THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

There are a lot of investing terms out there.

Some you can ignore while others are critical to investing success.

Two terms that must be understood by all investors is asset allocation and diversification.

The problem with these is they are very similar and as a result, many investors confuse the two.

But they both offer very important frameworks to investors.

In this post, I walk you through asset allocation vs. diversification so you can understand what each one means and why both are needed to be successful.

Table of Contents

Asset Allocation vs. Diversification

What Is Asset Allocation?

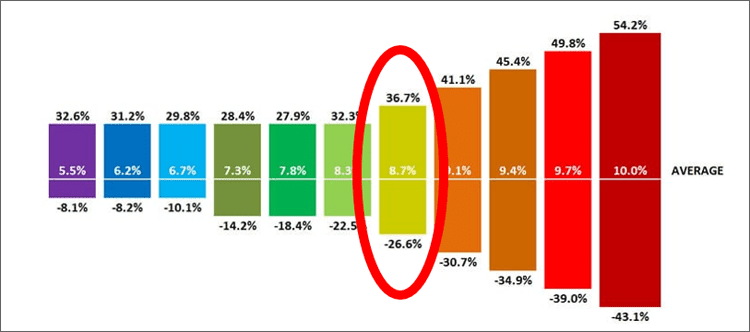

Asset allocation is investing your money into different asset classes into an investment mix that aligns with your risk tolerance and investing goals.

By picking investments based on your investment time horizon and your risk aversion, you can build a portfolio that grows in time and is able to balance risk and reward.

In basic terms, your asset allocation is your investment strategy.

A simple asset allocation strategy for an investor with a moderate tolerance for risk would be investing 60% of your money into stocks and 40% into bonds.

If you are an aggressive investor with a high risk tolerance, you might choose to invest in an 80% stock allocation and 20% bond allocation.

And if you are a conservative investor with a low risk tolerance, you might choose a target mix of 20% in stocks and 80% in bonds.

Over time, your risk tolerance may change and thus your original allocation will change as well.

It’s important to note that even market conditions over time will push your initial asset allocation out of sync, requiring you to rebalance your entire portfolio.

This is because asset classes earn different rates of return.

The stock asset class increases in value much faster than the bond asset class.

As a result, your original asset allocation mix will get out of alignment.

Rebalancing is critical to your investing success as having a mix of investments that doesn’t align with your investment risk can have a major impact.

This is because your portfolio might become too risky, causing you to lose more money than you are comfortable with.

Or it could become too conservative, causing you to not earn as much money as you need to.

What Is Diversification

Diversification involves taking the asset classes you identified and breaking them down into a more detailed mix of assets.

Doing this allows you to better manage risk, because your money is spread out among more asset classes.

Essentially, it is taking the idea of asset allocation one step further.

While it is important to know your risk tolerance and investing goals to determine an investment portfolio, your diversification strategy has you put your money into various asset classes.

So while your 60% stock and 40% bond portfolio is good, you need to pick specific stock and bond investments.

Diversification is this in action.

You determine how much of your stock portfolio is to be made up of U.S. large company stocks and U.S. small company stocks.

How much money should you put into domestic stocks or international emerging markets stocks?

How much is to be put into growth stocks or value stocks?

The same is true with the bond portion of your portfolio.

Are you investing in U.S. government bonds, municipal bonds, or corporate bonds?

Are you investing in short term bonds or long term bonds?

- Read now: Learn the pros and cons of large cap stocks

- Read now: Here are the pros and cons of small cap stocks

- Read now: Find out the pros and cons of muni bonds

Will you invest money into alternative investments like precious metals or real estate?

By taking your asset allocation one step further, you further reduce portfolio risk.

And this lower risk means the potential for smaller investment losses.

The easiest way for you to be diversified is to invest in a mutual fund or exchange traded fund.

This is because buying even one share means you are buying a partial share of thousands of companies.

As a result, you experience instant diversification.

Why Both Are Critical To Investing Success

Both diversification and asset allocation are critical to long term investing success.

You can’t have one without the other.

It’s one of the costly mistakes individual investors make when they only focus on one and not both.

Asset Allocation Without Diversification

For example, let’s say you determined your goals and risk and invested your money into a diversified portfolio of 70% stocks and 30% bonds.

But you skip diversification and put the 70% of your stock holdings in the small cap asset class and all 30% of your bond holdings in the long term government bond asset class.

While it is great you are investing based on your goals, because you are not diversifying your investments, you are taking on more risk as a result.

If the economy goes into recession, small cap stocks are going to get hit hard since they are higher risk investments compared to large cap stocks.

As a result, you would lose a lot of money.

Or if the economy is growing quickly, the Federal Reserve might start raising interest rates to cool things off.

When interest rates rise, your bond holdings could take a hit because investors will buy new bonds that come with a higher interest rate than your bonds.

In either case, you took a bigger hit to your investments than you needed to by not having an appropriate asset mix.

Diversification Without Asset Allocation

On the other hand, let’s say you skip figuring out your risk and goals.

But you do invest in a well diversified portfolio.

The problem here is you might have 90% of your money invested in stocks.

If there are wild market fluctuations, you might get scared because of how much money you are losing.

- Read now: Learn how to handle a volatile stock market

- Read now: Find out how to invest when you are scared of the stock market

To lower the potential risk of losing more money, you might sell everything you have left and put the money into a bank savings account as a result.

When the market takes off, you miss out on all the gains.

Because you didn’t take the time to understand your level of risk, you cost yourself a lot of money.

Building Your Investment Portfolio

At the end of the day, asset allocation and diversification go hand and hand.

Look at investing like a puzzle.

You need all the pieces to complete the puzzle and these are two of the pieces you need.

Can you sort of get by without one or the other?

You certainly can.

But you won’t have a complete picture and in terms of investing, you are putting yourself at risk, risk that you otherwise wouldn’t need to take.

The Easiest Way To Invest

While it sounds like a lot of work to make sure your investments meet your target allocation and to be well diversified, it really isn’t.

And thanks to mutual funds and exchange traded funds, you can quickly get it done.

In fact, you can be fully diversified with just 3 mutual funds or exchange traded funds.

All you need is the following:

- Total US Stock Market Fund

- Total International Stock Market Fund

- Total Bond Fund

With just these 3 investments, you are fully diversified.

This is because each mutual fund or exchange traded fund has holdings in all asset classes.

The stock funds have large cap stocks and small cap stocks, both growth and value.

The bond fund has government and corporate bonds, both short term and long term.

You don’t need to break things down any further.

All that is left for you to do is to determine your asset allocation.

And you can do this with a simple questionnaire.

Another option is to invest with a robo-advisor.

This investment broker will ask you questions about your level of risk and goals.

Based on your answers, they will assign you an asset allocation mix.

All that is left for you to do is set up a monthly investment.

From there, they invest your money in a diversified portfolio, reinvest dividends, and rebalance your holdings.

It’s completely hands-off for you.

The best robo-advisor is Betterment.

They are one of the first and continue to stand out among the field.

You can learn more by clicking the link below.

The bottom line is, don’t think the process of getting your investments right is hard.

It’s just a little work and then you can focus on other things.

Final Thoughts

There is the difference between asset allocation vs. diversification.

It is easy to get the two confused and think that because they have some similarities, you can only focus on one or the other.

You can’t, no matter what your financial situation is.

You need both in order to achieve your long term financial goals.

I encourage you to first take the time to understand the right asset allocation for your investment goals.

Then make sure you diversify your portfolio so you can minimize risk further and improve potential returns over time by staying invested in the market.

- Read now: Learn the benefits of buy and hold investing

- Read now: Discover the difference between market timing vs. time in the market

- Read now: Click here to learn how to invest with a small amount of money

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.