THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

A major part of being a successful investor is having the right asset allocation model for your risk tolerance and investing for the long term.

But what exactly does asset allocation mean?

What should your asset allocation strategy be?

And should it change based on your age?

In this beginners guide to asset allocation, I walk you through the basics of understanding this investing concept and how to find your ideal asset categories.

Table of Contents

Ultimate Beginners Guide To Asset Allocation

What Is Asset Allocation?

The first thing to do before we dive into the idea behind asset allocation, we need to know what it means by defining it.

Asset allocation is the practice of dividing your investments between various asset classes to get to an investment mix that meets your risk tolerance and long-term financial goals.

I realize that is a lot to understand, so let’s break it down into simple terms.

There are different asset classes you can invest in.

The main asset classes are stocks or equities, bonds or fixed income, and cash.

- Read now: Learn more about the major asset classes

And each of these asset classes can be broken down further.

For example, stocks can be broken down into:

- Large cap stocks

- Small cap stocks

- Mid cap stocks

- International stocks

- Emerging markets stocks

And each of these asset classes can be broken down into growth, value and more.

Even bonds can be broken down into government bonds, treasury bills, municipal bonds, and corporate bonds.

And you can further break these down based on bond maturity.

It is important that you invest in a mix of assets, as well as other investments.

This is because there is a level of risk that comes from investing in companies, called unsystematic risk.

This is company or industry specific risk that you can reduce by investing in various companies and industries.

You can read more details about this, and I recommend you do, in my post below.

- Read now: Learn the importance of investment diversification

- Read now: Understand the difference between asset allocation vs. diversification

We covered most of the definition now, except for your risk tolerance.

And this is where most investors mess up.

How do I know this?

Look at the questions below.

If you answer yes to either of them, then you have the wrong mix of investments and need to choose an appropriate asset allocation model.

- When the stock market crashes, you sell everything and run for the hills

- When an investment doesn’t perform as well as you hoped, you sell and buy something else

By allowing your emotions to get the best of you and make decisions based on market conditions, you are working off of fear or worry.

This is a sign you are taking on greater risk.

You need to dial back the risk, reassess your investment strategy, and choose an allocation that fits you better.

How do you do this?

Let’s take a look at 11 portfolios, all with a different allocation of stocks and bonds.

Various Asset Allocation Models

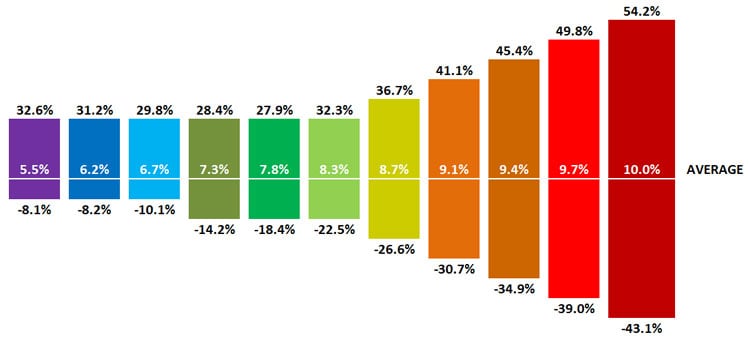

In the image below, you see we have 11 portfolios.

On the far right, we start out with a 100% bond, 0% stock portfolio.

As you move to the left, the percent of bonds you hold decreases by 10% and the percent of stocks you hold increases by 10% for each.

By the end, you have a portfolio made up of 0% bonds and 100% stocks.

In the middle, you will see a balanced portfolio of 50% stocks and 50% bonds.

Now look at the picture below.

This picture has the one year and average annual return for each of these asset allocations.

Let’s first focus on the average annual returns.

For a 100% bond portfolio, which is the purple rectangle on the far left, you can expect to average a 5.5% annual return on your investment.

Since stocks tend to return more than bonds, as you move to the right, you see that you can expect greater potential returns with the average annual return increasing to 10% for a portfolio made up of 100% stocks.

Now let’s look at the one year best return for each portfolio.

This is represented by the top number above each rectangle.

For example, with a 100% bond portfolio, again the purple rectangle on the far left, the best one year return is 32.6%.

For a 60% stock, 40% bond portfolio, the best one year return is 36.7%.

This is the number that tends to get investors into trouble.

They lose sight of the fact that when investing, risk and return are related.

When they seek out higher returns, they take on higher risk.

On the flip side, if they accept lower returns, they will have reduced risk.

Most investors focus on this one year potential and get excited about their money growing so fast.

What they don’t take into account is the number at the bottom of the vertical bar.

This is the greatest one year loss for each portfolio.

When looking at a 100% stock portfolio, this is a negative 43.1%.

How comfortable are you with the potential of losing close to half your money in one year?

Before you say the chances of this happening are slim, look no further than 2002 or 2008.

The reality is large swings like this happen more than we realize.

Let’s look at an example to see the impact this drop has on your money.

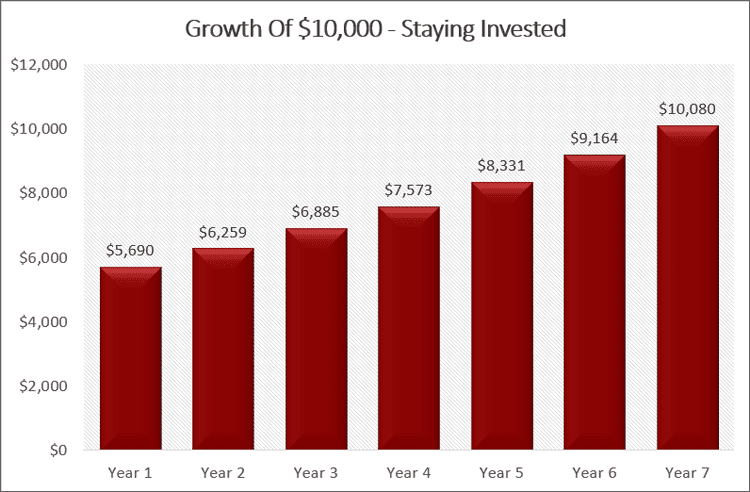

Let’s say you invest $10,000 in a 100% stock portfolio the beginning of the year of the worst decline.

After this the market returns the average 10% return.

Here is what this looks like.

After 7 years, your investment is finally back to what you originally invested in the market.

Unfortunately, you being the average investor never experience this.

Here is the typical way the average investor reacts.

You invest $10,000 at the start of the year and the market drops 43%.

Out of fear, you sell your holdings and put your remaining $5,690 into a bank account that at best pays you 1% annually.

In 7 years, you are considering returning to the market.

Your investment is now worth $6,100.

By allowing fear to control your decisions, you cost yourself over 40% or $4,000!

What if things could be different?

What if there was a way to choose an allocation model that limited your risk but still allowed you to earn a decent return?

There is.

And it all starts with you getting honest with yourself and picking the right asset allocation for your risk tolerance.

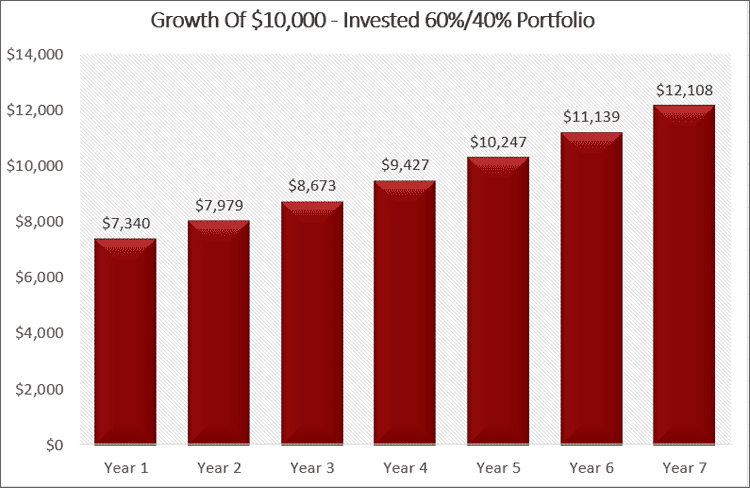

Let’s look at the exact same example, only this time, you choose an asset allocation that fits your risk tolerance.

After looking back at the chart of the various portfolios, you agree that a 60% stock, 40% bond portfolio is the best option for you.

You are comfortable with the potential loss of 26.6% of your money in a given year.

Now let’s say you invest $10,000 and this happens.

You lose 26.6% that first year.

You don’t panic and stay invested.

Here is how your money grows in the following years with an average return of 8.7%.

By investing this way and staying invested, you earned your original investment back in 5 years and after 7 years you have a gain of more than $2,000!

Reasons Why You Pick The Wrong Asset Allocation Model

There are many reasons why we pick the wrong asset allocation for ourselves.

- You want to get rich quick

- You seek short term gratification

- You discount the chances of a market drop

- You think you are smarter than the market

If you look closely, all of the reasons above are tied to emotion.

In all cases, you are greedy.

You want as much money in as little time as possible.

But when you invest this way, you set yourself up for disappointment and failure.

The end result is never growing your money and thinking that the market is rigged against you.

As a result, you decide to not invest at all.

The Danger Of Not Investing At All

I briefly touched on the idea of not investing at all above, but want to take a minute to show you the full impact of avoiding the stock market altogether.

Let’s say you invest $3,000 a year into a portfolio that is made up of 60% stocks, 40% bonds, earning an average annual return of 8.7%.

You do this for 30 years.

At the end of the 30 years, you end up with over $420,000.

But what if you avoided the stock market altogether and just put the money into a bank savings account?

Let’s say you averaged at best 2% annually for the 30 years.

How much do you end up with?

By putting your money into a bank savings account, you end up with just over $124,000.

That is a difference of $296,000!

Think about this in terms of your retirement.

If you spend $40,000 a year, the money you invested and grew to $420,000 will provide you with close to 11 years of retirement income.

This isn’t taking into account continual growth of the money while retired.

How many years can you live off the money you kept in a savings account?

About 3 years.

If you don’t invest your money in the stock market, you are going to need to save a lot more money just to afford retirement.

And chances are, you are going to have to work a lot longer or even work during retirement just to get by.

Luckily this financial situation can be avoided and you can be a successful investor.

You just need to get your asset allocation right for you.

Getting The Right Asset Allocation Model For You

Now we get to the good part, how to pick the right allocation model for you.

The easiest way to figure out your ideal allocation is to take a risk tolerance questionnaire.

I like the one Vanguard offers.

But these questionnaires aren’t perfect.

You still have to think through the questions they ask.

Many people get excited about the questions about potential return when they see the large one year return potential.

And then they discount the potential one year loss potential.

To overcome this, I encourage you to focus more on the questions about losing money.

Really think about how you would feel if you lost this amount of money.

If the question presents the loss in percentage terms, do the math.

Take your desired savings amount and multiply it by the potential loss.

For example, if you want $500,000 in your account and are asked if you are comfortable with a loss of 40%, see how much this is.

Take $500,000 multiplied by 0.40 and see that you will lose $200,000.

Are you comfortable with this?

Doing the math only takes a few seconds but puts things into perspective.

With that said, you have to also keep in mind that the stock market goes up over time.

If it didn’t, no one would invest in it.

In fact, the market goes up 73% of the time.

So while there will be years you lose a lot of money, you need to look long term and stay invested, knowing that if you do, in a few years you will make your losses back.

Ideal Asset Allocation By Age

A common question I get asked is what should my asset allocation be when I am a certain age.

This is a loaded question.

The reason is because we all have different risk tolerances.

Some of us have a high-risk tolerance and are willing to bungee jump off a bridge while others who have a low-risk tolerance would never consider doing this.

Or someone who grew up poor and without money, might be willing to take on less risk because they don’t want to experience life without money again.

With that said, it does make sense to move to a more conservative asset allocation as you age.

This is because as your investments grow in value, you have a lot more to risk.

For example, if you have $10,000 and lose 40%, you are losing $4,000.

But if you have $500,000 and lose 40%, you just lost $200,000.

So as you age, you should lower the amount of money you have in stocks.

One popular rule of thumb is to have bond holdings relative to your age.

So if you are 50 years old, 50% of your investments should be in bonds or fixed income.

If you are 20 years old, you can have just 20% in bonds.

The only problem with this advice is it was created when we retired at 65 and had a lifespan to 75.

Having an investment portfolio of 40% stocks and 60% bonds worked for those 10 years, but now we live to age 95.

Chances are a portfolio with 70% or more worth of bonds isn’t going to help you survive financially.

As a result, you have to weigh the investment risks and benefits and find the number that works best for you.

For example, if you have a guaranteed pension and Social Security, you can take a little more risk with your investments.

But if you don’t have these sources of income, you might want to be a little more conservative.

Again, this varies by person, and by the type of investor you are.

If you are a young investor, you likely have a longer time horizon and should be more aggressive investing in stocks.

But you might be a conservative investor and want a balanced portfolio.

Or you might be older and an aggressive investor, comfortable with high risk and want 60% or more of your money in stocks.

You have to take the time to make the right decisions for you and your investment goals.

Keeping Your Asset Allocation In Check

One final thing you need to understand about asset allocation is you need to review it.

As the market moves, your asset allocation is going to get out of alignment.

Stocks and bonds tend to move in opposite directions.

And not all stock sectors move in the same direction either.

One day large cap stocks might rise while small cap stocks decline.

As a result, your ideal asset category mix is going get messed up.

In the short term, this isn’t a big deal.

But over time, it is.

For example, let’s say you are comfortable with a 60% stock asset class and 40% bond asset class portfolio.

The market gets hot and stocks rise.

Because of this, at the end of the year your asset allocation is now 80% stock asset class and 20% bond asset class.

This might not seem like a big deal when you look at how much money you made during the year.

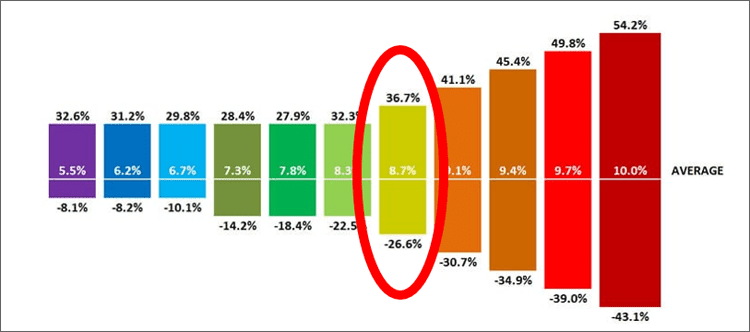

But let’s go back to the chart at the beginning of this post.

You chose the portfolio mix of 60% stock asset class and 40% bond asset class because you were comfortable with the possibility of losing 26.6% of your money in a year.

But now with your new allocation, are you OK with losing 45.4% of your money?

Probably not, otherwise you would have chosen that allocation instead.

What does this change in allocation look like in terms of money?

Let’s say after the great year, your investment portfolio is worth $20,000.

If the market tanks and the worst 1 year return happens, you would lose roughly $7,200 if your allocation was still in the 60% stocks and 40% bond portfolio you chose.

But if your allocation changed to 80% stocks and 20% bonds, you would lose close to $9,000

That is a difference of $1,800!

As your wealth grows, your potential loss only grows larger.

In other words, as the market moves, you can be taking on too much risk than you are comfortable with.

On an investment portfolio of $250,000 the loss goes from $90,000 up to $112,500 or $22,500!

The point is, you need to stay on top of your asset allocation and make sure you are still invested based on your risk tolerance.

Here are some guidelines for keeping your allocation in check.

#1. Check Your Asset Allocation Close To Year End

You should check your preferred investment mix at least once a year.

Typically most people check at the end of the year.

If you really want to stay on top of things, you can check twice a year, once in June and then at the end of the year.

#2. Know When To Rebalance

Rebalancing is the art of getting your allocation back in line with your goals.

Just because your portfolio is out of alignment doesn’t mean you need to take action.

The rule of thumb is any deviation of 5% or less needs no action.

This is because most times, it will cost you more in time and money to reallocate your portfolio than you risk losing by not acting.

So, only act if your original asset allocation mix is out of alignment by 5% or more.

Here is what this looks like.

If your investment model is 60% stocks and 40% bonds and after completing an asset review you find you have 65% stocks and 35% bonds, you would not rebalance.

But if you reached 70% in stocks, then you would rebalance.

What is the best way to rebalance your investments back to your ideal asset mix?

Unfortunately there isn’t a one size fits all approach here.

This is because retirement accounts and non-retirement accounts are taxed differently.

With that said, here are a few options for rebalancing each type of account.

- To rebalance a retirement account: You would simply sell a portion of your over weighted asset categories and use the proceeds to buy more of your under weighted asset categories holdings. This is the preferred method since you can make trades in a retirement account without tax issues.

- To rebalance a taxable account: Here is where things get a little more complicated. You can’t simply buy and sell because any gains you realize when you sell will force you to pay income tax. We don’t want this. Most people simply add new money into this account.

These are just two of the ways to rebalance your portfolio.

In the post below, I go into all the different ways to rebalance your portfolio.

Finally, know that if you invest in mutual funds or exchange traded funds, you still need to rebalance.

Even though these types of investments diversify your money, they still get out of balance based on market movement.

Using Robo-Advisors For The Right Asset Allocation Model

Finally, if you aren’t comfortable figuring out your ideal investment strategy on your own, you can invest with a robo-advisor.

These investment firms will walk you through the process and help you to pick the right investment mix based on many factors.

And while this is great, they also will work to keep a diversified portfolio made up of exchange traded funds tied to your asset allocation by rebalancing on a regular basis.

There are many robo-advisors out there and choosing one can be overwhelming.

My favorite is Betterment.

They are one of the originals and have some of the best features for the lowest cost.

Simply take 10 minutes to answer questions about your investment goals and risk and they will assign a diversified portfolio for you.

Just set up a monthly investment amount and they take care of the rest.

And you can start investing for as little as $10!

Click the link below to get started with Betterment.

Of course, they aren’t the only online broker out there.

You can read my post below to help guide you to finding the perfect investing platform for your needs and goals.

Final Thoughts

Hopefully this beginners guide to asset allocation helped you to better understand the right asset mix for you.

As you can see, getting this right is critical to successful investing.

By ignoring your investment mix, you are going to react emotionally and make rash decisions.

This is not good and only does you and your money harm.

So take the time to understand your investment objectives and pick your own asset allocation that makes sense for you and watch your investments grow.

- Read now: Here are the investing basics you need to know

- Read now: Learn the best way to invest a small amount of money

- Read now: See how investment fee eat away at your wealth

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Awesome and thorough post! Most of my retirement is invested through the Thrift Savings Plan, so asset allocation is easy. I just have to make sure I rebalance. Plus, now since i”m in my 30s, it will change a little. The Vanguard allocation you mentioned is something I’m looking into.

There are some fantastic tips. Now is a real important time for folks to plan out their asset allocation and put investing to work. We are in for some turbulent times ahead and it will pay to keep a cool head and remember that we are in it for the long haul!

Income and saving more is very important for anyone. Your post gives us innovative thinking about different ways to invest money in the right place in right time.

It’s a very useful blog.

Keep posting!