THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Do you know where your money is going?

While many financial experts recommend a budget if you want to reach your financial goals, the truth is, a budget can be time consuming.

Luckily there is an easier way to review your spending habits and save money at the same time.

Say hello to Truebill.

Truebill is a money-saving app that will review your spending and notify you of subscriptions you can cancel.

And it doesn’t end there.

Truebill will negotiate your monthly bills to save money, monitor cable and internet for service outages to get you refunds, get you bank fee refunds, as well as provide other services to help you cut your expenses.

Users report on average annual savings of $512 a year using this service.

And best of all, you only pay if Truebill saves you money.

In this detailed Truebill review, you will learn everything about this app and why you need to start using it today.

Truebill Review

- Ease of Use

- Features

- Account Fees

Summary

Truebill is a service that helps you save money by canceling subscriptions, negotiating your bills, monitoring outages and more. And with the average user saving $512 a year using the service, it is something to look into. Click here to see how much money Truebill can save you!

Table of Contents

Truebill Review | The Smartest Way To Cut Expenses

What Is The Truebill App?

Truebill is a free app you download for Apple or Android devices.

Simply download the app and enter your name and email address and you can begin to find potential savings.

The app works to find users various ways to cut your expenses and save money.

In fact, to date, Truebill has saved its satisfied users over $100 million by canceling subscriptions, lowering bills, and getting them refunds.

Using the app to help you cut expenses is simple as you will see below.

How Does Truebill Work?

Truebill works by finding users various ways to cut expenses and save money.

As of this writing, there are 4 main areas to help save money:

- Lowering Bills

- Monitoring Subscriptions

- Monitoring For Outages

- Electric Saver

Let’s look at each of these in detail.

Lower Your Bills

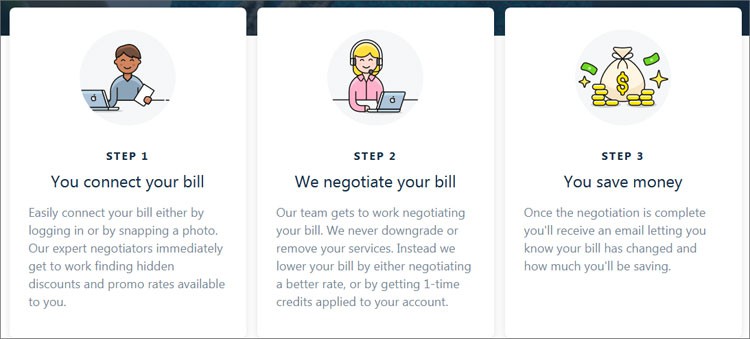

The feature that most customers use first is the lower my bills feature.

With this, Truebill negotiates bills on your behalf with over 24 service companies.

If you have ever dealt with a service company trying to get a lower bill, you know how much effort it involves and how maddening it can be.

You have to find time to make the calls.

Then you make multiple phones calls trying to negotiate with different customer service reps.

And don’t get me started on getting an offer during one phone call and then when you call back to agree to it, it magically is no longer available.

With Truebill, you save your sanity.

Upload a picture of a recent bill or log on to your account through Truebill and they will go to work for you.

All you do is sit back and wait.

How much can you expect to save?

Their website notes customers save 20% on average.

And the best part is, if they cannot get a lower price, you pay nothing!

If they do get you a lower price, the fee you pay is 40% of your savings.

For example, if Truebill saves you $50 on your cable bill, the fee you pay is $20 and keep the difference.

Note that the fee you pay is charged right away, not over the course of the year, and it is a one-time fee.

The companies that Truebill is most successful with include the following:

- Cable company

- Gym membership

- Cell phone plans

- Streaming services

- Car insurance companies

In other words, if you have a monthly bill, there is a good chance Truebill and negotiate it on your behalf.

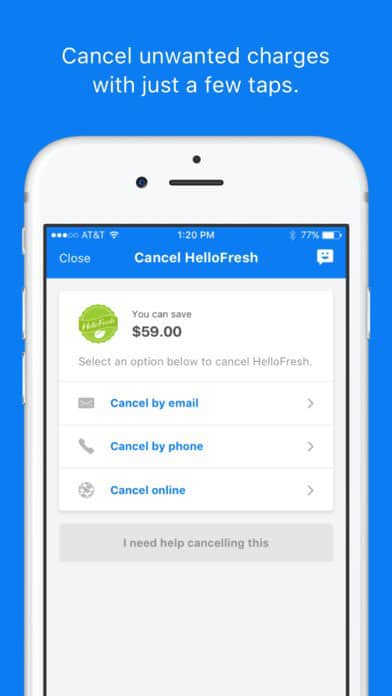

Monitoring Monthly Subscriptions

This is another popular savings feature for customers.

To get started, simply link your financial institution to Truebill and in less than 5 minutes they will analyze all of your spending, looking for recurring charges and price changes to bills.

It will also map out all of your bills on a calendar so you can visually see when each one is due.

Once you have the bills that were flagged, you work to cancel the unused subscriptions.

But don’t think Truebill leaves you hanging.

They offer step-by-step instructions on how to cancel as well as links to the company website to make canceling unwanted subscriptions easier.

And if you don’t want to do the work of canceling them yourself, you can have Truebill do it for you.

You just have to subscribe to Truebill Premium. I’ll talk more about this feature shortly.

Monitor Outages

One of the unique ways to cut expenses is to get credit for when a service you pay for is down.

For example, you pay your cable bill and expect to have access to the service 24 hours a day, 7 days a week.

If there is an outage, you are entitled to a refund.

But who actually calls up and requests one?

I don’t know of anyone.

With Truebill, they will monitor for outages and when they see one, they will get you a refund.

And if you don’t think this is a valuable service, think again.

According to the website, they get customers refunds of roughly $100 a year from outages alone.

Electric Saver

This is another unique feature with the Truebill app.

If you live in an area where your electric service is deregulated, you can easily save money by shopping around.

But this takes time.

A lot of time.

I know because I live in a state that has deregulated electric.

I shop around every 6 months to save the most money.

While shopping around isn’t hard work, it is just one more thing to my seemingly never ending to-do list.

With Truebill, they partner with Acadia Power and do the work for me.

And they save customers up to 30% on their monthly electric charges.

What Fees Does Truebill Charge?

To download and use the Truebill app is 100% free.

The only fees you are charged are when Truebill successfully negotiates a bill for you or gets you a refund due to an outage.

In both cases, the fee is 40% of the savings and you pay this fee immediately.

This is the only fee they charge.

If you want to upgrade to Truebill Premium, the fee is $4.99 a month or $35.99 a year.

The premium service offers a handful of additional benefits, which I go into detail next.

Truebill Premium

Truebill Premium is an optional plan you can pay for.

It costs $4.99 a month or $35.99 a year.

By paying for the premium subscription service, you get a handful of premium features over the basic service.

Specifically, you get the following:

- Subscription cancellation. Truebill will cancel subscriptions for you.

- Budgeting Tool. Create and follow a budget with unlimited categories.

- Smart Savings Accounts. Automate savings by specifying an amount to save each month.

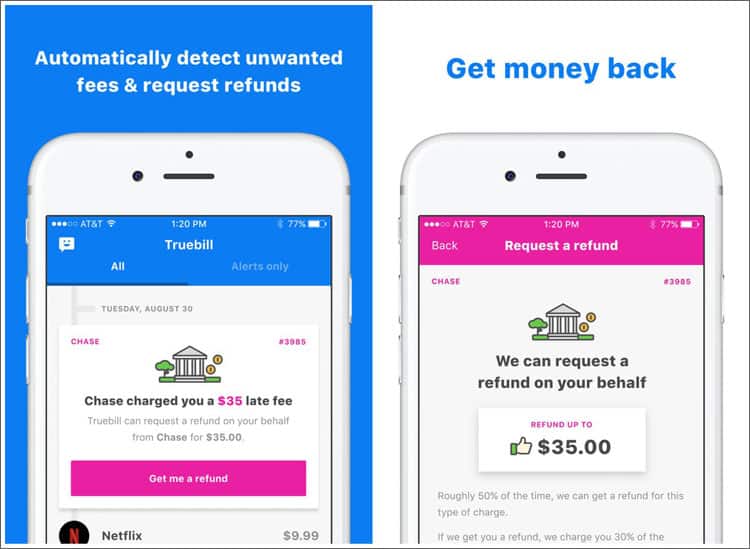

- Fee refunds. Get a refund when you are charged an overdraft fee or late fee.

- And more! You get first access to new features and other benefits.

The bottom line is for many people, Truebill Premium pays for itself.

And if you are unsure if it is worth to you, you aren’t locked in.

Try it out for a month or two and if it doesn’t add value, you can cancel and use the free version instead.

Advantages And Drawbacks

Here is a quick rundown of the advantages of using Truebill as well as some the drawbacks.

Advantages

Saves you time. It can take a lot of time to analyze your spending, identify areas to cut back or cancel and then actually follow through. Truebill does all the hard work for you.

Free to try. The only time you pay is when Truebill succeeds in saving you money. If you don’t save, then there is no fee.

Save money on fees. If you overdraft your account or pay late, the app will request refunds on these charges.

Electric savings. Let the app find you the lowest price on electric service. Only savings app that offers this feature.

Monitor Outages. With Truebill, they get you a refund when a service you pay for goes down.

Drawbacks

Fee due right away. When Truebill negotiates savings for you, you pay the fee right away. This eats into your savings the first month.

Might not find all subscriptions. Some users report that Truebill doesn’t find subscriptions you pay through the Apple App or Google Play stores.

Can’t negotiate with every company. While Truebill is able to work with many service companies to try to lower your bill, it doesn’t work with every company.

Alternatives To Truebill

There is a small handful of other services that work like Truebill.

Let’s take a look at how each one compares.

Truebill vs. Trim

There are a few major differences between Truebill and Trim.

First, Trim only charges you 33% when they lower a bill for you, whereas Truebill charges you 40%.

Second, Trim is not able to negotiate with as many service providers as Truebill, nor can it request refunds on overdraft fee or late fees.

Still it is a worthy competitor and one worth looking into if you are considering this type of service.

Truebill vs. Billshark

Billshark is set up very similar to Truebill.

In fact, both charge 40% when they are successful at negotiating a bill.

They also work with most of the same service providers as well.

One big difference is with Billshark, you can opt to pay the fee for a successful negotiation over time.

They do charge a convenience fee for this in addition to the 40%. But for some, it might be worth it.

Truebill vs. Mint

A lot of people try to compare Truebill and Mint but the truth is there is no comparison.

This is because Mint is a budgeting app that tracks your monthly spending.

- Read now: Discover 17 free budget templates to use

- Read now: Learn why budgeters love Tiller Money

Mint does not cancel subscriptions, get your refunds on bank fees, or provide negotiation services.

It simply is a money management tool.

Granted Mint will offer you potential savings from its ad partners, but it is nothing like Truebill.

Frequently Ask Questions

Here are the most common questions I get asked about Truebill.

This is also a great place to learn the basics if you are short on time.

Is the Truebill app safe?

Yes.

Truebill uses bank-level security, specifically 256-bit SSL encryption on all accounts.

Additionally, they have read-only access to any linked bank or credit card accounts.

This means they cannot log into these accounts and place transactions or do any transfers, payments, etc.

They simply read your bank statements so they can try to save you money.

Finally, no log in credentials are stored with Truebill so if their servers are hacked, there is no bank or credit card information to steal.

How do I cancel Truebill?

Canceling the premium service is simple.

Just log into the Apple App store or Google Play store to cancel your subscription.

Once you cancel your subscription, you can then reach out to customer service to request a refund of the amount you paid.

Note that when you do cancel Truebill Premium, you are not deleting your account.

You are only canceling the premium service.

Does Truebill sell my personal information?

No.

When you use Truebill, none of your personal information is sold or shared with others.

With that said, they do offer insurance and credit card comparison offers on the site.

If you decide to have them price compare either of these services, Truebill will share your personal information with these companies so you can get an accurate quote.

How does Truebill save me money?

Truebill saves you money by doing the hard work for you.

They analyze your spending and find bills to negotiate for you and subscriptions to cancel.

They also monitor outages and work to get you a refund.

And if you are charged an overdraft fee, Truebill will work to get it waived.

- Read now: Click here to learn what overdraft protection is all about

- Read now: Click here to learn how to organize your financial documents

In all, Truebill is a personal finance app that works to cut your expenses and save you money.

Does Truebill really work?

Yes.

Truebill is worth it for a number of reasons.

First is because it will save you money.

According to a recent study, 84% of Americans underestimate their monthly spending on subscription services.

The study participants said they spent an average of $80 a month on these services.

When the study did the research to see just how much the participants actually spent each month on subscription services, the amount was $237.

That is a difference of more than $150 a month!

Now ask yourself, how much are you spending a month on these services?

Then ask yourself how confident are you in that estimate?

And according the founder of Truebill, Yahya Mokhtarzada, the service saves users $500 a year by negotiating lower prices, canceling services and monitoring outages.

In other words, Truebill easily pays for and savings it gets you many times over.

Final Thoughts

Truebill is a game changer when it comes to cutting your expenses and finding extra money to save.

Face it, in today’s world, you have charges hitting your checking account and credit cards every day.

Monitoring these accounts for fraud and making sure your budget is on track is time consuming enough.

Who has the time to make sure the legit charges are for the right amount or if you even still use a service you are paying for?

This is where Truebill comes in.

Let them do the work for you and save you a ton of money in the process.

Not only will you have more money at the end of the month, but you won’t have spent any addition time getting that savings.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.