THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Dave Ramsey is an expert in helping people get out of debt.

His simple yet actionable advice explains the steps to change your finances from living in debt to living prosperously.

But while his advice on helping people to get out of debt is spot on, the investing strategy Dave Ramsey guides his followers with is dangerous.

So dangerous that many people potentially end up with a lot less in savings and run the risk of running out of money during retirement!

In this post, I will look at Dave’s investment philosophy and explain why it is flawed.

You must see this so that you don’t end up not saving enough or spending too much in retirement.

Disclaimer: I Like Dave Ramsey

Before you read why I am against the investing advice Dave Ramsey preaches, know that this doesn’t come from a place of dislike for Dave.

I love everything he says about debt and agree with most of his thoughts on building wealth.

For the majority of Americans that stink at saving money, following his Baby Steps will get you in excellent financial shape.

I even followed the debt snowball method when I was in credit card debt.

I love that he recommends term life insurance over whole life insurance.

And I love that he encourages people to get disability insurance since you are more likely to become disabled than pass away prematurely.

I agree with a few things about his investing philosophy, like avoiding annuities at all costs.

But with all my love for him, when I started peeling back the layers about the rest of his investing advice, I found some disturbing things.

And I think this is due to his experience.

Why is he great at helping people get out of debt?

He was in a mountain of debt and figured out how to get out once and for all.

But he doesn’t have experience when it comes to investing.

His wealth isn’t from investing in the stock market.

He makes his money through his syndicated radio show, selling books, and real estate investing.

So while he understands the basics of investing, he doesn’t have the same knowledge as someone who has been educated or has built their wealth through investing.

The result is solid advice for getting out of debt and not-so-great advice for growing wealth through investing.

And since my goal is to help you to achieve your financial dreams, I feel you should understand how Dave Ramsey’s advice can leave you in rough shape when it comes to achieving your dreams.

KEY POINTS

Table of Contents

5 Questionable Pieces Of Dave Ramsey’s Investing Strategy

#1. The 12% Belief

Dave Ramsey claims that an investor can reasonably expect to earn 12% per year on their investments over the long term.

Sounds okay, but in reality, it is wrong.

His math is technically correct, but he is wrong about what will happen in the real world.

When calculating annual returns, he uses arithmetic to get to 12%.

Here is an example of this.

You invest $100 for two years.

In the first year, your investment loses 50%. In the second year, your investment gains 100%. Your average rate of return is 25%.

As a result, your $100 should be worth $125, since your rate of return is 25% ($100 x 25% + $100).

But when you look at your account balance, you don’t have $125. You only have $100.

How is this?

Let’s look at the numbers more closely.

You have $100, and in the first year, you lost 50%, or $50. You have a balance of $50 remaining.

In the second year, you earn a 100% return. A 100% return on your $50 is $50, so you end up with an ending balance of $100.

In those two years, you have earned 0% on your money.

This idea can be confusing, but this is how the stock market works.

Here is the Dave Ramsey investment calculator he uses to prove the 12% return point.

Enter 1924 as the starting date and 2020 as the ending date and click the calculate button.

The result shows an average return of over 12% and an annualized return of 10%.

Notice how the word average next to the 12% is in quotations?

This is done to tell you that this is the arithmetic average and you can’t rely on this number.

Additionally, you need to check the box to adjust for inflation.

Adjusting for inflation is critical because, over time, every dollar you own becomes less valuable.

When we check this box and click the button to calculate actual returns, our real-world average annual return is 7.57%.

You might be wondering why this is a big deal.

Let’s use an example to help you understand it.

We have Bob, who expects a 12% return on his money.

He makes $60,000 a year and saves 15% of his income, or $9,000. He saves for 30 years.

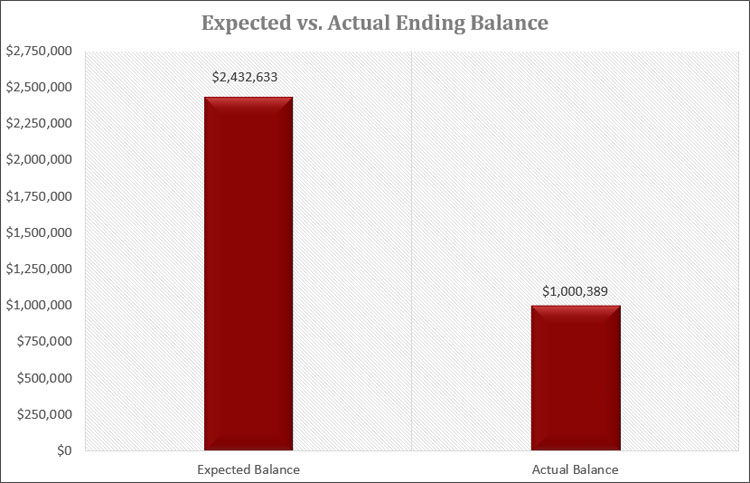

Based on Dave’s investing advice, he expects to have a nest egg at the end of the 30 years to be $2,432,633.

But when he goes to retire, he finds that his balance is worth $1,000,389.

While having a million dollars saved for retirement is excellent, look at the difference between what Bob was expecting and what he actually has.

It is a difference of over $1.5 million dollars!

Let’s look at another example.

Joe got into debt at a young age and broke the cycle when he hit 40.

He can save $300 a month for 25 years until he is 65.

Using the Dave Ramsey investment calculator, he expects to have $537,000 saved for retirement.

He makes plans based on this amount of money. But when he retires, he sees his retirement account is worth $263,000.

This forces Joe to give up on some of his retirement dreams.

Mathematically there is nothing wrong with the 12% number Dave Ramsey is using. It is correct.

However, it is very misleading because it doesn’t consider the compounding of returns.

Assuming you can safely earn 12% annually, you are setting yourself up for great disappointment in retirement.

Most financial experts cite 6-8% as a reasonable return on your money, so you have realistic expectations.

#2. Asset Allocation

The next area of Dave Ramsey’s investing strategy that is misleading is asset allocation.

Diversifying your investment portfolio across many asset classes is key to long-term success.

But this isn’t the case with the investment advice Dave Ramsey gives his listeners.

Here is Dave Ramsey’s investment strategy from his website:

He recommends you invest in 4 stock funds, 3 of which are roughly the same asset class.

By investing in growth, growth and income, and aggressive growth funds, you are investing in the same companies, just using different funds.

Investing this way does not diversify your risk.

You want to invest in different investments, like large-cap and small-cap companies.

For example, let’s look at a growth fund and a growth and income fund.

We will look at mutual funds from Vanguard.

Here are the top 10 holdings in the Vanguard Growth Index Fund (VIGAX) and the top 10 holdings in the Vanguard Growth and Income Fund (VQNPX):

Of the ten holdings in each, 40% are in both funds.

If we were to dig deeper, we would continue to see the overlap.

This overlap means you purchase the same stocks twice when you buy both funds.

It’s like buying a bottle of Coca-Cola and a bottle of Pepsi for a party.

Both are cola.

You are better off buying a bottle of Coca-Cola and a bottle of A&W Root Beer or Ginger Ale.

To be genuinely diversified in investing is to own various asset classes.

You need to own some combination of the following:

- Large cap stocks (both growth and value)

- Small cap stocks (both growth and value)

- International stocks (both large cap and emerging markets)

- Bonds (treasury, municipal, corporate)

- Commodities (oil, precious metals)

- Real estate

You don’t need to own something in each of these categories.

But, you should have exposure to more than just one, which is not what happens when you follow Dave Ramsey’s investing philosophy.

When fully diversified, you lower your overall risk and can still achieve a decent return.

But when you follow Dave Ramsey’s investing philosophy, you increase risk and don’t increase your return.

#3. Load Mutual Funds

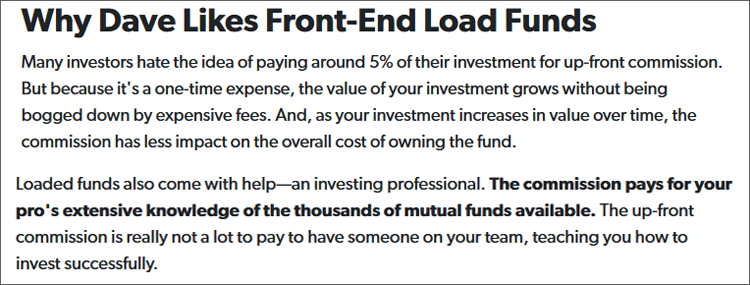

A big part of the Dave Ramsey investing philosophy is investing in load mutual fund investments.

Here is what he says on his website:

Note that there are two main types of mutual funds, load funds and no-load funds.

With a load mutual fund, you pay an investment fee upfront.

The fee you pay goes towards your investment advisor, which is how he earns his money.

Financial advisors who sell no-load mutual funds get paid by charging you a flat fee or a fee based on assets under management. This fee is usually around 1%.

The typical sales charge is 5.75% when investing in load mutual funds.

For every $100 you invest, $5.75 goes to the advisor, and you are investing the remaining $94.25.

And the money you invest gets charged the management fee of the mutual fund itself.

Here is why this is a bad idea.

You have $30,000 to invest into a load mutual fund for 25 years.

It is an actively managed fund, which charges 1.25% yearly as the management fee or expense ratio.

Your investment grows at 8% a year. How much do you have?

Of the $30,000 you invest, $1,725 goes to the advisor, and you invested the remaining $28,275.

Your ending investment is $141,391.

But what if you invested in a no-load mutual fund that doesn’t charge any upfront fees?

We will assume the mutual fund charges a 0.50% management fee.

Your investment would be worth $181,255.

That is a difference of over $20,000!

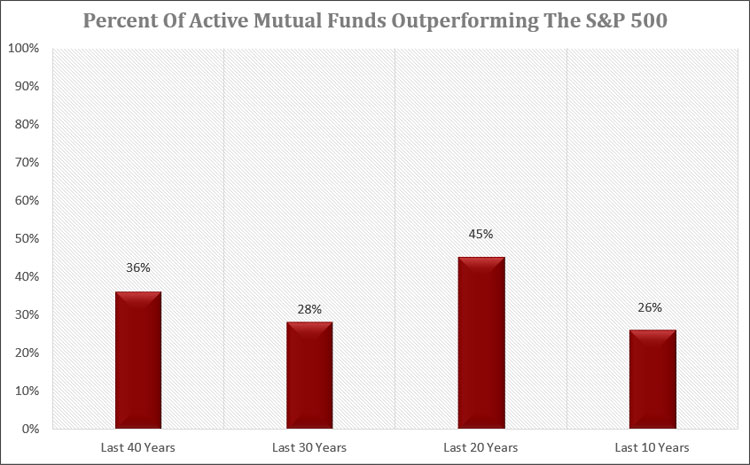

And before you think paying for a professionally managed fund is worth it, think again.

All mutual funds have professional management.

And the evidence shows that most active management mutual funds perform worse than passively managed index funds.

For example, here is a great chart showing you how many actively managed mutual funds outperformed the S&P 500 Index:

As you can see, the odds are slim that you earn what the market earns by investing in a mutual fund with active managers.

In other words, the odds are excellent that you will have less money if you invest in actively managed mutual funds than in index mutual funds.

Don’t make the mistake that many other investors make, thinking that the more you pay for a mutual fund, the better it will perform.

When it comes to investing, the opposite is true.

The less you pay, the more likely you will have higher returns.

How is this possible?

Because the money you pay in fees comes from the fund itself, these fees eat away at your ability to grow your wealth.

Look back at the example I showed you above.

The $20,000 difference is your opportunity cost.

- Read now: Learn what opportunity cost is

Had you invested in a mutual fund without a sales charge and a lower management fee, you would have another $20,000 in savings.

What could you do with an extra $20,000?

And this is just based on investing $30,000.

What if you were investing $100,000?

In this case, the load mutual fund would be worth $471,305 at the end of 25 years.

The no sales charge, lower management fee mutual fund is worth 604,186.

That’s a difference of more than $133,000!

In other words, you are paying money for something you can easily do yourself for much less.

And as you invest more money, the numbers continue to grow larger.

#4. SmartVestor Pro

Related to the load mutual fund advice is Dave’s recommendation on advisors.

Years ago, if you wanted to work with a financial advisor who followed the Dave Ramsey investment philosophy, you went with one of his Endorsed Local Providers (ELP).

These financial and real estate professionals Dave promoted as the best in the business.

According to the Dave Ramsey website, they were held to a higher standard of excellence so that investors were treated right.

To be part of the ELP program, advisors had to pay a fee.

This fee covers employment costs and website maintenance.

In exchange for this fee, advisors were given referrals from the Dave Ramsey website, and they had territorial rights to their geographic area.

These rights meant no other advisor in their local area could be an ELP.

The advisors who joined the program had to follow the Dave Ramsey investment philosophy, selling investors front-loaded mutual funds.

Today the ELP program has been replaced by the SmartVestor Pro program.

This program is an advertising service where investors can connect with local advisors.

Advisors pay an advertising fee for a listing on the Dave Ramsey website.

Under this new program, advisors no longer have territorial rights.

Instead of getting one advisor for your local area, investors now get the names of multiple advisors.

The advisors have to compete for your business.

There is no confirmation as to why the ELP program ended. However, the change came when the Department of Labor proposed a new law regarding the fiduciary standard.

The basis behind the fiduciary standard is that an advisor must put their client’s interests ahead of their own, regardless of whether the advisor will make money.

Surprisingly to many investors, not all advisors do this.

If an advisor is not a fiduciary, and many advisors aren’t, they only have to invest your money in a suitable way.

In other words, let’s say there are two identical investments, and one charges a higher fee than the other.

An advisor that follows the fiduciary standard must put your money into the one with the lowest fee.

They must do what is best for you.

An advisor that does not follow the fiduciary standard is not required to put your money into the investment with the lowest fee.

They can choose either, as long as the investment suits you.

What does this mean?

Suppose the advisor earns a commission from the higher-priced investment, and they are not a fiduciary.

In that case, they do not have to tell you this.

They can even choose only to offer you investment choices that give them a commission.

An advisor who is a fiduciary can still sell you an investment they earn a commission off.

However, they have to disclose this information to you.

The fiduciary standard stops this conflict of interest by making advisors act in their client’s best interests.

To be affiliated with Dave Ramsey, advisors in the SmartVestor Pro program pay Dave Ramsey an advertising fee.

The only other thing an advisor has to do is agree to the Code of Conduct.

While having a code of conduct is a step forward, it still isn’t good enough.

Instead of following the fiduciary standard, advisors affiliated with Dave Ramsey only need to follow the suitability standard and be registered with the Financial Industry Regulatory Authority (FINRA).

Following the suitability standard, they can still sell you high commission investments when a lower-cost option is available.

It is important to note that Dave Ramsey has been a vocal opponent of the fiduciary rule.

He claims that it will hurt investors.

He feels advisors will limit their advice because investors can now sue them.

I believe there is another reason.

Money.

Dave Ramsey makes a mountain of money from the advertising fees advisors pay to be part of the now defunct ELP program and the new SmartVestor Pro program.

Just how much money?

The fee advisors pay ranges between $400 and $1,500 depending on many factors.

If you take the 1,400 advisors in the SmartVestor Pro program and each pay the minimum of $400 a month, this comes to $560,000 in fees Dave Ramsey earns.

Over a year, the earnings from the SmartVestor Pro fees come to $6,720,000!

As you can see, Dave has a vested interest in keeping this program running.

#5. Retirement Withdrawal Rate

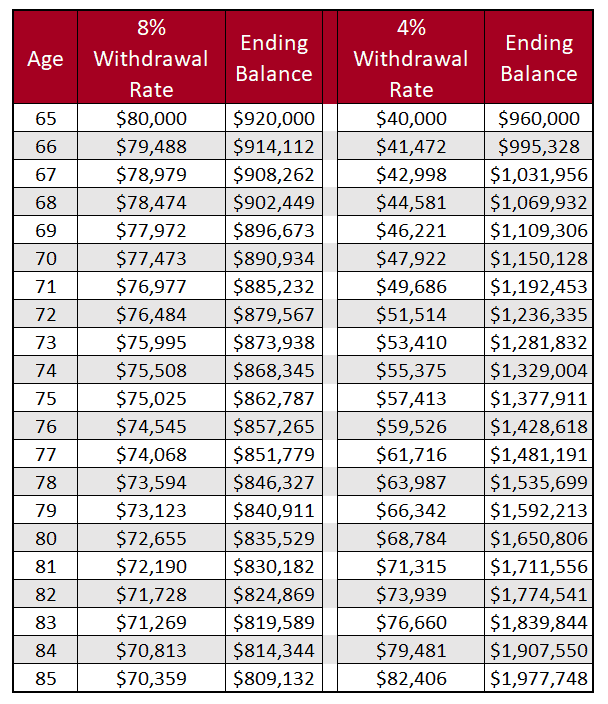

The final piece of advice that Dave Ramsey gets wrong is the rate at which you can withdraw money from your retirement plan to live on.

He suggests an 8% withdrawal rate is acceptable.

Most retirement experts suggest only 4% is an acceptable withdrawal rate.

And some experts think you can’t follow a fixed withdrawal rate.

Let’s look at an example of these withdrawal rates to see how they play out.

We assume you have $1,000,000 saved and will be taking this money out starting at age 65.

As you take your money out, your investments will continue to grow at 8% annually.

Here is how much money you will be withdrawing based on an 8% and 4% withdrawal rate and your ending balances.

As you can see, when you withdraw 8% of your money every year, your account balance decreases in size.

On the other hand, when you are withdrawing 4% of your money every year, your account balance grows.

Your balance continues to grow because you earn more than you are withdrawing each year.

But this example doesn’t paint an accurate picture because the market fluctuates yearly.

When we look at these numbers in the real world, we see some scary numbers.

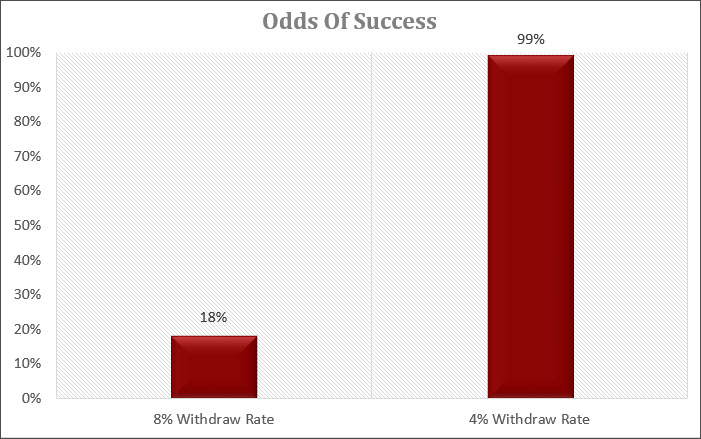

Here is the data from a monte-carlo simulation.

It takes 30 years periods from 1928-2020 to see the likelihood of you surviving retirement and not running out of money.

Using the 4% rule, you have a 1% chance of running out of money.

And in the worst-case scenario, you still have more than enough money than you started with!

But the numbers are very different if we look at an 8% withdrawal rate.

You have an 81% chance of running out of money.

And the best-case scenario, you have $5 million left.

I don’t like those odds. And neither should you.

You worked hard for your money and saved to enjoy your golden years.

Don’t let a foolish mistake cost you your dreams.

It would be best if you stuck with a lower withdrawal rate. Otherwise, chances are you will run out of money in retirement.

How You Should Be Investing Your Money

Now that you see the issues with Dave Ramsey’s investing advice, how do you invest your money?

I know you follow Dave’s advice because he is a trusted source, and investing is overwhelming with all the investment choices.

So why should you listen to me?

I’ve been in the financial services industry for close to 15 years and have worked with investors with millions to invest.

All along the way, I was a fiduciary and always put the client first.

I’ve been investing since the late 1990s and have grown my wealth to over seven figures using a buy-and-hold investing approach.

And I’ve helped friends, family, and readers of this site grow their wealth by working with them one-on-one.

You can grow your investment wealth without a financial advisor, and you don’t need to be paying loads on mutual funds to invest.

You can do it all yourself with just a little hand holding.

The first option is Charles Schwab.

They have Intelligent Portfolios that automate investing for you.

You enter your goals, and Schwab will invest your money for you.

There are no advisor fees and no trading fees.

If you do want some hand holding from a financial planner, you can pay $300 for a one-time planning fee and then $30 a month with their Premium service.

Another option is for those who are comfortable with being more hands-on.

It is called M1 Finance.

While M1 will handle the entire behind-the-scenes work for you like Schwab, the most significant difference with M1 is that you pick your portfolio.

You don’t answer a risk questionnaire as you do with Schwab.

You can choose from pre-built portfolios or build your custom portfolio using exchange-traded funds and individual stocks.

They also don’t charge any fees to invest.

The best part of M1 is that if you decide to go this route and need some help, assistance is just a phone call away to answer any questions.

M1 Finance broke the chains when it was the first to offer free stock trading. Even as other brokers come onto the scene, M1 Finance is one of the best choices for DIY investors looking to invest.

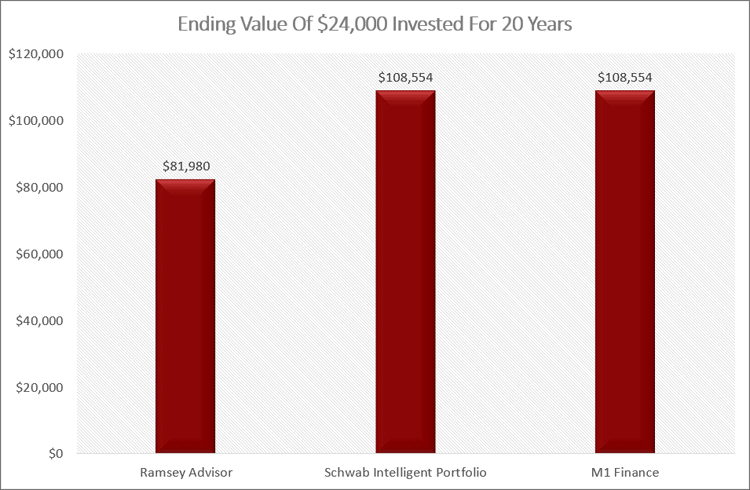

How Much Money Will You Save?

If you decide to go with one of these options over a SmartVestor Pro, here is how much money you will save.

If you invest $24,000 for 20 years, here is how much your investment will be worth after fees and expenses.

As you can see, the fees you pay to invest make a massive difference over time.

The difference can be as much as $26,000!

How much more enjoyable would retirement be if you had another $26,000 in savings?

Investing Basics To Learn

Regardless of the route you decide to take, you should educate yourself on the basics when it comes to investing.

Not only will it help you make smarter decisions with your money, but it will also help you save money and grow your wealth more consistently.

Here are some key things to remember to be a successful investor.

#1. Educate Yourself

The more you understand about investing, the more likely you will succeed.

We are all stretched for time, but investing isn’t complicated.

It sounds complicated because there is a ton of information out there.

Just know that most of them are selling you something.

Here are some links to some investing topics to get your education started:

- Read now: Find out the basics of investing

- Read now: Learn about the power of buy and hold investing

#2. Have A Plan

Having a plan when it comes to investing is critical to your success.

When times get tough (and they will), having a plan to remind yourself of why you are investing helps tremendously.

Start by investing your money in tax-advantaged investment accounts like 401k plans, a Traditional IRA, or a Roth IRA.

Then invest in a taxable account.

Investing in this manner will keep your taxes low, saving you money.

#3. Pay Attention To Costs

Your fees eat into your returns, much more than most think.

Understand how fees work and what you pay, not just today but over 30 or more years.

Also, look into mutual funds and ETFs as your core holdings.

By investing in suitable mutual funds, you can cut back on management costs by a lot.

Also, stay away from individual stocks, at least for now.

Investing in single stocks requires a lot more research and monitoring on your end.

Remember that all mutual funds and ETFs have professional management.

#4. Diversify

You can’t be invested 100% in stocks and think you will never lose money.

On the flip side, you can’t be invested 100% in bonds and think your money will grow enough to allow you to retire comfortably.

You need a mix of both and some other asset classes as well.

#5. Your Emotions Will Be Your Downfall

Almost every investor that fails does so because they give in to emotion.

They either get scared and sell when they shouldn’t, or they get greedy and buy when they shouldn’t.

Learn to control your emotions, use common sense, and you will see more success when it comes to investing.

#6. Focus On The Long-Term

Related to your emotions is your time horizon.

Most people look at the market over the short term, and the volatility scares them.

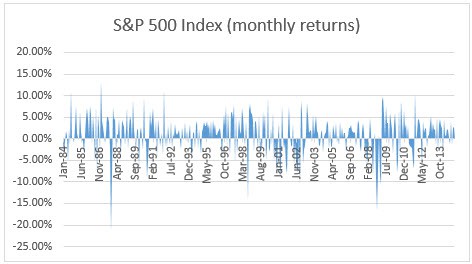

Look at the chart below as an example.

That is a lot of wild swings up and down.

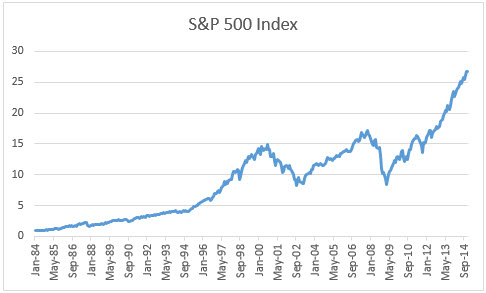

But if you pull back and look at things over the long term, you will see things aren’t so bad.

The market will be jumpy in the short term, but over the long term, the trend is positive.

Here is the same chart, looked at annually instead of monthly.

A lot less choppy.

Final Thoughts

I love Dave and the advice he gives listeners on how to get out of debt.

It is spot on.

But I disagree with Dave Ramsey’s investing philosophy.

It misleads people into thinking they can save less than they should because they can achieve higher returns that are not possible over the long term.

Furthermore, suppose you follow Dave Ramsey’s investing advice regarding your withdrawal rate. In that case, you will likely run out of money.

And the last thing you want to do at 85 years old is to have to go back into the workforce!

I highly recommend you follow Dave’s advice on getting out of debt.

But follow other advice when it comes to investing your money.

- Read now: Click here to see how to invest with a small amount of money

- Read now: Find out what target date funds are

- Read now: Discover index funds pros and cons

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Great breakdown Jon, I’m right there with you. The rate of return he preaches is bad enough, but when you throw #2 & #3 into the mix then the wheels absolutely fall off the bus. I can’t think of any instance where I’d recommend any type of load fund to someone – there are just too many options out there where investors can get a much better value and have that money work for them. I’m with him on most other things, but I’ll toss his investing advice.

I just don’t like how it is either a load fund or paying someone 1% to manage your money. There are tons of options in between that are cheaper and will meet the needs of most people.

I don’t think you should ever blindly follow someone else advice 100%, its always best to do you own research and homework. Coming up with a plan that works best for you.

I agree. The bad thing though is that many people do blindly follow the advice of people deemed to be “experts”.

Very timely article for me. My spouse and I are in steps 4,5&6 and have been using an elp for the past 5 months. When I dug into it the 5.5% commission was eating $55 for every $1000 invested like stated above, plus I was getting hammered at John Hancock for 1.71% in the fund I was in. Last night we took the steps to transfer to Vanguard and take charge of our wealth. While the elp was a nice guy, I can do the same thing he’s doing while keeping my $55 in my investment choice. Can’t be said enough, “Nobody will manage your money better than you!”

Awesome job Nate!! Sad to hear you spent so much money, but you learned from it and took action. That management fee on the John Hancock fund is crazy!

I just ran a quick scenario of $75K invested for 25 years. You would have paid over $100K in fees with the John Hancock fund – just the fund fee, not including the load. Now at Vanguard, assuming a 0.30% fee, you’ll pay under $25K. You just saved yourself $75K!!

I’ve never followed his advice, in fact I don’t know much about him at all – besides the fact that I know that most people that follow him have polarizing feelings. They either love him or hate him. But I agree with you about his investing assumptions, they aren’t very good. Assuming 12% returns….. Wouldn’t that be great.

I also have other opinions on some of his advice. While you can’t go wrong with paying off your house, I think that depends on more than just the fact that you have a mortgage. Personally my mortgage rate is pretty low and I believe the opportunity costs of keeping that tax deduction and putting the extra money towards investing and just needing to get returns that are greater than 3% are better than paying off my house.

I agree, Zee. There are personal variables that you need to take into account when dealing with your finances. It’s best to educate yourself and understand what makes the most sense for you and at the same time, understand what you are losing out on/giving up by doing it that way versus another way. If you are OK with that, then for you, it makes perfect sense.

It never hurts to get MORE information when building a financial plan. Listening to one expert is not enough……get info from more than one source, and figure out what is best for you. Great info, Jon!

DR is nothing more than a glorified salesman. Even his get out of debt plan is just common sense and has more or less been around for decades. I don’t like hoe he involves churches where hepays no money to the churches or to the “teachers” of his so called FPU. Beware of anyone who uses churches to make money. His investment advice is not advice but entials referring you to commissioned salesmen that put you into ripoff 5,75% front loaded mutual funds that totally underperform index funds. As a matter of fact, if you count survivorship bias (mutual funds that perform badly and are dissolved) the number of actively managed funds that beat index funds over the long term is close to zero (less than 1%)

Every investor is different on the type of financial advice they want – do they want to be self directed, enjoy the research and monitoring of the markets, or would they rather leave it in the hands of a professional? There are pros/cons to both, and one should determine what’s most important to them.

Think of it like working out – are you disciplined enough to solely rely on free at-home workouts? OR are you the personality type that gets value out of paid classes, gym memberships, or a professional certified personal trainer? (Or MAYBE you’re a little mix of both!)

Investors are not “one size fits all” and there plenty of folks that see the value in hiring a financial advisor to manage their wealth, create and maintain a comprehensive investment plan and help clients invest in a way that aligns with their goals and stay disciplined and focused.

I do not agree with DR’s investing advice (I am an advisor and a fiduciary, and the danger in his advice is glaring). A fee-based advisory relationship is not a good fit for those that want to do it and enjoy doing it themselves. BUT I think it’s important that if you are going to highlight the “drawbacks” of having a financial advisor, you should highlight the benefits, too.

Overall great post on something I don’t think is talked about enough! Thank you for sharing.

Dave, is an excellent motivator when it comes to getting out of debt. But that is where it ends. When it comes to his investing advice turn off the radio And/or close the book.