THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

When it comes to improving your finances, where do you start?

Most people answer this question by talking about investing or how to make extra money on the side.

This makes sense since these are the more exciting aspects of money.

But to build wealth, you need to focus on the foundation first.

When it comes to your money, your foundation is your budget.

By creating and following a budget, you know where your money is going and have more control over it.

But where do you start with budgeting?

The best and easiest option is a budgeting spreadsheet.

While you could learn how to make a budget in Excel or Google Sheets, you need to know how either of these software programs works.

And you need a considerable amount of time to build your template.

The good news is you can find a free budgeting template online that saves you a lot of time.

You don’t have to build a complete budget from scratch when you choose to use a template instead.

And with so many options out there, you are guaranteed to find the suitable budget template for you, whether it be a digital budget template or a spreadsheet template.

The bad news, though, is when you first start searching for free budget templates, you might become overwhelmed by the sheer number of choices.

This is where this post comes into play.

I’m highlighting 17 of the best free budget spreadsheets for you.

Some are Excel spreadsheet templates, some use Google Sheets, and others are online apps that allow you to budget digitally.

In some cases, there are basic versions that don’t cost anything, and if you want more features, you can pay for an upgraded version.

By the end of the post, you will have an idea of the best budget template for you and your situation.

KEY POINTS

Table of Contents

17 Best Free Budget Spreadsheets You Need To Consider

What Is A Budget Template?

A budget template is an organized way to keep track of your income and expenses.

When it comes to setting up a budget, you have many choices.

You can create your own with a pencil and paper, create an Excel spreadsheet, or use an online template.

No matter what you choose, any budget will follow the same basic principles of organizing your spending so that you are mindful of how and where you are spending.

The result is you will stop overspending each month and will begin to build wealth.

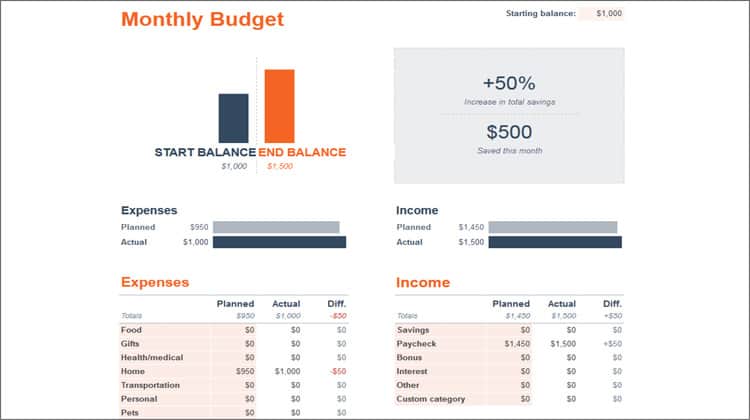

How Do Budgeting Templates Work?

As I mentioned above, budgeting templates work by looking at your various sources of income and subtracting your spending.

The goal is to get a zero balance.

This doesn’t mean you will have nothing left in your checking account.

It means you used your income to pay your bills and save money.

If you want a cushion in your checking account, you could opt to have your budget have a positive ending number.

This amount would stay in your account at month’s end.

For example, if you earned $2,000 and have $1,800 accounted for in your budget, you should end the month with an extra $200 in your account.

You don’t want your budget to show a negative balance at all costs. This means you are spending more than you are earning.

To avoid this, you will have to edit your planned spending so that your budget works out.

This can be difficult for some, as your income may be low or you have too many expenses.

In either case, you need to take action to correct this problem.

- Read now: Click here to learn how to easily slash your spending

- Read now: Click here to learn over 50 easy ways to start making more money

If you don’t, you are just digging into a deeper financial hole every month that will get harder and harder to get out of.

The other benefit of using a budget is tracking monthly expenses.

This will allow you to review your spending habits and identify areas where you might be spending more than you thought, allowing you to take corrective action.

Now that you know the importance of budgeting, let’s look at the best options.

Printable Budget Templates

#1. MoneySmartGuides Budget Template 1.0

OK, this is a shameless plug here.

This is the first budget I used, so I thought it would make sense to offer it to my readers.

It is a simple worksheet and great for someone just starting and looking for a monthly expenses template.

You begin by entering each budget category in the first column and the amount you plan to spend in each category in the second column.

Then you enter your actual spending in the third column and viola! You see where you need to cut back on spending.

The spreadsheet will automatically calculate your monthly totals for you.

This monthly expenses template makes tracking the areas you are overspending in easy by grouping categories together for simplicity.

You can download this budget here.

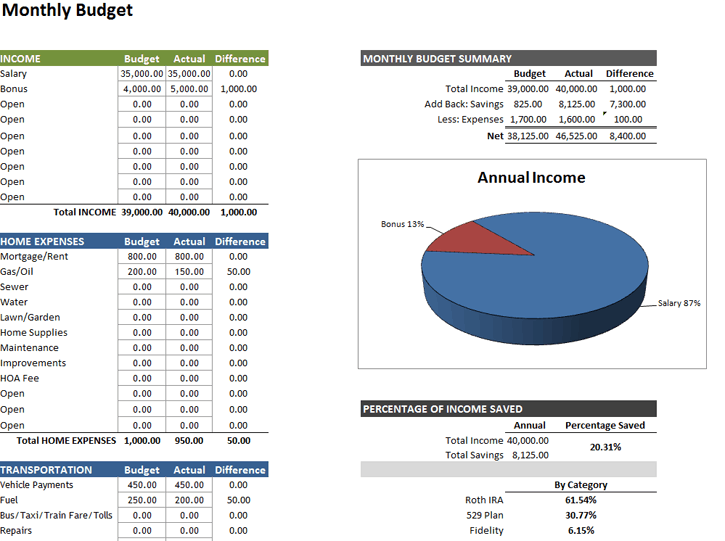

#2. MoneySmartGuides Budget Template 2.0

I’m all about the shameless promotion today!

Here is the second budget I used. It’s a modified version of the one above.

I created this one because it has a much cleaner look, and after getting married, I wanted a more detailed budgeting template telling us where our money was going.

My favorite part is I added a savings section to this Excel budget planner.

By including this, I can see the percentage of my monthly income I save every year and in each of my savings accounts.

You can access this personal budget here.

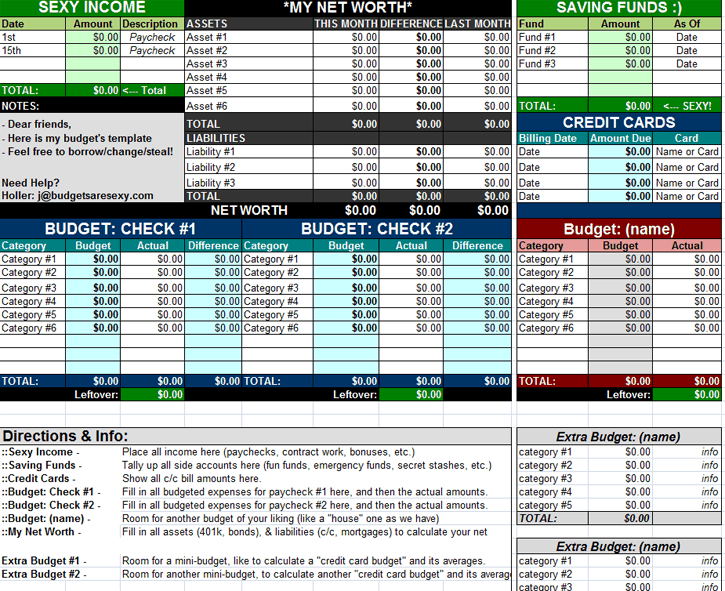

#3. Budgets Are Sexy Budget Template

J$ over at Budgets Are Sexy has a great Excel spreadsheet budget download for you to use as well.

This one is cool because it works as a home budget spreadsheet.

So if you have multiple sources of income, you can earmark one to pay the mortgage, car payment, and other bills, and the other paycheck for savings.

It is set up similarly to the first monthly budget, with more options for better control of your money.

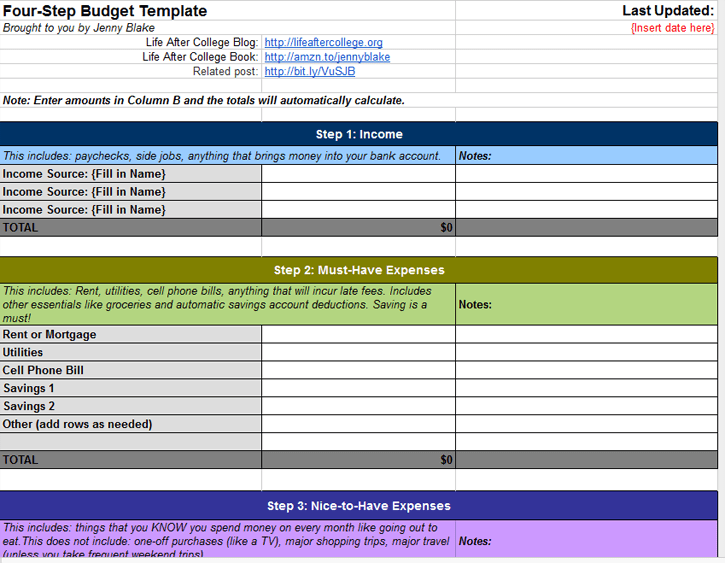

#4. The 4-Step Budget Template

This budgeting spreadsheet comes from Life After College.

What’s nice about this one is that after you fill in your income, and important expenses, it gives you your allowance to spend on discretionary items.

In other words, you cover all necessary expenses before spending money on your non-essentials, making it a great household budget template.

This is ideal because too many people have confused wants with needs.

This option makes spending clear again so you can get ahead financially.

#5. Kakeibo Template

Kakeibo is an ancient budgeting method from Japan that works incredibly well.

The main difference with this option is that to use it, you need to write out your budget physically.

There is no Kakeibo Excel template to use.

If you look hard enough online, you can find a Kakeibo spreadsheet online, but that goes against the core idea of this budget.

You need to manually write everything down because this forces you to think about your spending.

And when you are more aware of your spending, you will spend less and save money.

The make it work, you assign your spending to one of four pillar categories:

- Needs

- Wants

- Culture

- Unexpected

Then at the end of the month, you need to answer four questions:

- How much money do you have?

- How much money are you spending?

- How much money would you like to save?

- How can you improve?

Following these guidelines makes you more aware of your spending habits and can make positive changes to reach your financial goals.

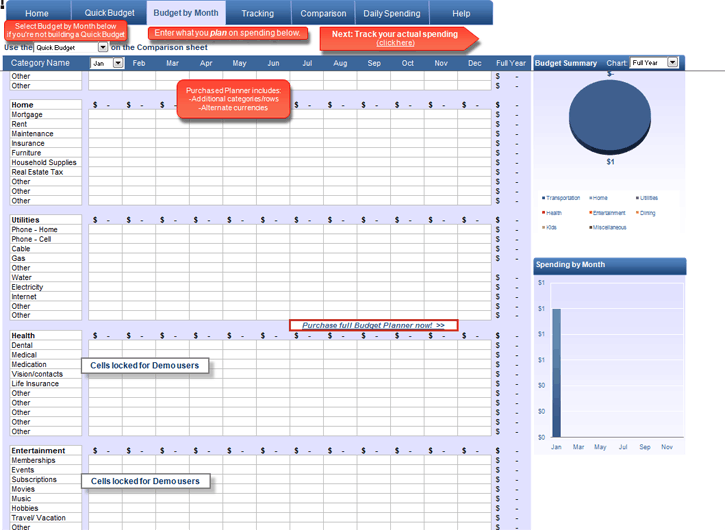

#6. Budget Planner Spreadsheet Template

Of all the templates I am suggesting, this is the only one that costs money. There is no free version of it.

The one-time purchase price is $15.95, which might sound crazy for an Excel template, but this one is really cool, as it is multiple spreadsheets in one.

First, you have a daily spending tab that allows you to categorize expenses daily.

This information is then linked to the rest of the budget using auto-fill.

While you don’t have to use this feature, it makes sense too.

From there, a comparison tab looks at your budget versus your spending up to this point in the month.

This lets you see a “real-time” snapshot of where you might be getting into trouble.

You also have a tab that looks at your budget every month so you can see the year in total.

Lastly, it allows you to specify the frequency of the budget categories.

If you pay your car insurance semi-annually, you can set this category up for semi-annual, and the spreadsheet does the rest.

I don’t usually suggest paying for a download, but this one is worth consideration.

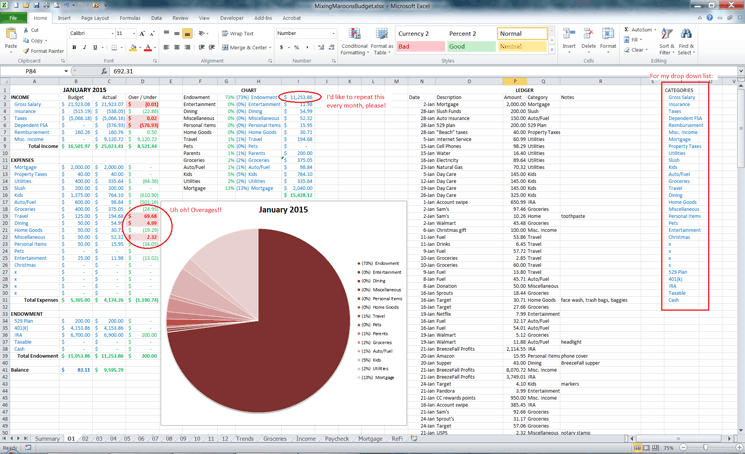

#7. Mixing Maroons Template

Mrs. Maroon recently posted how much she is an Excel geek, and I loved reading every last word.

She created this in-depth template from scratch and, being a fellow Excel nerd, had to check it out.

It is amazing.

For some, it might be overkill, but I recommend it as you can use the parts that make sense now.

When you want to track more things, you can keep using the same template since it has added features.

So why is this budget great?

It is broken down monthly and has a summary page to see everything in one snapshot.

You can track your income, net worth, and transaction history and even review your spending.

For example, how much did you spend on fruit at the grocery store last month?

That is how detailed you can get.

It even has a mortgage amortization sheet too!

As with many other budget spreadsheets, it compares your estimated costs with your actual costs to see how close you are to your goal.

Sadly the site has since gone offline, but I was able to download a copy, which you can access here.

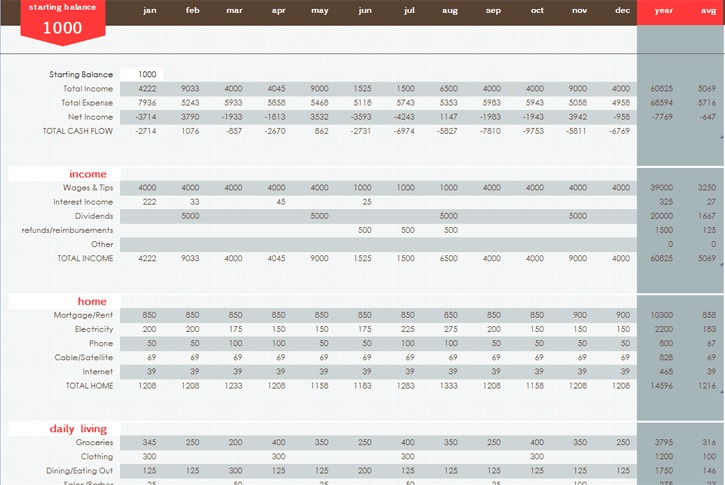

#8. Vertex 42 Excel Spreadsheet Template

Vertex42 has a ton of budget templates.

I’m confident they have one to fit your needs.

Their Excel spreadsheet downloads are free as well. They look great and are super easy to use.

You can pick from a basic, free one with a limited number of expense categories or more detailed options.

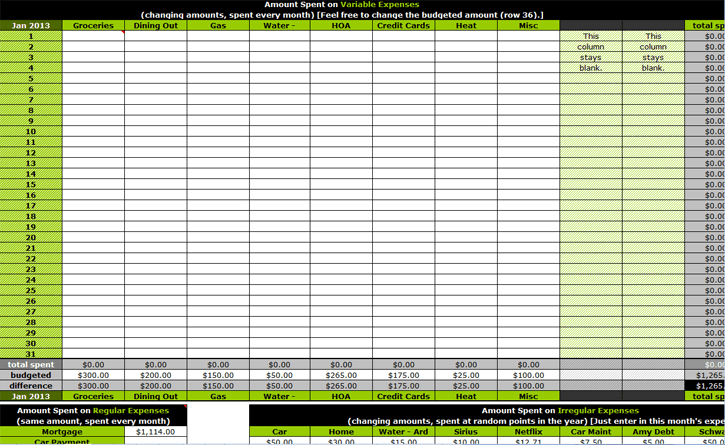

#9. Pear Budget Spreadsheet

This template was my first honest attempt at tracking my finances.

The first tab of this template lists the instructions to use it effectively.

You need to read through it before using it to get the whole picture of how it works.

This isn’t to say that it is difficult to use. You just have to understand it to get the maximum benefit from it.

Here is the link to access the budget.

#10. Microsoft Excel Spreadsheet Templates

If none of the above budget templates tickle your fancy, there is Microsoft.

They have over 100 free Excel budget spreadsheet templates to choose from.

If you can’t find one there, I don’t know what to tell you!

Digital Budget Templates And Spreadsheets

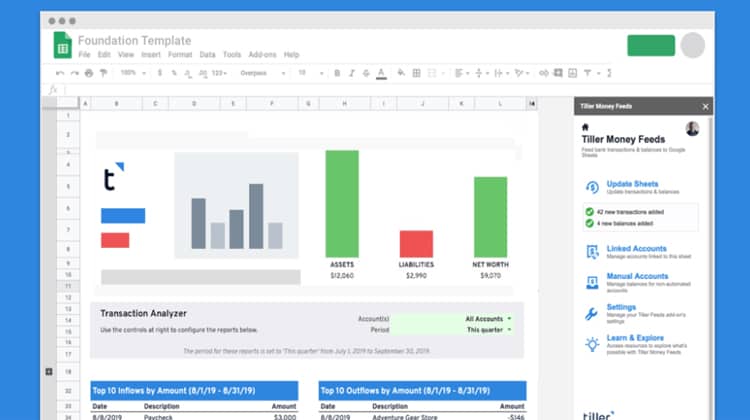

#11. Tiller Money Spreadsheet: The Best Budget Spreadsheet

My biggest gripe with budgeting had been finding one that did everything I wanted.

I tried automated services, but they never met my needs 100% of the time.

The setup didn’t meet my needs.

So I switched to Excel budget spreadsheet templates and created my own custom one.

This worked great, but there was one downside. Time.

It wasn’t an issue before, but once I married and had kids, manually entering everything into Excel took a lot of time.

But it was the best option I had.

That was until I stumbled upon something else.

It is called Tiller Money.

It is a hybrid spreadsheet budget, far and away the best spreadsheet budget.

When you sign up, you pick from a pre-made template that you can completely customize.

From there, Tiller automatically updates your transactions every day.

You have 100% control over the look and feel of it and the categories you want to track.

You can add graphs, a pie chart, create pivot tables, create new formulas, and more.

They simply pull the data for you to save time.

All you do is verify everything is correct.

I have to note that Tiller works off of Google Sheets or Excel. However, it is native to Google Sheets.

The ability to access it on either platform is excellent.

Another benefit is that I can easily share it with my wife.

No more updating the spreadsheet, saving it to Dropbox, and having my wife go there to look at it.

With Tiller, my wife can easily access the budget anywhere she has an internet connection.

Coming from an Excel geek, I’ve found it amazingly useful and easy to use. It saves me so much time.

You can try Tiller is free for 30 days. I highly recommend you try it out.

Tiller Money makes spreadsheet budgeting simple and fast. Use their pre-made budget and let Tiller automatically import your transactions. All you do is categorize them and you are done. No risk 30 day free trial.

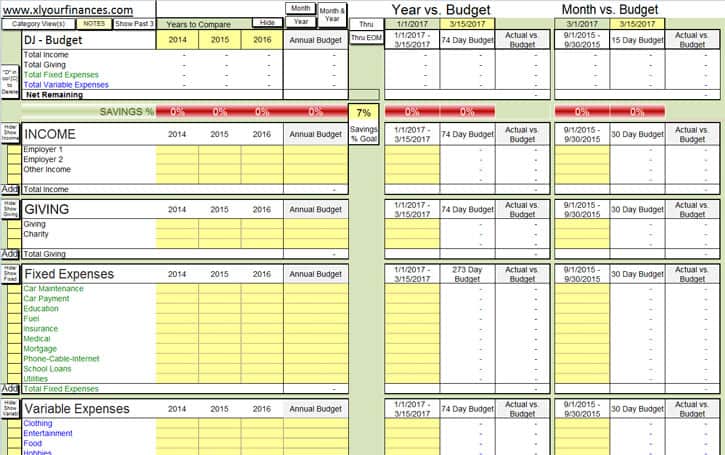

#12. XL Your Finances

Let’s say you like the idea of Tiller Money above but don’t want to give into automation 100%.

Do you have any other options? You do!

It’s an Excel personal budget template download from XL Your Finances.

It is all set up for you. All you have to do is enter your transactions from your credit card and bank statements.

It’s super easy to do this too.

Just download your statement in a .csv file and import it. Then with a bit of cleanup, you have your budget.

It helps you with auto-labeling transactions, removing duplicate transactions, and offers a couple of reports.

Using this spreadsheet will save you a ton of time and many headaches.

You can see it in action by watching the video below.

How much does it cost? That depends.

There is a completely free version that you can easily download and start using, but it requires manually entering your transactions.

If you opt for the paid version, it is only $19.99.

It’s a one-time charge, and you get free upgrades for life.

You can access the paid version by clicking here.

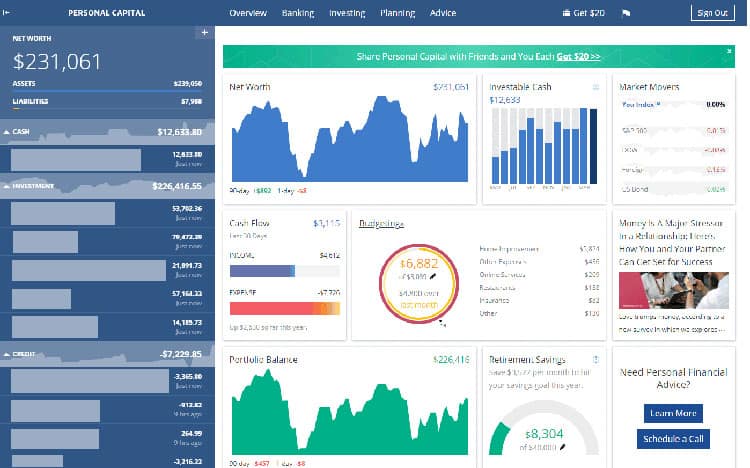

#13. Personal Capital

This online tool allows you to track your spending and highlight specific categories you want to watch.

For example, maybe you tend to overspend dining out.

With Personal Capital, you can set it up, so these variable expenses are front and center on the app to keep an eye on your spending.

Personal Capital is more than just a budgeting app too.

It also does a fantastic job of helping you calculate your net worth, review your investments, and create a detailed and customized retirement plan.

While their budgeting feature is less complete compared to the other options on the list, you should still consider Personal Capital.

Why?

For the reasons I mentioned above.

Using Personal Capital, you get a detailed look at your investments and an investment plan to make sure you are investing for your age and goals.

Additionally, the retirement plan is priceless.

It is the same thing we charged customers for at the high-net-worth planning firm I worked at.

You can edit the details, and it adjusts based on your investment balances. It is hands down the best thing out there.

And it’s 100% free to use!

You can click the link below to control your financial life with Personal Capital.

Want to know where your investments stand? Interested in a free financial plan to see if you are on track for retirement? Personal Capital has you covered. It's the best free tool for the average person to analyze their investments.

#14. GoodBudget

GoodBudget is a virtual envelope budgeting system, and it works great.

There are two versions of the app, and the free version should be enough for most users.

With it, you get one account that you can sync across multiple devices.

You get ten regular budget envelopes and an additional ten more.

There is no syncing to your bank account, so you need to add transactions manually.

The paid version allows you to have unlimited accounts and envelopes. You also get priority email support if you need it.

The GoodBudget Plus version costs $5 a month or $45, which you pay annually.

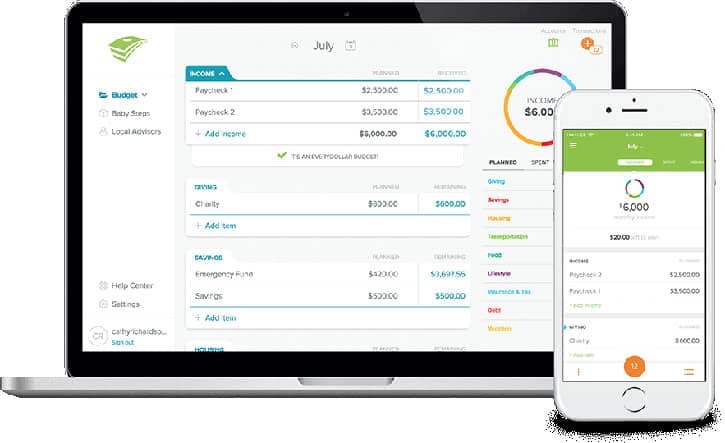

#15. EveryDollar

EveryDollar was born out of Dave Ramsey’s Lampo Licensing group to help people get out of debt and start budgeting.

After trying it out, I thought it was a great budgeting tool worth considering.

It has a clean look and syncs across all your devices, giving you access to an up-to-the-minute budget no matter where you are.

There are two versions of EveryDollar.

The free version allows you to set up and follow a budget and manually add transactions.

The paid version, EveryDollar Plus, costs $99 a year.

By paying for the upgraded version, you can link your bank accounts to monitor your balances and have transactions automatically added to your budget.

For most people, the free version is the way to go.

If you are thinking of the Plus version, consider another free household budget template I’ve listed, as you can get what you need and don’t have to pay for it.

Here is the link to learn more about EveryDollar.

#16. You Need A Budget

You Need A Budget (YNAB) is one of the best budgeting apps.

They take the envelope budgeting process one step further by giving every dollar a job.

When I first tried out YNAB, I needed to watch many of their support videos to understand how their budgeting process works.

In other words, this isn’t an option you can sit down and have a budget made in 10 minutes.

It will take you time to understand how it works.

With that said, this is a powerful choice. Users swear by it, and I can see why.

Once you get in the habit of their process, you will see a remarkable change in your financial life.

It costs $84 a year, but you can try it out for free for 34 days to see if you like it.

Even though this isn’t a free budget template, the $84 is well worth the cost if you want to see a change in your finances.

#17. Google Sheets

Like with Microsoft Excel, you can use some pre-made budgets using Google Sheets.

In some ways, Sheets is more powerful and easier to navigate than Excel, which is why many people prefer to build an annual budget using this software.

Why I Don’t Recommend Mint

If you search online for the best monthly budget template, you will find many recommend Mint.

While there is zero cost to using this monthly budget app, I cannot recommend it.

There are various reasons for this.

First and most importantly, is that it rarely works.

I’ve gone through linking my accounts and setting up my budget in the past, only to find that they stop syncing.

It turns out Mint is losing the secure connection to my bank.

At first, this was just an annoyance.

But then it happened so often that I spent all my time reconnecting my accounts and not seeing where I stood financially.

And many others have this problem too.

Another reason is why it is free.

It is free to use, but Mint partners with other financial services companies to show you advertisements.

If you have debt, they will show you ads for refinancing your debt to lower your interest rate.

This sounds good, but Mint doesn’t personally vet each service it is showing you ads for.

In other words, you don’t know just how trustworthy they are unless you spend the time doing your own research.

As a result, I recommend you stay away from Mint and try the other free options I mention.

Frequently Asked Questions

There are a lot of misconceptions about budgeting.

Here are the answers to some common questions to help you pick the best option.

Why should I start using a budget?

There are a handful of benefits to budgeting.

First, you are better at money management.

This means you know where your money is going and have a steady cash flow all month.

No longer will you get halfway through the month and wonder how you will survive financially until you get your next paycheck.

Second, you can set up and track spending goals.

This will help you get ahead financially, so you no longer live paycheck to paycheck.

Third, it will help you to avoid overspending.

Finally, it will help you make informed decisions around money to avoid overspending.

You will know if you can afford to spend money on a vacation or not, or you can look at your income and expenses at any point during the month and see where you stand.

What to include in a budgeting spreadsheet?

The biggest issue I see when starting is having too many monthly categories to track.

When you first start, have only five or so different categories.

For example, use a generic household expenses category for everything related to housing, like cleaning supplies, repairs, etc.

After a few months, when you have a habit of budgeting, then you can pick some of the categories and break them into more specific ones.

Doing it this way helps you avoid feeling overwhelmed when you have to update 30 different categories for income and expenses.

What are the different types of budgeting methods?

There are many different methods, and you can set up your personal budget template to follow the one that makes the most sense for you.

Most people opt for the zero-based budget, where you enter your income, and your budget categories for spending and saving will total up to your income.

An alternative to the zero-based budget is the 50/30/20 rule.

This uses three categories or buckets, making following it easier.

However, keeping track of detailed spending is more complicated with fewer categories.

- Read now: Learn more about zero based budgeting

- Read now: See why so many people love the 50/30/20 rule

Should I include savings goals in my budget?

You definitely should make savings goals a part of your budget.

If you assign total income to expense categories, you will never reach any financial goals because you are not putting anything into savings.

Ideally, you should have between 10-20% of your income go towards savings.

Final Thoughts

A budget is a critical personal finance tool that helps you see your financial health and helps you improve it.

As a result, you need to find one you will enjoy using and understand.

Since everyone is different, many free templates exist, including manual and automated options.

As I mentioned in the post, Tiller Money is the best budget spreadsheet template.

The others listed are good, but Tiller does so much for you, saving you time while allowing you to customize things completely.

Of course, some of you may want to avoid paying for a monthly budget template.

If this is you, the other options I listed are great.

If you are starting, I recommend a simple budget template like the ones I used initially.

They are easy to use and will get you in the habit of tracking your income and expenses.

From there, you can choose a more detailed monthly budget worksheet that has more bells and whistles.

Why do I recommend this strategy?

If you opt for the detailed worksheet, you might get overwhelmed and quit budgeting.

Keeping things simple at the start increases the likelihood of sticking with it long-term, which is a great habit.

This will then open doors and opportunities as you build wealth.

- Read now: Click here to read 10 simple steps you need to build wealth

- Read now: Here is an ultimate list of budget categories

- Read now: Discover the best budgeting methods to try

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.