THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

There is a lot of talk about investing in index funds and passive investing in general.

Some experts say this is the best way to build wealth in the stock market for the average investor.

Others claim that you can do better.

So how do you know if index investing is right for you?

In this post, I discuss the 10 biggest index funds pros and cons.

By the time you finish reading, you will have a solid understanding if this investment approach is right for you.

Table of Contents

10 Must Know Index Funds Pros And Cons For Success

Index Funds Pros

There are a lot of benefits to index funds.

I am highlighting the 5 biggest advantages that will have an impact on your wealth.

#1. Low Fees

Index funds, both mutual funds and exchange traded funds, have historically been the lowest cost investments.

In both cases, a professional management team runs specific funds.

For a fund that is not tied to an index, the manager and their team research stocks and actively buy and sell holdings, trying to maximize the shareholder’s return.

Obviously the people doing this work want to be paid, and they are paid through management fees, also called the expense ratio.

This fee is taken directly from the annual return of the fund.

For example, if you invest in a mutual fund that charges a 1% fee and it earns 8% this year, you will have earned 7%.

Index funds also have a management team.

But the difference is the holdings in these funds are tied to the index they are copying.

There is not consistent buying and selling trying to maximize return.

The goal is to simply return what the underlying index earns.

As a result, the expenses charged by index funds are much less.

The average expense ratio active mutual funds charge is 0.76% whereas the average index fund charges 0.08%.

Here is how this impacts your ability to grow your wealth.

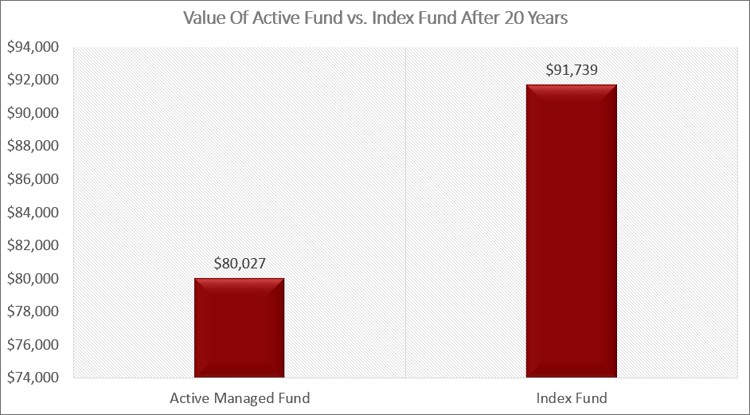

Let’s assume you invest $25,000 in both an active mutual fund and an index fund for 20 years and they both earn 8% annually.

At the end of the 20 years, the actively managed fund is worth $80,027.

The index fund is worth $91,739.

That is a difference of $11,712.

The lower fee allowed more of your money to stay invested and compound, which allowed it to grow into a larger ending balance.

#2. Steady Returns

The goal of passive index funds is to earn what the market earns.

While there are slight variations based on how the fund is built, most will return within 1% of the index they are tracking.

This is a benefit because you know you earn will closely match the performance of the market.

With actively managed mutual funds, you never know what your performance may be.

It is all dependent on how lucky the management team is.

Note that I use the term luck and not skill.

While fund managers are highly skilled, they still cannot control what the market does.

They can feel certain that a few stocks will grow in value but this may not materialize.

Even the most successful fund managers rarely beat the market on a regular basis.

As a result, the fund could have subpar returns even when the market does well.

To drive this point home further, in 2019 only 29% of actively managed fund managers beat the market.

This means you had a 70% chance of earning less than what the market did.

Put another way, if you invest in index funds, your money will grow more than if you invested in active management funds.

And you don’t get a reduction in the fee you pay when this happens.

Don’t make the mistake many others make thinking that a higher fee means better market performance.

The two are not related at all.

The bottom line is, index funds are a smarter investment for a long time horizon like retirement.

#3. Tax Efficient

Taxes have a major impact on your long term wealth with the stock market.

Some income, like bond income, is taxed at ordinary tax rates.

And while long term capital gains and dividends are charged a lower tax rate, the fact is you still have to pay taxes on these gains and income.

When you invest in actively managed funds, you will experience much higher amounts of capital gains on average.

This is because the managers are constantly buying and selling the underlying stocks.

With passive funds, managers are not doing a lot of selling.

As a result, the amount of capital gains you realize is much lower, saving you money on taxes.

#4. Simplicity Of Investing

Passive investing make investing in the stock market simple, even for new investors.

All you need to do is pick one or two indexes you want to invest in and find a corresponding fund.

There is no need for detailed analysis or the need to hire a financial advisor to keep an eye on your investment.

By investing in an index fund, you invest in a large number of stocks and you will know you will earn roughly what the market does, year in and year out.

This is perfect for new investors who can quickly become overwhelmed at the many different investing options.

You can get started investing with a relatively low level of risk, and then learn more as you go, knowing in the meantime your money is in a good investment.

#5. Convenience

If you invest in individual stocks, you need to buy a lot of different stocks to be diversified.

This results in you needing a lot of money.

The same can be said for many actively managed funds as well.

For example, if you invest in a large cap growth fund, you are only spreading your risk among larger, growing stocks.

But with an index fund, like the S&P 500 Index, you have a more diversified portfolio.

You not only own large, growing stocks, but also large stocks that are considered value stocks.

As a result, you can realistically be fully diversified in just 1 or 2 index funds.

So don’t think that by opting to invest this way you are limiting yourself.

Related to this point is there are numerous low cost index funds for you to choose from.

5 Cons Of Index Funds

Of course there are some big disadvantages of index funds.

Here are the biggest drawbacks you need to take into consideration before investing.

#1. No Flexibility

When the market is declining on a regular basis, many active managers will adjust some holdings to limit the losses you experience.

While they can never guarantee investors will never lose money, there are some options the manager can take.

For example, depending on the fund, they can shift money from equities to bonds.

Or they can sell some holdings and move the proceeds to cash for the time being.

With passive investing however, this is not the case.

The manager is tied to keeping holdings in line that best mimics the benchmarks they are tracking.

As a result, if the market is losing a lot, you are going to lose a lot as well, assuming you are investing in a fund tied to that index.

#2. No Large Gains

While it is nice to earn what the market returns, the fact of the matter is you will rarely ever experience an annual return of 30% or more when indexing the vast majority of time.

But with an active fund, you could see this return a lot more frequently.

Of course, you need to keep in mind the point mentioned above that active funds only beat the market 29% of the time.

And the reverse is true too.

When the market drops, an active investment could lose more money than the market, depending on its holdings.

#3. Risk Management

Index investing does not do a great job at risk management.

- Read now: Click here to learn your risk tolerance

What I mean is that the majority of indexes are made up of a specific criteria.

The S&P 500 consists of the largest 500 companies.

The Russell 2000 Index is made up of 2,000 small companies.

The Dow Jones is made up of just 30 companies.

If you invest in one of these index funds, you miss out on a lot of other opportunities.

For example, if you invest in an S&P 500 Index fund, you don’t invest in small companies or international companies.

In order to spread your risk, you need to invest in a few different funds or find a fund that invests in the total stock market.

And even with this approach, if you want to invest in both stocks and bonds, you might need to invest in a stock ETF and bond funds separately.

#4. Concentration of risk

Another issue with index investing is concentration of risk.

Some of the stock index funds are market cap weighted. All of the underlying stocks do not have equal weight.

Here is what this means.

Let’s say you buy a box of 64 crayons.

In the box, 25 crayons are blue, 15 are red, 10 are green, and the remaining 14 crayons are each a different color.

If you paid $10 for this box of crayons, one way to look at it is that since 39% of the crayons are blue, $3.90 of your money (39%) goes towards blue crayons.

Following this same logic, $2.34 buys red, $1.56 buys green, and the remaining colors are $0.16 each.

In an index fund, the same thing happens.

The majority of your money goes towards the largest holding in the index, concentrating your risk disproportionately.

#5. Lack Of Exposure To New Trends

This one is arguably the biggest drawback of index funds.

When you invest in these funds, you are stuck with the underlying funds that make up the index.

In the case of the S&P 500 Index, you are investing in 500 of the largest companies.

When new trends emerge, the companies tend to be smaller firms this investment doesn’t hold.

During the emergence of new trends is when most of the gains are made in the company stock.

So by investing in certain index funds you miss on these investment opportunities unless a larger company is involved or buys out the smaller company.

In other words, your portfolio lacks complete diversification if you only invest in an investment that only covers a certain sector of the market.

To overcome this, you would have to look at the various sectors of the market you want exposure to and then spread your money around those holdings.

Final Thoughts

At the end of the day, investing in index funds makes sense for the majority of individual investors out there.

The only people who it doesn’t make sense for are those who have a passion for researching stocks and actively trading.

But even then, there is no requirement that you have to pick one or the other.

You can split your investment dollars between actively managed funds and index funds.

This will allow you to get the benefits of both worlds.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.