THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Are you looking to increase your net worth over the long-term by investing?

With so many investment options out there, it can be hard to know where to start.

Long term investing is often a smart choice when done strategically, as it allows for more time for your money to grow.

In this blog post, we’ll explore some of the best types of long term investments available and how they could potentially help you reach financial success.

The key for you is to choose the ones that make the most sense for your strategy and risk tolerance.

KEY POINTS

Table of Contents

Appropriate Use of Long Term Investments

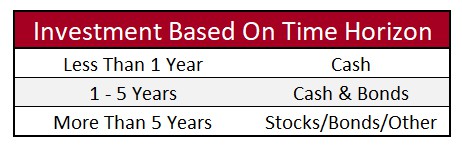

Before I get into talking about the various long-term investing choices, you need to understand what exactly your time horizon is.

Below is a little chart for your reference:

As you can see from the chart, if your time horizon is 5 years or less, we recommend short-term investments.

On the other hand, if your time horizon is longer than 5 years, long term investments are the way to go.

The reason is simple.

There is too much risk of losing money with a long term investment over the short term.

The stock market could enter into a correction, the economy could go into recession, or another geo-political event could have your investments fall in value.

Make sure you take investment decisions that make the most sense for your financial goals.

With that said, let’s get into the various long term investment strategies you can put your money in.

Knowing The Right Long Term Investing Choices

Once you choose between the short-term and long-term options, you need to consider your risk tolerance.

Make sure you invest based on how much risk you are willing to accept.

If you fear losing money, you should be investing with a larger bond allocation.

On the other hand, if you are comfortable with the movement of the market, consider individual stocks or a stock fund, as this will provide you with the capital appreciation that you desire.

It is critical that you build your investment portfolio based on your goals and level of risk.

Taking on too much or too little risk can mean disaster for your wealth.

15 Types of Long Term Investments

Let’s discuss everything you need to know about the 15 types of long term investments.

#1. Stocks

Stocks are equities, and when you own a share of stock, you own a piece of the company.

In the long term, an average investor can expect to earn an annual rate of return of roughly 7-8% from stocks.

This is excellent for building long-term wealth. However, the problem that most investors have with stocks is that they allow their emotions to influence their decisions and end up buying and selling frequently.

This is not ideal because, as I just mentioned, stocks are for the long term.

When you trade frequently, you are essentially turning them into a short-term investment, and when you do this, you greatly increase the chance of losing money.

Also, while investing in stocks, you need to know there are different asset classes.

Some are riskier investments compared to others, so it is important you do your research and choose investments that make sense for you.

Stocks are broken down by market capitalization first, so you have large-cap stocks and small-cap stocks.

- Read now: Learn the pros and cons of large-cap stocks

- Read now: See the pros and cons of small-cap stocks

There are mid-cap stocks too, which fall in between large and small.

From there, stocks are broken down further.

Here is a brief overview of some of the investment options you have.

- Growth stocks are companies that are growing revenues, and because of this, the stock prices appreciate in value more rapidly.

- Value stocks are at the other end of the spectrum. They are slow-growing, mature companies whose stock price doesn’t grow as quickly.

- Dividend stocks are stocks that pay dividends to shareholders. Companies that pay dividends believe that returning money to shareholders is a better use of revenue than reinvesting back into the business.

#2. Mutual Funds

Mutual funds are baskets of stocks or bonds or a combination of the two.

As a result, you can invest in stock funds, bond funds, or a balanced one, which is a percentage of both funds.

The reason you invest in these, as opposed to individual stocks, is two-fold.

First, it is more cost-effective for a purchaser to own a mutual fund.

You can buy thousands of companies with a $100 investment through a mutual fund, whereas that same $100 would only buy you a few shares of stock in one company.

- Read now: Learn the basics of mutual funds

Second, you are instantly diversified with mutual funds.

By owning multiple companies, you lower some of your risk as an investor.

In fact, having a diversified portfolio is a key ingredient of any financial plan.

- Read now: See the power of a diversified portfolio

Thanks to the benefits mutual funds provide, these are a very popular investment choice.

You can invest a small amount of money and remove some of the risks that come from investing too heavily in one company.

Of course, there are downsides to mutual funds, but these are still one of the best options for an average investor.

- Read now: See why VTSAX is a good investment

#3. Exchange-Traded Funds

Exchange-traded funds, or ETFs, are very similar to mutual funds.

The main difference is that you can trade ETFs throughout the day, whereas with a mutual fund, you get the day’s closing price, regardless of when you buy or sell during the day.

Another benefit is tax efficiency.

The investment fees you pay are traditionally the lowest in the industry, and they rarely pass capital gains to their investors.

Finally, most ETFs are index funds, meaning they are passively managed that track underlying indexes.

This means the investment fees you pay are lower than average, allowing more of your money to compound over time.

#4. Municipal Bonds

Municipalities have all sorts of projects they need to undertake, but they often don’t have enough money for all of them.

So, they will issue bonds to raise the cash and, in return, pay out interest to the owner of the bond.

Typically the term for municipal bonds runs anywhere from 10 years to 30 years.

Due to this, they make good long term investments.

A benefit of muni bonds is that the income you earn is usually tax-free in the state in which you reside.

By keeping more after-tax money, you are earning a higher than the stated return on the bond.

However, there is a risk of changing interest rates.

For example, let’s say you own a bond that pays you 4% interest.

Five years later, new bonds may be issued that pay 8% interest.

Obviously, you want to earn 8%, not 4%, but you are locked into the 4% that your bond is paying.

Your only options are to hold the bond or sell it.

If you sell the bond, you will get less for it because its demand will be low.

After all, nobody will pay full price for a bond that only earns 4% when they can get a bond that pays 8%.

#5. Treasury Bonds

Treasury bonds are bonds issued by the U.S. government.

Since the odds of the U.S. government defaulting on its bonds are low, the interest you earn from these bonds is also low.

However, I cannot overlook one great benefit of these bonds, which is their tax treatment.

Since these are issued by the federal government, you do not pay federal income tax on the interest you earn.

Depending on the state you live in, the interest may be taxable on your state tax return.

#6. Corporate Bonds

Corporate bonds are debt instruments a business uses to finance the need for more equipment, inventory, and more.

Since they carry more risk compared to government bonds, they pay a higher interest rate.

However, investing in high-quality corporate bonds are a great way to earn a good return.

#7. Inflation-Protected Securities (TIPS)

An inflation-protected security, or TIP, is also a bond.

However, instead of just paying a set rate of interest, you also earn an additional interest adjustment based on inflation.

Every 6 months, an inflation adjustment is made based on where inflation stands.

This feature allows for a reduction in the interest risk that you assume with owning bonds, which also lowers the risk of having the bond fall significantly in value.

- Read now: Discover the impact of inflation

Of course, since these are fixed-income investments, don’t expect to get a large interest rate overall.

#8. Savings Bonds

Back in the day, grandparents used to give savings bonds to their grandchildren at Christmas.

However, nowadays, that isn’t very common.

The term for savings bonds is 30 years, but you can redeem them earlier as well.

However, depending on when you redeem them, you may have to pay a penalty of 3 months’ interest.

#9. Real Estate

A real estate investment is a good choice for a few reasons.

First, the real estate market tends to be fairly stable, which means you will see a positive return on your investment most years.

Also, depending on how you invest in real estate, you can turn your investment trusts into a passive income source.

- Read now: Here are the pros and cons of real estate investing

- Read now: Learn the BRRRR method to invest in real estate

Of course, there are some drawbacks of real estate too. The biggest is the cost.

To buy a house or apartment complex to rent out, you are going to need a serious amount of money for the down payment alone.

One way to get around this is with real estate crowdfunding.

Pool your money together with multiple investors to buy a property.

You then earn monthly income from the rent and the long-term capital gain when you sell in line with your ownership percentage.

My favorite crowdfunding platform is called Arrived Homes, as it makes getting into rental real estate simple and fast.

Looking for an easy way to get started investing in real estate without a lot of money? Look into Arrived Homes. Pick the single family houses in the parts of the country you want to invest in and earn passive income.

#10. Tax-Sheltered Retirement Plans

When investing your money for the long term, a smart place to put your investments is in retirement plans.

A retirement account offers special tax benefits, helping you build your wealth.

For example, a traditional IRA allows your money to grow tax-deferred until you withdraw it during your retirement.

A Roth IRA, on the other hand, has your money grow tax-free, which means that you do not pay taxes when withdrawing the money.

Here is a short list of the various types of retirement plans you can invest in.

- 401k

- 403b

- Traditional IRA

- Roth IRA

- Solo 401k

- SEP IRA

- Simple IRA

- TSP

Depending on your income, tax situation, and goals, use one or a combination of these accounts to save for retirement.

#11. Life Insurance

For the majority of people, life insurance is not an investment but a way to lower the risk of dying prematurely.

However, for high-net-income wage earners, life insurance can make sense as an investment strategy.

This is because as your cash value builds up, you can take the money out as a loan, and enjoy its other benefits.

You don’t have to repay this money, as you can opt for the amount you own to reduce your death benefit.

#12. Annuities

Annuities are another long term investment option for some investors.

While I am not a fan of most annuities, simply because of the high fees, a few are worth considering.

- Fixed Indexed Annuity

- Fixed Annuity

- Deferred Income Annuity

All of these offer fixed interest rates, and the value of your annuity cannot go down.

This makes them a possible option for an income stream while retired, so I would only recommend these for seniors.

If you are younger, you are better off investing your money into a stock fund and a bond fund and riding out the potential stock market volatility over time.

- Read now: Learn more about annuities

As you near retirement, think about changing your asset allocation to more bond funds to reduce risk.

#13. Alternative Investments

Alternative investments are investments outside of stocks, bonds, and real estate.

These are typically made up of oil, gas, and precious metals and can be very volatile over time.

Just look back to 2005-2007 as an example; every time a hurricane or tropical storm entered the Gulf of Mexico, the price of a barrel of oil shot up a few dollars.

- Read now: Learn how to invest in farmland

When I say oil and gas, I mean the actual commodity.

This doesn’t apply to those owing stocks of large-cap companies like Exxon or BP, even though they are oil and gas companies.

#14. Certificates of Deposit

Bank CDs are a better pick for a short-term investor, along with a high-yield savings account, and these could be great long term investments in the right economy.

For example, as long as inflation is in check, and if a bank CD or high-yield savings account has interest rates above 4%, you can grow your wealth with very little risk.

For this investing strategy to work long-term, you want to take out as long of a duration bank CD as you can because you lock in the interest rate for the life of the investment.

I don’t suggest you lock up all your money, but a portion of it invested this way could be a smart move.

#15. Cryptocurrency

An article about long-term investing wouldn’t be complete without including cryptocurrency.

This newer asset class tends to be very volatile, which is why you should not try to trade it in the short term.

For example, over the best few years, the value of Bitcoin has gone from $15,000 up to $60,000 and back down to $20,000.

Trying to time this asset to get the best purchase price would be a difficult task.

With that said, if you can handle riding out the market swings, investing a small portion of your money in cryptocurrency could be a smart move.

Frequently Asked Questions

Is Bitcoin a good choice for investing your money?

Bitcoin is a risky investment with very high volatility.

You should consider investing in it only if you are financially strong, can manage to lose some money, and have a high risk tolerance.

What is the 72 rule in stocks?

The 72 rule in stocks is a simple way to calculate how long your money will take to double.

Divide the number 72 by the interest rate you’re hoping to earn, and you’ll get the approximate number of years taken to double your investment.

Final Thoughts

Overall, there are several great types of long term investments to consider.

A long-term investor has to find the asset allocation that balances the growth of their money while taking into account their risk tolerance.

If you can build a diversified portfolio that does this, stick with it as long as possible since this will provide a nest egg to fully fund your financial future.

- Read now: Learn the difference between active vs. passive investing

- Read now: Use these investing basics to get ahead

- Read now: Here are the best medium risk investments

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Great overview Jon.

You are exactly right on emotions and stocks – they don’t mix at all and can create real problems for investors if they don’t check their emotions at the door when investing for the long term.

Yup…if you look at why people fail at investing, the overwhelming number of times is because of emotion. You have to get them in check if you ever want to be successful with investing.

Great overview of all long term investments. It should be noted by investors that all investments arent good all the time and people should pick what they are comfortable and understand well. Each investment comes with its own risk/reward.

cheers

R2R

Great point! Thanks for adding that.

Great list of long-term investments. Thanks for sharing those!