THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Having insurance is a must in today’s world. But what many people don’t realize is they are overpaying for insurance coverage.

If you have been with the same insurance provider for over one year, chances are you are paying too much! But how do you know if this is the case? In the past, insurance shopping meant contacting multiple insurance agencies to get quotes. Today you simply use Gabi insurance!

Gabi is an insurance comparison tool that provides up to 40 quotes in 2 minutes. All you have to do is pick the one you want and switch. The great part is the average user saves $961 a year when using Gabi. There is no reason not to try it!

In this review of Gabi insurance, I’ll critique every aspect of it to help you save money. Apart from its details, I’ll also discuss its alternatives.Don’t worry; you’ll learn every thing you need as this is being reviewed by the highest-rated reviewer!

Table of Contents

Gabi Insurance Review: The Fastest Way To Save Money

Gabi is an insurance comparison tool for gathering insurance rates quickly and easily.

While there are quite a few places where you can obtain insurance quotes for your home or your vehicles, it’s not a fast process.

Since most insurance agencies work with only one carrier, you would need to call five or six agents to get a handful of quotes. While you could reach out to an independent licensed insurance broker to get multiple quotes, it isn’t going to be fast. You are going to wait a few hours to a few days to get the comparison.

However, with Gabi, you only fill out one form and get your quotes back in minutes.

Since they are connected with more than 40 different insurance companies, you will be able to make a quick decision on how they stack up for your needs without the hassle of getting the information.

While many people shop around for an auto insurance quote, Gabi offers quotes on many types of insurance, including the following.

- Auto Insurance

- Homeowners Insurance

- Renters Insurance

- Landlord Insurance

- Umbrella Insurance

The bottom line is if you want to save money on insurance, Gabi is the tool you need to use.

How Does It Work?

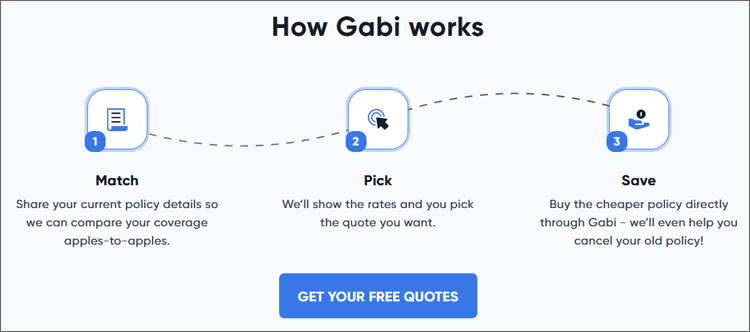

The entire process of working with Gabi is as easy as it can get.You begin by creating an account and providing basic information about yourself, like your name, birth date, home address, email address, and phone number.

Next, you simply share your current insurance policy, and they will work behind the scenes comparing your policy to up to 40 other insurance companies.

In two minutes, you will see the various rates and can pick the one you like best.

Finally, you will be asked a few follow-up questions to ensure the quote is accurate.

If you decide to move forward with the cheapest or cheaper policy, you buy it through Gabi. When you want to switch, just click the button, and you can pay with your credit card to activate your new policy.

The process takes you a couple of minutes in total and you don’t have to worry about getting the wrong policy. You are comparing the same coverage of what you currently have. However, you can also change coverage options to better fit your current lifestyle.

This can also open the door for more potential discounts as well.

Once your new policy is in place, you will contact the new insurance provider if you have a claim. When it comes to canceling your policy with your current insurer when you switch, Gabi will help you contact your current insurance company to cancel.

Also, even if you don’t currently have insurance coverage, Gabi can still work for you. You won’t be able to compare rates since you don’t have a policy but you will see the cheapest insurance option based on what it has found.

Advantages and Drawbacks

There are several pros and cons to using this method to find insurance for your vehicles and your home. I lay out the biggest for each below.

Advantages

Fast And Convenient. Since you get quotes online, you can do it any time of day or night. The quoting process only takes a few minutes to get your current policy to Gabi and even faster to get your free quotes.

No Pressure. When you call an insurance agent for a quote, some will call you back on a regular basis asking if you want to switch. With Gabi, if you don’t like what you see, there is no pressure or obligation to move forward.

Savings. I mentioned it before, but the average Gabi user saves over $950 a year on their insurance!

Multiple Quote Options. If you decide to switch, you have the option of doing it online by yourself or by calling or texting with an agent to guide you.

Multiple Insurance Products. You can use Gabi for your auto insurance policy, home, landlord, renters or umbrella insurance quotes. Some other comparison tools only allow for auto and home quotes.

Licenses In 50 States. This something many people overlook. Some insurance companies are only licensed in some states. And some comparison tools aren’t applicable to people living in certain states. Gabi works in all 50 states.

Drawbacks

As great as Gabi is, there are some drawbacks.

Here are the biggest to be aware of.

Insurance Broker, Not Provider. Gabi is simply an online insurance broker to get quotes. Once you switch coverage, you will no longer be working with Gabi, but with your new provider.

More Insurance Companies. Gabi offers quotes from up to 40 different insurance providers. But there are more out there that could potentially offer a lower rate. However, the chances are small given the large number of quotes you will get.

Quote Delay. For fastest quotes, you connect your current policy with Gabi. However, if you upload a copy of your current policy, it could take up to a day to receive your quotes.

Alternatives to Gabi

You can find some other options besides Gabi below:

Jerry AI

Jerry AI is very similar to Gabi in the way it works.

The main differences are as follows.

- Jerry will compare up to 45 quotes but only show you the best 6-8 to pick from.

- It will auto shop your coverage every year, so you will always be paying the lowest premiums possible.

- Finally, Jerry only offers quotes on auto, homeowner, and renter policies.

The Zebra

The Zebra offers multiple insurance quotes quickly for you to compare. The biggest difference, or as I perceive, drawback, is how the comparison works.

It groups insurance coverage into buckets as Minimal, Basic, Better, and Best. There is also no customization of your quote to get one that fits your needs and lifestyle.

However, it offers quotes on many lines of insurance, including RV, life, boat, motorcycle, and motor home insurances in addition to auto, home, and renters insurances.

Final Thoughts

Shopping for insurance is a hassle but Gabi makes it easy and fast, which is why there is no good reason not to get free quotes using it!

There is no obligation or pressure to switch, so you can try it out just to see how much money you could save. Chances are, you will be astonished by how much you overpay for insurance.

I encourage you to take some time out of your schedule and give Gabi a try. In just a few minutes, you could save yourself close to $1,000!

Click the link below to see how much money you will save.

- Read now: Click here to learn over 100 ways to save money

- Read now: Learn the best trick to negotiate a car and save thousands

- Read now: Click to find out why hybrids don’t save you money

- Read now: Learn how to slash your monthly expenses fast

If you have any questions or concerns, reach out at contact@moneysmartguides.com. Alternatively, you can find MoneySmartGuides on Facebook, Twitter, and Pinterest.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.