THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Table of Contents

Calculate Return on Investment Formula

Pretty straightforward right? Let’s walk through a calculation so that we are sure you have it down. Let’s say you purchased a stock for $1,000 and it is currently worth $1,600. Here is the breakdown of the return on investment calculation:

(Ending Value of Investment – Cost of Investment): $1,600 – $1,000 = $600

Next, take the $600 and divide that by the cost of the investment, $1,000 to arrive at the answer: 60%

Note that this formula will work if your ending balance is less than the cost of the investment. Your answer will be negative, which means you lost money on the investment. If you don’t feel actually performing the calculation, I have a calculator on my site that will do the math for you.

Importance of Return on Investment

Knowing the return of your investment is key for knowing whether or not your investments are profitable or not. In fact, there are many uses for the return on investment calculation:

- Investments: Stocks, bonds, etc.

- Resellers: If you buy something at a yard sale and resell it in eBay

- Landlords: determine which properties are most valuable to you

- Businesses: determine how much money certain products are generating. This can help you focus on higher producing items.

With all of these various ways to calculate the return on investment, you need to make certain you are using the correct inputs. Using the wrong values will give you the wrong answer and could prove to be very costly.

The Higher ROI The Better

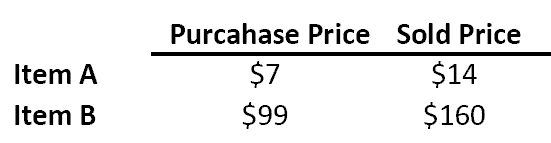

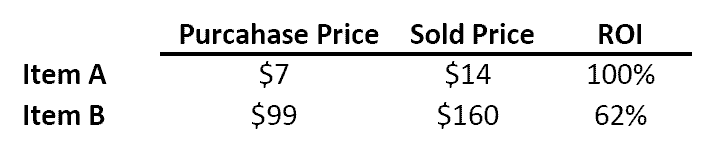

Of course, you want to invest in the highest return on investment items the most. This is where the calculation really comes into play. Let’s say you have two products that you are selling. Below are the prices you paid for the item as well as how much you sold the item for.

Just by looking at the numbers, it looks like Item B is the more profitable product. But when we calculate return on investment, we see this is not the case.

Item A has a 100% return on investment while Item B has a return of investment of 62%. Both of these are great returns to have, but if you want the best return for your money, Item A is where it’s at. Every time you sell one, you are doubling your money.

Final Thoughts

Knowing how to calculate return on investment is key for understanding the best investment you can make. As you can see from the bullet points above, you can calculate return on investment for many industries and needs. The key is just knowing which inputs to use.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Great post! Investing is an incredibly important part of life but, too many people invest without really knowing exactly what they’re going to get out of it. Calculating returns can seem to be difficult but, you outlined it pretty well here. Thanks!

Thanks Joshua!

I think that a lot of people see a dollar amount and assume it’s a good return, when that isn’t the case at all. Depending on how much you paid for something determines whether or not that gain was a good return or not.

ROI can be used for some many things. You can do it for your time along with investing, business and many other things. It is one of my favorite calculations.

I didn’t think about your time. That’s a great way to use the calculation.

We use ROI to track how we are doing with our rental properties. It’s a great measure to see how profitable those are for us each year.

Thanks for sharing how you use ROI, Brian! I was trying to mention all of the ways you can use it.

I try to calculate the ROI on absolutely everything I do that I’m investing in. It’s important.

Great breakdown on ROI Jon. It’s such a vital calculation to be able to do that many do not. The crazy thing is that it’s really just simple math and can be so helpful to be able to do.

I agree, it’s simple math so there should be no excuse why you shouldn’t calculate it.

Calculating ROI is pretty straightforward and this article is a good reminder that we should stay current in analyzing our investments. I think many of us can get lazy in keeping track of ROI though because it’s either already done for us (via say your online brokerage account) or because we just don’t keep up with it.

You made ROI calculation so simple for me. I am very much new into this investment and this post helped me to understand the basics. It is very important to know how to calculate the returns if you have plans of investment. Thanks for sharing Jon

Is there a rule of thumb as to how often you should calculate your ROI? Monthly? Quarterly?

That’s a great question. For my investments, I use a software program that calculates it automatically for me. I would say for most people, annually would be best. With other assets, it would depend on what you are comfortable with. I was reselling electronics for a little while and would calculate ROI on each product to get an idea of what my best performers were.

We all want to have higher ROI in our investments but there are risks involved also which should be taken into consideration. But this is a great intro on ROI as there are investors who skip monitoring their investments.