THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

When it comes to investing, why don’t you invest?

Are you scared to lose money?

Maybe you have no clue where to start since everything you read tells you something different?

Or maybe you want to start but investing sounds too complicated?

I have good news for you.

There is a way to help you start investing without fear and possibly even help you lessen the chances of losing money.

Say hello to Betterment.

Betterment automates the investing process so you can sit back and not worry if you are doing the right thing.

They put you in the right portfolio based on your investment goals and level of risk.

All you have to do is open an account.

In this complete Betterment review, I break down why I love Betterment so much and why I think it’s a smart choice for investors.

Table of Contents

My Betterment Review 2021 | The Best Robo Advisor

What Is Betterment?

Betterment is the most trusted online investment platform and is one of the original robo-advisors.

They have been around since 2010 and they are an SEC-registered investment advisor.

Their broker-dealer is a member of SIPC and FINRA. This means you can trust them with managing your money.

Their investment approach is simple.

They manage your investments so you don’t have to.

And they mean it. They manage everything for you.

Betterment Review Summary

- Ease of Use

- Account Fees

- Account Types

- Features

- Customer Service

Summary

Betterment will build you a portfolio based on your goals and will do all of the work for you. The small fee they charge is worth the benefit you get of making investing hands-off. Give them a try today and see just how easy Betterment makes investing!

They do this so you reach your goals by focusing on the long-term, which is what successful investors do, and ignoring the short-term volatility, which is what most investors focus on.

- Read now: Click here to learn how to become a stock market millionaire

- Read now: Discover the investing basics you need to know

With Betterment, you are always diversified, balancing risk and reward.

And investors are realizing this.

Betterment currently has over $22 billion in assets under management and over 400,000 customers.

Here is a quick video about Betterment if you are short on time.

Betterment has become so well respected that other businesses are using it.

- Betterment and Fidelity joined forces to connect registered investment advisors (RIAs) with the services Betterment provides.

- Betterment is partnering with Vanguard and Goldman Sachs to diversify their offerings to users.

- Uber has partnered with Betterment to offer retirement planning services for their drivers.

How Does Betterment Work?

To start investing with Betterment, you first create your free account.

From there, you choose your financial goals.

This is why you are investing your money.

Examples include retirement, buying a house, taking a vacation, saving for college, etc.

Betterment makes all of this easy.

They have many pre-selected choices for you to pick from.

You can also choose to just invest without picking specific goals as well.

Next, Betterment will help you determine your risk tolerance.

This simply means how comfortable you are taking risks with your money.

It is important you get this right because this is where most investors stumble.

They lose more money than they are comfortable with and end up taking their money out of the stock market.

Understand that you can’t eliminate the risk of losing money in the stock market.

But you can limit it to an extent.

The final step is picking your timeline.

This is how long you plan to keep the money invested until you need it.

Based on your goals, Betterment offers you a customized investment strategy and selects your asset allocation.

Your money will be invested in either the Betterment Core Portfolio or the Goldman Sachs Smart Beta Portfolio.

I talk about these in more details in the next section, as well as other investment choices as well.

By having the experts at Betterment pick your portfolio based on your goal, you can sleep well at night knowing your money is being put to work.

Once you have everything set up, your next step is to set up an automatic transfer from your bank account to Betterment.

Betterment will take these automatic deposits and invest this money for you based on the date you choose.

And as you near the date of reaching your goal, Betterment will automatically adjust your allocation so you take less risk with your money.

This helps to ensure you don’t lose most of it if the market were to crash.

Betterment Investment Portfolios

Betterment builds all of its portfolios using the Modern Portfolio Theory of investing.

They use a combination of low cost exchange traded funds (ETFs) for their portfolios as this keeps costs low.

They do not offer investing in individual stocks, simply because of the added work of researching investments and knowing when to buy and sell.

By investing in ETFs, it makes things much easier.

There are 2 main portfolios to choose from.

The Core Portfolio is a global portfolio, meaning it invests in companies through the world.

It is also weighted more towards value stocks, which tend to outperform the market over the long term.

The Smart Beta portfolio is built very similar to the one above, investing globally, with a value tilt.

The different though is that it takes on more risk, which means you could achieve higher returns over the long term.

In the event these two portfolios don’t meet your need, Betterment has some additional investment portfolios as well.

They currently have 3 socially responsible investing or Environmental, Social, and Governance (ESG) investing portfolios.

- Broad Impact Portfolio

- Climate Impact Portfolio

- Social Impact Portfolio

Additionally, if you are looking at a short term goal and taking on the risk of equities isn’t right for you, there are two cash portfolios to invest in.

- Betterment Cash: Invests in a program bank network for higher than average interest rates

- BlackRock Target Income: Invests in fixed income securities

Finally, there is the Flexible Portfolio.

This is where you can adjust the weights of individual asset classes, or choose to not invest in certain investments or geographical regions of the world.

The bottom line is, there is a portfolio for every investor with Betterment.

And if all these options sounds overwhelming, don’t let it discourage you.

Betterment is built for investors of all experience levels.

If you are new to investing, the Core Portfolio is perfect for you and don’t have to worry about making choices when it comes to investment options.

How Betterment Portfolios Are Built

As I mentioned earlier, Betterment uses exchange traded funds to build their portfolios.

Doing so makes your investments more tax efficient as well as less expensive.

Depending on the goal and portfolio you select, your portfolio will be created with a mix of ETFs in the stock basket and the bond basket.

Here is a list of the ETFs currently being used.

Note that you won’t be investing in all of these ETFs within your portfolio.

Betterment offers 2 similar ETFs for each investment class depending on various factors.

Stock ETFs:

Total Stock Market (U.S.):

- Vanguard U.S. Total Stock Market Index ETF (VTI)

- Schwab U.S. Broad Market ETF (SCHB)

- iShares Core S&P Total U.S. Stock Market ETF (ITOT)

Large Value (U.S.):

- Vanguard US Large Cap Value Index ETF (VTV)

- Schwab Large Cap Value ETF (SCHV)

- iShares S&P 500 Value ETF (IVE)

Mid Cap Value (U.S.):

- Vanguard US Mid Cap Value Index ETF (VOE)

- iShares Russell Mid Cap Value ETF (IWS)

- iShares Russell Mid Cap 400 Value ETF (IJJ)

Small Cap Value (U.S.):

- Vanguard US Small Cap Value Index ETF (VBR)

- SPDR S&P 600 Small Cap Value ETF (SLYV)

- iShares Russell 2000 Value (IWN)

International Developed Markets:

- Vanguard FTSE Developed Market Index ETF (VEA)

- Schwab International Equity ETF (SCHF)

- iShares Core MSCI EAFE ETF (IEFA)

International Emerging Markets:

- Vanguard FTSE Emerging Index ETF (VWO)

- SPDR Emerging Markets ETF (SPEM)

- iShares Core MSCI Emerging Markets ETF (IEMG)

Bond ETFs

High Quality Bonds (U.S.):

- iShares Core U.S. Aggregate Bond ETF (AGG)

- Vanguard US Total Bond Market Index ETF (BND)

Municipal Bonds (U.S.):

- iShares National AMT-Free Muni Bond Index ETF (MUB)

- SPDR Nuveen Bloomberg Barclays Municipal Bond ETF (TFI)

Inflation Protected Bonds (U.S.):

- Vanguard Short-term Inflation Protected Treasury Bond Index ETF (VTIP)

High Yield Corporate Bonds (U.S.):

- Xtrackers U.S. High Yield Corporate Bond ETF (HYLB)

- SPDR Bloomber Barclays High Yield Bond ETF (JNK)

- iShares iBoxx High Yield Corporate Bond ETF (HYG)

Short Term Treasury Bonds (U.S.):

- iShares Short Term Treasury Bond Index ETF (SHV)

Short Term Investment Grade Bonds (U.S.):

- J.P. Morgan Ultra Short Income ETF (JPST)

International Developed Markets Bonds:

- Vanguard Total International Bond Index ETF (BNDX)

International Emerging Markets Bonds:

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB)

- Vanguard Emerging Markets Government Bond ETF (VWOB)

- Invesco Emerging Markets Sovereign Debt ETF (PCY)

Betterment Sample Portfolios

Betterment portfolios are customized for each investor based on your goals, risk and time horizon.

Unfortunately, Betterment does not post the allocations to the sample portfolios they use.

However, they have provided information that shows you the historical performance of the Core Portfolio.

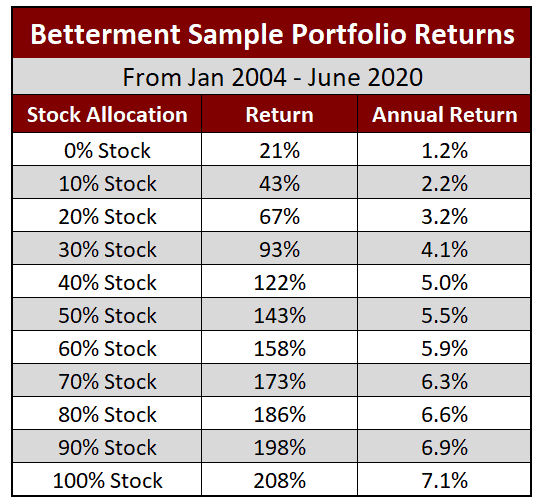

Below are the historical returns for the Core Portfolio at the various asset allocation offerings.

You will see the asset allocation, the overall return, and their annualized returns.

As you can see, looking at the returns the portfolios perform well.

But how do they compare?

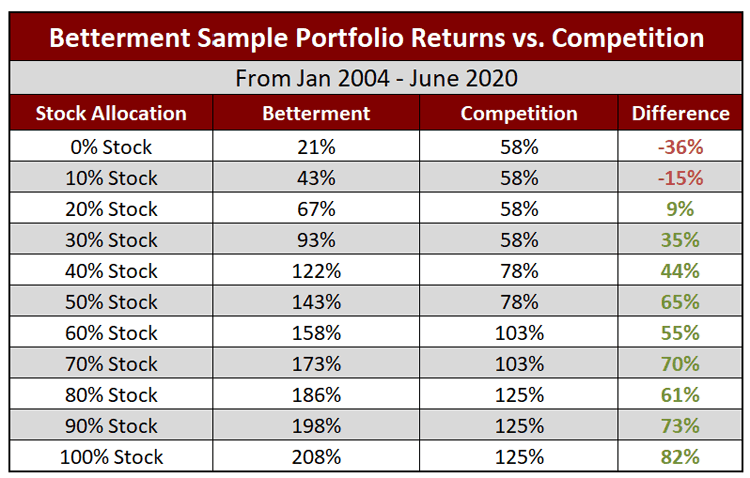

Below is a chart that compares the various allocations in the Core Portfolio to the average private client investor.

Betterment shows you how other investors compared to their model portfolio by using the ARC Private Client Indices.

These provide real performance of other investors from participating investment managers.

In other words, you can see how other investors performed in similar portfolios compared to Betterment.

Again, Betterment outperforms most of these as well.

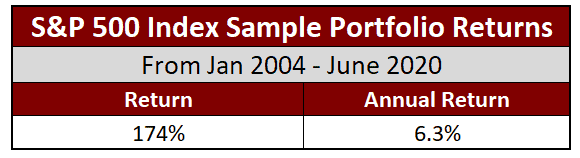

Finally, let’s compare Betterment with the S&P 500 Index, since this is the gold standard.

As you can see, Betterment outperforms the S&P 500 Index in 3 of the allocations and matches the return in another.

It would be foolish to see every allocation beat this index since the S&P is 100% stocks and by holding bonds with Betterment, you are naturally lowering your returns.

The bottom line is, you can rest at night knowing that investing with Betterment is going to grow your wealth in line compared to investing in the stock market by yourself.

Betterment Cost And Fees

When investing with Betterment, there is a cost.

The fees they charge are based on what level of service you are looking for:

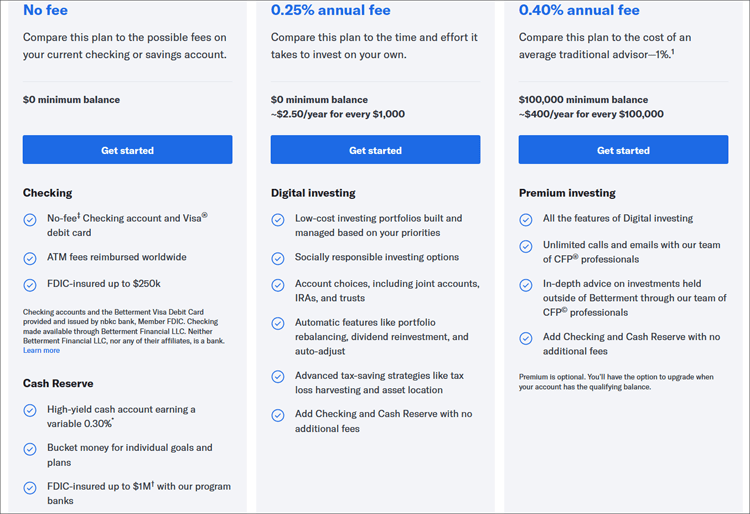

Betterment Cash Reserve

This is a free version of Betterment that replaces your traditional bank.

You have a checking and savings account to bucket money for goals and plans for your money.

You can learn more about this feature by clicking the link below.

Betterment Digital

This is the classic version of Betterment where you let automation work 100% for you.

The fee is 0.25% on balances up to $2 million.

Balances above $2 million are charged 0.15%.

There is no minimum investment to get started.

Betterment Premium

Betterment Premium is a step up from the Digital version.

Not only do you receive the automated investing service, but you also get a dedicated Certified Financial Planner who you can talk with throughout the year.

You do need a minimum investment of $100,000 to use this service and the fee is 0.40% for balances up to $2 million.

Balances above $2 million are charged 0.30%.

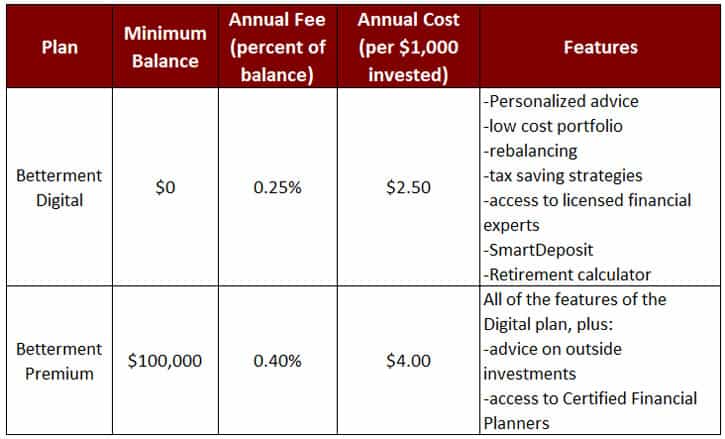

Here are the two account options above in an easy to read chart:

Impact Of Fees

Since fees matter when it comes to investing, I want to walk you through an example of how much Betterment fees will cost you.

For example, on an account balance of $5,000 and using the digital plan, Betterment’s fees come to $12.50 a year.

There are no other annual fee or fees in general that they charge.

If you have an account balance of $100,000 then the fee for the Betterment Digital plan comes to $250 a year.

With the Betterment Premium plan, the Betterment fee is $400 a year.

Understand that you still pay the management fees of the underlying ETFs that you invest in.

This holds true if you invest in ETFs or mutual funds with any broker.

In other words, the ETF fee is one you cannot avoid no matter who you choose to invest with.

Now, we all know I’m not a fan of investment fees.

But in the case of Betterment, the fee is acceptable.

Here is why.

The average investor earns 2% annually on their investments. That’s all, a measly 2%.

On average, Betterment returns investors 1.25% MORE than the average investor, and this takes into account the management fee they charge you.

In addition to this, when you combine the fee Betterment charges and the underlying management fees of the ETFs, you are looking at a total fee of less than 0.50% for the digital service.

This is much less than what most investors pay in management fees to an investment advisor alone.

In many cases, you are looking at 1.25% or more with a traditional investment advisor.

The reason why Betterment works is simple.

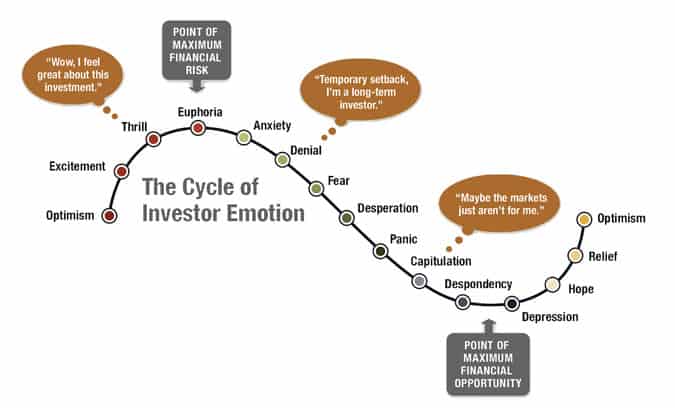

The average, non-Betterment investor allows emotion to enter the picture and cloud their judgment.

When the market rises, they buy and when the market drops, they sell. This is the exact opposite of what should be done.

Here is this concept as a graph.

With Betterment, you are buying regardless if the market is up or down.

When it is up, you buy fewer shares with your automatic investment.

When the market drops, you buy more shares with your automatic investment.

You are taking advantage of the stock market when stocks are on sale.

You buy more shares at a lower cost and fewer shares at a higher cost.

And that’s not all.

With Betterment, you stay invested for the long-term.

Your emotions don’t sway you into doing the wrong thing.

In other words, they don’t allow your emotions to derail your goals because they do everything for you.

Types Of Accounts

With Betterment, you have options when it comes to the types of investment accounts you can open.

Here is the complete list.

- Individual taxable account

- Joint taxable account

- Trust account

- Roth IRA

- Traditional IRA

- SEP IRA

- Inherited IRA

- Cash reserve

This is why I like this robo advisor the best.

Many others only have limited choices when it comes to account types.

But with Betterment, you don’t have to have multiple brokers for every account you want.

You can have everything under one roof.

Advantages And Drawbacks

As with anything in life, there are both advantages and drawbacks to Betterment.

Below I’ll go through what I feel is great about Betterment and some areas where I think they could improve.

Advantages

No researching investments. All you have to do is pick a goal and set up a monthly transfer and you are done.

Low fees. The most important thing you can do when investing is to choose investments with low fees and Betterment makes this possible.

Investment choices. There is a portfolio for any investor, no matter if you are a beginning investor or have been investing for years.

Automatic rebalancing. As the market performs over time, you asset allocation will change. Betterment rebalances for you at no additional cost.

Tax loss harvesting. Betterment will actively monitor your portfolio and make trades to keep your taxes low when it comes to capital gains.

Tools. The site has a lot of tools you can play around with to help you see where you will be in the future and what you can do to help make your goals more of a reality. They also offer a tax-coordinated portfolio tool, a tax preview tool, and a charitable giving tool.

Drawbacks

Not ideal for some investors. While Betterment is great for 99% of investors, if you are interested in dividend investing, or investing in specific stocks, Betterment is not the best option for you.

No REITs or Commodities. If you are looking to invest in REITs or commodities, look elsewhere as Betterment doesn’t invest in these asset classes.

Inability to manage external accounts. While you can view your external accounts within Betterment, you still need to log into the other brokers to make any changes.

Limited investment options. There are only a few ETFs which your portfolio is built upon. This is actually a good thing, but for some investors looking to invest in a specific ETF, it might not be available.

Alternatives To Betterment

There are a lot of robo advisors out there. I’m not going to compare all of them to Betterment.

I’ll highlight the major differences between the most popular ones.

Betterment vs. M1 Finance

M1 Finance is similar to Betterment in that it automates investing for you.

You can choose from pre-selected portfolios or create your own.

The biggest differences are that with M1, you can invest in individual stocks and ETFs to build a portfolio.

Also, M1 charges zero fees to invest, which is a game changer for many investors.

Betterment vs. Acorns

Acorns also follows the automatic investing philosophy.

They are different in that they only have a select number of portfolios to choose from. There is no customizing beyond these portfolios.

- Read now: Click here to learn more about Acorns

Acorns charges a flat monthly fee depending on the plan you choose.

This fee ranges from $1 to $5 per month.

Finally, Acorns allows you to invest your round ups, which many investors love.

Betterment vs. Wealthfront

Wealthfront is the other original robo advisor and is very similar to Betterment.

The main difference is that Wealthfront allows you to invest in stocks whereas Betterment does not.

There are other small differences between the two, but for the most part, they are very similar, even charging the same fees.

Below is a chart that compares Betterment a few additional brokers, including Fidelity, Schwab Intelligent Portfolios and Vanguard Personal Advisor services.

Other Features

As time passes, Betterment is always adding to the service they provide while keeping their fees the same.

Here are a couple of new features they have added that are worth talking about.

SmartDeposit

This is a great feature Betterment now offers.

When you choose to use this feature, you can invest any extra money you have.

All you have to do is log into your Betterment account and set up a dollar amount threshold for your checking account and the dollar amount you want to invest.

Any time your checking account balance is over your threshold amount, Betterment will take the amount you set and invest it for you.

Account Aggregation

With account aggregation, you can link all of your outside accounts, regardless of where they are, to Betterment.

This allows you to have greater insight into your overall asset allocation, fees, and where you can make some changes.

Banking Options

You can do all your banking with Betterment using the Betterment checking account and the Betterment Cash Reserve savings account.

Charitable Giving

With this feature, you can donate shares from your account directly to charities that have accounts with Betterment.

You can read more about charitable giving with Betterment by clicking here.

Frequently Asked Questions

I get asked a lot of questions about Betterment.

If you are short on time, here is a quick read through the most common ones.

Can you lose money with Betterment?

Yes.

When you invest with Betterment, you are investing in the stock market, and your investment can lose value.

This is the case with any broker.

The key is to make sure you pick the right risk tolerance so you don’t lose more money than you are comfortable with.

How much does Betterment cost?

There are varying fees depending on the program you choose.

With the Betterment Digital plan, you pay 0.25% per year on the money you invest.

This fee drops to 0.15% when you have $2 million or more invested.

With the Betterment Premium plan, you pay 0.40% per year on the money you invest.

This fee drops to 0.30% when you have $2 million or more invested.

There are no other fees you are charged.

What account types are available with Betterment?

Betterment offers many different account types, both taxable accounts and retirement accounts.

They include the following:

- Individual taxable account

- Joint taxable account

- Trust account

- Roth IRA

- Traditional IRA

- SEP IRA

- Inherited IRA

- Cash reserve

Is my money safe with Betterment?

When doing anything online, you have to take security into account.

This is especially true when investing your money.

Betterment takes security seriously.

Here are the protections they take with your personal information.

- Fraud Protection: Betterment will work to recover any loss that results from unauthorized use of your Betterment account.

- SIPC Coverage: Securities in your account are protected up to $500,000 in the event of fraud or mismanagement.

- Qualified Custodian: Betterment is subject to regulatory oversight which means they have to meet higher standards than most brokers.

- 256-bit SSL Encryption: Top level data security for all your accounts.

- Personal Privacy: Your personal info is never shared without consent.

- Hacker Checks: Betterment runs both internal and external security audits to makes sure things are working properly. In other words, they try to hack into their own system to find any bugs or weak areas that need attention.

- Two-Factor Authentication: Instead of just entering in a password, Betterment now offers a second layer of security by having you enter a unique verification code that they will text you. No more worrying about someone gaining access to your account.

Is Betterment good for beginners?

Yes. Betterment is great for beginning individual investors.

This is because they automate the process.

The less you are involved, the lower the chance you react emotionally and lose money.

Plus, you can be confident your money is working for you as you learn the basics of investing.

Does Betterment have a minimum?

The minimum deposit to get started is $10.

There is no minimum balance required for the Digital plan.

For the Premium plan, you need $100,000 to invest.

Can I invest in multiple portfolios?

Yes.

For each goal you create, you can invest in a different portfolio.

For example, if you are investing for retirement, you might be in the Core Portfolio.

But for your goal of a house down payment, you may use the Flexible Portfolio.

Having the ability to invest in different portfolios is a great way to help you reach your various goals.

Why I Recommend Betterment

To me, it all comes down to what I get for my money.

I’ve learned that you can’t just look at what something costs you.

You have to look at the benefit it provides.

For example, when I worked for a financial planning firm, we had a client tell us at the end of a meeting that he paid us over $10,000 in fees to manage his money for him.

He then explained that this was the best money he ever spent.

It turns out, if he tried to invest on his own, he admitted the drops in the market would have caused him to sell his investments and never come back in.

But because we helped him stay invested for the long term, he was able to retire sooner than he planned and experience a lot more of life.

The same idea holds true with Betterment.

They charge a fee to invest. OK, that stinks. I’ll be the first to admit I would love to invest for free.

But, what do you get in the long run for paying this fee?

You get an increased chance of having money for a secure retirement or any other goal you choose.

On top of that, look at what else you get:

- Free Trades

- Free Reinvesting of Dividends

- Free Rebalancing

- Free Tax Loss Harvesting

These typically cost more money with other brokers.

But those aren’t the only benefits of Betterment.

It’s also the fact that everything is automated for you and you can begin investing within 10 minutes and never have to lift a finger again.

You never have to think about making it a point to invest for your future. You set up the transfer once and then forget about it.

Automating like this works.

You will stay invested and be less likely to react based on emotions.

Again, this is what defeats the overwhelming majority of investors out there.

They allow their emotions to interfere.

Final Thoughts

If you want to reach your financial goals, I urge you to take a look at Betterment.

Betterment saves you time by automating the entire process, and saves you money in the long-run by keeping you invested and your investments optimized.

Give it a try and relish in the fact that you are making one of the smartest financial moves of your life.

I highly encourage you to take the next 10 minutes and open your account at Betterment.

You can open your account with a minimum deposit of as little as $10 and then set up a recurring transfer each month after that.

You’ve got nothing to lose and everything to gain.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Betterment has removed the hassle from investing and given even the newbie investor a platform on which they can invest in a clear, consistent and well researched manner; in investments that have been demonstrated over time to be the better option for the average investor – index funds.

The beauty of it all, simplicity and affordability!

That’s why I love it – it’s really simple to open an account and start investing. You don’t need to have a degree in investing. Just understand some of the basics, set it and forget it!

Very comprehensive post there Jon.. This seems to be the way that the financial services sector in the states and probably Australia in 5 – 10 years is going..

Good write up and awesome to see services like these being actively promoted. Those management fees are very low and impressive but I suppose it is what you would expect to see from a provider with reasonably vanilla investment options

A lot of these types of services are popping up here. I think it is because you have financial advisors, who target higher net worth individuals and you have the discount “no frills” brokerages that target the people with little money at all and just want to buy a stock here and there. These isn’t a service for those in the middle, that want good investments and be on a plan that the “big guys” tend to get. With Betterment, you get a plan and good solid investments, all for a low fee.

@Jon Dulin: Yeah, if I had a crystal ball and wasn’t in high school 10 years ago that’s probably the type of business that I would have looked to start :)..

Btw Jon, what is the best way to contact you directly? Probably though the contact tab above?

There is a contact me tab all the way at the top of the page. That would be the easiest.

I definitely need to check out Betterment. Mr. LH has dabbled in stocks, but he always gets too emotionally involved. I personally like mutual funds and play it safe. This sounds like a good option for us to still invest in stocks and ETFs, but have someone else manage the account.

When I started my account with Betterment, I invested in 80% stocks. As time went on, I decided to change my allocation to 90% stocks because I was able to handle the volatility in the market. All I had to do was click on a button to make the change and Betterment did the rest for me. It’s great having someone else do all of the work for me.

If you are investing less than $2,000 a month, you’ll come out ahead with Betterment because of their low fees. If you have more than this to invest each month and a couple extra minutes, you’ll come out ahead if you manage things yourself. From the looks of it, Betterment is an awesome tool!

You will definitely come out ahead by doing things yourself. Unfortunately for many investors, going alone is what limits them because they give in to their emotions. If you can ignore your emotions and stay invested for the long term, then going alone is a great choice.

This sounds like a great app, I think I’ll check it out. Nevertheless, I don’t like the lack of investment options. See, we don’t need to have a lot of investments to have a diversified portfolio, but I like to have the freedom to choose which investment to invest in, so it’s a big con for me.

I can see how the lack of options can turn some people off. Of the choices they do offer, the entire spectrum is offered – from small cap to large cap and everything in between. But as you said, some people just want to pick their own investments, which is fine. For those that don’t understand everything or don’t have the time, having a set basket of funds is a great option.

I have been with Betterment for close to two years. I do like the ease of use and I have my Roth with them. I like what I am doing so far, so I have no need to change.

Glad you like them Grayson! I haven’t been with them for that long, but in the time I have been with them, I love what I am seeing.

Nice review. I’ve been with Betterment for over a year and am so thankful they exist. I’m not a fan of trying to understand investing, so I let them handle it for me. I just tell them how much to invest and I’m done. If it wasn’t for them, I’d probably wouldn’t be investing and not making any progress on growing my money.

They are the lazy’s man path to wealth! Just set up your account and sit back and let it grow!

Jon thanks for the thorough write up on Betterment. 125 bps premium sounds good to me.

Some might balk at an extra 125 BPS but over time that small amount really adds up!

A huge difference. It’s about a $200k difference on $1,000 per month invested over 30 years.

I like betterment for there ease of use and simple fee solutions. You don’t need a lot of capital to start like a commission-based broker and you are not paying huge management fees like a financial planner…

The low starting point is key in my eyes. You can get started with $25. It doesn’t sound like much, but really adds up over time. I remember when I started investing in my 401k out of college. I was investing $20 a paycheck. I was blown away at the end of the year just how much I had saved.