THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

While multiple bank accounts allow you to divide your finances, mixing them up is easy when you have multiple of the same type.

Using bank account nicknames helps differentiate between similar accounts.

It also makes the online banking experience more visual, benefiting budgets and savings goals.

In this post, I share the benefits of giving your accounts nicknames and offer some ideas to get you started.

Table of Contents

Bank Account Nicknames 101

What Is An Account Nickname?

A bank account nickname is simply a way to make banking easier for you when you have more than one account at the same bank or credit union.

If you don’t rename your accounts, you will see a list of accounts when you sign in like the following:

- Savings 4857

- Savings 6573

- Savings 1039

- Savings 0038

Depending on your financial institution, you might see the entire account number or just the last four digits.

Transferring money between these can quickly become confusing, as you have to try to remember the account number for each account.

The convenience lies in giving these accounts names.

Now they look like this:

- Emergency Fund

- Car Insurance

- Vacation

- Fun Money

A quick glance at your activity lets you see exactly where your money went.

And if your bank allows, you can add a note or memo into the transfer field to stay better organized.

Why You Should Nickname Your Bank Accounts

Many people have multiple bank accounts to make the budgeting process more manageable.

Others have various accounts to help them stay organized.

For example, I use a sinking funds strategy with my savings accounts.

- Read now: Learn the pros and cons of sinking funds

I have separate savings for different goals.

For example, I have an account for my auto insurance premium that I pay every six months.

I have another account for my emergency fund and another for car maintenance.

In total, I have over 20 accounts.

While you don’t need to nickname your bank accounts, taking the time to do this can help immensely by:

- Separating similar accounts

- Budgeting by distributing funds into named accounts

- Watching your savings accounts grow for specific goals

Nicknaming your bank account is an easier way to navigate online banking visually.

Like the envelope method, the named accounts allow you to separate funds and pay attention to where your money goes.

Separating Similar Accounts

If you have multiple accounts of the same type, you’ll understand how difficult it can be to tell them apart when they are with the same bank or financial institution.

Naming your accounts on third-party budgeting apps and within your online banking platform will help you differentiate between each account.

For example, you may have two savings accounts with your bank, one for minor emergencies and another to cover your expenses for a few months.

By giving each savings account a different nickname, it’s easier to transfer to the correct one and ensure you have the right amount.

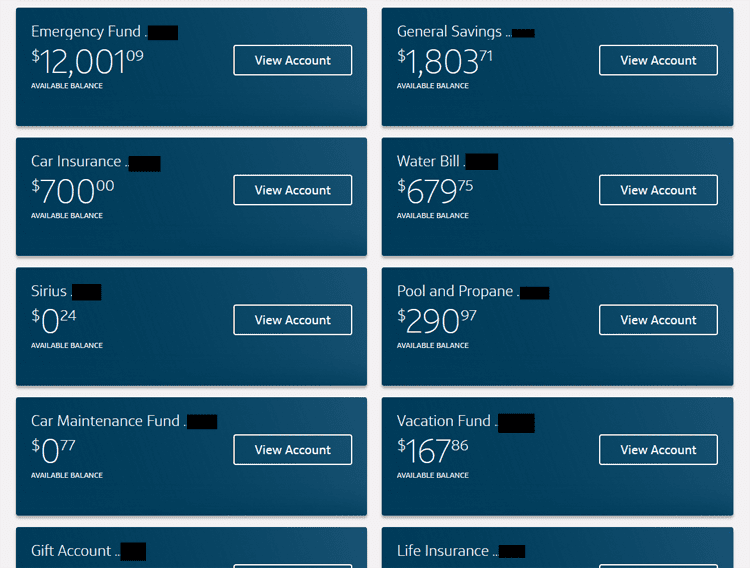

Below is a screenshot of my accounts at Capital One 360.

As you can see, having nicknames makes it easy to find the account you are looking for and this helps you stay motivated to save.

Budgeting

If you can open multiple checking accounts without incurring fees, you can create different sections in your bank to funnel into your budget.

Previously, you had to write down every transaction, and monitoring spending in specific areas was much more manageable.

Now, with everything lumped together, there is no clear separation.

This process is similar to the envelope system that helps you visualize your budget, but it works for online banking and does not require you to mark down or balance your totals.

Savings

It’s challenging to save for a specific goal, even if your heart is in it.

Separating your funds and naming the goal increases your chances of following through and meeting that need.

You can have a separate account for everything needed or desired, such as:

- A 6-month emergency fund

- Vacations funds

- A new vehicle

- College funds

Instead of clumping all your savings together, separating and naming them lets you see which goals need more attention and can help you cover the necessities first.

Drawbacks Of Naming Your Bank Account

There can be a few drawbacks to renaming your accounts.

With that said, I feel the benefits outweigh the disadvantages and still recommend it.

#1. Time Consuming

It will take time to rename all the accounts, especially if you have a lot.

But this is a one-time commitment and shouldn’t stop you from doing it.

#2. Mobile Banking Glitches

I’ve had a few issues where even though I entered a name when I would sign on to my account, some accounts would not have the nickname.

If I logged out and logged back in, the issue went away.

This glitch can be frustrating, but luckily it has only happened twice.

#3. Outdated Banking Software

You might name your account and make transfers between accounts.

But then, when you look at your transaction history, you see the transfer went to Savings 0036 instead of saying, Emergency Fund.

Luckily this is rare, but it is something to keep in mind.

How to Change Bank Account Nicknames

Log into your bank account and select the account you want to change the name on.

Go into the accounts settings, view your account information, and then choose “nickname account.”

The site should offer you a text box to change the account nickname.

Pick something to help you identify the account quickly, then click save.

You should return to your main mobile banking page to ensure the change holds.

Some banks do not allow you to change the bank account nickname.

If you have issues figuring out how to change the name, contact your bank’s support team.

They will let you know if this is possible and guide you through the process if it is.

107 Bank Account Nickname Ideas

Whether you need a generic nickname or one to fit a specific budget, we have some ideas to get you started.

You can also use this list to inspire ways to use multiple accounts.

You can use these ideas for checking account nickname ideas or savings account nickname ideas.

Generic and Miscellaneous

Generic and miscellaneous nicknames accommodate some of the more obscure uses for a bank account.

They can also be fun identifiers for your accounts in third-party budgeting apps.

#1. Swear Jar

#2. Fun Money

#3. Birthdays

#4. Unaccounted Cash

#5. Safe to Spend

#6. Extra Dough

#7. Buffer Money

#8. His Money

#9. Her Money

#10. Miscellaneous Money

- Read now: Learn how to withdraw money without an ATM card

- Read now: Find out how to avoid ATM fees

Children

You can use different accounts to separate funds for your children’s expenses, or you can use them to create savings for the future.

#11. Child’s Name

#12. Allowances

#13. Babysitting and Daycare

#14. Date Night Babysitter

#15. Baby Supplies

#16. Kids Activities

#17. Toy Funds

#18. Child Support

#19. Baby Necessities

Personal Care

Setting aside money for personal care ensures you pay yourself first, prioritizing self-care and minor splurges.

#20. Treat Yourself

#21. Spa Day

#22. Hair Care

#23. Dry Cleaning

#24. Laundry

#25. Makeup Money

#26. Self Care

#27. Cut and Color

#28. New Me

Savings

Any accounts you use to set aside funds should have an appropriate name to identify your goal.

This name lets you know what the funds are for and can encourage you as you get closer to your goals.

#29. Emergency Fund

#30. Retirement Fund

#31. Not Safe to Spend

#32. Investing

#33. Don’t Touch This

#34. Rainy Day

#35. Life Insurance

#36. Taxes

#37. Identify Goal Savings

- Read now: Discover over 100 creative ways to save money

- Read now: Here is how to build a six month emergency fund

Gifts and Donations

Having money on hand for charitable donations ensures you can contribute to the causes that mean the most to you, especially in an emergency.

#38. Charity or Organization

#39. Philanthropy

#40. Tithes

#41. Gifting

#42. Give Away

#43. Christmas

#44. Holidays

#45. Birthdays

#46. Anniversary

#47. Weddings

Transportation

Ensuring you have money to support transportation protects your commute and your ability to explore.

#48. Gas/Fuel

#49. Car Registration

#50. Maintenance

#51. Car Payment

#52. Car Insurance

#53. Get to Work

#54. Public Transportation

#55. Uber

- Read now: Learn how to save money on transportation costs

- Read now: Here are the best free gas hacks

Home Related

Home-related expenses can catch you by surprise.

An account dedicated to these fees lets you identify the cost of renting or owning your home, and you can better prepare for the future.

#56. Property Taxes

#57. Mortgage/Rent

#58. Home Improvement

#59. Remodel

#60. Landscaping

#61. Lawn and Garden

#62. Furniture and Decor

Bills And Utilities

Setting aside money for bills and utilities can keep the lights on and ensure you don’t miss a payment.

It also helps you set up autopay without worrying about cutting into other funds.

#63. Monthly Bills

#64. Electric Bill

#65. Cell Phone and Internet

#66. Subscriptions

#67. Water Bill

#68. Sewer Bill

#69. Student Loans

#70. Extra Credit Card Payments

#71. Tuition

- Read now: Learn how to lower your monthly bills

- Read now: Can you hire someone to pay your bills

- Read now: Discover the pros and cons of online bill pay

Shopping

Everyone loves having some money for shopping, and an account dedicated to your favorite expenditures prevents you from dipping into the cash you need.

#72. Specific Store

#73. Clothing

#74. Sporting Goods

#75. Hobby Fund

#76. Toys

#77. Amazon Prime Fee

- Read now: Find out how to stop buying things

- Read now: Here is how to save money shopping online

Entertainment

Setting aside money for the things that entertain you enriches your life and helps you interact with the culture and details that mean the most to you.

#78. Book Haul

#79. Theater Fund

#80. Amusement

#81. Music

#82. Artsy

#83. Netflix and Chill

Health And Fitness

An account for health and fitness will set you up for future success.

It guarantees you have money for emergencies, and you can take charge while investing in your condition.

#84. Health Insurance

#85. Dental Insurance

#86. Dentist Fund

#87. Doctor Fund

#88. Eye Care

#89. Gym

#90. Pharmacy

#91. Beach Body

#92. An Apple a Day

#93. Sports Fund

Vacation

Whether you want to take a road trip or fly overseas, a vacation account helps you fund your getaway.

#94. Destination Name

#95. Camping

#96. On the Road Again

#97. Hotel Fund

#98. Adventure

#99. Car Rental

#100. Airline

#101. Getting Around in Destination Name

Pet Care

For some people, their pets could have their full-blown budget.

For others, a separate account for vet fees and pet care is enough.

#102. Pet’s Name

#103. Furry Friend Fund

#104. Vet Bills

#105. Grooming

#106. Spoiling Pet’s Name

#107. Companion Care

Final Thoughts

Nicknaming your bank accounts makes it easy to search through and identify charges and separate funds for different sections of your budget instead of memorizing various account numbers.

As long as your bank offers multiple free accounts, this is one of the easiest ways to automate the categorization of your expenditures without reverting to pen and paper.

And the more time you can save here, the more free time you will have to do other things you enjoy.

- Read now: Here are the benefits of saving money

- Read now: Learn how to value time vs. money

- Read now: Checking vs. savings and why you need both

- Read now: What is a starter check

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.