THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Do you want to save money but find that doing it is boring?

Wish there was a way that excited you to save so you can reach your financial goals?

The good news is there is a way.

It is called a money savings challenge.

These are games you play to make saving money for your financial goals fun and exciting.

You can plan alone or with your family.

You can even play with friends to see who can save the most.

In this post, I share 49 various money saving challenges for you to play.

You don’t have to play all of them. Just pick the ones that interest you the most and get started.

By the end of the year, you will have created a habit of saving and will be excited to see just how much you have saved.

And in many cases, you can save $1,000 or more using these ideas!

Table of Contents

The Ultimate Guide To Money Saving Challenges

What Is A Money Saving Challenge?

A money saving challenge is a fun way to help you save money for a vacation, a new house, or anything else you want to buy.

It can also help you review how you spend money and stop wasteful spending habits.

By making it enjoyable to save money, you are more likely to follow through on it and reach your goal.

- Read now: Discover the best things to save up for

I’m confident you will find a challenge I list that you can get behind and be excited to complete.

Why Do A Money Savings Challenge?

Saving money isn’t glamorous.

For many people, it’s not even something they think about.

As a result, it gets pushed off to some other time.

Sadly that other time never happens.

But what happens is they lose their job, the roof leaks, the oven breaks, or they want to vacation.

Now they need cash and don’t have any savings.

The result is going into debt to pay for these things, which worsens their financial situation.

By completing a money saving challenge, you make it fun and exciting to build your savings.

And by being fun, it makes it easier to change your habits.

If you were to try cutting out buying coffee, you might succeed for a few days but eventually will revert to your old habits.

But having savings goals that have a purpose, like skipping coffee so you can have cash for a vacation, increases the likelihood of sticking with it long term.

In other words, saving money relieves some stress you might experience when you need money for something but don’t have anything saved.

Because of this, I encourage you to take part in some of the ideas I list so you can improve your financial situation and have cash for the things you want in life.

49 Money Saving Challenges To Try

#1. 52 Week Money Challenge

The 52 week savings challenge is the classic savings challenge that many savers start with.

The reason is that it is so simple to follow.

It works by having you save the amount that equals the week of the year we are in.

There are 52 weeks in a year, so during the first week of the year, you save $1.

During the second week, you save $2, and so on.

By the final week of the year, week 52, you save $52.

In total, if you save the recommended amount each week, you will end up with $1,378 saved.

The advantage of this savings challenge is that it is easy to follow along.

The drawback is it can get tough towards the end of the year to match the savings goal.

For example, during December are weeks 49 through 52, meaning you need to save a total of $202 for the month.

For some readers, this isn’t an issue.

But if you have a low income, it can be.

- Read now: Here is how to survive on $1,000 a month

#2. Reverse 52 Week Money Challenge

The reverse 52 weekly challenge is the one I just described, only in reverse.

Instead of saving $1 during the first week, you save $52.

Then in week 2, you save $51.

The amount you end up putting in your nest egg is the same, $1,378.

The main draw to this version is that it motivates some people more.

For example, when the excitement of building your nest egg starts to wear off at the end of January, you will have saved $202.

This higher amount could motivate you to push through to the next month.

If you do, by the end of February, you have $388 saved.

If you did the original version, you would have $36 saved by the end of February.

The bottom line is you pick which one fits your life best.

#3. Double 52 Week Savings Challenge

This option is another variation on the original saving challenge.

Instead of saving $1 in week one and $2 in week two, you double the amounts.

Save $2 in week one and $4 in week two.

At the end of the year, you have $2,756 saved, which is excellent for those looking to save a lot.

#4. Random Weekly Savings Challenge

This game is a more fun version, in my opinion.

Instead of being tied to a specific amount based on the week, this one has you save a random amount each week.

It works by having you write out the amounts of $1 through $52.

Then you pick a random amount, save it, and cross it off.

The following week you pick another amount, save it, and cross it off.

The result is again the same, but it allows you to play along a little more, which can help motivate some people to start accumulating a cash cushion.

#5. Twice A Month Challenge

If putting something aside every week sounds like too much work, you can do the twice-a-month challenge.

Here you will save something two times a month.

You can pick the days, but most people choose the 1st and the 15th or the 15th and 30th.

And I do recommend you keep the same two days every month.

This consistency will allow you to set up a reminder so you save money every month and don’t miss out.

As for the amount you save, it is entirely up to you.

You can choose the same amount or save different amounts each time.

It is entirely up to you.

#6. Bi-Weekly Money Saving Challenge

If you get paid every two weeks, the bi-weekly money saving challenge might work best for you.

On the day you get paid, you save money.

Again, you can set up the amount you want to save.

If you plan on doing this challenge and have a savings goal for the year in mind, take that number and divide by 26, which is the number of paychecks you get.

This amount will be what you need to save from every paycheck.

For example, if your goal is to save $1,500 for the year, you need to save between $57 and $58 every payday.

#7. Money Challenge For Tight Budgets

If you are on a tight budget, you don’t have to give up on these money saving challenges.

You just have to modify them.

For example, cut the amounts in half if you want to do the 52-week challenge but are concerned it is too much.

Save $0.50 the first week, then $1 the second week, and so on.

Of course, you could look at other games too.

Many of the ones I list below are perfect for people on a tight income because you save a smaller amount each week.

And don’t think you are stuck putting aside less of your income.

Towards the end of the post, you will find other challenges you can play in addition to this one, allowing you to save more.

#8. 365 Day Money Challenge

If you are determined to save and do your best by doing something every day to create a habit, the 365-day money challenge is for you.

With this one, you will save something every day of the year.

The catch is to make this amount something you can afford to save.

What I mean by this is there are 30 days most months.

If you try to save $10 a day, you will save $300 a month.

If you are living paycheck to paycheck, putting aside this much might not be possible.

Ideally, you will look over your budget and see what a reasonable amount is for you to save.

But don’t limit yourself by trying to save a small amount.

If you see you can easily save $3 a day, make it a true challenge and try for $5.

This increase in difficulty will force you to look over your spending and figure out ways to cut back.

When you are successful at this, you will get greater satisfaction in reaching your goal.

#9. One Month Savings Challenge

Is putting something aside every month your game?

If this is the case, set up a monthly savings challenge so you can save as much as possible for the year.

You could take a cue from the 52-week challenge, total the monthly amounts, and save this each month.

For example, in January, you would save $10, and in February, you would save $26.

You could also reverse this, setting aside $202 for December and January and $186 for November and February.

Or you could save a set amount each month or make it random.

#10. Six Month Savings Challenge

The six-month savings challenge is excellent for people with a short time frame to save.

Maybe you are trying to save for Christmas gifts, and it is June, or it’s January, and you want to have extra money for a vacation in the summer.

This game is for you.

Start by figuring out how much you want to save and divide by six if you’re going to save once a month.

If you’re going to commit weekly, divide by 24.

Here is how this looks.

Let’s say you want $1,000 for your next vacation.

If you save monthly, it comes to $166.67 a month. If you save weekly, it comes to $41.67 a week.

#11. Monthly Saving Challenge

Another money challenge is to set up a different goal for each month.

Maybe this month you want to save $500, and next month you want to save $300.

The monthly savings challenge works great for those with variable incomes as it allows you to budget and save every month.

#12. The 1% Challenge

The 1% challenge, or salary challenge, is another option for those on a low income or those just trying to get their finances in order.

To play this saving challenge, take 1% of your gross weekly paycheck and save that amount.

Note that I suggest you take the gross amount, which is the amount before taxes and other deductions are taken out, not your net amount, which is your paycheck after taxes.

I suggest this because it is a way to force you to save a little more.

Another twist is if you are behind on your retirement goals, increase your 401k contributions by 1% for the year.

Then increase it another 1% the following year.

Over time, this 1% increase will add up to thousands more and could help you achieve financial freedom.

#13. Increasing 1% Challenge

The increasing 1% is a fun variation of the challenge above.

You again will pick to save 1% of your paycheck, either gross income or net income.

But when you get your next paycheck, you increase the amount you save by 1%.

For example, let’s say you choose to save 1% of your gross paycheck, which is $1,000.

You take $10 and put that into a bank account.

When your next payday comes, you now save 2% of your income, or $20.

If you get paid twice a month, you will save 26% of your income by year-end.

#14. The $1,000 Savings Chart

This game requires a little work but offers a nice payoff.

The goal is to have $1,000 saved after a specific time.

You need to decide how long you play the game.

Let’s say you want to have $1,000 after 90 days.

You then create a chart with 90 spaces and put a random amount next to each space.

These random amounts should total $1,000.

Then randomly pick a space each day, cross it off, and save that amount.

Repeat the next day and so on.

#15. The $1 A Day Challenge

Here is another fun challenge for people with tight budgets.

Challenge yourself to save $1 a day.

Over the year, you will have $365 in savings, which is a good start for your emergency fund.

If you find saving $1 a day easy, you can always increase the difficulty by trying to save $2 a day.

#16. The $5 Challenge

Instead of playing with percentages or doing any math at all, you could choose to play the $5 bill challenge.

This one has you save $5 every time you get one.

The only catch here is you have to pay with cash regularly.

If you are strictly a credit card or debit card person, you can still play it, but you won’t be saving much since you won’t have many opportunities to stash a $5 bill.

#17. The $1 Challenge

Same idea as the one above, but only with a $1 bill.

I’ve played this one in the past, and it is interesting.

I started putting the dollar bills in an envelope, but the envelope was full in a few months.

I moved the cash to a shoe box and watched the pile grow.

At the end of the year, I was excited to count my savings.

The letdown was the big pile I had totaled $178.

I’m not complaining that I made it a priority to save.

I was disappointed that my big pile of cash was smaller since it was a pile of one-dollar bills.

#18. Ending In 5 Challenge

If you like the idea of the two money saving challenges above but don’t pay in cash, here is an alternative.

Make it a habit to check your bank balance every week.

Every time your balance ends in a 5, you transfer $5 to savings.

For example, if you have $435 in your account, you save $5.

If you have $432, you don’t do anything.

This will allow you to save money when you don’t pay in cash.

#19. Rounding Challenges

Here is a twist on the above.

When your bank balance ends in 1 through 4 or 6 through 9, you round the amount to a 5 or a 0.

Here is how it works.

Let’s say you have $432 in your bank account. You round down to $430 and move $2 to savings.

If you have $439 in your account, you can either round down to $435 and save $4 or round down $9 to $430.

The choice is yours, and you don’t have to stick to one or the other.

#20. Cash Only Challenge

A cash-only challenge is a fun option if you usually pay with plastic.

Make the switch for a month to only pay with cash.

Most people don’t realize there is an emotional connection with money.

What I mean by this is when you have $10 in your wallet, and you go to spend it, there is a moment where you think twice, simply because you see less money in your wallet.

You don’t experience this with a credit card as there is no emotional connection with it.

You will think more about spending cash and will end up paying less.

- Read now: Learn how to live a cash only lifestyle

- Read now: See how you can avoid ATM fees

In addition, it is a hassle to go to the ATM every time you need cash.

You may want something, but going to the ATM to get cash might be a big enough chore to make you reconsider.

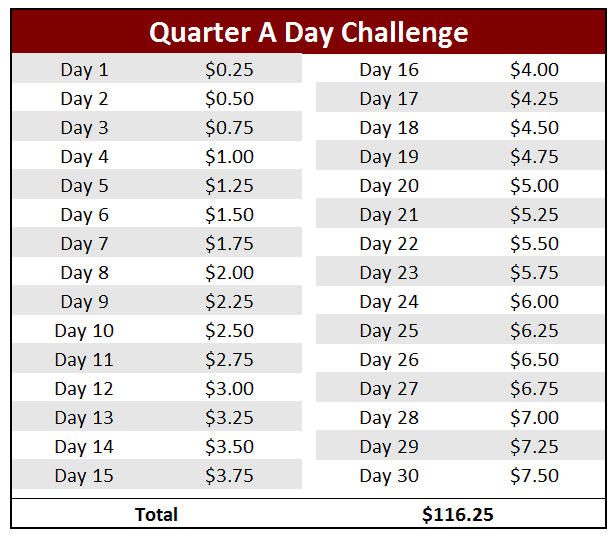

#21. A Quarter A Day Challenge

For this one, you will save one quarter on the first day of the month, then two quarters on the second day, and three quarters on the third day.

- Read now: Here are the best places to get quarters

On the 30th day of the month, you will save 30 quarters.

At the end of the month, you will have saved $116.25.

The following month you start all over again.

At the end of the year, you saved $1,426.25!

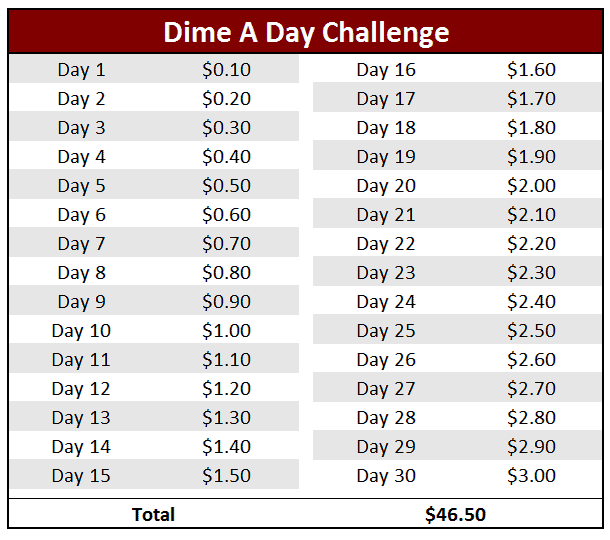

#22. A Dime A Day Challenge

Same idea as above, only using dimes instead.

By the end of the year, you have $570.70 in savings.

Because this challenge is easier than most others, you can combine this one with others to boost your savings rate.

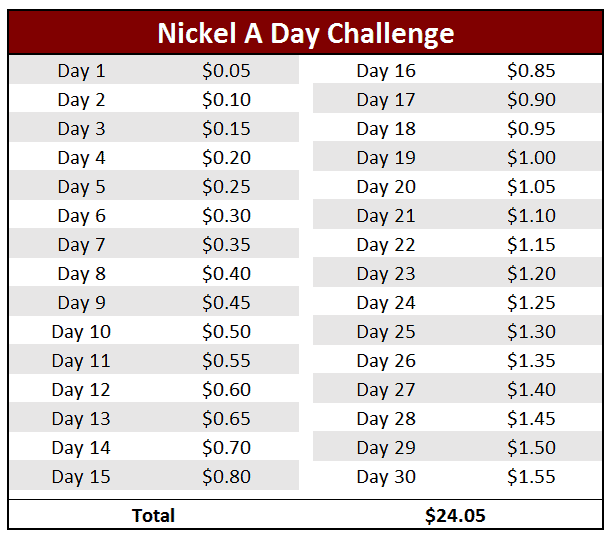

#23. A Nickel A Day Challenge

Following in the footsteps of the above is the nickel-a-day challenge.

Save one nickel on day one, two nickels on day two, etc.

At the beginning of the next month, you start all over again.

At the end of the year, you have $294 saved.

#24. Penny Saving Challenge

The penny savings challenge is like the quarter, dime, and nickel challenges, except that you don’t restart at the beginning of each month.

You keep saving another penny based on the day, so at the end of the year, on day 365, you are saving 365 pennies.

This amount sounds like a lot but only comes to $3.65 for the day.

As a result, you end the year with $667.95 in savings.

The penny challenge is excellent for people on a tight budget who cannot save much.

It helps you to get into the habit of saving, so you will when you can increase the amount you save.

#25. Age Saving Challenge

To play this game, take your age and try to save this amount every week.

So if you are 35 years old, you will save $35 a week, which comes to $1,820 for the year.

The older you are, the more money you will save.

If saving this amount is too much for you, dial it back and save your age every two weeks or once a month.

#26. Random Number Challenges

This challenge is another one that involves you more in the game.

You take 31 numbers, from 1 up to 50. Then you randomly write each down on a small piece of paper and fold it in half so you can’t see it.

Put the folded-up papers in a basket or a hat.

Then on the first day, pick a number and save that amount.

Put the paper to the side and the next day, pick another number and save that amount.

At the end of the month, put all the numbers back and restart.

Of all the money challenges, this is my favorite one.

But a word of caution, you might want to start with smaller numbers.

For example, you can still use numbers between 1 and 50, but write a handful that are 4 and 6, etc.

You want to do this because you could get into the predicament where you pull out the numbers 50, 45, 38, and 40 in consecutive days.

In four short days, you saved $173 and aren’t even through the first week!

Or, if money is tight, you can cap the highest amount at $20 and include less than whole dollars to save to make up the difference.

For example, you might save $1.25 or $3.65.

#27. 100 Envelope Challenge

This money challenge has you take 100 envelopes, label them from 1 to 100 and then shuffle them up.

Every day, you pick an envelope, save the amount listed on it, and seal it.

In the end, you save $5,050.

The downside to the challenge is not many people can save this large amount in such a short time.

But if you can always modify it to fit your financial situation, it is a great way to save quickly.

#28. Windfall Challenge

This game can lead to serious savings if you follow through with it.

You need to save a portion of it whenever you come into money you weren’t expecting, like money for your birthday, a tax refund, other gifts, etc.

Save the entire amount for small amounts like birthday money or small lottery winnings.

For more significant windfalls, like tax refunds, save 50% of it.

I know saving that much sounds like a lot, but you can do it.

If your tax refund is $3,000, you save $1,500 and get to spend the other $1,500.

Ideally, you would save more than 50%, but this is a good starting point.

If you commit to this challenge and one of the others I list, there is no reason you can’t end up with $3,000 or more of savings in just one year!

#29. Eating Out Challenge

Eating out is a considerable expense for many people.

To make it easier to cut back or cut out this expense, you can try the eating out challenge.

Here, every time you don’t order out, you take the money and put it into savings.

If you order out but place a smaller order than usual, put the difference into your piggy bank.

Doing this will help take the sting out of lowering this monthly cost.

- Read now: Here are the best places to eat cheaply

#30. No Spend Challenge

Here is another fun game to try.

The no spend challenge has you pick a spending category that you want to cut back on and try to go a set amount of time without spending money.

Most people choose seven days or 30 days for this challenge to last.

What categories can you pick from?

The easiest spending category to cut out is discretionary spending, which includes spending money on entertainment, Uber/Lyft, and other wants.

For example, you wouldn’t do this with your mortgage payment, rent, or electric bill.

- Read now: Learn how to stop buying things

#31. No Spend Weekend

If you are overspending on the weekends, do a no spend weekend challenge.

Pick a weekend and choose not to spend any money, no matter what.

No fun nights out, no groceries, no gas, nothing.

While the goal here isn’t to have you give up spending entirely on the weekends from now on, it is to open your mind to the idea of spending less money.

Many of us spend on the weekends because we get bored.

By finding other things to do that are free, you can start doing these things regularly, saving yourself money in the long run.

#32. Coffee Break Challenge

This monthly bill can add up quickly if you buy a lot of coffee.

Consider taking a break from coffee or brewing your own coffee.

Either way, you can use the money you saved to fund your financial goals.

I know for some people, cutting out coffee seems impossible.

But the truth is, you can survive without coffee.

If you need coffee to wake up, you aren’t getting enough restful sleep.

Changing this habit can open the door to more opportunities to save money.

#33. Expense Tracking Challenge

When was the last time you reviewed how you spent your money?

With this money saving challenge, you review your spending to spot areas where you are overspending or can cut back.

For example, maybe you notice your electric bill keeps going up.

You might consider ways to lower this bill and save the difference.

Since there are many things to review, take your time with this one by picking one or two areas at a time.

#34. Cancellation Challenge

Taking the above idea one step further is the cancellation challenge.

Review your bills and the subscription services you pay for.

Are there any you no longer use?

If so, cancel them.

If you are short on time, you can use an AI assistant like Rocket Money to do the work for you.

They will point out these memberships and subscription services, and then you cancel them.

Or you can have Rocket Money cancel them for you.

They will even negotiate some bills for you, like your cable bill, saving you hundreds of dollars.

Rocket Money is your assistant to help you find and cancel subscriptions, track your spending, create a budget, and more. Join the other 80% of people saving money thanks to Rocket Money.

#35. Find Extra Money Challenge

Instead of reducing your spending to save, this money saving game asks you to find new money.

Set up a goal for how much extra money you want per month.

Then figure out ways to find the extra cash.

There are many ways you can do this.

You can find things you don’t want around your house and sell them.

You could pick up a side hustle completing surveys.

- Read now: Click here to learn how to take surveys for cash

- Read now: Here are the best things to sell around your house for cash

You could recycle scrap metal or start an Etsy shop.

The choices are endless.

I personally love this one as it gets you to think outside the box for ways to bring in additional income.

And in some cases, you might stumble upon an idea you love to do and can make a decent income if you put in the effort.

The only word of caution is to start small.

Many people will want to set a goal of $500 a month.

I recommend starting with $50, as this will be challenging for most people.

As you get good at this, increase the amount.

- Read now: Click here for over 50 ideas to start making money today

- Read now: Here is how to save $3,000 quickly

#36. All The Change Challenge

An easy money challenge to play is saving all your spare change.

Most people put this cash into their piggy bank or a random savings jar at home.

But to make the spare change challenge easier, I recommend you use Qapital.

It works like this.

You pick a goal, say emergency savings, vacation, or whatever you want.

Then you link your bank account to Qapital.

Qapital will round up your purchase to the nearest dollar and transfer that amount to a savings account when you spend money.

So if you spend $10.84, Qapital will round that up to $11 and transfer $0.16 to your account.

You can also save a set amount, like $1 a month, on top of this.

They even offer some of the saving challenges I list here as options to boost your savings.

Use Qapital to round up your purchases and to transfer money based on rules you set up. It's fund and easy to use. Get a $25 bonus once you make your first deposit.

#37. The Acorns Money Saving Challenge

While I love the idea of rounding up your purchases and saving the spare change, this idea has a minor issue.

Let’s say you are saving up for a house, and your goal is to have the cash for a down payment in 10 years.

Putting the cash in a savings account isn’t going to grow very much.

But if you start investing that money, you can grow your savings tremendously.

Acorns is an investing app that rounds up your purchases and invests the savings for you.

Thanks to the higher return the stock market offers, you can grow your wealth faster here.

And you can choose a conservative portfolio, so you aren’t taking on a lot of risk.

It’s a win-win if your money goals are long-term.

Acorns changed the game when they allowed you to start investing your spare change. With a simple to use app and effortless ways to invest, Acorns is a solid choice for many investors just starting out without a lot of money to invest.

#38. Money Mistake Challenge

We all have our bad habits.

Whether it is buying Starbucks, smoking cigarettes, or staying up late, bad habits cost us financially.

This type of money challenge is a way to “punish” you when you do these things.

First, pick your bad habit, then select an amount you will save when you give into it.

For example, let’s say my bad habit is drinking soda. Every time I drink a soda, I owe myself $5.

If I drink eight sodas in a month, I will have $40 in savings at month end.

The trick here is you have to be accountable to yourself.

You can easily drink the soda and not punish yourself by making the transfer.

Other times you might be busy and tell yourself you will transfer the money later in the day but forget.

There are ways around this, from always transferring the money right away to keeping a note on your smartphone when you give in and transfer the money.

But at the end of the day, it is all about being accountable.

#39. Money Mistake Challenge Alternative

An alternative to this idea is to save the money when you stop the bad habit.

So if you smoke cigarettes and skip buying a pack one day, you take the money you would have spent and move it into savings.

Again, you have to be accountable here and most times, moving the money right away is a good solution.

#40. Weather Challenge

The weather challenge is a fun option and is up to you how you want to play it.

You could pick a day of the week, say Friday, and whatever the high temperature is in your area that day, you save that amount.

Or you could decide to save $5 every time it rains.

It doesn’t have to stop with the weather either.

If the weather doesn’t interest you, pick something that does.

For example, let’s say you enjoy football.

Whatever your team score is at the end of the game, you save that amount.

If you enjoy trying new recipes, save $5 every time you try something new.

The possibilities for ways to save are endless.

#41. Save The Savings

This fun game is one I started doing when money was super tight after I bought my first house.

One day after grocery shopping, I noticed at the end of the receipt it told me how much I saved in large font.

They wanted me to focus on this number instead of what I spent so I would feel good about the store.

While I could have done nothing about it, I decided to save this money when I got home.

After I put my groceries away, I sat down and made the transfer.

Then I made it a point to do this every time I went grocery shopping.

The amount I saved each time varied based on what I needed, what was on sale, the coupons I had, etc.

I averaged about $15 a week, which comes to $780 a year.

After a few months, however, I also expanded this idea to other shopping trips.

When I bought anything on sale, I made it a point to transfer the savings, so I saved it.

Fast forward to today, and I still play this game.

It’s a lot of fun and easy to set money aside.

#42. Pantry Challenge

Most people do the pantry challenge in January since improving their finances is a new years resolution for many.

However, you can do it any month you want.

The idea is to limit or even eliminate grocery spending for a month.

Instead, you go through your pantry and make meals based on what you have.

Since we all have food stuffed in the back of the pantry or buried in the freezer, this is a great way to use the food and not waste money.

- Read now: Click here to learn the many ways you waste money

- Read now: Discover the best ways to spend less on groceries

The interesting part for many comes towards the end of the month.

You get to a point where you are making your potluck meals because you have random food items to use.

#36. Pause Game

We all make impulse buys now and then.

The pause game is a way to help you overcome impulse purchases.

Before you buy something you want and weren’t planning on buying, pause for a minute.

Ask yourself why you want it.

How will it improve your life? How will you use it? How often will you use it?

The more questions you can ask yourself, the better because you will discover if the item is an impulse buy or if it will benefit you and you will use it.

#43. Would You Rather Game

A twist on the above is the would you rather game.

Again, before buying something you want, ask yourself a simple question.

Would you rather have the item or the cash?

Asking this fundamental question will get to the root of your desire.

If you find you would rather have the cash, make sure you transfer the amount you saved into a separate account.

#44. 30 Day Rule

An alternative to the last two ideas is the 30-day rule.

Before you buy something you want, you have to wait 30 days.

This patience helps you avoid impulse buys.

But waiting 30 days helps you in other ways as well.

Here is how this works.

For the first ten days, simply forget about the item entirely. If you are successful at that, it indeed was an impulse buy.

If you are still thinking about it after ten days, spend the next ten days doing research.

Look into the benefits and drawbacks of the item and see if any alternatives are better or cost less money.

After this time, if you still find you want the item, spend the next ten days looking for ways to reduce the cost.

Can you wait until it is on sale? Can you find a used version on Facebook Marketplace?

Could you find some coupon codes to reduce the price?

By following this strategy, you can limit impulse buys and save money if you do move forward with the purchase.

#45. Dollar Store Challenge

The next time you need to go shopping, make your list and visit the dollar store first.

Then see how many things you can buy there instead of at other stores.

The first time I did this, I was amazed at how much I saved.

Greeting cards at the dollar store are usually $0.50 or $1.00, which is a huge savings.

I found personal care items like body wash and shampoo.

I even found a tube of caulk that I needed.

In just one trip, I spent $5.50.

If I were to buy these things as I usually would, it would have cost me close to $25!

#46. Generic Brands Challenge

Related to the above point is to try to buy generic brands as much as possible.

Store brands get a bad rap but have come a long way.

Many of the items we buy are now store-brand items.

The taste and quality are comparable to brand names, and the savings are enormous.

I challenge you to buy private label items and feed your family without telling them.

Chances are they won’t even notice a difference.

#47. Holiday Gift Challenge

Shopping for gifts breaks many of our budgets.

In many cases, we go into debt to buy gifts only to spend the next few months paying off this debt.

We make it harder to achieve financial success because we are paying interest on the gifts we bought, making them more expensive in the long run.

There are a few solutions to this.

First, you can set a dollar amount limit for gifts.

If your limit is $25, you can’t go over this amount.

Another option is to think of things you can make instead of buy.

Many times this is cheaper than buying something.

Finally, you could limit the number of gifts per person.

Here you only buy two gifts for each person.

Another option is to set aside some cash every month and use this to pay for gifts.

As long as you don’t spend more than this, you avoid debt and the issues that come with it.

#48. Shopping List Challenge

We all buy things we never intended to buy.

Whether tempted with the donuts at the grocery store or some random item at Walmart, something catches our eye, and we buy it.

The challenge here is to make a list before you go out shopping.

Write down the things you need and stick to the list.

If the item you see and want isn’t on your list, you cannot buy it.

This teaches us self-control and how to not give into our impulses.

Trust me, it is hard at first but gets easier as you do it more.

But you will always have weak moments where you have to fight the urge, no matter how long you have practiced self-control.

#49. Flexible Challenge

The flexible challenge is the money saving game with no rules.

You make up the rules that best fit your goals and finances.

All that matter is you are aware of your income and spending and are finding ways to save extra cash regularly.

This could mean you save a lot this month because you know your expenses will be low, and you will save less next month.

The most important thing with any of the ideas listed is that you start a habit of saving.

Where To Put Your Savings

Anything you save needs to go into a savings account.

You can’t leave your savings in your checking account because you will spend it.

By moving it out of your checking account, you won’t see it as often and, as a result, won’t justify reasons to spend it.

For example, I didn’t move the money into a dedicated account when I was playing one of the games I listed.

I was just happy to be saving in the first place.

But after a few months, I realized I wasn’t getting ahead financially.

All my work to save money was a waste because I was finding other things to buy.

Once I proactively moved the money I saved into a dedicated account, I finally started to get ahead.

So make it a point to put your savings into a savings account.

I use and recommend CIT Bank.

This online bank pays much more interest than my local bank, which means my balance grows faster.

My process of saving was to put all my savings into one account, which was my emergency fund.

Once I got the balance up to $5,000, I opened another account.

I split the money saved between these two accounts.

One was for emergencies, and the other was for long-term savings.

You can do it however you want.

I found that having a separate savings account for all my savings goals helped motivate me as I saw the balance for each.

With one of the highest paying interest rates in the U.S. CIT Bank stands out as the best high yield savings account. Add in ease of use and great customer service, and you have a clear winner.

Final Thoughts

There are 49 money saving challenges to try.

Pick the savings challenges you find most interesting to you and give them a go.

By making it a game to save, you will be motivated to play longer, and as you see your bank balance increase in size, you will be even more motivated.

Follow my tips to create dedicated savings accounts and move any money into savings.

And don’t fall for the trap of thinking that saving a small amount isn’t worth it.

Thanks to compounding, anything you save will grow into more significant amounts if you give it enough time.

Of course, if you are in debt, you can use your savings to pay off your balances and become debt free.

- Read now: Click here to learn the power of compound interest

- Read now: Learn how to avoid lifestyle creep

- Read now: See the importance of time vs. money

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.