THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

The cash envelope budgeting system has helped countless people and families manage their finances and stay out of debt. But trying to follow this system in today’s world is close to impossible. I know because I’ve tried more times than I care to admit!

I initially have high hopes, thinking I’ve found something that works, but ultimately I fail. The main reason for this is the digital world we live in. I rarely, if ever, carry cash with me. I pay for things with one of three credit cards I use based on the rewards and what I am buying. I also sometimes use my debit card.

And when I have cash, like when I go out to dinner with friends, I pay with Qube Money.

It’s a new app whose goal is to take the cash envelope budget and turn it into a digital system that will help you manage your finances easily.

In this post, I’ll share my complete Qube Money review, which includes the good, the bad, and some alternatives to consider.

Qube Money Review

- Features

- Account Fees

- Ease Of Use

- Customer Service

Summary

Qube Money is a new digital cash envelope budget system that helps you make more informed spending decisions. With its use of technology, you can use this budget method in a cashless world. No other budget app offers what Qube Money does. Click here to create your budget!

Table of Contents

My Complete Qube Money Review

What Is Qube Money?

Qube Money has been in the works since 2016. At that time, Ryan Clark founded ProActive Budget, the first version of the Qube digital envelope budgeting method, because he saw many people struggle with budgeting.

As a financial coach, he knew the power of cash envelopes for budgeting and how it can help millions of people.

The app officially went live in 2017, and on the first weekend, the transaction processing partner closed the shop. He quickly scrambled to find another processor, but there were limitations that made the app all it wasn’t meant to be.

So ProActive Budget was shut down, and Shane Walker was brought on board. Through a lot of trial and error, Qube Money was born in 2019.

Today, the app is the only true digital cash envelope budgeting app for consumers.

It combines a bank account with a budgeting system to let you take control of your finances by making informed spending decisions. If you are short on time, here is a quick video that lays out the basics of how Qube Money works.

How Does It Work?

Qube Money works different than the other budgeting apps out there. To start, apply for an account at QubeMoney.com.

You need to meet the following criteria to be approved:

- US residency

- 18 years or above in age

- Social Security Number

When completing the signup process, you will need to provide some personal information, including:

- Full name

- Residential address

- Email address

- Date of birth

- Social Security Number

- Current bank account login information

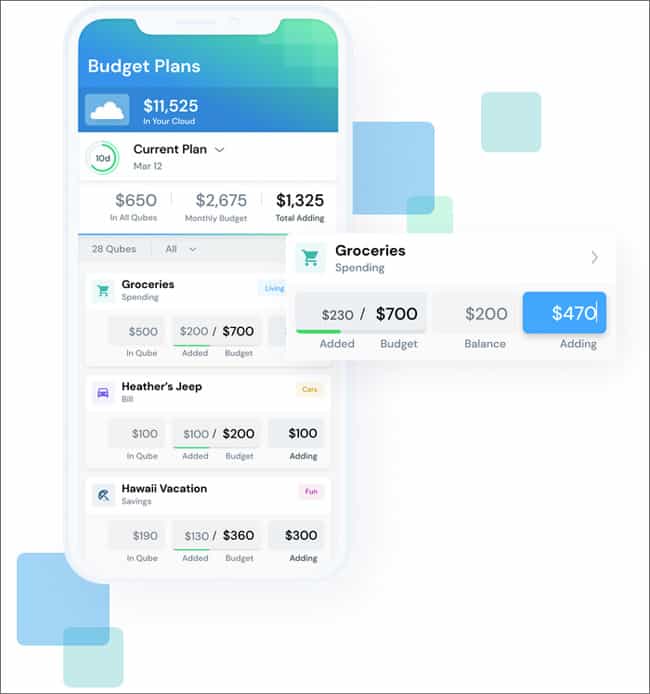

Once you create your account and download the app, you create budget categories called ‘qubes’ (pronounced cubes). These are your digital cash envelopes. After you create your qubes and allocate money into categories, you can start to follow your budget.

To spend your money, you open the app and select the qube you want to spend from.

The app is your cash envelope wallet where you can see how much money you have spent in each qube, how much remains, and move money around.

For example, if you are shopping at a grocery store, you would pick groceries or food qube. Funds are instantly transferred to your Qube card for you to spend.

After the transaction is complete, any remaining money is taken from your debit card and placed back into its qube.

Qube Money helps you see your spending habits and make better choices so you can reach your financial goals.

Features

Qube Money offers several incredible features. Here is a rundown of the best ones.

Account Maintenance Fees: None

Income Tracking: Yes

Expense Tracking: Yes

Bill Pay: Coming Soon

Check Writing: No

ATM Access: Yes

ATM Fees: None

ATM Reimbursement: $10/Month Maximum

Mobile App: iOS and Android

How Much Does It Cost?

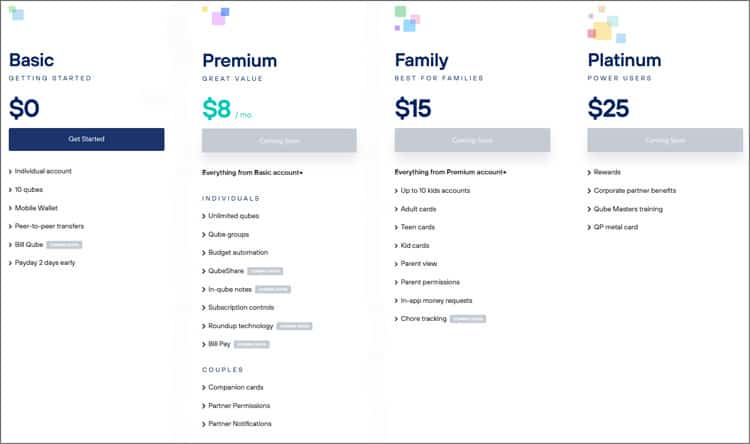

There are a handful of options when it comes to the cost of Qube Money. There are various monthly plans, each with a different price, but overall, prices are very affordable.

The good news is there is a free version that also offers plenty of features. But if you need more features, they offer the Premium, Family, and Platinum plans that offer more features on top of the lower-tier plans.

Check out the image below to see what each tier offers.

Basic Plan

This free plan is a good option if you are unfamiliar with the cash envelope system and want to get your spending under control.

You get ten qubes to set up, a single debit card, and a mobile wallet. However, you cannot automatically transfer money from your linked bank account. This must be done manually.

Premium Plan

This is perfect for people who want complete control over their money.

For starters, you get unlimited qubes, multiple users, and budget automation.

This is also a great option for couples as you each get physical debit cards and are instantly notified when each other spends money. In other words, you will always be in the know when it comes to your budget.

Family Plan

This is a great plan for involving children and teens in the family finances and teaching them about personal finance.

Not only do you get everything in the Premium Plan, but you also get kid debit cards, teen debit cards, parenting permissions, and other tools to help you take control of your money and teach -your kids good money habits.

Platinum Plan

This plan is not yet available. It includes rewards, corporate member benefits, a metal card, and more.

Advantages and Drawbacks

Let’s go over the advantages and disadvantages of Qube Money.

Advantages

Cost: A free version and a few paid plans allow you to pick the perfect option.

Fraud protection: No worrying if you lose your Qube card as there is never any money on it unless you transfer money from your qube for a purchase.

Real-time updates: Get immediate updates on spending activity.

Link current checking account: You can link your bank account to the Qube card. There is no need to switch banks.

Custom allocation: If your pay varies by paycheck, you can set up custom allocations to make having an irregular income easier to budget.

ATM reimbursement: Up to $10 a month in ATMs are covered, saving you money.

Drawbacks

Must use a Qube card: For the system to work, you have to use the provided Qube debit card.

No earning rewards: With Qube Money’s debit card, you won’t earn cash back or other rewards as you do with credit cards or some debit cards.

ATMs: There is no word on how many free ATMs you can make cash withdrawals from.

Alternatives to Qube Money

There are several budgeting apps out there, but only a few envelope budgeting apps. Here are two alternatives to Qube Money that you can consider.

EveryDollar

This cash envelope alternative, EveryDollar, is from Dave Ramsey, who follows his Baby Steps approach to help you get out of debt.

With the free version of the app, you get ten spending categories or envelopes to begin tracking your spending. With the paid version, called EveryDollar Plus, you can sync your bank accounts so the tracking of your spending is automated.

The major difference here is that you don’t get a debit card for spending with either version. So while you can set up a digital envelope budget with this app, you need to do a lot more work to get it to function correctly.

GoodBudget

Formerly known as Easy Envelope Budget Aid, GoodBudget is a basic cash envelope app.

There are two versions, a free and paid version.

The major difference between the two is that with the paid version, you get unlimited envelopes, and you can connect multiple accounts, like a checking account and a credit card account.

With either plan, you have to manually categorize your transactions, as the app doesn’t do it. There is no debit card either, and to make changes to your budget, you have to log onto the website. You currently cannot make edits on the mobile app.

Non-Cash Envelope Budgets

Of course, there are other budget options out there. The most popular is a spreadsheet budget. You’ll have to do some work setting it up and manual upkeep to stay current. This is why people look more toward a budget envelope system.

However, there is another option – Tiller. This is a spreadsheet budget but offers a template to use and automate transactions, saving you loads of time.

At the end of the day, you have to find the budget that works for you, as this is the one you will stick with long term.

Final Thoughts

Technology is great, but some great things we love to use become obsolete as we progress. The cash envelop budget is one of those things.

For a while, many people struggled with a budget because the old way just didn’t work anymore. But with Qube Money, the cash envelope method has been transformed into a modern way to track your spending, helping you save money.

If you are a fan of this type of budgeting, I encourage you to try it out and see just how powerful it is!

Frequently Asked Questions (FAQs)

Here are the most common questions about Qube Money.

- Is Qube Money safe?

For starters, Qube Money uses the latest 2456-bit level encryption that banks use to keep your data safe from hackers from accessing your account. Plus, they use Default Zero Technology for their debit card.

With this, there is never money on the card that can be spent unless you move the money to the card. Any money that is moved over, automatically transfers back to your bank account, so it can’t be used for any reason.

Hence, Qube Money is safe!

- Is my money safe?

Your money is deposited to Choice Financial Group and is FDIC insured, just like at other banks, so it’s safe.

- Is Qube Money free?

Yes and no.

There is a basic free version that allows you to take advantage of the digital cash envelope budget. There are also a few paid versions that you pay monthly to use, so you can find the right plan for your needs.

- Who is Cube Money for?

It is for anyone who is struggling to get ahead financially. Using this version of the cash envelope system gives you greater control over your money. You also make more conscious spending decisions since you get real-time updates as you spend your money. It helps you build healthy money habits over the long term.

- How do I contact its customer service?

The best way to get help or support is to use the built-in chat tool on the website. This is the fastest way to get assistance. Alternatively, you can send an email, and a customer service representative will get back to you.

- What if I lose my debit card?

In the instance of a lost card, you would contact customer service to have a replacement card sent to you. Note that funds cannot be spent on the lost card since there is no money on it.

- Is Qube Money available on iPhone and Android?

Yes, the app is available on both mobile devices.

CLICK HERE TO START USING QUBE MONEY

If you have any questions or concerns, reach out at contact@moneysmartguides.com. Alternatively, you can find MoneySmartGuides on Facebook, Twitter, and Pinterest.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.