THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

And when you have many cards with a balance, making sure you pay each one becomes overwhelming.

Add in trying to figure out a plan for how to best get out of debt, and it is no wonder why so many people give up.

But there is hope.

It is called Tally.

Tally is a free app that automates your debt repayment, so you can get out of debt and keep your sanity.

In this Tally review, you will learn why using Tally makes a lot of sense if you want to save time, money and be debt free.

Table of Contents

Tally Review | A Smart Way To Pay Off Credit Card Debt Faster

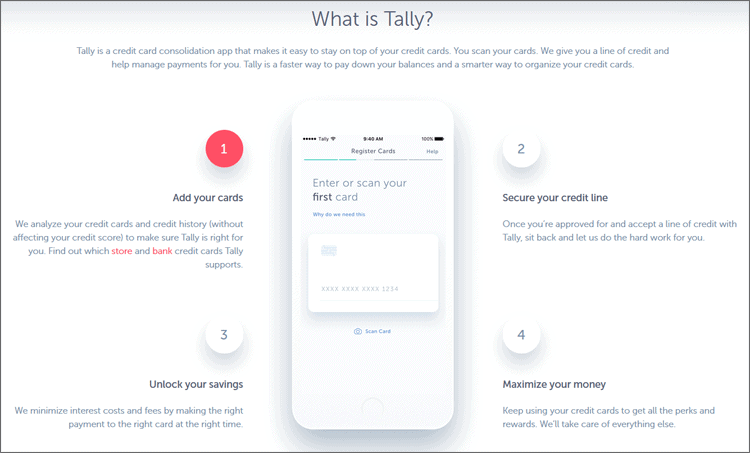

What Is Tally?

Tally is the first automated debt manager that makes it easy to manage your credit cards and get out of debt.

Once you create an account, Tally makes strategic payments to help you get out of debt and save on interest.

The company was founded in 2015 by Jasper Platz and Jason Brown and the app is available on both Android and Apple.

Here is a quick video about the company if you are short on time.

How Does Tally Work?

Tally works as a middle man between you and your credit cards.

You pay Tally and they pay your credit cards every month. They apply the debt avalanche method to paying off your debt.

This means it will pay the minimum balance on your smallest and lowest interest debt.

The rest of your payment will go to your highest balance and highest interest rate debt.

Doing this ensures you save the most money on interest charges.

When it comes to paying your credit cards, you have two options.

- Tally Pays

- You Pay

Tally Pays

This is the simplest solution and the one most users should choose.

Using Tally Pays, Tally opens a line of credit for you. They then make your credit card payments based on the above debt avalanche payoff plan.

You then get a bill from Tally for the payment it made, plus the interest from the line of credit. In most cases, this interest is less than what you pay your credit cards.

You Pay

The You Pay option is more complicated, which is why most people are better off with Tally Pays.

With You Pay, you either pay your credit cards through the Tally app or on the credit card issuers website.

If you pay through the Tally app, they will record the payment and will update your plan.

If you pay through the credit card issuer website, Tally will not see the payment for a few days until it is post by the credit card company.

This becomes an issue if you have Tally late fee protection enabled and you make a payment close to the due date.

This is because Tally won’t let you miss a payment. As a result, they will make a payment if it doesn’t see one made.

This ensures you are not charged a late fee.

The problem is you made a payment and Tally made a payment.

In other words, a double payment is made.

For example, you make a payment on the credit card issuers website two days before payment is due.

Tally doesn’t see this payment for a few days and in the meantime, thinks you are going to miss the due date.

So they make a payment for you.

You just made two payments.

To avoid this, they recommend you turn off late fee protection when choosing You Pay.

Who Can Use Tally?

To use Tally, you must be 18 years old or older and have a minimum credit score of 660.

Additionally, Tally isn’t available in all states. Currently it is available in 30 states plus the District of Columbia.

Here is a rundown of the state’s where the service is available:

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Florida

- Georgia

- Illinois

- Idaho

- Iowa

- Louisiana

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Missouri

- New Mexico

- New Jersey

- New York

- Ohio

- Oregon

- Oklahoma

- Pennsylvania

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Washington

- Wisconsin

- Washington DC

If it is not available in a state where you live, you should still create a free account, as they are expanding to new states all the time.

By creating an account, you will be on the wait list and get an email when it is available to you.

How To Get Started With Tally

To start with Tally, you first download the free app.

Next, enter your personal information and create a username and password.

From there, you scan your credit cards using your phone’s camera. If there is an issue with the image, you can type in your card number.

Tally then does a soft credit pull to see if you qualify for a line of credit.

If you aren’t approved, you can have then notify you when you do become eligible, or you can choose to close your account.

If you are approved, you can begin the Tally Advisor process.

What Is Tally Advisor?

Tally Advisor is an automated debt feature that helps you get out of debt.

It works by analyzing your credit card debt, spending habits, and your desired debt free date.

After crunching the numbers, Tally Advisor gives you a plan for how to reach this goal.

The cool thing here is this plan isn’t set in stone.

It will crunch the data every month.

Then it will tell you how to make your payments to maximize your interest savings and reach your debt free goal.

Here is a short video that covers the basics of Tally Advisor.

What Are Tally Fees?

Tally charges zero fees to use.

The app is free to download and there are zero maintenance or account fees for using the service.

The only cost to you is the interest rate with the line of credit.

What Is Tally Save?

Tally Save is an automated option for you to save money.

You set a savings goal and Tally will make a transfer from your checking account to a savings account.

You choose the amount and the frequency.

Your savings do not earn interest, but rather rewards points. You can redeem these rewards points for gift cards to popular retailers.

Note that you do not have to use Tally Save if you are using Tally to pay off your credit cards.

And you can use Tally Save if you don’t have debt.

Advantages And Drawbacks

If you are short on time, here is a quick run down of the advantages and drawbacks of Tally.

Advantages

Saves money. By consolidating your high interest debt into a line of credit, you save money on interest.

Simplicity. No longer will you have to make multiple credit card payments every month. Just make one simple payment.

Improved credit score. By focusing on paying down your debt, you will improve your credit score.

No added fees. There is no origination fee when starting with them and there are no extra fees you pay.

Late fee protection. With this free service, you avoid getting charged late fees because you will not miss a payment.

Customer service. The customer service is excellent and is always willing to help.

Drawbacks

Availability. It is not available everywhere. As of this writing, it is available in 30 states, but they are working hard to make it available nationwide.

Interest rate. Most people will save money with their line of credit. But the maximum interest rate they charge could be higher than your credit cards.

Frequently Asked Questions

Is Tally legit?

Yes, Tally is a legitimate company.

The company was founded in 2015 and is headquartered in San Francisco, CA.

It has won many awards. This includes Fast Company Most Innovative Companies Award and FinTech Breakthrough Award.

Is Tally safe?

Yes.

Tally uses secure SSL encryption for transferring all data between you and its servers.

And it never stores your username or passwords on their servers.

This means even in the small chance they get hacked, none of your sensitive information is at risk.

Finally, they do not share your personal information with third parties unless you allow them to.

Where is Tally available?

As of this writing, the service is available in 30 states plus the District of Columbia.

The list of available states includes Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Illinois, Idaho, Iowa, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Missouri, New Mexico, New Jersey, New York, Ohio, Oregon, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, Washington, Wisconsin, and Washington DC.

If your state is not listed, you can create a free account and they will notify when it is available in your state.

Does Tally hurt your credit?

No.

When signing up, they perform a soft credit check, which has zero impact to your credit score.

From there, Tally improves your credit by helping you to pay off your debt.

What credit cards does Tally work with?

Tally works with all major banking credit cards including American Express, Bank of America, Barclays, Capital One, Chase, Citibank, Discover, US Bank, Wells Fargo and more.

They also work with many major store branded credit cards. These include Amazon, Best Buy, Home Depot, TJ Maxx, Target, and more.

What fees does Tally charge?

Tally does not charge any fees.

The only cost to you is the interest charged on the line of credit.

As of this writing, the interest rate on the line of credit ranges between 7.90% and 19.90%

Will Tally save me money?

For most users, Tally will save you money. There are 2 reasons for this.

First, you will pay off your highest interest rate debt first.

Since this debt is costing you the most money in interest, paying this off fast saves you money.

Second, Tally’s line of credit has a lower interest rate than your credit card in most cases.

This means you will save money because they will pay off the higher interest debt with the lower interest line of credit.

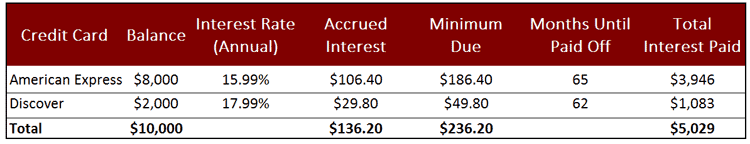

Here is a hypothetical example of how Tally can save you money.

Let’s say you have 2 credit cards with a total debt balance of $10,000. You use Tally and get a $10,000 line of credit.

Here is how your current credit card debt situation look like before working with Tally.

You have two payments to make each month, totaling $236.20.

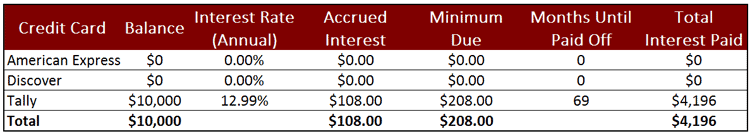

Here is how your credit card debt situation looks with the Tally line of credit.

Since your credit card interest rates were higher than the line of credit, Tally paid off both cards.

You are now left with paying Tally.

You have one payment to make each month, totaling $208.

In the end, by using Tally, you saved yourself $28 the first month because of a lower monthly payment.

And this lower monthly payment will remain, saving you money every month.

As for interest, if you don’t use Tally and only make the minimum payments, you would pay $5,029 in interest.

By using Tally, you pay $4,196 in interest, a savings of $833.

Understand everyone’s situation is different and your monthly payment and interest savings will vary.

Why use Tally?

Tally makes paying off your debt easier than if you tried to do it on your own.

And seeing how credit card debt stands at over $87 billion dollars, a lot of people would benefit from this service.

In the end, Tally will do the following for you.

- Save you time. You only have to make one monthly payment to Tally

- Debt plan. No more wondering which card to pay off first. Tally analyzes everything and tells you what to do.

- Save money. By getting a line of credit with a lower interest rate, you will save thousands in interest charges.

What is the debt avalanche?

Debt avalanche is the term given as a way to pay off your debt and is different from the debt snowball.

With the debt avalanche, you pay off your highest interest debt first.

Doing this will save you the most money on interest.

The debt snowball has you pay off your smallest balance debt first. The idea here is you will pay off debts faster, motivating you to stick with it.

Both methods have advantages and disadvantages to them.

It is critical you pick the right one for you, as doing so will increase the chances you pay off your debt.

Alternatives To Tally

There are no direct competitors to Tally. But there are other services in this space that can help you pay off your credit card balances.

Here are two examples.

Qoins vs. Tally

Qoins works differently than Tally.

Qoins rounds up your purchases and transfers this amount to a savings account.

Once your savings balance grows to a certain amount, Qoins will send the money to the debt you choose for a $1.99 fee.

The benefits are you can use Qoins for credit card debt, student loan debt, mortgages, and more.

As of this writing, Qoins has helped its users pay over $4 million in debt. The average user pays an extra $600 a year towards their debt.

Credible vs. Tally

Credible is a company that refinances your student loans and offers personal loans as well.

I list them here because if your credit score is below the 660 minimum to work with Tally, you can work with Credible.

Apply for a personal loan and then use that money to pay off your credit card debt.

You have one payment a month at a lower interest rate, saving you time and money.

Final Thoughts

Tally is a great way for people who have credit card debt to get a handle on it and pay it off.

By using the service, you simplify things by having one monthly payment and you have a detailed plan get out of debt.

Add in the late fee protection, and you will save even more money.

While Tally isn’t a fit for people without credit card debt, if you do, it is worth looking into.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.