THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

One of the biggest challenges is investing for your children, grandchildren, nieces or nephews.

Since they are under 18, they cannot open a brokerage account themselves.

They need an adult to do it for them.

As simple as this sounds, it is more involved than you think.

You need their social security number and other documents just to open the account.

While many larger brokers allow for custodial account for minors, many of the newer investing apps and brokers do not.

Then there is the issue of actually investing the money and keeping the kid’s interest.

While some kids might be excited about mutual funds, most are more into individual stocks.

They know companies like Disney, Hasbro, Domino’s and others.

By owning shares in these companies, kids take more of an interest.

But stocks can be pricey.

Let’s look at Amazon as an example.

At the time of this writing, in order to buy one share of Amazon, you need to have close to $3,300.

Most grandparents were thinking of gifting little Johnny $50 for his birthday, not $3,300!

The solution is called buying a fractional share of stock.

This is where you can buy a percent of stock.

Using the Amazon example above, you would buy $50 worth of Amazon stock and own 0.015 shares.

This is great, but doesn’t solve the issue of opening an investing account for kids.

Both of these issues are solved with Stockpile.

Stockpile is a new broker that makes it simple to give the gift of stock to kids and for kids to get started investing at a reasonable cost.

I know, it sounds too good to be true.

But it really isn’t.

Here is my detailed Stockpile app review.

Table of Contents

My Stockpile Review

What Is Stockpile?

Stockpile was created a few years ago by Avi Lele.

He wanted to buy his nieces and nephews something other than toys for the holidays.

He wanted to give them something that would benefit them.

He landed on stocks.

So he set out to buy them some stocks.

The problem was the stocks he wanted to invest in were too expensive to purchase as a gift.

And for stocks he found not to be too pricey, he found it was a major hassle just to buy the stock.

He ended up giving up and buying them toys.

But he didn’t give up on the idea. And from that idea, Stockpile was created.

Here is a short video interview Avi Lele did on Mad Money with Jim Cramer.

How Does Stockpile Work?

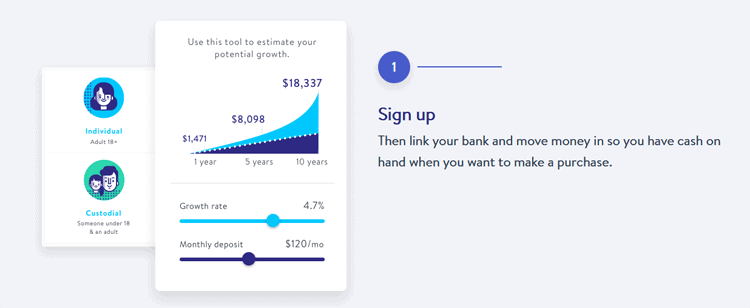

The process to get started with Stockpile is simple.

Stockpile works in one of two ways.

- You purchase either e-gift cards or physical gift cards for shares of stock and gift it to a friend or loved one.

- If you want to buy stock for yourself, you open a free account, choose the stock you want to buy and pay for the stock plus the $0.99 trade commission with your debit or credit card or bank transfer.

It’s so simple, anyone can do it!

Getting Started With Stockpile

To get started investing with a Stockpile brokerage account, you can either create an account on the desktop version of the site, or through the Stockpile app.

In order to open an account you need to meet the following requirements:

- Be 18 years old or older

- S. citizen

- Have a Social Security Number

- Have a legal United States residential address

Once you create your account and verify your email, it is time to login to Stockpile.

The layout of your account is great on both devices, allowing you to easily navigate around and start investing.

Your next step is to link your bank account, debit card, or credit card to your account so you can move money when you want to buy stocks.

Of course, this isn’t required as you can also just purchase gift cards worth of stock as well.

However, you will save on fees if you link your bank account.

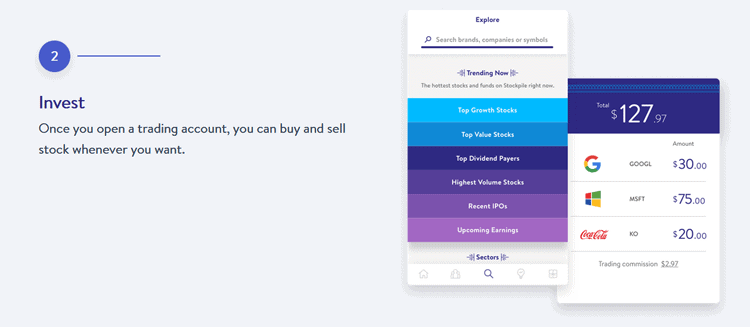

Next, you pick the stock you want and place a trade.

From there you sit back and let the market do its work.

You can follow your investment on either your desktop or the mobile app as well as place additional trades.

If you are opening an account up for a minor, the process is a little different.

You will need to decide who the custodian of the account will be.

This is another way of saying who has legal authority over the account since the child is a minor.

Once the account is set up, you can provide the login details with the child so they can login in and watch their investment grow.

You will skip the part about linking a bank account since the child will invest future money using gift cards.

Advantages And Drawbacks

Now that you know more about Stockpile, I want to run through some things I like and dislike about them so you can better think through things and make the best decision for you.

Advantages

Investing for kids. Hands down, the main feature of Stockpile is the ease for kids to invest in individual stocks.

Selection. You can invest in over 1,000 stocks and ETFs, so there shouldn’t be an issue finding the right investment.

Buying stock. You can buy stock using your credit card, debit card, bank transfers or through gift cards.

Fractional shares of stock. You can purchase a fractional share of stock, which is huge.

Reinvesting dividends. One of the great ways to build long term wealth is to reinvest dividends. Stockpile allows you to reinvest dividends for free.

Automatic investing. You can put your wealth building on autopilot by using their automatic investing feature.

Gifting. Stockpile makes it easy to purchase gifts of stock either with a physical gift card or a digital one.

Educational resources. They offer a wealth of resources to help kids and adults learn more about investing.

Drawbacks

Pricing. Stockpile charges $0.99 to buy a stock whereas many brokerage firms allow you to trade for free.

Customer service. Customer support is hit or miss. Some people have zero issues, others complain of having issues.

No real time trading. There is no real time trading using the Stockpile app. You either get the stock at the end of the trading day price if you place a trade before 3pm, or the next day’s closing price if you place a trade after 3pm.

Frequently Asked Questions

I know you probably have questions about Stockpile, so I am highlighting a bunch of common questions you have and answering them.

As time goes by and I get asked new questions, I’ll add them to this list.

What stocks are available for purchase?

There are over 1,000 stocks, ADRs and ETFs you can buy.

You can purchase any stock in the S&P 500 and many others that are listed on the Nasdaq or Dow Jones.

To see a full list of stocks, you can check out this link.

Can I reinvest dividends?

Yes, you can reinvest dividends.

As a default, any cash dividends you receive will be put into your account as cash.

But if you elect to reinvest dividends, any dividends you earn will get reinvested for you at no cost.

Can I set up an automatic investment?

You can set up an automatic deposit.

You decide on the amount you want to invest and how frequent you want.

All this can be done on the Stockpile app.

What are the Stockpile fees?

The trading fee is $0.99 to trade stock. There are no monthly charges.

However, if you use your credit card to buy stock, you will pay the credit card transaction fee of 3% in addition to the $0.99.

For example, if you want to purchase $50 worth of a stock and you transfer money from your bank account, it will cost you $0.99, so $50.99.

If you buy $50 of stock with your credit card, you will pay the $0.99 fee plus 3% to cover the processing, for a total cost of $52.49.

Trading stocks with your debit card also incurs a fee.

The debit card fee is 3%, as with the credit card fee.

When it comes to the trading commission on gift cards of stock, the fees get a little trickier.

For e-gift cards that you buy virtually on Stockpile, the fee is $2.99 plus the $0.99 trade fee, plus the 3% processing fee.

For example, if you give $100 e-gift of stock, you will pay $105.99 and your recipient will get $100 worth of stock.

If you buy a gift card from a store, the fee varies between $4.95 and $7.95 depending on the value of the gift card.

These work like the Visa and Mastercard gift cards you can buy where you pay the fee on top of the gift card value.

There are no additional fees with Stockpile.

How much is it to sell stocks?

To sell a stock, you would pay the $0.99 commission.

How do I pay for stocks?

You can pay for stock with any cash you have in your Stockpile account, with a debit or credit card or through PayPal.

If you link your bank account, you can transfer money directly to you Stockpile account as well either as a one-time transfer or as a recurring transfer.

How does Stockpile make money?

The first way they make money is through the $0.99 trade commission.

But this is only a small part of their income.

In fact, in many large brokers, they don’t make a lot of money on trading commissions. They make their money through lending.

The way Stockpile makes most of its money is through the fees they charge for gift cards.

How do I give free stock as a gift with Stockpile?

There are two ways to give stock as a gift through Stockpile, both of which involve stock gift cards.

First, you can give a physical gift card.

These can be bought at stores you shop at or you can buy direct from the Stockpile website and have them mail you the gift card.

Currently there are over 10,000 stores where you can get Stockpile gift cards at.

Here is a short list of retailers:

- Kroger

- Safeway

- Wegmans

- Shoprite

- Target

- Kmart

- Sam’s Club

- Toys R Us

Understand that when you buy a physical gift card, there is a processing fee that you pay.

The charge depends on the dollar amount of the gift card as follows:

- $25 gift card: $4.95 processing charge

- $50 gift card: $6.95 processing charge

- $100 gift card: $7.95 processing charge

For example, if you buy a $50 gift card, it will cost you $56.95 and the recipient will have $50 to invest.

If you don’t want to buy a physical gift card, you can go to the Stockpile website and buy an e-gift card there.

Here you can choose the amount you want to gift, anywhere from $1 up to $2,000.

The price for an e-gift card is $2.99 for the first one and $0.99 for each additional e-gift card.

You also pay the $0.99 trade commission so that the recipient can buy stock completely free.

Finally, you also pay the credit card processing fee of 3%.

Am I stuck with the stock the gift card is for?

No.

In many cases, you can buy a gift card that says it is for stock in Netflix or Amazon as an example.

But the recipient of the gift card can use it to buy any stock they choose.

Is there a limit to how much stock I can buy at one time?

Yes.

You can buy up to $1,000 using your debit or credit card.

What price do I get when I buy stock?

If you place a trade before 3pm, you buy stock at the closing price for that day.

If you place a trade after 3pm, you will get the closing price the following trading session.

For example, if you place an order to buy General Electric at 2pm, you will own the stock based on the closing price that day.

However, if you place your trade at 3:30pm on a Tuesday, you will own the stock at the closing price as of Wednesday.

There is no open for advanced order types, like stop loss or limit orders.

How can my grandchild/child/niece/nephew buy additional stock?

Additional stock can be bought by either buying gift cards in store or online.

Another option is to have a bank account, debit card, or credit card of the parent linked to the account.

What types of accounts are available?

As of this writing, you can open either an individual or custodial account.

There is no option for a retirement account at this time.

Can anyone open an account?

Currently Stockpile is only available to US citizens and residents.

Are there any minimum balance requirements?

There are no minimums when opening an account.

You can open an account without any money and then add money when you or a child is ready to invest.

Also, there is no account minimum you need to keep to avoid fees.

Stockpile only charges the trading fee.

Will I receive a 1099 for taxes?

Yes.

After the year end, usually in January, Stockpile will create a 1099 for you that you can access on your account online.

Is Stockpile safe?

Yes the Stockpile platform is safe.

In addition to using the latest technology and 256-bit encryption to protect your data, they are members of SIPC and FINRA.

These are the two authorities all reputable brokers belong to.

Additionally, trades placed with Stockpile are settled and cleared through Apex Clearing Corporation, which is also a member of both FINRA and SIPC.

Are there any complaints against Stockpile?

As of this writing there are zero Stockpile complaints.

You can see a summary report by FINRA BrokerCheck here.

Clicking on the “detailed report” link will show you any current complaints against Stockpile.

Alternatives To Stockpile

Are there any other options out there other than Stockpile for buying stocks?

There are a few.

Acorns vs. Stockpile

Acorns has the option of opening a custodial account.

But, they only offer pre-built portfolios made up of exchange traded funds.

So if you are investing for a child and they want to own Disney stock, they will own it indirectly through the ETF.

Robinhood vs. Stockpile

The advantage Robinhood has is you can invest for free with Robinhood.

However, if you are looking to invest for your kid, grandchild, niece or nephew, you are out of luck.

Robinhood does not offer custodial accounts.

M1 Finance vs. Stockpile

M1 Finance is a new broker on the scene.

They also offer free trades and offer all stocks and ETFs to trade.

I highly recommend them.

The only issue is there is not option for a custodial account with the free version.

However, with M1 Plus, you do have access to custodial accounts.

The annual fee for M1 Plus is $125.

Schwab vs. Stockpile

Schwab is probably the best alternative to Stockpile if you invest with their Schwab Stock Slices.

This feature allows you to invest in almost and stock for as little as $5.

You can even print out stock certificates for your child to have.

Who Should Invest With Stockpile

The bottom line is if your goal is to get your kids, grandkids or nieces or nephews investing, Stockpile is a good option.

They make the process of buying your first stock fun for young people.

While larger brokers, like Schwab and Fidelity offer accounts for minors, it is more involved to open an account.

Plus you are stuck with giving them a check as a gift and not a gift card.

And while Stockpile is simple for new investors, there are better options out there if you are investing for yourself.

I recommend looking at M1 Finance or Acorns.

Final Thoughts

At the end of the day, Stockpile is filling a need.

The need to make it easy for parents and grandparents to invest for their child and have the child be interested in the stock market.

The Stockpile app makes it interesting for kids to invest and learn more about the market, which is a great thing.

With the power of compound interest, the earlier they begin investing, the greater impact it will have on their finances in the future.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Have you looked into M1 Finance, its very similar to Stockpile but they use fees instead of .99 trades. I believe the first $1000 invested is free.

I have not heard of them but will check them out. Thanks!

Stockpiles is a great option for people who can’t invest huge amounts but want to be the part of of the growing stocks. Thanks for sharing such helpful idea available Jon. 🙂

I’ve heard alot of negative things about Stockpile and was kind of leary on putting my money in there. I have 9 grandchildren I want to give stock to but kind of scared. I don’t have money to loose like that.

What negatives have you heard? I’ve been investing with them for 6 months and love everything about them. If you let me know about the negatives, I can try to address them for you.

I’ve had an account with Stockpile.com for just over a year now. I sent money every couple of months from a bank account and purchased 4-5 stocks with it. This month I began selling the first batch of stocks, and the account became unceremoniously locked. After sending them an image of my driver’s license, they unlocked the account, but the money from selling the stocks was “unavailable” to me. A few days later, the account was unceremoniously locked again.

It’s now 44 calendar days since selling my first shares. The last time I was able to see my account balance, that money was still “unavailable” cash. I say the last time because my account is currently locked for the third time now (this time for over a week).

Sorry to hear you are having issues with Stockpile. This is the first case in which I have heard of this. Please keep me updated.