THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Are you struggling to survive on $1,000 a month?

Does it feel like the cost of living keeps going up, making it harder to get by?

Many people are in the same situation as you are.

A few years ago, I was too.

Back in 2007 at the height of the housing bubble I bought my first home.

It was one I couldn’t afford but I was approved for the mortgage anyway.

I quickly realized I was in trouble when I added up my monthly mortgage payment, utilities and homeowners association fee.

They totaled close to 90% of my take home pay.

I had a friend who was in need of a place to stay and he agreed to move in and I charged him rent.

But even with him paying rent, I was surviving on peanut butter and jelly sandwiches and putting just enough gas in my car to get me to work.

Add in me ignoring my finances and spending on my credit card, and my financial life was in trouble.

I wasn’t following a monthly budget, I was just spending as l pleased, not caring about the consequences.

My thinking was one day I’ll figure it all out.

But this kind of living led to a lot of stress.

I slowly became a different person, depressed and unmotivated.

My happiness was gone.

One day I decided to make a change.

I started to watch my spending and in the coming months, I slowly dug myself out of debt.

In this post, I share with you the steps you need to take to survive on $1,000 and work towards getting ahead with your finances.

Table of Contents

How To Survive On $1,000 A Month

Trying To Live On $1,000 A Month

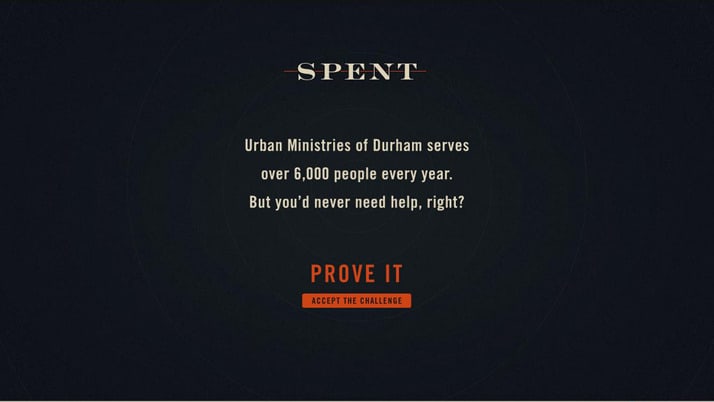

It took me back to the days of thinking through all my purchases, trying to survive on my income.

The premise of the game is that you’ve lost your job and house and are down to your last $1,000.

Can you to get by on $1,000 for a month?

As you play the game, you need to find a job, a place to live, buy food, and deal with everything else life throws at you.

The game only takes 10 minutes to play, so I suggest you try it out.

You can play a few different times as each time the scenarios are different.

Click on the image below to play the game.

When you are finished, you can read my experience below.

How To Live On $1,000 A Month: Lessons Learned

How did I do trying to live on $1,000 a month?

I failed to survive on $1,000.

I ended up running out of money after 12 days.

I thought I was smart about my spending decisions, but life kept throwing me curve balls.

I could have run away from the accident or not answered that collection call.

But I just couldn’t do it. I’m too honest!

The most striking thing that I learned from playing the game is how expensive it is for health insurance.

Many low income earners forgo health insurance because of the cost.

But if any issues come up, they will cost you much more money than if you were paying for health insurance each month.

It sounds simple to buy coverage, and from a strictly personal finance point of view, this is the right thing to do.

But many cannot afford it without forgoing something else.

- Read now: Learn what happens if you bounce a check

There are so many tough choices that you need to make.

For anyone reading this post that is living close to the edge, realize you aren’t alone.

It can feel like this when you see others with the latest gadgets and vacation posts on Facebook.

But the truth is, over 60% of Americans cannot come up with $1,000 in the event of an emergency.

If this describes you, here is my advice for helping you to break from the cycle and start growing your wealth.

I realize it isn’t easy to change your financial situation.

But if you have a plan and stick with it, in time you will begin to see some changes for the positive.

10 Steps To Change Your Financial Situation

#1. See Where Your Money Is Going

You really need to set up a budget so you know where your money is going.

I remember the first time I sat down and made a budget.

My eyes were as big as saucers when I saw just how much money I was spending eating out at restaurants.

As I spent my money, I didn’t think $10 here and there really added up.

But it did.

By knowing just how much I spent eating out, I made some small changes and freed up a little bit of money.

- Read now: Here is how to eat out cheap

Then I tackled the next area.

To get started with a budget, you have a few options.

The one that works for many is a basic spreadsheet budget.

Of course, if you want something automated, my favorite option is Tiller Money.

- Read now: Learn why people love Tiller Money

It’s a spreadsheet budget, but your spending is automatically pulled from your bank account, so all you have to do is update the category.

Thousands swear by it.

You can try it out by clicking the link below.

At the end of the day, it doesn’t matter which budget you choose, just the one that works for you.

Record your spending for a month so you can see exactly where your money is going.

As with my eating out, those little purchases can make a big difference.

Now I know even though a budget is important, some of you still aren’t interested in taking this first step.

The problem with this is that you will never really change your situation if you don’t understand where your money is going.

You will wake up 5, 10, or 20 years from now in the same or worse financial shape.

You don’t want that and I don’t want that for you.

So here is my compromise.

If you really aren’t interested in following a budget, try this out.

Practice patience.

When there is something you want to buy, don’t buy it unless you need it to survive.

Otherwise put it back and wait a few days.

Chances are you will have forgotten about it or have realized you don’t want it any more.

Congratulations, you just saved yourself from wasted spending!

If you want to take this idea one step further, take some time to figure out what you value and what makes you happy.

Then spend your money on these things.

When I did this, it was revolutionary.

Before I did this I was buying new cars and other stuff.

I thought these things were making me happy, but they weren’t.

They were my way of trying to show off or fit in with others.

Once I figured out what I valued, I stopped buying stuff and found I had a lot more money left over at the end of the month.

- Read now: Learn how to live a life of wealth

And I didn’t miss these things.

In fact, I was happier because I was spending my money on the things that I really did enjoy.

#2. Have A Place To Call Home

Having decent shelter when you are trying to live on very little income isn’t easy.

Your first step should be to apply to your County Metropolitan Housing Association for help finding housing.

Just know that the process usually takes 6 – 12 months before you are offered a residence.

However, if you are willing to live in a non-desirable part of town, you might be able to find shelter sooner.

Going with this option, your rent is based on 30% of your income.

So if you have no income, then you have no rent.

If you earn $750 a month, your rent is $250 a month.

Plus you will have no basic utilities to pay.

Note that cable and internet are not considered a basic utility.

Another idea is to lower your housing costs by moving into a one bedroom apartment.

This doesn’t sound ideal, but it is a better option than finding a stranger for a roommate.

And don’t get me started on the bad financial possibilities with that.

While trying to live in a smaller apartment isn’t ideal, the less money you have to pay on housing costs makes a big difference.

Finally, you can consider moving back in with family members.

Again, this isn’t ideal.

But you have to make short term sacrifices to get back on your feet financially.

The more you can sacrifice now, the sooner you can start living a better life.

#3. Find Areas Where You Can Cut Back On Expenses

Once you see where your money is going, it is time to try to find ways to cut back.

Some options include buying alternatives, like store brands over name brands.

- Read now: Click here to learn how to easily cut your monthly bills

- Read now: Find out how to spend less on groceries

You can also limit your spending.

You can live off of Ramen noodles for a while.

Buy non-perishables like canned vegetables that will last. Take advantage of food stamps.

Can you lower your transportation costs?

If you have access to public transportation, buying passes to ride will be cheaper than making a monthly car payment, paying for car insurance, gas and maintenance.

Also, make note of any charitable organizations in your area.

Talk with them to learn where the food pantries are located or what organizations can help you with other expenses you have.

When it comes to clothing, all you need are the basics.

You don’t need a lot as your money is more important spent on food and shelter.

For buying clothes you do need, your first stop should be thrift stores.

There you can get good quality clothes for very little money.

It may not be glamorous, but don’t worry what others think and be proud of who you are and where you are going.

As I mentioned earlier, when I was struggling to get by, I was eating peanut butter and jelly sandwiches for lunch every day for months and even for dinner too.

#4. Cancel Unused Expenses

Do you still have a gym membership that you never use?

Maybe get magazines in the mail you never read?

You can save money by ending these subscriptions.

And thanks to Trim, it gets done for you!

Trim will review your expenses and find bills that you can cancel.

They will also scan your bills, including your cable and internet bills and work with you to get a better price than what you are paying.

In fact, they save the average user $30 a month on their cable bill.

It’s a great way to get a quick review of your expenses.

You can learn more by clicking the image below.

#5. Take A Look At Your Big Expenses

This includes your mortgage and student loans.

Can you refinance your student loans to save money?

Maybe refinance your mortgage as well?

What about lowering your insurance premium?

Lowering these large expenses can have a dramatic impact on your monthly cash flow.

They will give you some breathing room because you will free up a few hundred dollars each month right away.

For example, let’s look at auto insurance.

While you can call your insurance agent and try to get your premium lowered, there is a better option.

It’s called Gabi.

When you use Gabi, they will compare your policy to 40 other insurance providers and show you the ones that will save you the most money.

- Read now: Click here to learn more about Gabi

You then pick the provider you want and save money.

The average Gabi user saves $960 a year!

Click the link below to see how much money you will save.

Another possible option is to challenge your property tax assessment.

If you are paying a lot more in property tax on a similar size house compared to your neighbors, you can save a good chunk of money.

And don’t forget about health insurance.

This is a big expense as well.

If you aren’t covered by health insurance at work, be sure to shop around for coverage to try to save the most money.

Even then, because of the high cost of health insurance, you might be tempted to pass on coverage.

This isn’t ideal as you never know when you may need it.

In fact, you might be able to look into and get Medicare.

If you are eligible, your health insurance expenses will be drastically lower.

#6. Make Saving A Priority

When it comes to saving money, make sure you save first.

Too many times people spend first and save what is left over.

It doesn’t take a genius to see that if you are spending all the money you earn you won’t be able to save what is left.

Instead, make it a point to save when you get paid.

- Read now: Learn the benefits of saving money

You don’t have to save a lot of money, just save something to start building an emergency fund and improve your finances.

How can you save money when money is tight? Here are a few options.

- Inquire at work. Many times your employer will let you split your direct deposit between banks. If your employer allows this, have the majority of your paycheck deposited into your checking account and have a smaller amount transferred into your savings account.

- Set up automatic transfers. Log on to your bank account and create an ongoing transfer. Make it occur once a month for $10. Then the money will be saved without you doing anything.

Where should you save your money?

My favorite is CIT Bank.

They offer an online savings account that usually has one of the highest yields in the country.

- Read now: Click here to learn why I love CIT Bank

By having a high interest rate, your savings will grow faster.

To open your free savings account, click the link below.

By making saving money a habit, it will be easier to increase the amount you save down the road as your income increases.

#7. Find A Second Source Of Income

You don’t need to work a low paying job here.

With the internet, you can turn just about any skill, hobby or talent into a side hustle.

You can easily earn anywhere from an extra $100 to $1,000 or more per month.

- Read now: Learn how much $15 dollars an hour is annually

- Read now: Find out how much $10 an hour is annually

It is up to you how much effort you want to put into it.

Just remember, the more effort you do put into it, the more money you can potentially make.

Think for a minute what that extra income would mean to you.

Would it allow you start saving money? Maybe help you pay off debt?

The bottom line is, the more income you have coming in, the easier it will be to make ends meet.

Here are just a few ideas to get you started.

One popular side hustle is taking online surveys.

You get paid a few dollars to offer your opinion on things.

If you do it right, you could make an extra $100 or more a month.

The best survey site to try is Survey Junkie.

They are legit and pay a competitive rate per survey.

You can click the link below to get started.

Another option to try out is Swagbucks.

This is site is my favorite because you can do other things to earn money in addition to surveys.

- Read now: Click here to learn more about Swagbucks

For example, you can play games, watch videos and earn cash back for shopping online.

When you click the link below to sign up, you will get a $10 bonus.

These are just a few ideas to get you thinking.

I encourage you to read the posts below to learn more great ways to make extra money on the side.

- Read now: Find over 50 ideas to start making money today

- Read now: Learn 17 ways to make $1,000 fast

#8. Be Smart When Spending Money

Advertisers trick us into spending money.

They get us emotionally connected to a product so we think we need it.

Then a few days later, we realize we didn’t need it and suffer from buyer’s remorse.

Luckily to beat advertisers at their game, we have a trick we can use.

I call it the pause test.

All you have to do is wait before you buy something.

For example, when you see something you want, wait a few days before you buy it.

In many cases, you will forget about the item or realize you don’t really want it.

When this happens, congratulate yourself as you just saved yourself some money.

While this works for things you don’t need, what about things you do need?

Here are a couple tips to help you save money.

- Ask for a discount. You’ll be amazed at how many times this works. Simply ask if there are any coupons or discounts that can be applied to your purchase. You can even ask if there is a discount for paying with cash.

- Find coupon codes online. Before you buy, look for a discount online by searching for the company and the word ‘coupon’.

- Use cash back websites. You can get up to 25% cash back on your purchases when you shop through Rakuten. As a bonus, new members get a free $10 gift card just for joining.

By taking 5 minutes to be a smarter shopper, you can easily save yourself a lot money.

#9. Start Investing

Putting money into a savings account is great and is critical for covering you in case of an emergency.

But eventually you are going to have to start investing money into the stock market.

I know some of you might be scared to invest, but investing isn’t complicated.

The hardest part of it is keeping your emotions out of your investment decisions.

To be successful as an investor, you buy low cost investments and add money on a regular basis.

The only catch is you don’t sell, even if the market is tanking.

Most investors will sell, because they allow emotions to make their decisions for them.

You need to overcome this fear and keep investing.

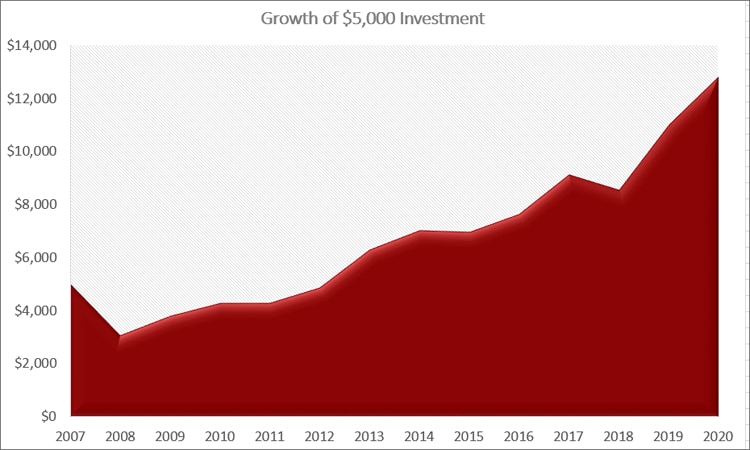

Look back to the last crash in 2008.

Most investors fled after losing a lot of money and stayed out of the market for years.

But if you stayed invested through the end of 2019, you would have made all your losses back and then more than tripled your money.

Even in 2020 when the market crashed, it came roaring back.

For example, let’s say you invested $5,000 in the stock market at the start of 2008.

That year the market was down 38% and you would have been left with just $3,075.

But if you stayed invested, you would have made your money back by 2013.

And by the end of 2020, you would have close to $13,000.

The key is to stay invested!

The best option for people on a tight budget to start investing is Acorns.

The reason I suggest this broker is because of their round up feature.

You can invest a set amount each month, as little as $5.

Or you can skip this option and just invest your spare change.

In this case, when you buy something, your purchase will get rounded up to the next dollar and that amount will get invested for you.

So if you buy groceries for $35.18, Acorns will take $0.82 from your linked bank account and invest it for you.

Now before you think saving your spare change won’t add up, understand this.

When I did this, I had over $750 in a year from round ups alone.

A few other readers told me they had close to $1,000 from round ups as well.

Don’t dismiss this idea thinking a few cents here and there won’t add up.

It does.

You can get started with Acorns and get $5 in the process when click the link below.

#10.Stay Positive

Everyone experiences setbacks in life.

Learn to not get down when a setback happens and instead grow and become a better person from it.

Check out the video below for some perspective and realize that no matter what setback you might be experiencing you still have it better than most.

Work on improving your outlook so you see the positive in every situation.

It isn’t easy and you will never be perfect.

But you will be happier and uncover more opportunities in life when you do this.

Final Thoughts

Living on $1,000 a month is not easy and your quality of life isn’t going to be ideal.

But if you are in this situation, you don’t have to settle and accept it.

There are things you can do to change your circumstances.

You just have to be willing to put in the effort.

If you can take steps to better your situation, you will begin to see changes.

Use those achievements as motivation to keep pushing through and reaching your goals.

If you make no changes, your current life with the stress and unhappiness will be your life forever.

And without making a change, the stress and unhappiness will grow along with your debt.

Make the sacrifice and better your life.

For me, I made the sacrifices.

I made it a point to put $10 away each month in a savings account with CIT Bank.

I shopped for store brand groceries. I found the grocery store that offered the lowest prices in my area.

I didn’t buy new clothes for a few years and went without the latest smartphone.

Other things I did included:

- I stopped using my dryer and put my washed clothes on a drying rack.

- I plugged all my electronics into a power strip and when I left for work, I would unplug that to save electricity.

- I replaced my light bulbs with higher efficiency LED bulbs to use less energy.

- I shopped cell phone plans to find a cheaper option.

- I took money I received from tax returns, my birthday and Christmas and used that to pay down my credit cards. Once the debt was gone, used that money to build up my emergency fund.

- I found things around the house of value that I didn’t use and sold them on eBay and Craigslist.

I also worked hard at my job and earned a few raises as the economy turned around a few years later.

It all paid off.

Shortly after getting my second raise, my friend moved out to live with his girlfriend.

I was now on the hook for everything.

Luckily, I was able to afford to live on my own through all the sacrifices I made.

Money was still tight, but I was saving money each month and paid off my debt.

This allowed me to keep improving my financial situation and get to a point where money was no longer a stress in my life.

Those lessons I learned during that difficult time served me well.

I became a smarter consumer and a great saver.

It allowed me to leave my employer in 2013 to work for myself.

You can overcome this.

It will be hard and it will take time.

But you will come out the other side stronger and more confident.

This will pay off in more ways than just financially in the future.

And remember, the sacrifices you make today are not permanent.

Sacrifice a little now and be better off for many years to come.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Thinking back to college, one of the best ways I saved money was by having roommates. It’s amazing how cheap living in a 3 or 4 bedroom apartment with roommates can be. This may not be an option for most people, but for someone who owns a house they could rent out a room (or two) to try and save money there. Great advice!

@Court @ The Path to Financial Freedom: I shared an apartment in college too. It was nice to only pay half. Then when I bought my house, I had my friend move in with me and he paid me rent each month. Again, it was nice to split the costs with someone else.

Bad things happening around us, staying positive is hard to do, but once we get to know how to do so, it really helps us survive and reach our goals more easily. Staying positive lets us find more hustles, save money more, and do a lot of things. That is what staying positive can do to us, endless possibilities!

@Jayson @ Monster Piggy Bank: It builds confidence and when you grow your confidence, you try new things more and more. This leads to more opportunities and areas for growth which just builds more confidence.

There’s a variety of online tools to help you cut back. One calculator illustrates the big impact of cutting back on ‘little things’ https://www.yourmoneypage.com/family/fam_lbb3.php

@Mark: Thanks for sharing Mark!

With a family of six I see no way we could live on 1k per month. Based on our monthly budget we are spending about that much per week.

@Brian @ Luke1428: I can imagine as the size of a family grows, so does the need for monthly income. It really makes you think about those less fortunate and how they manage to get through life.

We r a family of 5 and survive off of $1200 a month without any government assistance. It’s very hard but it is possible

I have had hard times over the years I don’t think that the game offers enough choices.

how did you do it. what did you do specifically?

A pretty tough game. It was clear I wasn’t doing well until it crashed on Day 9.

I guess the difference is that in real life our choices aren’t as black and white. For instance, my day spent in court got me a “job strike”, but in reality I would have informed my employer and worked up my hours at other times, etc…

In my current budget over the past 12 months, my expenses have averaged £860 per month, which is the equivalent of $1,344 at today’s exchange rate.

If I absolutely had to reduce that down to $1,000 a month, I think I probably could, but I certainly wouldn’t want to!!

Also, its so low as we have almost paid off the mortgage and hence housing is very low, etc etc…

@moneystepper: Yeah, there are some things that aren’t as black and white in real life, but it does gives you a glimpse into how tough it really is to make it when you have little coming in.

A person will make different choices when they’re actually in a situation where they HAVE to stay within a certain amount of money. I remember once in college when I had a bunch of unexpected expenses and only had $12 to buy food for the week. It wasn’t a great feast of food, but I made it!

@brock @cleverdude: Peanut butter and jelly or Ramen noodles?

I can already tell I’d really fail at this game. A few months ago I was shocked to read MMM’s strategy about living off of $2K per month and I still couldn’t even get my expenses that low. Good tips towards the end. I’m sure anyone who truly lives off of $1K per month knows how to make that dollar stretch.

@MyMoneyDesign: You’re right. I’m sure there are some people out there that know some tricks that save money that most of us don’t know or simply overlook.

I’ll have to check out that post on MMM.

Its simply a process of evaluating NEED vs WANT and truly knowing the difference.

We couldn’t pay our mortgage for $1000 a month, but I guess that’s part of the game, finding cheap housing. I will try the game later today, but I imagine I would try to make choices that aren’t available, like staying with a friend or going to the food bank. I think it’s possible to live on $1000 a month, but not if you are in debt and paycheck to paycheck. Having no savings would wipe you out after one wrong turn.

@Kim@Eyesonthedollar: Yeah, you certainly don’t have all of the choices you would have in real life, but the game does make you think and forces you to make some tough choices.

I can see how it would be really tight with kids, but I made it thru on $640.

@jim: Way to go Jim!!

Interesting game. Like Brian though, with a family of five we’d be hard pressed to live on $1,000 per month or less. Our mortgage would take us out of the equation right off the bat. 🙂 That said, we live pretty frugally otherwise.

@John @ Wise Dollar: I can imagine it would be tough. Good to hear though that you are living frugally as best you can!

I ended up with $602 at the end of the month. Maybe because I’ve actually been there, done that. No gifts for co-workers, no lottery tickets, no after school activities that cost me money, the cheapest food options, etc. I also opted out for health insurance in the game

I have a millionaire friend who looks like and dresses like a bum. He had a mild heart attack and his doctor immediately referred him to the emergency room of the local hospital. The first thing he told the ER when he walked in was “I may be having a heart attack but I don’t have health insurance.” They told him that it was no problem and admitted him right away, where he stayed overnight. When he got the bill, it was around $20,000, but it said that the bottom that it was discounted to about $2,000 for the non-insured rate. He even had the option to pay it over time. So if a millionaire can get by without health insurance, why should I have to pay for it if I’m only making $1,000 a month?

@Fred: Interesting story about the health insurance. When I worked for a financial planner, our clients were mostly people you would never think were millionaires. They dressed like most everyone else and drove the older cars too.

Living off this much money per month would definitely be easier if you started off at a lower amount living with your parents and then worked your way up. You’d be much more used to living with the minimum, instead of going from a high paying job, down to $1000 per month.

Love the post Jon, thanks!

@Dan Western: Definitely easier to live like this when you are already on a tight budget than if you are making a ton and have to suddenly cut back.

Damn, lost on Day #9 too. Hit a parked car and didn’t want to drive away and not pay up! Makes you really think about your actions if this was all for real… Easy for me to say I’d be the good guy when I have food and shelter and a decent bank account, but if literally had nothing?? Comes down to survival 🙁

@J. Money: But in real life, if you hit someone in the FrankenCaddy, you would have opened up the mail to see a check for $20K haha!!

The biggest trick would be housing, especially in NYC. You’d need several roommates to get your housing costs below $500, though that is what I paid for my old apartment in Jersey.

@Stefanie @ The Broke and Beautiful Life: So true. When I was in accounting, I became friends with the one guy who was the auditor at one of the big 4 firms in NYC. He said he was sharing an apartment with 2 other guys and they were each paying over $1,500 a month!

Well, made it to day 24 without doing anything too stupid but the game definitely throws some curve balls. I wish I could have rid myself of the car…

It makes me think of the insights I read in the book Scarcity. It addresses how differently someone in a state of scarcity (money, time, love) behaves compared to someone who does not have these stresses.

Thanks for exposing me to this game. It was eye-opening. I felt cornered many times before my ultimate demise. Lucky for me, it was just a game.

@Free to Pursue: I’ll have to check out the book, sounds interesting!

Wow, after reading the comments I must be a pro to have survived until the end! Of course I lost my job after I lost my car due to not having the money to get it out of impound after I tried to skate by a few days without paying my registration; so I don’t know how I’d be able to do the next month in real life. Harsh game, just harsh.

I was happy to find that I didn’t bat an eye at many of the cheaper options. Tell the kid he has to eat the free lunch at school or starve instead of trying to appear non-poor, done. Yard sale instead of pay to store stuff, of course! Stock up on beans at the grocery store, you bet! I do all those things now and we have plenty! (Besides the free lunch. We don’t qualify but I do insist on packing lunches everyday instead of paying for the hot lunch. And the kids understand and are cool with it.)

In fact, I am in the middle of writing a post right now (stopped to read others’ blogs to get through a small block) about how hard it is to have charity offered to you when you are probably richer than the person offering it. So yes, I appear poor. But RICH (in many things) I am. : )

I was down to $11 at the end of the month,..had to get momma the medicine. In reality though, thru much prayer, since I had to sell my truck (becuz of hard times) four years ago, I have been able to get by without a car living in NYC. When I want to go see my kids (who are now grown, and my son has a car in CT) i take greyhound. i am able to see a few movies now and then, get some wine, to celebrate life. I have regular tv…but INTERNET is a must. so, for now, i can live without cable tv.

Interesting game. I did indeed fail the first time but made it to $67 in my pocket by the 3rd time.

Really in requires a lot of no’s to your kids and yourself. No you can’t have ice cream, no you can’t go on the field trip no I can’t go to the wedding. But yes to endless pb sandwiches and yes to hand me down coats. But really isn’t that what you should be doing.

Like everyone said some of it was really stringent and you couldn’t do some stuff that would make more sense.

The ones that really get you are the survival ones as jmoney said.

And lastly it highlighted to me the importance of education. Like being able to help your kid with how instead of outsourcing.

@The Roamer: Definitely makes you think about things. Even though real life isn’t as stringent, it still makes you think about what really is important in life when trying to make ends meet.

I made it to the end of the month with $8 left, but my car had been repossessed and I lost my job, so I wouldn’t have made it through the 2nd month.

@Cassie: Luckily it’s only a game. But you still did better than most of us!

There’s no way I could get a rental for less than $1,000 a month. Even with roommates, it’d be pretty tough in Los Angeles. When I was young (many years ago), I squeaked by on $1,200 a month, but that was when my rent was under $400 with roommates and rent was a lot cheaper!

@Little House: It’s crazy how vastly different the cost of living is depending on where you are in the US.

At age 2o, I lived on way less then $1000 a month. My rent for a furnish apartment which included utilities was $110. I earned part time earnings of $120 a month. I was on food stamps and only had $10 a month for everything else. I walked everywhere, used some of the money for taxi fare once a month to buy groceries. No insurance. So living on $1000 is probably comparable to what I did then.

I worked hard and was able to retire at age 50. But I NEVER forgot the hard life I had back then.

When I was young, many years ago, I earned $700 per month. My rent was 65, I walked everywhere, bought fresh cheap veggies on the market, made my own sandwiches with the cheapest meats, paid $30 hydro per month, had no phone (phone at work though) and cold shower only. I paid $50 for public transport, Washed my clothing in the sink and had few but nice and quality clothing. Made sure, most entertainment choices were free (hiking, public events). After one year I had saved $2000 and I went to Brazil for 6 weeks. I never lacked anything or felt poor. My secret is: make things instead of buying, when you buy, get only what you need by the end of the year and shop for the best price. Go for quality vs quantity, look after your possessions, go shopping only when you truly need something and dont shop for entertainment. I now make.$1800 after tax, have a house, a car and go overseas once a year, and consider semi retirement with 55. I have no kids, but a dog and 2 cats, and btw I tithe and donate to charities.

This is very interesting and it’s getting harder and harder to make these tips work, but the savings potential could be amazing if you could.

I just finished a book called “Build Wealth and Spend It All” by author Dr. Stanley Riggs. I want to recommend this book as I finished it truly feeling like I have learned invaluable lessons about the future of my families finances. Most people are so hung up on retirement and how much money they will end up with, they don’t take stock of what to do with it along the way. Dr. Riggs offers very down to earth advice and planning for the everyday person to not “get rich quick” but instead to build wealth…which is much more valuable in the long run.

Hope it helps someone else as it has helped me. http://buildwealthandspenditall.com

A few things not mentioned are:

Always paying your bills on time, paying more on a credit card that what is scheduled or pay off completely before due. At one point in my life I had to use an expensive cash advance to on a credit card to pay my rent when I had no income (waiting for unemployment to kick in) or I could have become homeless; most major apartment complexes start and eviction process after you are late only 21 days, depending on where you live.

If you can’t afford where you live, be willing to downsize an compromise, but find the best you can for what you can afford. After my divorce, I moved into a one bedroom apartment with my 1 year old son and slept on the couch for 7 years and let him have the bedroom until I earned enough to afford a two bedroom.

I have now since heard that renting or by a trailer and park it in a trailer park might have been cheaper as trailers depreciate in value considerably ; might be something to check into.

When I was unemployed and actually had to live on much less than 1,000 a month, I found you need to find free and cheap ways to entertain yourself. Your local free public library is a Godsend during tough times. You can check out book, videos and educational materials and sometimes they have free story time or interesting workshops for kids for free or a very small fee. I also found our local Family Video (which is a national chain) offered kids and educational videos for free with a membership for a few days.

Our treat was Fazoli’s fast food restaurant kid’s night, where with one adult entree kids get their meals for .99cents and there is a free craft or activity. Even if you don’t have this restaurant near you, many times there are restaurants that offer cheap or free meals with an adult entree purchase; you just have to go looking for them.

This is a really great article.

Check out a relatable article of how a single parent can save $1,000 including a free tool to do so: http://ow.ly/FCq06

I love that you listed “stay positive” so important!

Making retirement savings a priority is key. Being active in learning about different parts of your portfolio and keeping that portfolio diversified is helping me to get closer to financial freedom and security. I recently decided I needed to gain more knowledge regarding my annuity strategies. I found a great book called ‘The Annuity Stanifesto’, by Stan Haithcock. It really motivated me to research my options, and I even was able to reach out to the author himself on his website (www.stantheannuityman.com). Hopefully I’ll be able to enlist his help in the near future. I can’t recommend this book enough.

You made it through the month with $338

(But rent’s due tomorrow)

I did not play any game, but having $1000 to live on each month would be a real luxury for me. I live on much less than that1

I made it easily to 30 days with $683 in the bank but with not quite enough for the next month’s rent – $120 shy. My comments on the game – there are not enough choices. Choices for housing should include couch surfing, roommates, or sleeping in Mom/Dad’s house. Should also include options for a cheaper phone, selling the car and walking or using public transport. Food should include options for SNAP or food pantries. Or how about buying shoes/coats at Goodwill/Salvation Army/thrift shops ? And as a prior person mentioned, I’d have negotiated with my boss for court time off and made up the time another day. The most important thing to understand is that the choices a person makes are the ones that will either get them by or cause them grief.

For me this game was all too familiar. I made it through the month with $167 but I think some of the questions dont factor in $ saving tips. I know how to cook to make food last my family a longer time and they didnt factor in public transportation options. Iunderstand the idea behind the game but for those of us living on $1000 a month, we have to be creative

I made it through the month with $233.00 left but now the rent is due. It is really a thought provoking game that forces you to make hard decisions about your own integrity (leaving someone’s car damaged) and your personal survival. Really hard choices when survival is at stake….

Hi Jon,

Another way that can help someone stick to tight budget is by learning about how much other people like them are actually saving.

It turns out that when it comes to saving money, a concept like “keeping up with the Joneses” is equally as powerful as it is for spending money.

People are more likely to ditch a few channels on their cable TV or ditch cable altogether if they learn that their neighbors are doing it too. Companies like Nest (smart thermostat) and Opower (energy savings) are using this approach and having great success helping people lower their consumption. aboutLife is using this approach to help people cut down their monthly budget.

Check out our website to learn how people like you are spending and saving money: https://aboutlife.com.

You might be surprised to find out which areas you are spending more or less compare to other people like you who live in the same neighborhood. 🙂

I made it through with $448 left, but I don’t have any kids and I don’t use credit cards. Still, it was an interesting game.

Thank you for sharing this challenge with others. I have been in this situation in the past and still have a small budget. Optimism and ingenuity are key to making it into an amazing life lesson instead of a crisis. Remember this challenge when you view others who are in the same situation – giving is never a mistake.

I love that you listed “stay positive” so important!

Making retirement savings a priority is key. Being active in learning about different parts of your portfolio and keeping that portfolio diversified is helping me to get closer to financial freedom and security. I recently decided I needed to gain more knowledge regarding my annuity strategies. I found a great book called ‘The Annuity Stanifesto’, by Stan Haithcock.

My real life is “Spent”! I’m trying to live off Soc. Security which is less than $1000 monthly! My credit is in the toilet and I can’t get a job since I’m 65 and cannot sit or stand too long. So although “Spent” is a game to you, try it on a daily basis!!!!

I live on $918. Cash and $132. Food stamps and occasional visits to the food bank. My biggest concern each month is how do I afford to feed my dog. She is a big girl and has to eat a quality food. I am also gluten free due to food allergies. It has taken me a year to learn how to make ends meet on the money I receive. I’m finally able to have a bit left at the end of the month to start an emergency savings envelope. loosing half of my income due to an injury was hard to adjust to but it can be done.

For feeding your dog, my dog now eats food I cook her myself, cooked brown rice and boiled chicken thighs. I shred the meat and mix it up with the rice. She is 60 lbs and gets one bowl a day and is looking good. I put her thyroid pill on top, and then you could add her vitamins in there too. This is cheaper than buying dog food for me. Now, I am certainly not a vet, but my vet knows about it and has not said anything contrary. Occasional use at least might help you stretch your dog food budget .

Made it to the end with $297.

I live paycheck to paycheck already. It isn’t easy but we make it through.

If you can’t win this game uou have obviously never been poor…. I “won” it twice to make sure it was just chance using my secret power: “sucking it up”

So I ended up having $268 at the end of the month. Wish it was really like that for us. I have lived paycheck to paycheck for 15 years. It really is a good reality check for people who think $4000 a month isn’t enough. I rarely have gas the end of the month.

Been here did this..Played the Spent game and only spent 689. I did loose my job at the end ..but I made it through…just like I did when my three kids where depending on me when they where young. It takes its toll..and guess what? Now I get to figure out how to live on 975 a mo t….I live with my friend from high school….I don’t get food stamps yet bit have in the past two years. I get a medical assistance plan fornbasic health care and the Conway is 10 bucks…hospital 30. I did have a part time job but it was so stressful I had to quit. So now I need to look for another one. Problem is all my teeth are bad and I can’t ignore it so through the medical plan I am getting dentures..have to have all my top teeth out.so.

Mean while my ex ..who never paid child support…make 6 figures and had just divorced wife #5..and lives a great life…..sometimes life is not fair..In the last 3 years I have had 2 major health issues and went to Hospital…I did not pay the bill..I could not…affordable health and medical care is NEEDED! Don’t make enough o qualify for Obama care.so you see….it goes on

I can spend less than $1000 a month by just lowering my expenses and trying to manipulate my budget. It’s really about lifestyle and forgetting some habits sometimes.

I have no car, I work for the cable company so that’s free, I shop at the discount grocery. But my rent is $1150 a month. I lose.

I lived in the Philippines $1,000 a month. I got massages haircuts dined at nice restaurants got manicures traveled.

I am 77 years old and I live on 1000.00 a month, that is what I receive from Social Secirity. My husband was ill for 9 years and depleted our savings. It can be done, if you are frugal. Thankfully my children give me money for my birthday and christmas , I pay insurance with that..

I live on 827.00 a month. If I didn’t live in subsidised housing, I would still be homeless. My doctor renedered me disabled in in 2003. You can make it but I thank my Heavenly Father for everything I have and if I got a 1000 a month I would be so grateful to him.

This was amazing! I survived the month with the game with 800 left over. But that’s just because I’m used to scrimping by so much. Great advice in this!

No way my wife and I could live off $1000/month. At least not where we live now. Just HOA fees, property taxes, insurance and utilities would push us up that high! And we gotta eat! 🙂

Made it to the end off the month with $760. Having just graduated college and about to start my first adult job, I’m very accustomed to thinking about this kind of budget.

Made it to the end of the month with $107 dollars left, though the game did remind me that I had to pay rent soon. Sent kid to field trip, paid for parent’s medicine and went to grandparent’s funeral – these were the three choices I could save money on but would have made in real life anyway no matter what the situation. The character has broken the vase at the store and have chosen to hide it, which was… ok, not good, but tough times. Also, got two strikes at work. Otherwise – yes, not being too prideful, accepting hand-me-downs and shopping at thrift stores helps a lot. As well as denying yourself lots of life’s pleasures. But – where are the choices of getting a roommate? Shopping for an apartment near the bus line, so that you don’t actually NEED a car? Giving the pet away to a loving family if you feel that you won’t be able to provide for it? Getting the cheapest phone plan with limited texts and minutes? I AM one of these people living on <$1000/month, yes, it means making lots of sacrifices, but it also means getting very creative and relying on making friends – in your community, with your roommates, et.c. Moving to smaller towns in rural area also brings down the cost of living – a lot!

I lived off of $1200 a month for 15 months. I had a very strict budget. I paid rent for a small studio apartment in a not so good area $700. Paid for internet $40, Netflix $8, Hulu $8. My car insurance was $20 (I paid my car off before i quit my previous job). Electricity was about $100, I did not have to pay for water because the apartments were old and did not have water gauges. The rest was spent on food and gas and occasionally I would be able to go out. It was very manageable to me at the time,