THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Buying a new car is an exciting time.

Driving around with a new car smell puts a smile on everyone’s face.

But you first need to go through the process of buying a car.

And many people get tripped up when it comes to figuring out how to save for a car fast.

With the average cost of a new car being $40,206 and a used car being $25,410 it can be overwhelming trying to come up with the cash.

Since most people finance their cars, you only need to come up with a small amount of money for the down payment and you can finance the rest with monthly payments.

Or you can completely skip monthly car payments if you want to save the entire amount.

And this is where this post will help you.

I’ll show you 10 ways for you to start saving money for a car so you can get the vehicle you want quickly.

Table of Contents

10 Best Ways To Save For A Car Fast

#1. Figure Out How Much Money You Need

The very first step you need to do is determine how much money you need to buy the vehicle.

Are you paying for the car in full or are you taking out an auto loan?

This will determine how much money you will need to save.

Assuming you are taking out a loan, you want to save between 10% and 20% of the purchase price.

The more money you can put down, the smaller your monthly payment will be, so aim to save as much as possible.

Once you know how much money you need for your savings goal, you can start figuring out the ways to go about saving money.

Note that I am assuming you already did your homework on type of car you want, if you want a new vehicle or a used one, how much car you can afford, and the overall cost of the car.

- Read now: See why hybrids aren’t worth it

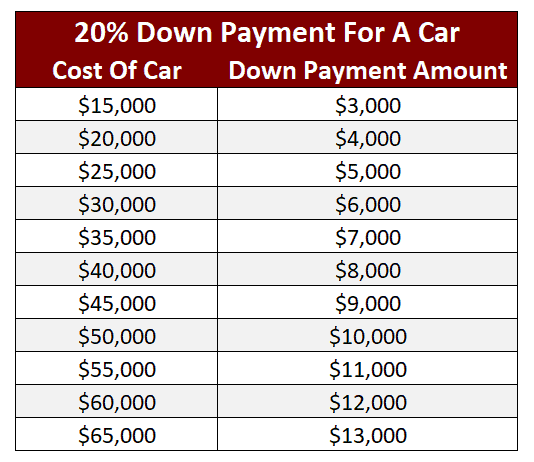

Here is a rough breakdown for how much you need to save based on the price of the car.

This assumes you put down 20%.

One final note if you will be looking into financing options when you buy your car.

A good idea is to make sure you work on improving your credit while you are saving for your down payment.

The higher your credit score, the lower interest rate you will be charged when you take out the loan.

This can save you thousands of dollars in interest charges over the life of the loan.

While you won’t be able to dramatically increase your credit score, you will be able to increase a few points and this could be the difference between a higher interest rate and a lower one.

#2. Make A Car Buying Spreadsheet

The next step to saving money for a car is to create a goal spreadsheet to track your progress.

This will help you to stay accountable during the process.

After all, most people can’t save up $5,000 or more in a couple of months.

By creating a spreadsheet to track your progress, you will reach your goal faster.

If spreadsheets aren’t your thing, you can use a pen and paper or keep track of your progress on your phone.

I just like using a spreadsheet since I don’t have to do the math.

If you go the pen and paper route, here is how to make it enjoyable to save.

Draw a picture and then make guide marks along the side.

As you save money, you fill in the picture.

This will help you to see the progress you are making and motivate you.

#3. Make Saving Money Fun

Speaking of making it fun, the next step is all about turning saving money into a game.

Many people don’t get excited to save money, so you have to trick yourself by making it enjoyable.

Luckily there are many money games you can play just for this.

For example, you can play the dollar bill challenge.

With this game, you save every dollar bill you get.

Another game is the dollar a day game.

Here you save $1 every single day.

If you want to save more money, you can try the 365 day challenge.

With this one, you save $1 on day one, $2 on day two, $3 on day three and so on.

The good news is you can play one or more games at the same time to save extra money and boost your savings quickly.

#4. Set Up Automatic Transfers

Automating your savings is another great idea.

This is because you won’t have to think about saving money, it will happen automatically for you.

- Read now: See the simplest way to become rich

Ideally you will open up a separate bank account so you can keep track of the money you have for your down payment.

Just visit your local bank, credit union, or an online bank, basically wherever you have an account and open up another savings account for your car fund.

Then set up a monthly transfer from your checking account into savings on a specific date.

You should set aside enough money each month to help you reach your goal but not so much that money becomes an issue for you.

If you play any of the money saving games I listed above, you can add these amounts to your savings account as well.

#5. Cut Back On Some Expenses

The next step is to look over your monthly budget and see where you are spending your money and try to cut back.

I’m not suggesting you give up your coffee forever or anything like that.

Instead, just change on your spending habits a little.

If you buy coffee every day, can you cut it down to 2-3 times a week and save the difference?

Maybe eat out every other week instead of twice a week?

If you typically spend $200 a week on groceries, can you lower your budget to $150 or $175 a week?

- Read now: Click here to learn how to save $1,000 on monthly bills

- Read now: Learn over 100 ways to save money today

All of these things will allow you to add more money to your car savings fund.

And don’t think you have to stick with one idea here.

For example, cut back on coffee for a couple of weeks, then switch to limiting how often you dine out.

By switching things up, you never feel like you are giving something up.

Another trick here is to use Trim.

This is an app that will scan through your spending and alert you to subscriptions you can cancel.

It will even negotiate some monthly bills for you.

For example, Trim saves uses an average of $30 a month on their cable bill.

Use Trim once and you can increase your automated savings amount by $30.

- Read now: Click here to learn more about Trim

Since Trim did the negotiating for you, it will feel like free money!

Click the link below to see how much money Trim will save you.

#6. Sell Your Body

The bad news when it comes to saving money is you can only cut back so far.

At some point, you need to start bringing in more income so you can save more money.

Ideally, you will get a raise at work.

But this takes time and we are trying to save money fast.

So we are going to skip this and focus on other areas.

One overlooked area that can bring in large amounts of money is selling your body.

I know it sounds shady, but hear me out.

There are many things you can sell to make quick cash.

You can donate plasma, sperm, or eggs.

You can sell breast milk or even your poop.

Yeah, you read that right.

In the case of poop, you can make $40 for every bowel movement you make.

If you send in 2 samples a week, in one month you have over $300 to put towards your car.

And just think of the stories you can tell when someone asks you how you paid for your car and you tell them with poop!

Here is a great article on the many ways to make money selling your body.

#7. Sell Your Stuff

Another way to save some quick cash is to sell unwanted or unused things lying around your house.

We all have things we no longer use or need, so why not make some money selling it and putting the cash towards your next car?

You can sell on eBay, Craigslist, Facebook Marketplace, Poshmark, Mercari, or even have a yard sale.

Depending on how many things you are selling you could make a couple hundred dollars quickly.

#8. Get A Part Time Job

Getting a second job is also a great option.

But you want to skip over low paying fast food or retail jobs.

Look into a side hustle like bartender where you can make a lot of money with tips.

Or consider walking dogs if you enjoy animals.

A dog walker can easily earn $20 an hour and if you do this a couple times a week, you can make $150-$200 a month.

Other ideas include:

- Babysit

- Teach fitness classes

- House or pet sit

- Mow lawns

- Referee youth sports

At the end of the day, there are a lot of ways to make money on the side to help pay for your next car purchase.

The idea here is to pick things that pay well for the time you are working.

Stay away from jobs that pay $8 an hour where you are working 10 hours a week.

You can make a lot more working fewer hours with the ideas listed above.

#9. Sell Your Old Car

When it comes to your current car, will you sell if privately or trade it in?

The general rule is you will get the most money when you sell your car instead of trading it in.

To know for sure, go to Kelley Blue Book and see the current value of your car.

Then look to see what the average price range is for the trade in value is and what the average private party value is.

If you are willing to put in a little work to advertise and sell your car yourself, you could end up with a few thousand dollars more.

There are some cases where the best way isn’t to sell your car yourself.

If your car isn’t of much value or you just don’t have the time to sell it yourself, it might make sense to trade it in.

But if you go this route, be sure to negotiate and try to get a little extra cash for it.

Even if you only get $250 or $500, that is less money you have to finance.

#10. Negotiate The Car Price

This one is a little different than the previous ideas.

No price is set in stone, so you should make it a point to negotiate the car price.

While this might sound scary to some people, it is common practice and it is really simple.

Whatever the price of the car is, ask if the seller will take $1,000 less.

If they say yes, you just saved yourself some work of saving more money.

If they say no, don’t worry.

They will come back with a counter offer and even if it is $200 less, you just saved money.

In the event they don’t counter, ask them if there is any wiggle room in the price and let them name a lower price.

No matter what happens, if you get a lower price, you saved yourself money.

Note that while you can negotiate any car price, you will probably be able to get a better deal from a private seller as opposed to a car dealership.

This is because a car salesman is skilled at negotiating and will be harder to get a great price.

Final Thoughts

At the end of the day, it’s not hard to save money for a car fast.

It just takes time.

And that is the most difficult part.

We all want the new car now. We don’t want to wait.

But there is some waiting involved.

The good news is you are in control of how long it will take you to set aside money.

If you are dedicated, you can save up the money you need in a few short months.

And if you find it is taking longer than usual, then you can consider buying a different, less expensive car.

- Read now: Learn how to save $950 on auto insurance

- Read now: Click here for 15 steps to building wealth

- Read now: Find out how to save $100,000 fast

- Read now: Don’t just give your car back, here are better options

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.