THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

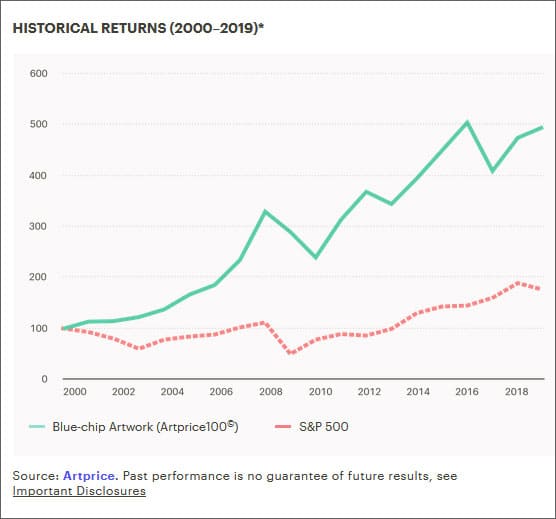

By making certain you have your money invested in various asset classes, you lower your overall risk while increasing your return over the long term.

The problem is that most investors stop short of a truly diversified portfolio.

Sure you invest in large cap, small cap and international stocks. And you have some investment money in bonds too.

But you lack the investment in alternative investments.

This isn’t entirely your fault.

In many cases, the barrier to entry in many alternative investments is closed to most investors.

Masterworks.io is looking to change that.

They are opening the door to the investment art world to investors.

In this post, I will tell you who Masterworks is and how they work.

By the end, you will be able to decide if a small portion of your investment dollars belongs in this alternative investment.

Table of Contents

Masterworks.io Review | The Ultimate Guide To This Alternative Investment

Who Is Masterworks.io?

Masterworks is based in New York City and was founded in 2017.

They are art connoisseurs with over 75 year’s experience in the art world and want to open the doors of top-tier, blue chip art investments to all investors.

They open the doors by purchasing artwork and then selling fractional ownership shares to investors.

The end result is people without millions to invest in artwork having the ability to own great pieces of art.

How Does Masterworks Work?

The process of allowing investors to fractionally invest in artwork is simple.

To begin, the people behind Masterworks reviews and analyzes data to determine the appreciation rate of different pieces of artwork.

They then go about purchasing a piece of artwork that they believe will continue to appreciate in value at a rate that makes sense for investors.

Once the piece of artwork is acquired, Masterworks registers it with the Securities And Exchange Commission so they can then offer fractional ownership shares to investors.

Once approved, investors can then purchase shares in the artwork. Each share is worth $20, meaning you can own very small amounts of various pieces of artwork.

Note however to get started with Masterworks, an investor needs to initially deposit $1,000.

After a number of years and the price of a piece of art has appreciated, investors can vote based on the number of shares they own to sell the artwork or continue to own it.

If sold, the proceeds of the sale are distributed among the investors, again based on their percentage owned.

Masterworks Fee Structure

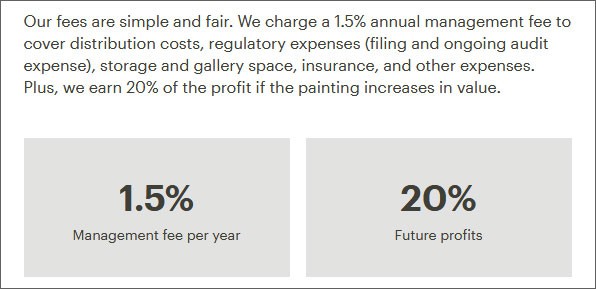

The fees Masterworks charges is similar to hedge funds.

For starters, there is an annual 1.50% fee that is used to cover the safety of the artwork including insurance.

Additionally, there is a 20% fee on profits when artwork is sold.

For example, let’s say you invest $5,000 into a piece of artwork and it grows 20% annually for 5 years.

Your investment grew to $11,832 and you paid a total of $436 in annual fees.

At this point, the artwork is sold, and Masterworks takes its 20% fee on profits.

Your ending result is you turning your $5,000 investment into $9,465.

Advantages And Drawbacks

What are the things that make Masterworks something to consider investing in and what are some things to make you take a harder look at this service?

Advantages

New asset class. Most investors cannot invest in artwork simply because of the capital needed.

Masterworks opens the door and allows you to have access to this asset class.

Small investment. While you do need $1,000 to register with Masterworks, you can invest with as little as $20.

Experience. The people behind Masterworks have over 75 years combined experience.

This means they will be better able to identify high appreciating artwork to buy compared to you, helping your investment to potentially grow.

Drawbacks

Lack of understanding. Since you vote when to sell the artwork you invest in, you might pick the wrong time and limit your potential profits.

Fees. The annual fee of 1.50% and the 20% profit fee is not something that can be ignored.

You have to be certain to take these into account when deciding to sell any piece of art.

Illiquid investment. As of this writing, there is no way for you to get your money back after investing it in artwork.

While Masterworks is building out their platform, you need to know your invested money is locked up with the company at this point.

Untested Idea. This is an innovative way to invest in artwork and as a result, has a high degree of risk associated with it.

Frequently Asked Questions

Here are the common questions I receive when it comes to Masterworks and investing in artwork.

Is Masterworks.io legit?

Yes.

While the company was founded in 2017, the founders have started a number companies over the years that are valued at over $1 billion.

How much money should I allocate to alternative investments?

The majority of your investment dollars should be allocated to traditional investment categories, like large and small cap stocks, international stocks, as well as bonds.

The alternative investment portion of your portfolio should be made up of 5-10% of your money.

Is art a liquid investment?

No.

Art is not a liquid investment.

Whereas you can buy and sell a share of stock in the same day, you will be holding onto art for many years.

The ideal investment horizon for this asset class is 7-10 years.

In other words, investing in art is not suitable for someone interested in day trading. It is a long term investment.

How risky is it to invest in art?

Art is risky to invest in based on the fact there is no underlying benchmark.

Art sells for whatever price the buyer is willing to pay for it.

In other words, you could be selling a piece of artwork that one investor deems is worth $2 million whereas another investor might value it at $4 million.

While you do have price discrepancies with stocks, the range is not as large as it potentially can be with art.

With that said, over time some art does appreciate nicely.

Final Thoughts

At the end of the day, diversifying your portfolio is a smart thing to do as an investor.

The one area that most investors lack investing in is alternative investments due to the difficulty in entering the market.

But Masterworks is changing this and is allowing investors to gain entry for a reasonable amount of money.

If you want to diversify your portfolio with art, then Masterworks is a company you should look into.

Click here to learn more about Masterworks!

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.