THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

One key part of a successful investment strategy and making money in the stock market is to stay invested for the long term.

But for a variety of factors, many investors have a hard time doing this.

Instead they jump in and out of the stock market, even jumping between investments on a regular basis.

This leads to below average returns and frustrations.

In this post, I walk you through the difference between market timing vs. time spent in the market and why you need to focus on staying the course.

I’ll also share with you some helpful tips to keep you focused on the long term and not give into market swings.

Table of Contents

Market Timing vs. Time Spent In The Market

What Is Market Timing?

Timing the market is simply the act of jumping in and out of the stock market, at the optimal times.

In an ideal world, you would make an investment, sell when the individual stock, mutual fund, or exchange traded fund hits its high, and then wait until it hits its low to reinvest.

As you will see shortly, this investment strategy rarely succeeds.

It’s important to know that market timing isn’t just about entering and exiting the market.

It is also about switching investments.

If your mutual fund isn’t performing well and you see another mutual fund that is outperforming, you sell your shares and buy the other fund.

Many experts call this chasing returns and it too doesn’t work.

What Is Time In The Market

Time in the market is simply the period of time you keep your money invested.

It’s important to know that this means keeping your money invested in the same holdings and not switching investments whenever you feel like it.

You pick a handful of mutual funds, exchange traded funds, or individual stocks, and hold them for years.

When you have additional money to invest, or dollar cost average, you buy more shares of the same holdings.

The Market Cycles Of The Stock Market

Before we get into the details of why timing the market doesn’t work, we first need to understand how the stock market works.

The stock market is cyclical in nature.

This means it doesn’t always move up or always move down.

It moves up and based on the economy.

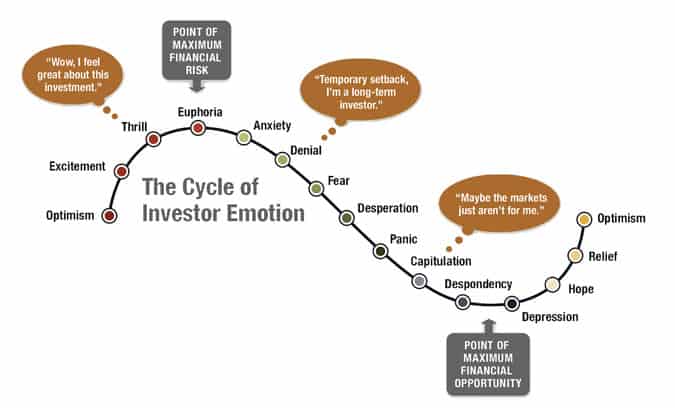

Below is an image of the cycles of the stock market, along with investor emotions during this process.

As you can see, investors start out optimistic.

They believe they are going to grow their wealth, otherwise they wouldn’t be investing in the market to begin with.

As stock prices move higher, they get excited and eventually turn euphoric with how well their investments are performing.

In most cases, this is when investors will put more money into the market.

They love seeing their money grow in value.

The problem is this is the point of the most risk.

But you don’t know this.

You think the market will keep going higher.

When it doesn’t, and starts to fall, you get anxious and then fearful.

Eventually, you panic and out of desperation, you sell your investments when the market bottoms.

But then the stock market starts to rise again.

You slowly become hopeful and then optimistic.

This is the point when many people will jump back in the market.

The emotional roller coaster then repeats, rising for a bit before falling, only to rise again.

There are many things going on here that you need to understand.

#1. The Cycle Takes Time

The image makes it look like a cycle is short.

It can be short, but it can also be drawn out.

For example, when the financial crisis hit in 2008, this was the absolute bottom, the depression phase.

Investors were getting out the stock market as fast as possible.

Fast forward to 2011 and the market has had huge returns, but was still only at the relief and hope stages.

It wasn’t until 2015 that many investors finally got optimistic about the market and began to invest again.

Sadly, some still had not gotten here and remained on the sidelines.

#2. Buy Low, Sell High

This is the mantra of making money in the stock market, buy low and sell high.

But most investors do the exact opposite.

They buy high and sell low.

This is all because of emotion.

When the market is rising, they see their money growing in value and think the market will keep rising, so they invest more.

They don’t want to miss out.

It isn’t until close to the market bottom when they sell their investments, having taken on big losses.

They react emotionally and want to protect what they have left, so they sell.

Why Market Timing Doesn’t Work

Now that you know what market timing is all about and the emotional cycle of investing, let’s look at why trying to pick the right time to enter or exit the market fails.

The reality is, when you invest in the market, you have no idea what is going to happen on any given day.

No one has a crystal ball telling them the future.

The market could be up or down.

If you flipped a coin, you might be right 50% of the time.

With the market, the odds are the same.

While you might think you like those odds, here is why you shouldn’t.

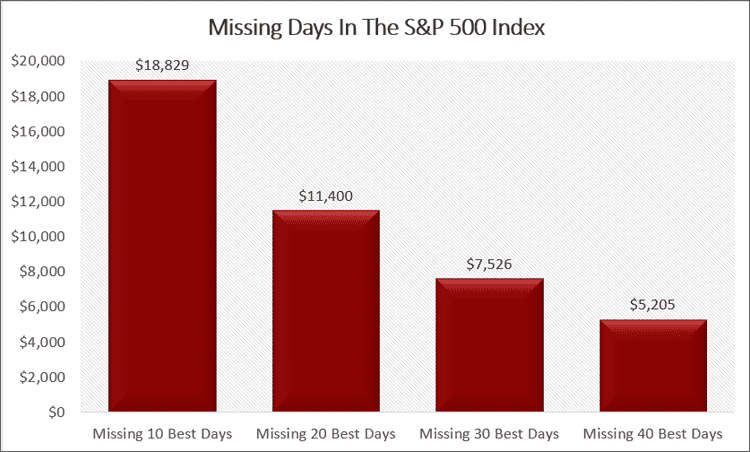

Let’s look at what happens when you start missing the best days of returns for the stock market.

First, we will assume you are excellent at timing the market and you only miss 10 of the best days.

A $10,000 investment from the end of the year in 2005 through the end of the year in 2020 would now be worth $18,829 or a 4.31% return.

If you missed the best 20 days during this same time period, your investment would be worth $11,400 or positive returns of 0.88%.

Missing 30 of the best days and your investment would be worth $7,526.

This is a loss of 1.88%.

Finally, if you missed 40 of the best days, your investment would be worth $5,205, a loss of 4.26%.

Here are these numbers in a chart.

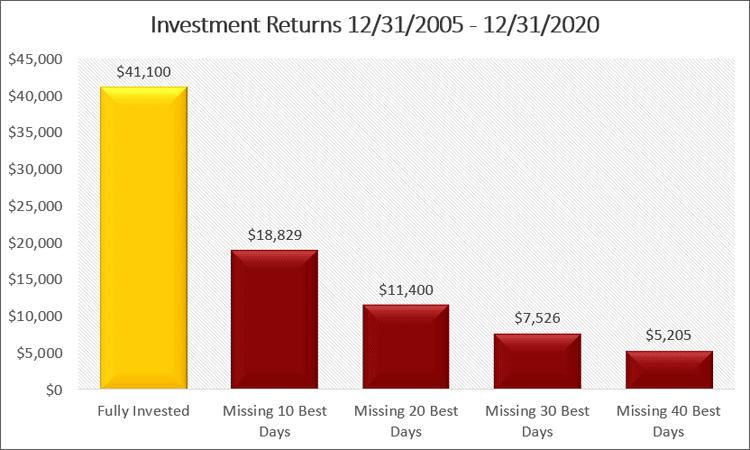

Now let’s say you kept your money invested during this entire time.

This includes being in the market on the absolute worst days.

Your $10,000 would be worth $41,100 or a 9.88% return.

Let that sink in for a minute.

By not giving into emotion and riding out the market fluctuations, you would have more than doubled your money.

There are two additional points about this example.

#1. It Includes The Financial Crisis

In order for you to have earned the 9.88% return, you would have had to stay invested during the financial crisis.

This is important to know because this is when most people sold out.

By sticking with your investments for the long term, you came out better in the end.

You were invested during the worst days possible, but still earned more money in the end.

This is critical to understand.

#2. You Never Know When Good Days And Bad Days Will Happen

I said earlier you have a 50/50 shot at predicting if the market will be up or down on a given day.

What are your odds of knowing the days when the market will skyrocket higher, or sink like a rock?

Very slim to say the least.

This is why it is so easy to miss the best days of the market.

Let’s look at 2020 as an example.

Can you guess when the biggest moves were?

3/9/2020 -7.6

3/12/2020 -9.51

3/13/2020 9.29

3/16/2020 -11.98

3/24/2020 9.38

You had a huge drop on 3/9 and another 3 days later.

But the very next day, you had a huge gain, only to lose all of it, and more, 3 days later.

Then a week later, you had a huge gain again.

Ask yourself this question.

After the first two huge drops, are you expecting the rally the very next day and investing all your money back in the market?

My guess is 99% of investors would answer no.

This is why timing the market does not work.

You have big moves every day in a volatile market.

Because of this, you never know when the market is going to be up or down.

To drive this point home, here are the daily moves of the S&P 500 Index during March and April of 2020.

If you were market timing, you would have most likely stayed out of the market entirely.

But on May 1, 2020 after most of the market volatility calmed down, you would have only lost 5%.

And if you had a diversified portfolio, odds are your loss would have been less.

For the year, the market was up over 18% but most investors, still scared of the volatility in March and April, were still out of the market, missing the best days.

7 Tips For Long Term Investing Success

So now that you know the pitfalls with trying to time the market perfectly, what can you do to help you stay invested for long term success?

There are a couple of simple things you need to do.

#1. Create A Financial Plan

The very first thing you should do is create an investment plan.

This plan will list out the reasons why you are investing, what you are investing in, and your investment time horizon.

Then when the market gets wild, you can refer back to it to remind you to stay invested.

#2. Assess Your Risk Tolerance

Your risk tolerance is the amount of risk you can handle in the market without worrying of selling.

By knowing your appetite for risk, you can build a diversified portfolio with an asset allocation that limits the potential for loss.

- Read now: Learn how to figure out your risk tolerance

- Read now: Here is a beginners guide to asset allocation

This isn’t to say you won’t lose money by investing in various asset classes, but you can certainly reduce your risk.

And when you do this, you can sleep better at night without the stress and worry over a market crash.

#3. Turn Off The News

When the market get turbulent, you need to avoid the news.

Always hearing about the stock market is going to get your worried, and certainly they will have people on that might scare you even more.

The more you can disconnect, the better off you will be.

#4. Remember It’s Only Temporary

The market never goes up indefinitely and it won’t drop indefinitely either.

You just have to give it some time and things will calm down.

Sometimes the cycle is quick, other times it is slow.

Just know that it won’t drop to zero.

#5. Keep Perspective

You might want to keep an image of the cycle on your phone or in your wallet to remind you of it.

You might also want to keep the lesson I taught you about the crazy days in March and April and how the market can come roaring back in as little as a day.

By keeping these things in mind, they can help you not make any rash decisions.

#6. Keep Investing

A buy and hold strategy is best for most investors and you can improve your odds of staying invested by continuing to invest.

If you can invest every month, known as dollar cost averaging, you will take advantage of market drops by investing money during these times.

When there is a bear market and stock prices are low, you buy more shares.

And when there is a bull market and stock prices are high, you buy fewer shares.

By buying at all times, your money continually grows and compounds, helping you to achieve your goals.

#7. Have A Partner

Finally, you want to have a trusted friend.

If you are thinking of selling, talk to someone first.

Doing this might help you to realize you are about to make a big mistake.

The only downside here is if they too are fearful and can’t talk you out of selling.

You might even want to consider getting professional advice.

A financial advisor will hold your hand during a volatile market environment and help you stick with your plan.

While they do cost money, the fee you pay is worth if they keep you invested for the long term.

Final Thoughts

There is the difference between market timing vs. time in the market.

It’s critical to your financial goals to be a long term investor and not try to time the market.

When you do try to be a market timer, you only hurt yourself and your chances of achieving your goals.

Even worse, you might ruin your financial situation as well.

So figure out the best ways to help you not make any quick investment decisions and keep your money in the stock market.

- Read now: Discover the biggest investing risks you face with your money

- Read now: Learn how to rebalance your portfolio

- Read now: See how investment fees destroy your wealth

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.