THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

They offer some features that others don’t, or at least not as well. This is a good thing as not everyone is the right fit for brokers like Betterment or Ally Invest.

In this Wealthsimple review, I will walk you through what this robo-advisor has going for it, where it shines, and where it falls short. The goal is to provide you with enough information to made a confident decision in choosing a broker to invest your money with.

Let’s get started with my Wealthsimple review!

Wealthsimple Review Summary

- Ease of Use

- Account Fees

- Account Types

- Features

- Customer Service

Summary

Wealthsimple is a new robo-advisor to US investors and offers a ton of create features to make investing simple and easy. You can use another robo-advisor with a lower annual fee, but Wealthsimple is perfect for those just starting out and who are interested in growing their investment accounts. Click here to get started!

Table of Contents

My Wealthsimple Review

How Wealthsimple Works

Wealthsimple works like other robo-advisors. You open your account, answer a short questionnaire to determine your risk profile, and you are assigned a portfolio. The portfolio Wealthsimple assigns you is based on the following factors:

- Financial goals

- Risk tolerance

- Time horizon

- Investment experience

- Investment knowledge

After you have a portfolio created, you set up an automatic transfer for a monthly investment and let Wealthsimple go to work for you.

Up until this point, this is how most robo-advisors work. But here is where Wealthsimple throws in a twist. Instead of offering a large quantity of portfolios to invest in, they offer just a handful. This includes a conservative portfolio, a balanced portfolio, and a growth portfolio.

Here is how each is allocated:

- Conservative (35% stocks, 65% bonds)

- Balanced (50% stocks, 50% bonds)

- Growth (80% stocks, 20% bonds)

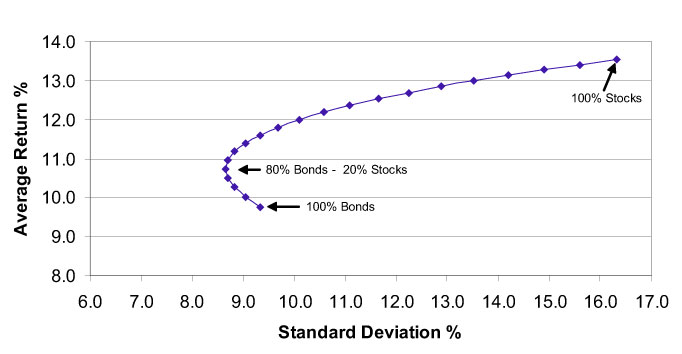

While it sounds nice to have more portfolio options, the reality is, more isn’t always better. If you follow the Efficient Frontier, you will see that you don’t get a much higher return investing in a 100% stock portfolio. But you do get much more risk. In the picture below, more risk is shown by the x axis of standard deviation. The farther right your travel, the more risk you assume.

Along the same lines, Wealthsimple keeps the underlying ETFs that you can invest in to a short list as well. Again, more might seem better, but many smart investors tout a simple 3 fund portfolio.

Here are the current ETF options for Wealthsimple:

Stock ETFs:

- Vanguard US Total Stock Market ETF (VTI)

- Vanguard Mid-Cap Value ETF (VOE)

- Vanguard Small-Cap Value ETF (VBR)

- Vanguard FTSE Europe ETF (VGK)

- WisdomTree Japan Hedged Equity Fund (DXJ)

- Vanguard FTSE Emerging Markets ETF (VWO)

Bond ETFs:

- iShares National Muni Bond ETF (MUB)

- iShares TIPS Bond ETF (TIP)

- Vanguard Total Bond Market ETF (BND)

- VanEck Vectors Fallen Angel High Yield Bond ETF (ANGL)

Wealthsimple invests their clients using Modern Portfolio Theory, which is an investment theory developed by Nobel Prize-winning economist Harry Markowitz. While you can click the link above and learn the details of MPT, the idea behind it is that you can minimize risk and maximize return through diversification.

If you are interested in seeing this in action, check out my power of investment diversification post.

Social Responsible Investing

While the above investing concept is great, there are many investors who are interested in socially responsible investing. For these investors, Wealthsimple has specific ETFs for you to invest in:

- Lower Carbon Exposure: iShares MSCI ACWI Low Carbon Target ETF (CRBN)

- Clean-Tech: PowerShares Cleantech Portfolio (PZD)

- Socially Responsible US Companies: iShares MSCI KLD 400 Social Index Fund (DSI)

- Gender Diversity: SPDR Gender Diversity ETF (SHE)

- Local Initiatives: PowerShares Build America Bond Portfolio (BAB)

- Affordable Housing: iShares GNMA Bond ETF (GNMA)

As you can see, these ETFs invest in companies that focus on things like lower carbon exposure, clean energy innovation, gender diversity in senior leadership roles, and government-issued mortgage-backed securities that promote affordable housing.

If Wealthsimple sounds like the right fit for you, here is the link to sign up!

Advantages To Wealthsimple

So where does Wealthsimple really shine? Here are the areas where they have an advantage over the competition.

No account minimums. You can start investing with Wealthsimple with nothing if you want.

Free tax loss harvesting. Wealthsimple will tax loss harvest your portfolio to ensure you are paying the lowest amount possible in taxes.

Access to an investment professional. Clients with a small balance get a 15 minute call with an investment professional to talk about financial planning basics, investment taxes, what type of account to open, etc. With this information, you can easily go about creating your own financial plan to ensure investing success.

Those investors with more money (over $100,000) get access to an investment professional who will create a detailed investment plan. Both services are completely free.

Investment review. You don’t even need an account for this one! Wealthsimple will review your most recent investment statement and review your asset allocation, tax efficiency, and account fees you are paying.

Wide variety of accounts. You can choose between a taxable (personal or joint), custodial, trust, traditional IRA, Roth IRA, or SEP IRA account.

No account transfer fees. Usually when you transfer your account to another broker, you are hit with account transfer fees. But not with Wealthsimple. They do not charge an account transfer fee.

Reimburse account transfer fees. What if you are transferring an account to Wealthsimple? If your current broker charges an account transfer fee, Wealthsimple will reimburse you the charge. Note this is only done for accounts with a minimum transfer of $5,000.

Disadvantages To Wealthsimple

Where does Wealthsimple fall short? Here are a few areas.

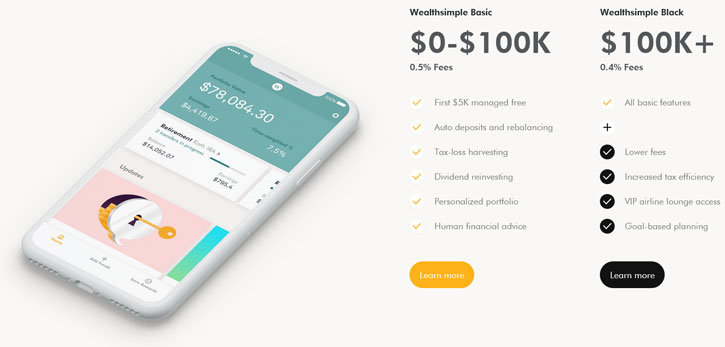

Fees. While the advisory fee they charge isn’t outrageously high, it is higher than most of the competition. For those with less than $100,000 invested, the annual fee is 0.50%. For those with more than $100,000 invested, the fee is 0.40%.

However, your first $5,000 invested during the first year is free. There is no fee you pay on it.

Tax loss harvesting. I mentioned this as an advantage before, but it is a disadvantage for those with less than $100,000 invested. This is because tax loss harvesting isn’t automatically done for these investors. You need to call and request it be done.

It’s not the end of the world to have you call in, but it would be nice if they simply offered it to all clients.

Website Options. This could be an advantage or disadvantage depending on how you look at it. When you use the Wealthsimple website, it is clean and simple to navigate. It is there for you to invest. It is perfect for investors who want to completely automate investing.

But if you are looking for tools, like retirement calculators, you won’t find any here. This can be a let down for those investors who want to do detailed planning as well as investing.

Of course, a simple solution is to use Personal Capital to do all of the detailed planning for retirement.

Wealthsimple Basic vs. Wealthsimple Black

After reading through the advantages and disadvantages, you might have noticed varying fees and services. Wealthsimple offers 2 different account plans, Wealthsimple Basic and Wealthsimple Black. Both are straightforward and easy to understand.

If you have less than $100,000 to invest, you will be a Wealthsimple Basic client. You management fee is 0.50% and you get free automated deposits, no fee trades, and free dividend reinvestment. You get a 15 minute call with an investment professional to answer any of your questions. You also get free tax loss harvesting, but you have to call to request this.

Finally, your first $5,000 invested is free for the first year. You will not be charged the 0.50% management fee.

If you have more than $100,000 to invest, you are a Wealthsimple Black client. Your investment fee is 0.40% and you get all of the same features listed above. There are a few differences. First, you don’t have to call to get tax loss harvesting, it is done for you automatically.

Second, you don’t get a 15 minute call with an investment professional, you get a free financial plan from an investment professional.

Lastly, you get access to a complimentary membership to VIP Priority Pass, which gives customers plus a travel companion unlimited access to more than 1,000 airline lounges in 400 cities around the world.

Click here to start investing with Wealthsimple!

Frequently Asked Questions

Here are some common questions I get from readers about Wealthsimple.

Is Wealthsimple Safe? Yes. Wealthsimple uses 128-bit SSL encryption on all information that is transmitted online. Additionally, they use state of the art backup technology and firewalls, so that you always have access to your account. Your account is also insured for up to $500,000 through SIPC.

Are there any Wealthsimple complaints? No. As of this writing there are no complaints again Wealthsimple through FINRA. You can see current details using BrokerCheck.

How are returns calculated? Wealthsimple uses 3 methods to calculate your returns. They include simple return, time-weighted return, and money-weighted return. Since all 3 have their shortfalls, offering all gives investors a detailed look at their investment performance.

Can I change my portfolio? Yes! Even though Wealthsimple assigns you a portfolio based on your answers to the questionnaire, you might feel strongly about a specific portfolio allocation. To change what they recommend, simply email them and they will change it for you.

How often is my portfolio rebalanced? When there is a variance of more than 20%, Wealthsimple will rebalance your portfolio the next day. For portfolios with a variance less than 20%, any dividends earned will be invested in to the most underweighted holding.

Can I buy fractional shares? Yes! The beauty of Wealthsimple is since you can buy fractional shares, all of your money is always invested. You never have cash not working for you by having it sit on the sidelines.

Wealthsimple Versus The Competition

Wealthsimple vs. Betterment

Both robo-advisors offer similar services. But if you are looking for more planning tools, then Betterment is your choice. It is also less expensive too.

But if you just want to invest and are not interested in tools at this stage, then Wealthsimple offers a competitive product.

Wealthsimple vs. Ally Invest

When it comes to Wealthsimple or Ally Invest, it really depends on what you are looking for. Active investors who want to trade stocks and options are better served with Ally Invest.

For those looking for a robo-advisor, it’s a tougher call between the two. With Ally Managed Portfolios, you need $2,500 to start investing. With Wealthsimple you can start investing with $5. But the management fee with Ally is 0.30% while with Wealthsimple it is 0.50%.

Wealthsimple vs. Acorns

Wealthsimple is the better option compared to Acorns, especially when you have less money invested. This is because with Wealthsimple, your first $5,000 during your first year is free. With Acorns, you are paying $1 each month.

As your Acorns balance grows, the monthly fee stays at $1 and becomes a smaller fee in percentage terms. So for most investors, Wealthsimple is the better option.

Of course, if you are really stretched for cash to invest, then Acorns is better because they will invest your rounded up change, which can have a big impact over the long term.

Wealthsimple vs. Vanguard

Wealthsimple is a better option for investors without a lot of money to invest. This is because to invest in Vanguard mutual funds, you need $3,000 for each fund. So to build a 3 fund portfolio, you need at least $9,000.

For investors with more money, Vanguard is a better option over Wealthsimple Black. This is because with Vanguard Personal Advisor Services, you are charged 0.30% and have a dedicated investment professional.

The catch though is that you will be investing in Vanguard holdings. If you would rather invest in other holdings, then paying a little more for Wealthsimple Black is an option.

Final Thoughts

At the end of the day, Wealthsimple is a great addition to the robo-investing industry. While their management fees are a little higher than others, they offer great service and features for investors. I would definitely have them on my short list as I narrowed down finding the right online broker for me.

Here is the link to get started with Wealthsimple!

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.