THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Ask a handful of people for a great way to build wealth and many will say real estate.

This is true.

Investing in real estate is a great way to build wealth.

But as I’ve read books about wealth building, some of the smartest people talk about investing in land.

Their argument is land is a finite resource.

We can’t create more of it, so the value of it is only going to increase in time.

Now there are various ways you can invest in land.

You can find empty lots around your area and buy them.

The only downside is you have no income while you own it. You only see a return on your investment when you sell it.

A solution is to invest in farmland.

Yes, you can invest in farmland and FarmTogether is a platform that allows accredited investors to do this.

In this post, I will give a full review of FarmTogether so you can see this investment option makes sense for you.

Table of Contents

My Complete Farm Together Review

What Is FarmTogether?

At its roots, FarmTogether is a real estate crowdfunding platform.

This is a fancy way of saying individual investors pool their money together to buy farmland.

Your ownership is based on the size of your investment and the total investment.

For example, if you invest $10,000 into a $1 million dollar investment, your fractional shares equal 1% of the investment.

The business was started in 2017, though the management team has over 70 years of combined experience investing in real estate and agriculture.

You can check out the infographic below for more details on why investing in farmland makes sense.

How Does It Work?

Investing with FarmTogether starts with an initial offering.

Here the company will list an offering on their website for investors to learn about and invest in.

Currently, there is an offering for an almond farm in California.

You can click here to learn more about it.

Minimum investments in an offering vary, but usually are between $10,000 and $50,000.

On the opportunities page of an investment offer, you will see a brief overview of the investment, as well as some key metrics.

- Offering size: The total size of the investment opportunity.

- Remaining: The amount of the investment that is still available to invest in.

- Target IRR: The internal rate of return is an estimate of your potential return.

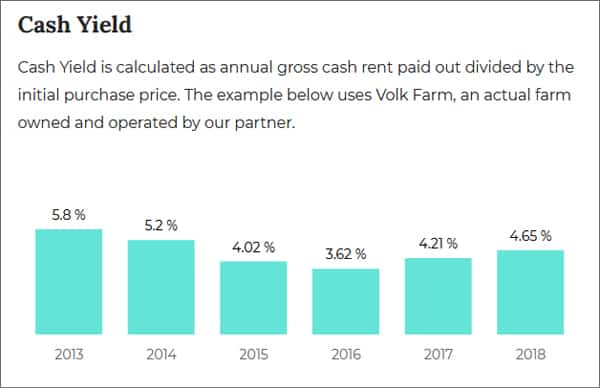

- Cash Yield: The estimated return on the annual distribution the investment produces.

- Target Hold: This is how long FarmTogether plans to hold the property before selling. Once it is sold is when you would get you initial investment back along with any gains from price appreciation.

If you see an investment offer that interests you, you create a free account to get more details.

And honestly, even if you don’t see an offer that interests you, but investing in farmland is something you want to do, create a free account anyways.

This will save you the time of doing this when an offer does come along.

The other benefit registering is you can learn more details about current offers so you can better educate yourself.

If you do find you are interested in an offer, here is where you will be vetted to ensure you are an accredited investor.

Once the offering is closed and the investment is made, you can begin collecting distributions from the investment.

Distributions are based off the harvest sale schedule and occur quarterly or annually, depending on the investment.

For most offerings, you are looking at a cash yield of between 3-9%.

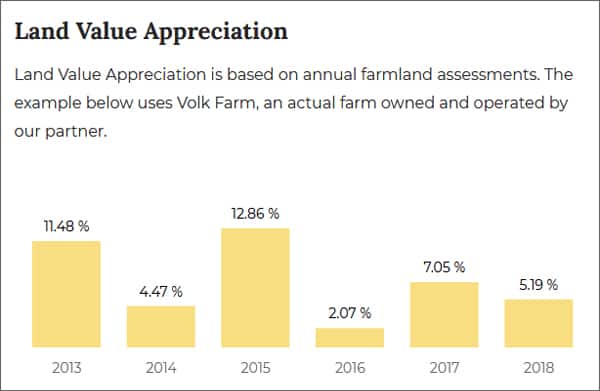

In addition to the annual distributions, you also get a percent of the gain on the sale of the land.

The amount you gain is based on your ownership interest.

Advantages And Drawbacks

Advantages

There are a handful of advantages investing with FarmTogether. Here are the biggest in my opinion.

Alternative investment. Investing in land is a great way to diversify your investments.

High potential return. Over the past 30 years, investing in farmland has averaged roughly an 11% return.

Possible investments for non-accredited investors. The company says it is working on new opportunities for non-accredited investors to invest in.

Excellent resources. While not specifically related to your investment, the website has a great library of information on agriculture investing for you to learn about.

Great long term investment. Over the past 30 years, no investment class has outperformed the return of farmland.

Partnership. All the investments that FarmTogether lists, they also invest in. So they are putting their money own into each investment.

Drawbacks

Of course, there are drawbacks as well. Here are the ones you need to be aware of.

Must be accredited investor. This is a requirement of the government, not FarmTogether and limits the potential investor pool.

High minimum investment. Again, this limits the potential of lower income investors looking for different ways to diversify their portfolio.

Limited track record. FarmTogether is a relatively new investment platform. Therefore, there is risk with investing in it.

Frequently Asked Questions

I get asked a lot about investing in land and FarmTogether in general.

Here are the most common questions.

Is my money safe?

Yes and no.

Understand that FarmTogether is a registered company with the Securities And Exchange Commission, so the investment opportunity is not a scam.

Here is a link to their ADV form.

With that said, as with any investment, you do run the risk of losing money.

However, FarmTogether invests in all of the opportunities it lists.

In other words, the investor pool is not 100% outside investors. FarmTogether has skin in the game.

Also understand that investing in real estate is an illiquid investment.

Most real estate crowdfunding opportunities require you keep your money invested for 10 years or longer.

Are there any fees?

Yes.

The fees vary by investment opportunity but in most cases involve both an origination fee and an annual fee.

In some cases, there is also a fee on the gain from the sale of the investment.

This would be disclosed in the investment details after creating your free account.

FarmTogether states that they aim to keep lower than the industry average, which in most cases should be under 2% for the annual fee.

Who can invest?

Not anyone can invest with FarmTogether.

You need to be an accredited investor, which means you have to meet one of the following criteria.

- Earned income that exceeds $200,000 in each of the prior two years, and reasonably expects the same income for the current year. For married couples investing with a spouse, the income limit is $300,000.

- Have a net worth of more than $1 million dollars, either alone or with a spouse. This excludes the value of your primary residence.

Remember, you only have to meet one of these criteria to be able to invest with FarmTogether.

Why should I invest in farmland?

There are many reasons why investing in this asset class makes sense.

First off, it is relatively stable.

The value of farmland rarely goes down like the stock market or even commercial real estate.

This is because farms produce food for people to eat.

The next reason to invest in farmland is as an inflation hedge.

As the cost of food prices goes up, the price of the land rises as well.

Finally, there is the yield or income you get from the land.

In addition to the income from selling crops, farms also lease out their land to hunters, billboard companies, renewable energy companies, and more.

This provides a steady stream of income all year long.

Is farmland a good investment?

Historically farmland is an excellent investment.

Since 1999, farmland has a negative return in only one quarter.

Additionally, it does not have the wild swings of the stock market. It tends to be a steady solid investment option.

Finally, the yield on farmland, the annual distributions earned, averages over 4% over a 10 year period.

A US government bond during this same period as a yield of 1.92%.

Final Thoughts

At the end of the day, investing in farmland is not only a great way to diversify your portfolio, but you also get a strong return on your investment.

While FarmTogether is a new player in this industry, its management team has over 70 years worth of experience in the industry.

This doesn’t ensure that the company will be around long term, but it definitely helps.

Finally, as with any investment, be sure you do your due diligence to make sure you understand what you are investing in, how you can sell, and what the fees are.

To learn more about their current offering, click here.

- Read now: Learn the pros and cons of investing in real estate

- Read now: Here are the major asset classes you can invest in

- Read now: Discover the best types of long term investments

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.