next let’s look at Swagbucks and Rakuten.

Before I buy anything online, I visit each of these sites to see if I can earn cash back by shopping through them. Most times I can.

So, I see which site offers a larger cash back amount and I shop online through their site.

Here is how it works.

I’ll use Rakuten as an example.

I visit Rakuten and search for the online store I want to shop at.

In this example, I’ll use Best Buy.

When I click on the Shop Now link, I get sent to Best Buy’s website and I shop as I normally would.

After I make the purchase, I get credited with cash back from Rakuten. If the cash back amount is 2% and I spend $100, then I made $2.

That is all there is to it.

You take an extra 2 minutes to shop through either Swagbucks or Rakuten and you earn money.

You might think this $2 is pointless.

But remember it only took me a minute to complete.

When I shop online for Christmas gifts, I easily make a few hundred dollars.

This is because I do all my shopping though Rakuten or Swagbucks and each online retailer sets a different cash back amount.

Some go as high as 25%.

I easily earn close to $400 in cash back every year by shopping online through these sites.

I also do other things as well, like sell things on Amazon that earns me more money on the side.

Even this blog used to be a side gig for me.

At one point, I was making close to $10,000 a year through the various side hustles I was doing.

And I wasn’t budgeting that money for my daily expenses. I pretended it never existed and just invested it.

After 5 short years, my finances were looking really good.

I had more than $50,000 in savings just from side hustles.

This allowed my wife and I to travel a lot.

Over the course of a few years, we took trips to Belize, Mexico, Grand Cayman, St. Martin, Anguilla, and Ireland.

- Read now: Click here for 25 ideas to make $1,000 dollars fast

- Read now: See the benefit of multiple streams of income

I encourage you to read through my post that covers more than 51 ways to make extra money.

It has ideas to help you make anywhere from $100 a month, up to $1,000 or more.

Finally, I want to take a minute to talk about passive income, as you probably came across the term.

Passive income is when you earn money without doing any work.

There are not many side hustles that qualify as passive.

You have to work to earn the cash.

For building wealth, I consider investing and money in savings accounts as passive income.

This is because you don’t have to do anything to make the money grow.

The interest it earns will grow the money no matter what you do.

When it comes to making money in your 20s, start off by following the career advice I offered and then find something you enjoy doing to make money on the side.

Then do like I did and pretend the extra money doesn’t exist.

Use it to get rid of your student loans or put it all into savings.

You will be amazed at how much of an impact it has on getting you ahead of the game.

How To Start Investing In Your 20s

Starting a retirement fund and other investment accounts is another key part of building wealth in your 20s.

For most of you reading this, you weren’t affected by the recent stock market crashes, but this doesn’t mean you are safe.

Here is the thing about investing money.

The market goes up some days and it goes down some days.

It could move in either direction a lot and get scary at times.

But over the long term, there are more up days than down and as a result, the market tends to rise over time.

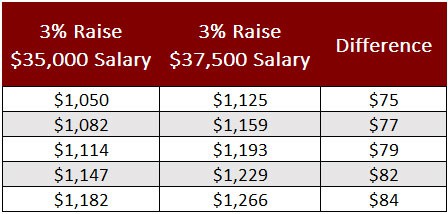

Just look at the below chart as an example.

The up years outnumber the down years by close to a three to one margin.

In other words, over the long term, you will make money investing in the market.

If you invest for the long term, meaning 10 years or longer, you can expect to earn an average return of 8% annually.

Whereas if you put your money in savings at a bank, you are lucky to earn 2% annually.

What impact does this have on the growth of your money?

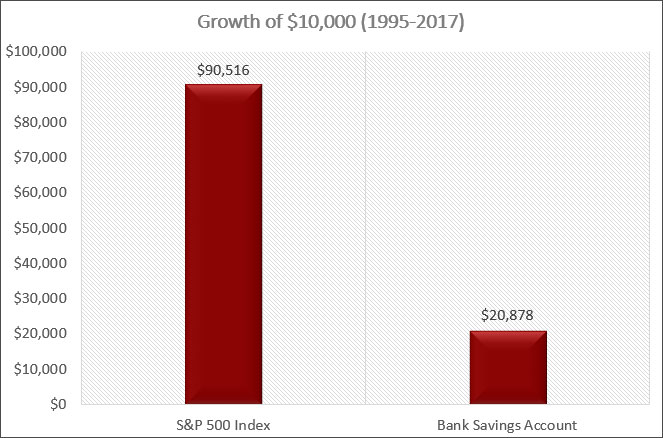

Below is a chart comparing the annual returns of the S&P 500 Index from 1995 through 2017 as well as the annual returns of a bank account.

If you put $10,000 in to each of these and forgotten about it, how much would you have today?

If you invested your money into the stock market, you would have $90,516.

That is close to $70,000 more money!

As you can see, investing is critical for your long term financial well being.

But don’t think this means you should skip putting cash into savings accounts.

You need to have some savings in an account for emergencies.

This is because the money will be safe in terms of you not losing it, like can potentially happen when investing in the market.

Therefore, you need to put money into a bank account for emergencies and other short term savings goals.

Short term means less than 5 years.

For everything else, you need to invest in the stock market.

But starting to invest can be overwhelming regardless of your age if you don’t have any knowledge about investing.

Luckily I am here to help.

For starters you should check out the investing section of this site.

There you will find investing posts to help you be a successful investor and cover the basics you need to know.

In the meantime, you need to open an investment account.

Two of the best options are below.

Betterment

If you are in a good place financially and can afford to invest $25 or more each month, open an account with Betterment.

They are an online advisor that does everything you need to be successful.

All you have to do is take 10 minutes to open your account and set up a monthly transfer.

They do everything else for you.

Betterment is one of the original robo-advisors out there. And they are still thriving thanks to their belief in always innovating. When you invest with Betterment, you know you are making a smart choice.

Acorns

If money is tight and you can only afford to invest $10 or less each month, open an account with Acorns.

They too will do everything for you, but they invest smaller amounts of money.

They will also round up your purchases and invest your spare change for you.

It’s incredible how well this system works.

You also get $5 for opening your account.

Acorns changed the game when they allowed you to start investing your spare change. With a simple to use app and effortless ways to invest, Acorns is a solid choice for many investors just starting out without a lot of money to invest.

Now that you see the importance of investing in the market, why is it important for you to start your retirement fund in your 20s?

The simple answer is time.

Time works wonders when it comes to investing.

The longer you have for your money to grow, the more it compounds upon itself, which means the wealthier you become.

Let’s look at a simple example.

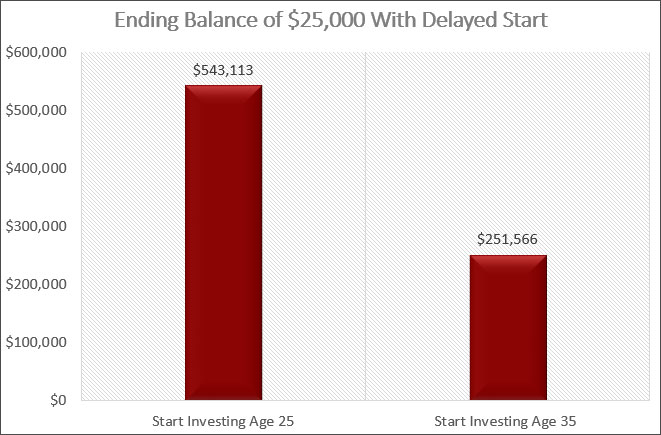

You invest $25,000 at age 25 and it grows at 8% per year until age 65.

You never add another dollar and after those 40 years, your investment grew to be worth $543,113.

Now let’s say you invest $25,000 at age 35 and it grows at 8% annually until age 65. Again, you never add another dollar. After those 30 years, your investment grew to be worth $251,566.

By simply putting off investing 10 years, you cost yourself $291,547!

Take a minute and think about what you could do with an extra $291,000.

Time is powerful when it comes to compounding so the sooner you begin investing, the better off you will be.

I know investing for your retirement in your 20s doesn’t sound exciting or even important.

But it is.

You need to invest something, every month starting now, into your retirement account.

The easiest way to do this is with your 401k plan at work.

- Read now: Here are the pros and cons of 401k plans

When you get your first job, one of the first things to do is fill out the form with your employer to put 10% of your salary into your 401k.

Then ignore it.

Don’t follow the investment returns or the balance.

Just let it grow and in a few years, you will have over a thousand dollars saved.

Your future self with thank you.

From there, consider a Roth IRA account.

This is one of the most popular retirement accounts and for good reasons.

While you don’t get any tax write offs by contributing to this account, you do get tax benefits when you take the money out.

Specifically, your withdrawals are 100% tax free.

Having tax free money in retirement is a great thing.

Finally, I want to caution you if you still think you will wait to begin investing later in life.

Let’s say you are thinking you will just start putting money away for retirement in 10 years.

You see the example above and think you will still be OK financially.

While right now this plan seems fine, let’s look at life in 10 years.

Odds are you may be married. You may even have children. You probably have a mortgage too.

All these things means higher expenses, meaning money could be tight.

The reality is most people who follow this thinking end up not starting to invest at age 35, or 40 or even 45.

Life happens and they forget to start.

Then money gets tight and they plan to wait until they have extra to put away.

The end result is they never start and wind up never being able to retire. They have to work their whole life.

And for those that eventually do start, they see how much they will need for retirement and think getting there is impossible.

This is why the average retirement savings is only $25,000.

Don’t be like everyone else.

Start investing in your 20s and retirement and money won’t be a stress for you as you get older .

Paying Off Student Loans In Your 20s

Ah, student loans.

The bane of your and many of your peers existence.

I remember having student loans and I won’t lie, paying them back for close to 10 years was not fun.

Having a large monthly bill for $300 or more can really crimp your options in life.

Remember the point I made earlier about credit card debt and working to pay someone else instead of enjoying the money yourself?

Well your student loan debt fits this description perfectly.

While you might want to stop paying your loans or pray that one day the government will let you erase your debt like they did for the big banks back during the housing crisis, your best option is to pay them off.

And do this as quickly as possible.

How do you do this?

There are really only 2 steps to the process.

#1. Look Into Refinancing Your Student Loans

When you refinance your loans, you accomplish 2 things.

First, you get a lower interest rate on your debt.

This saves you money over the long term.

For example, if you owe $25,000 and are paying 6% for 20 years and only pay the minimum, you are looking at paying a grand total of $42,985!

If you can refinance and lower your interest rate to 4%, you end up paying $36,358.

You saved $6,627 just by refinancing.

And when you refinance, you typically can lower your monthly payment too.

So instead of paying $300 a month, you may be paying $200 a month.

All this sounds great, but how do you refinance?

The best solution is to visit Credible.

Looking to save money on your loans? Look into Credible. They offer refinancing on student loans and mortgages. They also offer great loan rates for other types of loans as well.

In less than 10 minutes, you will have a free quote for your new interest rate and monthly payment.

You can choose to refinance right then or not at all.

I highly encourage you to look into this.

It’s a simple way to lower your monthly payment and save a lot of money overall.

#2. Pay As Much As You Can Each Month

After you refinance, your next step is to put as much as you can on your student loans each month.

Some of you are living on a tight budget as it is and can’t afford to pay extra on your student loans.

But you can. All you need are a couple of side hustles.

By earning some extra cash on the side, you can make a huge dent in your student loans.

Just paying an extra $100 a month will save you close to $10,000 and have you retire your debt 10 years early.

And you can easily make $100 or more a month by following the tips I outlined in the build wealth section of this post.

For example, when I was in credit card debt, I worked two jobs.

All the money I earned from my part-time job went towards my debt.

By putting everything that I earned there plus some money from my full-time career towards my debt, I was able to pay off my credit cards in just over a year.

If I didn’t do that, it would have taken me over 2 years to be debt free!

The key here is to pay off your student loans as quickly as possible.

The sooner you do, the sooner you have more doors open for you.

Insurance You Need In Your 20s

This post about how to build wealth in your 20s isn’t complete without talking briefly about healthcare.

Ideally, you will be covered by your employer’s healthcare.

But choosing a plan isn’t as simple as it used to be.

To reduce costs, many employers now offer high deductible healthcare plans.

This means that you pay out of pocket for a lot of your healthcare costs each year until you hit your deductible.

After that, co-insurance kicks in and you pay a lot less.

In many cases, your out of pocket costs will be $3,000 or more before you hit your deductible.

This might sound scary to some of you reading this, but you can make out like a bandit financially if you are smart.

Here is how it works.

Chances are, in your 20s you are healthy and rarely need to have any expensive procedures done.

As a result, you won’t be paying much out of pocket for healthcare.

This is because in most plans, preventive care, like annual physicals and dentist visits, are covered by your plan and you pay nothing.

You take some money and put it into your health savings account, or HSA.

This is an account that you put money in and use to cover healthcare related expenses.

The money you save is taken out of your paycheck pre-tax, and it grows tax free.

If you use the money for healthcare expenses, you don’t owe taxes on it when you spend it.

The trick here is to put as much as you can into this account and wait to use it until you are older.

Here is a perfect example.

When the companies my wife and I worked for switched to a high deductible plan, we were saving around $100 a paycheck in the account.

Our employers also contributed a small amount to our HSA account as well every time we were paid.

We never used the money for health related expenses because we were healthy.

We invested the money instead.

Fast forward to today and we have close to $20,000 in our HSA accounts.

We use some of the cash for some healthcare expenses now, but plan to let the majority of it grow tax free until we are much older.

If you are working part time or on your own and are not covered by your employer’s health plan, you need to buy coverage.

I know that saving your money instead sounds like a good idea, but the truth is, you never know when you might need health coverage.

And with the costs of medical procedures skyrocketing, you need to have coverage.

Otherwise, you will dig yourself a financial hole you can’t ever recover from.

This is why medical debt is the leading cause of bankruptcy.

And be sure to set a reminder to shop around every year so that you are getting the best deal for your money.

One last point about insurance and that is disability insurance.

Everyone talks about the importance of health insurance but disability insurance is just as important to you at this age.

According to the Council For Disability Awareness, someone in their 20s has a 25% chance of becoming disabled before they retire.

And this injury could have a major impact on what jobs you can work and how much money you are able to earn over your lifetime.

The bottom line is, it makes sense to look into having disability insurance.

Too many people think it won’t be them until it is too late to get coverage.

Options And Opportunities In Life

Throughout this post, I’ve talked about how creating a financial plan in your 20s allows you to have more options and opportunities in life.

I wanted to take a few minutes to talk about what I mean by options and opportunities.

Earlier I mentioned how I was laid off and wasn’t stressed because we had a nice nest egg to fall back on.

Additionally, I ended up starting my own business at the time as well.

This opportunity only came about because we did all of the work of making sure we followed these tips to build wealth in our 20s.

If we didn’t get our finances in order, I would have been scrambling to find a job and the stress would have been immeasurable.

Here is another example.

Let’s say you don’t like your work. You are thinking of changing jobs and do something more fulfilling, but it pays less.

If you don’t have your finances in order, you don’t have the option to take the job that will make you happier.

You are stuck in a career you hate.

But if you had worked to build wealth in your 20s, things might be different and you could take that lower paying job and still get by.

Or maybe in 10 years you will find yourself married and have a new child.

You or your spouse may decide that staying home to raise your child is important.

If you didn’t make these financial moves in your 20s, you might not have this option.

You will have to put your child in daycare, which is another added expense.

This is what I am talking about when I say you have more opportunities and options when you get your finances in order.

Simply put, money opens doors and gives you choices.

You can take a lower paying job, survive financially and be happy.

You can take a year off to travel. You can stay home to raise your kids. You can start a business. You can retire early.

- Read now: See how much happiness costs

- Read now: Here are the best things money can’t buy

They are all options when you have your financial house in order.

When your financial house is a mess, none of these are options.

You are stuck and will stay there until you get your finances in order.

I have seen both sides of this.

I’ve seen friends who made it a point to enjoy life today and followed the financial moves to make in their 20s. Today they are enjoying life more than ever.

I have also seen friends ignore this advice and now 20 years later are miserable and are not fun to be around.

They are stuck and can’t seem to get ahead. Every time they try, something else comes up and pushes them back down again.

If you want to live the best life possible, follow these financial moves to make in your 20s.

Critical Financial Moves To Make In Your 20s

Now that we have covered all areas of your finances, let’s talk specifics and put them into an easy to follow list.

I’ll highlight the critical financial moves to make in your 20s so you will be putting yourself into great financial shape and will have many options and opportunities in life.

Here are the most important financial tips for your 20s.

#1. Save 15% Of Your Income

If possible try to save more than this.

But with student loans and possibly credit card debt, this could be tough.

But do your best to save at least 15% of what you earn.

This can be done in a variety of ways, like 10% saved in your 401k plan and 5% in a bank account.

Just don’t get lost in the details. Focus on saving as much as you can.

#2. Keep Living Like You Are In College

I know you want nicer things now that you have a steady income, but the longer you wait to “upgrade” your lifestyle, the more financially set you will be.

This means avoiding car payments, buying designer clothing, going out every night, and more.

So try to keep living like you don’t have a lot of money.

This will make it easier to save at least 15% of your salary.

Just make sure you find a healthy balance between enjoying today and setting yourself up for tomorrow.

#3. Pay Off Your Debt

I can’t stress enough how important it is to get out of debt.

When you owe other people money, it limits your choices.

By getting rid of these obligations, you open more doors for the choices you can make.

#4. Begin Investing Now

When it comes to investing, time is your best friend.

I showed you when you delay saving just 10 years can cost you tens of thousands of dollars.

Don’t make the mistake and think investing $25 a month is pointless.

It will grow in time and you’ll be thankful you invested in your 20s.

#5. Get The Most Out Of Your Career

Step outside of your job description and take on new roles and responsibilities.

Keep note of them all and how the company benefits.

Then present this to your manager in hopes of earning a larger raise.

Also put these on your resume.

Having this information on your resume will help when changing jobs too.

Also, pursue skills that will make you more valuable to employers.

It’s a simple thing to do to help you increase your earnings.

Financial Goals For Your 20s

Now that we have covered how to build wealth in your 20s, let’s talk goals.

By the time you hit your 30s, you should have certain financial aspects nailed down.

Here is a list of financial goals for your 20s that you need to hit before you turn 30.

#1. Emergency Fund With 6 To 9 Months Worth Of Living Expenses

You might think that you don’t need to save this much in an emergency fund, but should an emergency happen, you will be happy that you have this cushion.

The reason is simple.

When an emergency happens, like a broken down car, a lost job, etc. it is stressful.

When you have ample savings, you take away some of the stress.

Think about it.

What is more stressful, having a car that needs $2,500 worth of work and having no money for it, or having a car that needs $2,500 worth of work and having $25,000 in savings?

I’ll take the savings any day of the week.

Where should you keep this money?

Build up an emergency fund to around $10,000.

This will take some time, but is the first step.

I recommend CIT Bank because they offer one of the highest interest rates in the country.

With one of the highest paying interest rates in the U.S. CIT Bank stands out as the best high yield savings account. Add in ease of use and great customer service, and you have a clear winner.

A higher interest rate means your savings grows faster, which allows you to move on to the second part of your emergency fund.

Once your savings is at $10,000 then it is time to start earning some more interest safely.

For this I recommend Worthy Bonds. It is a great way to safely earn 5% interest.

I suggest you put 50% into Worthy Bonds and the other 50% into your savings account.

Looking to safely earn a higher return on your money? Worthy Bonds offers 5% 7% interest on your money. Invest in small businesses and earn a return for doing so. New users get a $10 bonus when purchase your first bond.

#2. Saving 15% Of Your Income

For some reading this, saving 15% of your salary right away might not be possible.

This isn’t the end of the world.

All you have to do is make it a point to get your finances in order so that by the time you hit 30 years old, you are saving 15% of your salary.

For example, let’s say you are only able to save 10%.

Work to increase this by 1% every year and you will be saving 15% by the time you are 30.

Some of you might be interested in having a dollar goal here.

But that isn’t possible for a variety of reasons.

Where you live, how much you make, whether you were in school until 28 or you graduated at 22 all make a big difference.

So aim for saving 15% of your salary.

#3. Zero Credit Card Debt

Paying off your credit cards should be a priority and by the time you are hitting 30 years old, you should have any monthly balance wiped out.

This should be made simpler by creating a payoff plan and paying extra each month and using some of the money you are making through a side gig.

#4. Make Significant Progress On Your Student Loans

As with a savings amount goal, having a number goal for your student loans is tough too.

Again, everyone is in a different place financially.

So your goal should be to have a significant amount of your debt wiped out.

Try for 75% or more.

Remember, the less debt you have, the more options and opportunities you will have.

The way to make this possible is to first refinance your student loans. Again, I recommend Credible.

By refinancing, you lower your interest rate, so more of your monthly payment is going towards your loans and your monthly payment will be lower.

This means you can keep paying the same amount and get out of debt faster.

#5. Investing Extra Money

In addition to your retirement savings, you should have some money in a taxable account.

This would be used for long term goals like buying a house, a car, etc.

The amount you have isn’t as important as having an account and making it a habit to regularly put money into the account each month.

The best option is Betterment.

Even if you can only invest $25 a month, do it. You will thank yourself in 10 years.

You can click here to open your account.

If money is tight or you don’t want to invest $25 a month, go with Acorns.

Here, they will round up your purchases and invest the spare change.

You can click here to open your account and get $5 free!

Don’t make the mistake of putting off investing. Start today with a small amount and increase it in time.

#6. Have A Profitable Side Hustle

Any extra money you can make on the side is going to help you tremendously.

Start off by using the options I listed, like Survey Junkie and Swagbucks for starters.

Then be open to new ideas as well.

Just remember the most important part.

Make sure you enjoy doing it. It will never feel like work and you will want to do it.

#7. Track Your Net Worth

Your net worth is telling you how you are doing financially.

To calculate it, you simply take your assets and subtract your liabilities. The result is how much you are worth.

The goal is to have this number increase on a regular basis. How do you get it to increase?

Pay off debt, save and invest. That’s it.

I like to calculate mine monthly, and you can see how to do so in this step by step guide.

But you can also use Personal Capital as well.

It will calculate your net worth for you and help you lower investment fees and create a retirement plan for you, all for free.

It’s a powerful tool and my wife and I swear by it.

Want to know where your investments stand? Interested in a free financial plan to see if you are on track for retirement? Personal Capital has you covered. It's the best free tool for the average person to analyze their investments.

#8. Have Goals

What do you want your career to look like? How do you see your future playing out?

Don’t look at this as only an exercise to try to figure out what you want to do in retirement.

Look at your entire life.

For example, when I was dating my wife and we were talking about marriage and starting a family, we both made it clear that we wanted to be there for the kids.

- Read now: Are you financially ready for a baby?

We wanted to be able to attend their school events and their extra-curricular activities.

We can’t do this if we are working at jobs until 8pm every night.

So we started to take action so that we would have this option.

Will we be able to attend every event? Probably not. But we will be able to be there for as many as possible.

The point is, take the time and figure out what you want and start making plans for it.

Your plans will change as you grow older and you get married and start a family.

But by making goals now, you will set yourself up for your future years.

#9. Work On Yourself

In addition to having goals, make it a habit to improve yourself every day.

This can be as simple as reading every day or going for a walk.

By making sure you are your best, you can enjoy life more and this opens the door for more possibilities.

Final Thoughts

So there is your outline for how to build wealth in your 20s.

I realize it was a lot of information, so take it one section at a time.

The important thing is that you work your way through it so that by the time you reach your 30s, you are in great financial shape.

And by the time you are reaching your 40s, you are well on your way to becoming rich and becoming a millionaire.

Just remember the key points.

Enjoy today but still work to plan for and save for tomorrow.

The better you can balance this, the more you will enjoy life now and in the future.

And the more you will be able to take advantage of any opportunities that come your way.

Finally, don’t measure financial success by comparing yourself to others.

Define what success means to you and do the work to reach your goals.

- Read now: Learn how to save $100K fast

- Read now: Find out how to build stealth wealth

- Read now: Learn how to balance time vs. money

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Great article Jon….I hope many millennials read this article and follow your advice. It is so important for people in their 20’s to start saving money as soon as get your first job.

Time is a great compounder of wealth. I wished I had read this article when I was in my 20’s. I really didn’t start seriously saving money until my 30’s.

Thanks again,

Alan

This is a great piece. What young people fail to understand is that in their 20’s, they have the time and energy to supplement their income and save for the future before it catches up with them.