THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

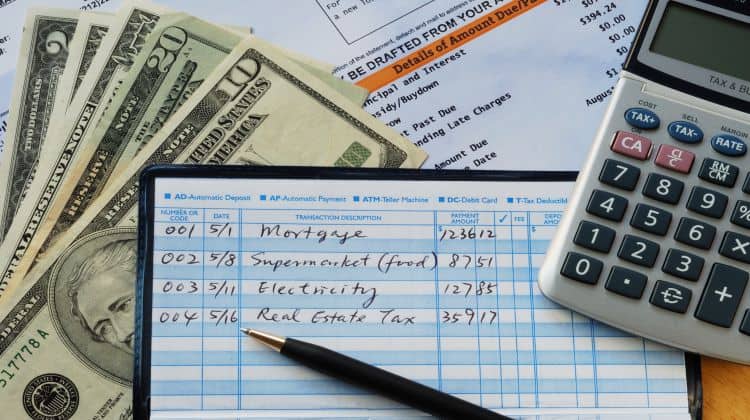

Congratulations on looking into starting your budget.

Building a budget is an exciting time, but your budget is only as good as the information you put in it.

This is why I created this ultimate list of personal budget categories.

It is designed to help you put together the perfect budget for you, so you can hit the ground running.

By the time you are done with this post, you will be ready to set up a budget and begin to follow it.

Before you know it, you will see improvement in your personal finances and progress towards reaching your financial goals.

Table of Contents

Ultimate List Of Personal Budget Categories

How To Use This List

The very first thing you need to understand about making your first budget is no two budgets will be the same.

This is because your financial life is different than your neighbors or your friends.

There will be some overlap in categories, but not all categories.

As a result, there are a lot of items in each category listed.

- Read Now: Click here for my complete budget to learn how to budget

- Read now: See 17 free budget templates you can download now

Do not think you need to include all of them.

Only use the main categories you need and keep moving.

What you will find is in time, as your life changes, so too will your budget categories.

It is at this time you can expand on the basic budget categories and build bigger spending plan.

You need to think of a budget as something fluid and not set in stone.

Added to that, in some of the personal budgeting categories listed below, you will see items listed in different places.

For example, auto insurance.

This will be in the insurance category as well as the transportation category.

Since this is your budget, you put it where it makes the most sense for you.

Some people want to limit the categories so they put insurance items in the other categories.

There is no right or wrong.

Just do what works for you.

Finally, be certain to include a random expense or miscellaneous category in your budget.

There will be times where you buy something that doesn’t have a category.

Put in in miscellaneous and label it somehow so you remember what it is.

If you find it becomes a regular expense, it is time to update your budget to account for it.

Income

The most important category in any budget is your income.

Understanding how much income you receive every week, bi-weekly, monthly, or in irregular income, plays a crucial role in financial planning.

It also helps determine how much needs to go to your living expenses and what you wish to do with the remaining funds.

For the majority of individuals, your monthly income will remain stable as you work your 9-to-5.

However, some may have different income calculations due to the nature of their position.

We will discuss this more in the next section.

For now, here are the major income sources to include:

- Salary (Yourself, Spouse, Others)

- Bonuses

- Tips

- Alimony Income

- Child Support Income

- Gift Income

If some of these income sources do not apply, simply do not add them to your budget.

Business Income And Side Hustles

Few budgets take into consideration the fluctuations in income that are presented when you’re working on a side hustle or running your own business.

However, this is the reality of the situation when you sell products or services to your community or nationwide.

- Read now: See 59 side hustles you can start today

So, how would you calculate this in your budget?

The best way to incorporate business income or income from side hustles is to go with a ballpark estimate that generally holds true for your monthly business income.

Although this number may rise and fall from month to month, a general estimate will help you plan ahead accordingly.

Here are the sources of business income to include:

- Business Income

- Reimbursed Business Expenses

- Side Hustles

If you have other types of income for this category, feel free to include them as well.

Taxes

Before we dive into some of the more obvious expenses that you will have to list in your budget, it’s important that we talk about one of the most overlooked categories, taxes.

From state and federal taxes, which can get a bit more complicated if you’re a business owner, to property taxes, no one is exempt from paying taxes.

That being said, some people may lump taxes up with their savings category, which decreases the amount of money you’re actually putting away.

Give this its own category and make sure that you’re setting aside the right amount you anticipate paying later.

- Read now: Learn how to save on taxes like the wealthy

- Read now: Discover the difference between tax credit vs. tax deduction

This will give you an accurate overview of your finances.

Here are the taxes you should consider including in your budget.

Depending on where you live or what your income sources look like, not all of these will apply to you.

- Federal Income Tax

- State Income Tax

- Local Income Tax

- Social Security Tax (FICA)

- Business Taxes

- Self-Employment Tax

- Personal Property Tax

- Real Estate Property Tax

- Capital Gains Tax

Most of these won’t have a significant impact on your budget since for many people these taxes are withheld from their paychecks.

But it is good to have this information in one place so you can compare previous years.

Paycheck Deductions

This is a heated topic, as some people insist on including this budgeting category in their monthly budget while others don’t think it is necessary.

Others simply don’t include it because it is more work.

While it is certainly easier to ignore automatic deductions from your paycheck, the truth is that including them in your budget will help you to improve your finances.

For example, when it is time for benefits enrollment at work and you have to pick an insurance plan, how much will the price increase impact your finances?

Most people have no clue.

But if you have this item in your budget, you can quickly see the impact and make a better financial decision.

- Health Insurance

- Dental Insurance

- Vision Insurance

- 401k Contributions

- 403) Contributions

- Health Savings Account Contributions

- Flexible Savings Account Contributions

- Life Insurance

- Short-term Disability Insurance

- Long-term Disability Insurance

- Pension Contributions

- Union Dues

- Wage Garnishments

Again, including these items in your budget will add some work, but it is worth it in the end.

Saving And Investing

Savings and investments should have a prominent spot in your budget after you’ve calculated all of your necessary expenses.

If you have trouble saving, then you might want to consider moving it up to the primary spot, even before you deal with any of you monthly spending.

- Read now: Learn the simplest way to become rich

- Read now: Discover the 15 steps for building wealth

By making it a point to save first, you guarantee you will save money every month.

This is why I have it so high on this list.

For saving, you should focus on items like your short-term and long-term savings goals, including retirement savings, as well as establishing an emergency budget.

This is in the event that you temporarily lose your income or have a major expense you can’t pay for with your paycheck.

When it comes to investing, focus on figuring out which investment vehicles will be the best fit for your current financial situation.

If you don’t know where to begin, you can always get started with a small app like Acorns that will begin investing your money for you.

- Emergency Fund

- Car Replacement Fund

- House Down Payment Fund

- Home Improvement Fund

- Home Repairs Fund

- Insurance Payment Fund

- Vacation Fund

- Wedding Fund

- Baby Fund

- Hobby Fund

- Long-Term Goals Fund

- College Fund

- New Furniture Fund

- Taxable Investment Account Contributions

- IRA Contributions

- Roth IRA Contributions

- Self-employed Retirement Account Contributions

- Financial Planning Fees

- Investment Expenses

At the end of the day, you cannot get ahead financially if you don’t save any money.

Make it a priority and you will see positive results in your bottom line.

Debt Repayment

Do you have debt that you have to pay back?

If so, this is going to require its own special spot in your budget.

Debt payments can often take precedence over expenses on this list, so it’s important to calculate how much you owe and come up with a repayment plan with your lender.

- Read now: Find out how to get out of debt forever

- Read now: See why I recommend the debt snowball method

If you’re up-to-date on your payments, you can focus on making sure you’re paying the correct amount monthly.

However, if you’re behind on debt repayments, you may want to bump up the amount you’re paying to catch up and get out of debt.

This category can take a bit more strategy than the others.

Don’t fret if it takes a bit longer to establish than other budget items on this list.

- Mortgage Loan

- Home Equity Line Of Credit

- Home Equity Loan

- Car Loan

- Student Loans

- Credit Card Debt

- Personal Line Of Credit

- Personal Loan

- Medical Debt

- Debt Consolidation Loan

- Cash Advance Loan or Payday Loan

- Cell Phone Debt

- Utility Debt

- Furniture Loan

- 401k/Retirement Loan

- Business Debt

- Tax Debt

- Life Insurance Loan

Debt is very similar to savings.

If you are in debt, it will be hard to build wealth as you are trying to dig yourself out of a hole.

The sooner you can pay off your debt, so sooner you can improve your finances.

Rent And Mortgage Payments

Housing expenses are one of the main focuses when it comes to bills that we have to pay, largely because the consequences of doing so are disastrous.

As this will most likely be the first bill you pay and the most expensive, put this at the top of your budget so that you know how much you’re automatically spending each month.

If you have a mortgage with a variable interest rate, keep records of these changes so that you can make the necessary changes to your budget when your rate rises or falls.

This applies to any changes in rent as well!

Although we will include a section for insurance later on, most homeowners and some renters will have renters or homeowners insurance that they pay for.

You can either give this its own category if it’s costing you a substantial amount or put it in this category.

Given that it’s more related to rent and mortgage rather than general insurance, it could be easier to include it here instead of putting all insurance costs into a category of its own.

Here is a list of items for this budget category.

- Mortgage Payment

- Escrow Payment

- Homeowners Insurance

- Property Tax

- Flood Insurance

- Private Mortgage Insurance

- Homeowners Association Dues

- Rent Payment

- Renters Insurance

Some people may even want to put more home maintenance costs in this section as well.

Again, do what works best for you.

Utilities

As any homeowner or renter is familiar with, rent is not the only expense that you have to pay for your dwelling.

Utilities are a major expense that you can anticipate paying each month.

For the most part, this will cover items like water, gas, electricity, and other miscellaneous items like trash pickup.

However, some may wish to include bills such as their cable, phone service, or internet service.

- Read now: Learn how to cut your monthly bills and save $1,000 a month

- Read now: Discover over 100 ways to save money today

Make sure that you properly define this category so that you don’t miss any expenses that will surprise you later on.

The list of items to include in this section are as follows:

- Cable TV

- Internet

- Landline Telephone

- Cell Phone Service

- Water

- Irrigation Water

- Sewer

- Electricity

- Natural Gas

- Heating Oil

- Home Security

- Trash Collection

- Recycling Collection

In the event these bills are not paid monthly, but quarterly, you should still save monthly.

Simply take the anticipated quarterly amount and divide by three to determine the amount you should save each month.

Transportation Costs

Owning a car is by no means cheap, and this is something that will be reflected in your budget.

The transportation category should include all costs that pertain to your vehicle or vehicles.

This means items like maintenance or products you have to purchase to maintain your own car, gas, car insurance, and more.

- Read now: Learn how to save for a car fast

- Read now: See why hybrids aren’t worth it

If you ever use rideshare apps or take other forms of transportation that cost you money, you should include those in this category as well.

- Car Payment

- Car Insurance

- Fuel

- Car Repairs

- Oil Changes

- Other Regular Car Maintenance

- Tire Replacement/Rotation

- Parking Fees

- Car Washes

- Car Detailing

- Car Registration

- Car Property Taxes

- Driver’s License Fees

- Extended Warranty

- Car Storage

- Tolls

- Train Passes

- Bus Passes

- Subway/Metro Passes

- Uber/Lyft/Taxis

- AAA Membership

Some people opt to lump some car maintenance items into one, like parking fees and tolls.

Or train passes, bus passes, and taxis into public transportation.

Feel free to do the same if this category takes up too much space.

Groceries And Personal Care

Generally speaking, we have the same eating habits and self-care habits that can make it easy to determine how much we typically spend on these items and what our monthly goal is.

Groceries may be lumped together with personal care items simply because we often buy these types of items together and they’re usually an essential expense, unlike other expenses in your budget.

To create a budget for this category, make a quick list of all of the items that you generally purchase on a monthly or bi-monthly basis.

Then, add these items up and set a budget for you to meet or fall below each month.

- Read now: Learn how to spend less on groceries

Another way to save money and use your funds more wisely is to set a budget goal and to shop at the grocery store with that in mind instead.

Whichever method works best for you, set it up immediately so that you can budget for these categories successfully.

- Groceries

- Baby Food

- Dining Out

- Coffee

- Work Lunches

- School Lunches

- Convenience Store Drinks/Snacks (On The Go)

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Bathing & Hygiene Goods

- Feminine Hygiene Products

- Cosmetics

- Skin Care Products

- Clothing

- Haircuts

- Other Hair Services

- Nail Salon Services

- Gym Membership

- Massage Services

Many people opt to have a separate food category that only includes groceries and dining out.

Then they have a personal care category for all their personal care needs.

This is what we do, as lumping them together makes budgeting too complicated for us.

Household Expenses

Beyond groceries and personal care, there are usually miscellaneous purchases that we need to make for our household.

Some of the items that we may purchase include paper towels, cleaning solutions like bleach, and other such products.

Bigger expenses like a new vacuum can always be put into our budget later so we can see what impact it has on our overall budget.

Note that his category can be hard as many of these variable expenses are not purchased on a regular basis.

As with business income, give this a ballpark estimate so that you can include it in your budget.

If you go over, you can always readjust this category down the road.

- Paper Products

- Kitchen Items

- Cleaning Supplies

- Laundry Supplies

- Tools

- Pool Care

- Pool Supplies

As you budget, you will add more items here.

The ones listed are the most common items for this category.

Insurance And Related Medical Costs

Monthly premiums and copays for your health and dental insurance can add up.

This creates a need to have all of your health insurance and related medical costs recorded in their own budget category.

Beyond health and dental, you may also have medical costs like prescription medications, therapy sessions, or hospital visits as you work towards curing an illness or disease.

No matter how much you’re spending on medical treatment and insurance to cover those needs, record them here.

- Insurance Premiums

- Co-Pays

- Coinsurance

- Out Of Pocket Expenses

- Prescriptions

- Over The Counter Medication

- Vitamins and Supplements

- First Aid Supplies

- Dental Cleanings

- Other Dental Work

- Orthodontics

- Vision Exams

- Eyeglasses/Contact Lenses

- Gym Membership

With the ever rising cost of healthcare, it is important to pay particular attention to this area of your budget.

Recurring Subscriptions

I know what you’re thinking.

Does this type of spending really need a category of its own?

Whereas the other categories consist of mostly individual purchases that you won’t forget to pay, it can be easy to forget about certain subscriptions if we have too many.

If you have some services that you pay for by subscription and you want to make sure that you’re accurately tracking these, consider listing these in their own category.

If you ever decide you no longer wish to use the service or if you forget about it completely and see a surprise charge, you’ll have a list of subscriptions on hand to know exactly what you should be canceling.

- Streaming Services (Netflix, Disney+, Hulu, etc.)

- Music Streaming Services (Pandora, Spotify, etc.)

- Magazine subscriptions

- Gym memberships

- Satellite Radio

- Movie Rentals

- Subscription Boxes

- Meal Delivery Services

- Movie Theater Tickets

- Season Tickets

- Warehouse Club Memberships

- Amazon Prime

- Professional Memberships

- Storage Unit Rent

- Credit Monitoring and ID Theft Services

- Dry Cleaning

- Lawyer Fees

- Tax Preparation Fees

- Other Accounting Fees

- Continuing Professional Education

- Post Office Box Rent

For many people, subscription services are becoming the rule rather than the exception.

And the couple dollars a month a subscription charges doesn’t seem like much.

But when you combine all the subscriptions you have into one, you suddenly see the true cost.

Consider using a bill negotiation app like Trim or Truebill to help you lower the cost and save money.

- Read now: Learn how Trim saves users money on many recurring expenses

- Read now: Find out how Truebill is one of the best ways to negotiate your bills

You can try either one out by clicking the links below.

Child Care

Children are a major responsibility and require a category of their own.

From clothing to school supplies, there are likely some expenses that will fall outside of the budgeting categories listed above.

Giving child care its own section can help you better track and estimate expenses that may apply only to your children babysitters, field trips, etc.

As with the above, this can be a major category that fluctuates frequently.

A ballpark estimate here is fine!

- Baby Supplies

- Day Care

- After School Care

- Babysitting

- Summer Camps

- School Uniforms

- School Lunches

- School Supplies

- School Fees

- Clothing

- Toys or Electronics

- Books

- Sports Fees

- Extracurricular Fees

- Birthday Parties

- Allowance

- College

- Child Support Paid

As with healthcare, this section can balloon in size quickly.

Therefore, it is important to stay on top of these costs and try to find ways to keep them in line.

Pet Care

From pet food to vet visits, your furry friend costs money!

The good news is that creating a pet budget is relatively easy as you most likely have a regular schedule for buying food, taking them to the groomers, and even going for checkups at the vet.

All you have to do is add up these anticipated expenses and add them to your budget.

- Pet Food

- Pet Treats

- Toys

- Dog Walker

- Annual Check-Up

- Vaccinations

- Medications

- Other Vet Bills

- Boarding

Entertainment

Whether you want to go to the movies, eat out, or buy something that doesn’t quite fit into the necessary categories above, discretionary spending is the perfect budget category for these items.

Just make sure you set a limit so you don’t spend all of your money here.

- Sporting Events

- Hobbies

- Technology Expenses

- Books

- Concerts

- Games

- Going Out On The Town

- Dating Expenses

- Party Hosting Expenses

- Golf

- Vacations

- Trips To Visit Family

- Wedding Travel

- Other Travel

Miscellaneous

Finally, you should put a category in your budget for miscellaneous spending that doesn’t fit in other categories.

I know this might sound odd considering all of the options listed to far, but you will be amazed how common it is to have unexpected expenses that don’t fit anywhere else.

The trick is to label it so you know what it is.

Otherwise, in another month when you look back, you will have no idea what the $21.15 in miscellaneous was.

The other reason to label it is to see a trend.

If you begin to see you are spending money in this random place on a regular basis, it means it is time to update your budget so you can begin to account for it.

- Random Expenses

- ATM Fees

- Other Banking Fees

- Postage

- Safe Deposit Box Fee

- Other Miscellaneous Expenses

I have found leaving a few extra spaces at the end of my budget works well for the random expenses I missed when putting together my budget.

Final Thoughts

There you have a complete list of personal budget categories and the items that make up each of them.

I know it looks like a lot and might be a little intimidating.

But run through the list and only mark down the items that apply to you.

You will quickly see a more manageable list staring back at you.

From there, it’s time to figure out the budgeting method you want to use.

As I mentioned before, a budget is unique to you, so take your time in picking the one that fits your lifestyle and interests the most.

The most important thing when making a household budget is to have the budget work for you.

You might not get it right the first time.

The just remember to stay positive and adjust until you find what works for you.

- Read now: Discover the types of budgeting methods to choose from

- Read now: Learn why so many people love to budget with Tiller Money

- Read now: Find out how to calculate your net worth and get ahead financially

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.