THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Tax savvy investors know that municipal bonds are a great way to diversify your investment portfolio.

In addition to offering tax benefits, muni bonds offer other advantages over other types of bonds.

However, this doesn’t mean that muni bonds come without risks.

In this post I share 10 pros and cons of municipal bonds to help you make an informed decision about whether or not this investment strategy is right for you!

Table of Contents

10 Big Pros And Cons Of Municipal Bonds

5 Pros Of Municipal Bonds

There are many positives by investing in municipal bonds.

Here are the biggest ones you should know.

#1. No Federal Income Tax

By far the biggest benefit of muni bonds is the interest they earn is free from Federal taxes.

This is huge because of the higher income tax brackets for Federal income taxes versus state income taxes.

If you were to invest in U.S. government bonds or corporate bonds, you would be paying Federal income tax on the interest you earn on these bonds.

Since munis avoid this tax, they can be a better investment.

The catch here though is you need to do a little math to determine if buying muni bonds make sense for you.

This is because the municipal bond yields tend to be lower than other bonds but since you don’t pay taxes on munis, you might come out ahead.

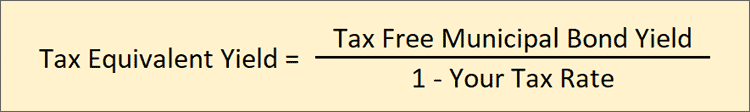

To better understand this, you have figure out the tax equivalent yield.

This formula will tell you the interest rate of a comparable taxable bond.

Here is the formula to use:

Start out by subtracting 1 from your tax rate.

If you are in the 25% tax bracket, this would be 1 – .25 which gets you .75.

Next take the muni bond yield and divide it by the above.

If the bond pays 3% interest, then 3 divided by .75 gets you 4%.

You would need to invest in a 4% taxable bond to get the same return as a 3% tax exempt bond.

#2. No State And Local Tax

While U.S. treasury bonds charge income tax on the Federal level, they do not charge tax on the state or local level.

But municipal bonds do.

The catch here is that this isn’t always the case.

In most cases, muni bonds are tax-exempt from state taxes if the investor buys bonds issued from their state.

For example, if you live in Maryland and you buy Maryland municipal bonds, there is no state income tax.

However, if you bought Maryland muni bonds and live in Virginia, then there is state income tax you owe.

Also note that if you live in Illinois, Iowa, Oklahoma, or Wisconsin, you will pay state income tax regardless if you buy in state muni bonds.

#3. Low Volatility

Since municipal bonds are low-risk investments, they also have relatively low volatility.

This means that you can typically expect your investment to fluctuate less than if you invested in stocks or other types of more risky investments.

Because the risk is lower with muni bonds, this could help decrease the overall fluctuations of your portfolio as a whole and help you stay on track for your financial goals.

By using municipal bonds to get your asset allocation correct, there is a greater chance you will stay invested for the long term, thus increasing the odds of success.

#4. Highly Liquid

If you need to access the money you put into your muni bond investments, it can be done easily.

There are many bond buyers on the secondary market looking to invest in individual munis, so there is no need to worry about getting money from your investment in a short period of time.

And if you invest in muni bond funds or municipal bond ETFs, the selling process is even easier.

You should be able to sell your investment within minutes and have the cash in a few days.

#5. Low Default Risk

Compared to corporate bonds, municipal bonds are a low risk investment.

And since they are backed by local and state governments, the actual default risk, or the risk of you never getting your money back, is low.

It isn’t as low as investing in treasury bonds, but it is close.

Understand that this doesn’t mean muni bonds are completely risk free.

As you will see shortly, there are plenty of risk associated with this type of investment.

5 Cons Of Municipal Bonds

You might think that muni bonds are the perfect investment option.

But they do have some drawbacks. Here are the ones you need to know.

#1. Interest Rate Risk

As with any bond in this asset class, you have the risk of changing interest rates.

When an individual bond is issued, it is assigned a fixed interest rate for the term of the bond.

If interest rates rise, the value of a previously issued bond will drop in value.

So if you try to sell your bond before it matures, you will lose money.

On the other hand, if interest rates drop, then a previously issued bond will go up in value.

If you decide to sell before it matures, then you will earn more money.

For example, let’s say you have a bond that is paying 5% interest and interest rates rise to 10%.

If municipal bond investors are looking to buy a bond, are they more likely to buy the one that is paying them 5% interest or 10% interest?

They will choose the 10% interest bond.

If you want to sell your 5% interest bond, you are going to have to lower the price of yours to find a buyer.

On the other end, if your bond has a 5% interest rate and the new bond rates are 2%, you are going to have a lot of bond investors looking to buy your bond if you decide to sell it.

Here the price of your bond will increase as a result.

It’s important to understand this concept so that you can limit any potential loss when investing in bonds.

#2. Might Not Beat Inflation

Since the interest rate of muni bonds is generally lower than other types of investments, it can be difficult to beat inflation.

When investing your money for long periods, you need at least some portion of it to outpace inflation if you are going to have any chance at increasing your net worth over time.

Therefore you have to find the right balance between the asset classes you invest in to match your risk tolerance and still achieve rate of return you need to earn.

However, if you are using an investment strategy that is meant to help protect your assets, then this drawback might not be a big issue for you.

For example, if inflation rises at about the same rate as interest rates on muni bonds, there won’t be much of a difference in real returns when compared with other investments.

But if inflation rises at a much faster rate than the interest rates on muni bonds, you might end up losing money.

It is important to look at how you will invest your money and compare that with the potential loss from rising inflation.

#3. Risk Of Default

As mentioned above, muni bonds are backed by local and state governments.

It may seem safe to invest in them because you are getting a steady stream of income from the interest on your investment.

However there is still risk that these municipalities and governments will not pay back their debts when it comes time for repayment or they might even fail completely.

This risk is called default risk or credit risk.

Understand this is rare, in fact much lower than 1% versus close to a 7% default rate risk for corporate bonds.

While there are some safeguards in place for municipal bond investors to get some of their principal back in the event of a default, it isn’t foolproof.

Because of this, you as an investor need to do your homework before investing in muni bonds, or any bond for that matter.

Ask yourself, is the company or local government stable, or could they go out of business?

How likely is it that these companies or local governments won’t be able to find enough revenue to make their bond payments?

#4. Not Tax Free

Many new investors confuse the tax exempt status of muni bonds with the idea they are tax free.

While the interest income you earn is free from Federal income tax and in most cases state and local taxes, you still may owe taxes on this investment.

In this case, I am talking about capital gains taxes.

If you sell a bond for greater than par value, or what the bond is worth when issues, you owe capital gains tax on the difference.

So if you bought a bond with a par value of $1,000 and sold it for $1,200 then you owe tax on the $200 gain you realized.

When it comes to capital losses, the math gets a little tricky as you have to amortize the premium over the term of the bond and adjust the capital loss accordingly.

Also, muni bonds have a de minimis rule, where a bond purchased for a minimum discount it is subject to capital gains tax and not ordinary income tax.

At the end of the day, if you are deciding to invest in municipal bonds, you need to understand the capital gains and tax implications aspect of this investment.

You might also want to consult with your investment advisor or accountant to make sure you are limiting any potential taxes you might owe.

#5. Call Risk

When a company or local government can pay back their debt early for whatever reason they choose to, this is referred to as being called by the issuer.

Typically, muni bonds don’t have any call provisions.

However, there are some that do and these special cases need to be considered before you buy the bond because it might affect your investment strategy.

This is because the call provision can affect bond prices if you decide to sell your bond early.

Also, the interest rate on these bonds might be different as a result of this increase in risk.

Final Thoughts

There are 10 pros and cons to municipal bonds.

At the end of the day, muni bonds are a good option for investors looking to complete their diversified portfolio.

They are also a smart investment option for high income taxpayers as they can avoid a higher tax bill with a tax exempt stream of income.

But there are risks when investing in muni bonds.

Make sure you do your homework before investing to ensure you are making the best decisions based on your financial situation and goals.

- Read now: Learn the importance of a diversified portfolio

- Read now: Here is how to rebalance your portfolio

- Read now: Click here for the best short term investments

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.