THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

The 50/30/20 rule is a budget system that assigns your spending into one of three basic buckets.

It’s a great option not only for those new to budgeting, but also those who don’t want to spend a lot of time with a detailed budget.

In this post, I will walk you through everything you need to know about the 50/30/20 budget rule, how it works, and the advantages and drawbacks of it.

Table of Contents

How To Use The 50/30/20 Rule For Financial Health

What Is The 50/30/20 Rule?

Whereas some may seek to know intricate details of their spending habits, such as through zero-base budgeting, others may choose to employ incremental budgeting using the 50/30/20 rule.

Put simply, the 50/30/20 rule budget helps individuals split their money across specific categories so that they’re using their funds most effectively for their needs.

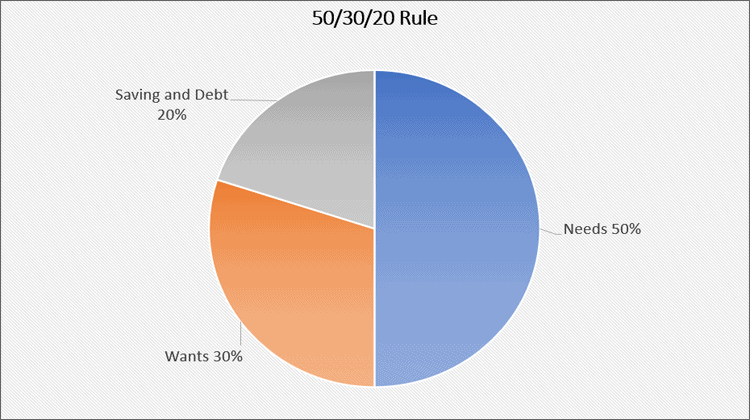

More specifically, this budget states that you should be spending 50% of your income on needs, 30% on wants, and 20% on saving and debt.

As it is with most budgets, incremental budgets are designed to help you be more responsible with your money while still being able to have fun and save some of your money in the process.

How To Use The 50/30/20 Rule

Getting started with the 50/30/20 budget to improve your financial situation is quite simple as the budget’s name defines its purpose upfront.

Here are the steps to follow to make this budget work.

#1. Calculate Your Monthly Income

Your income is the foundation of your budget.

When you are calculating your income, be certain to work on your net income and not your gross income.

- Read now: Click here to learn how much $20 an hour is annually

- Read now: Find out how much $15 an hour annually is

Your net income is what you are paid after taxes, insurance premiums, and retirement contributions are taken from your paycheck.

In other words, it is your monthly take-home pay, or if you use direct deposit, it is the amount that gets deposited into your checking account.

For most people, this is all you will use for income in your budget.

Of course if you are married, you would use both yours and your partners income.

If you work a side hustle and use the money to get by, pay off debt or build your savings, you will include this income as well.

Most people should not include dividends or interest payments unless you live off this income.

#2. Determine Your Needs

The biggest difference with this budget vs. other types of budgets is that you don’t need to create specific categories to track your spending.

Instead you lump all of your needs into one bucket.

What are needs when it comes to your budget?

These are essential expenses you need in order to survive.

So things like your rent or mortgage payments, the money you spend on groceries to feed your family, car expenses to get to and from work, basic clothing needs, utilities, etc.

- Read now: Find out how to spend less on groceries

Understand that needs are the things you absolutely need to survive.

In this case, your cable bill is not a need as you don’t need it to survive.

As you can see, in order to get this budget to work, you need to be honest in your assessment of needs vs. wants.

#3. Determine Your Wants

Your wants category covers things like entertainment subscriptions, going out money, gym memberships, cash for dining out, and similar things.

In other words, this is discretionary spending, or you do not need in order to survive.

#4. Identify Your Debt And Savings Goals

It’s important to remember that this bucket will cover things like building your emergency fund to cover unexpected expenses, your regular savings account, retirement savings, and any investments that you may choose to put money into.

- Read now: Click here to learn the pros and cons of multiple bank accounts

- Read now: Find out why Dave Ramsey recommends sinking funds

It will also include your debt repayments like car payments, student loan debt, and credit card debt.

This bucket will be the one you have to do some math on if you have debt because you need to pay off your debt to get ahead financially as well as actively save money every month.

#5. Make Any Necessary Changes

If you have variable income, chances are you’re going to need to make alterations to your budget every now and again to make sure that this budgeting method is working in your favor.

Otherwise, your buckets will be way off and it will be a lot harder to figure out how to get everything back in line.

Advantages And Drawbacks

Every budget comes with benefits and disadvantages.

Some of the advantages that come with using this budget include the following.

Advantages

Meets all your needs. Without a budget, making sure that you’re using your available income to meet all of your needs can seem near impossible, especially when it comes to saving money.

With the 50/30/20 budget, you can make sure that you’re paying for all of your essentials while still having some extra money left over to use on yourself as well as store away for a rainy day or invest over time to build your wealth.

Having dedicated spending criteria. When using a budget like the zero-base budget, you have to assign spending categories for every single expense you want to use your money towards, which can be confusing and time-consuming.

If you want a general framework that gives you what you need to specify your monthly expenses later rather than having to think of everything off the top of your head, the 50/30/20 rule may be the best budgeting tactic for you.

Makes the budgeting process easier. Some budgets can be hard for people to use because they may not have used a budget in the past or the thought of budgeting overwhelms them.

The 50/30/20 budgeting rule is a great starting point and is friendly to those who are familiar with budgeting as well as those who have just started using a budget for financial purposes.

Makes you think: This budget plan makes you think about your lifestyle choices more than other budgets.

This is because you can only put your expenses into the needs or wants categories.

Instead of just accepting all your spending, you are forced to consider if an expense, say your cell phone, is a need or a want.

And if it is a want, is it really needed.

Drawbacks

Here are the biggest downsides of this budget method.

Not for everyone. Arguably the biggest disadvantage of the 50/30/20 rule is that it’s not going to work for everyone and all incomes.

For those without a steady paycheck, it can be hard to follow this budget.

Likewise, if you live in a very high cost of living area, you might find that your needs are much more than 50% of your income.

Not for those with lots of debt. If you are in a lot of debt, it can be tricky to use this budget.

This is because most of your 20% bucket will go towards debt repayment, leaving little to nothing to put towards savings.

And if you have a lot of debt, including student loans, you might find that your debt repayments alone are more than 20% of your income.

Lack of detail. Unlike other budgets where you are categorizing every expense, you don’t this with the 50/30/20 budget.

As a result, if you find your wants are making up more than 30% of your spending, you won’t know what spending is causing this.

Are you eating out too much? Spending too much money on entertainment?

Alternatives To The 50/30/20 Rule

If you are interested in budgeting but aren’t convinced this is the budget for you, fear not.

There are a lot of other budgets out there for you to consider.

While the post above walks you through a handful, here are a couple that might be better options.

Zero Base Budget

The zero base budget or zero sum budget, has you assign every dollar you earn with an expense you have.

The goal is to zero out your budget, so that all your income is going towards your living expenses.

Note that it doesn’t mean you end the month with zero dollars in your checking account.

It simply means you give every dollar a job.

It’s a good option for beginners and helps you better understand where your money is going.

Priorities Based Budget

The priorities based budget has you list your expenses based on importance to you.

You start off listing your absolute basic needs, like food, shelter and utilities and subtract these expenses from your income.

Then you list out the remaining expenses you have.

At the top is the most important expense, then the next most importance and so on.

You then assign a spending amount to each and adjust the numbers until you give every dollar you earn a job.

Custom 50/30/20 Budget

There isn’t a name for this type of budget that I am aware of, so I am calling it the custom 50/30/20 budgeting system.

It’s the one I currently use and it meets my needs.

It’s based off the 50/30/20 rule but is a little different.

We take 10% of our money for charity or tithing and 20% for savings.

If we had debt, it would be included in the 30% savings bucket.

The remaining 60% is for all of our expenses.

We are free to spend 60% of our income however we like, as long as we don’t go into debt.

I do make it a point to write down and categorize all of our expenses, but only because I want to know this information.

It is not required.

The reason I love this version is we don’t have to worry about spending buckets or if a shirt my wife wants is a need or a want.

And since we are putting 30% into savings, we know we are moving towards our financial goals.

Final Thoughts

There is a detailed overview of how the 50/30/20 budget works.

It is a budget I recommend for most people just starting out, as it is a simple way to budget without getting caught up in the time consuming task of categorizing expenses.

But, it isn’t perfect and it’s not for everyone.

As long as you have an open mind, you can tweak it to fit your needs or find a better budgeting solution that is a better fit for you.

- Read now: Learn the best ways to lower your monthly bills

- Read now: Discover 100 ways to save money today

- Read now: Click here for 17 good money habits you need to develop

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.