THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

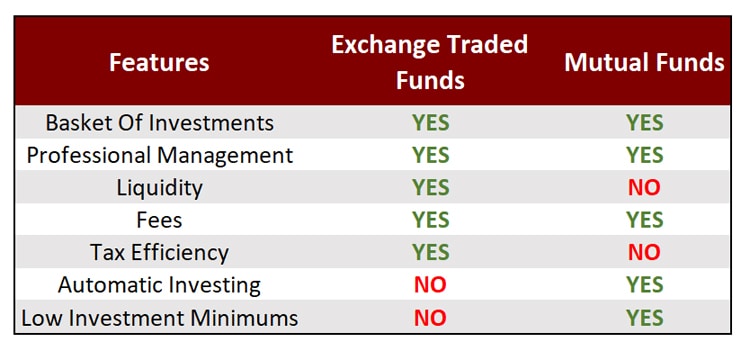

To help this reader and others, I did put together a chart comparing ETFs with mutual funds and hopefully it will help you make the decision of ETF or mutual fund easier to answer.

Table of Contents

ETF or Mutual Fund Chart

ETF or Mutual Fund Chart Explained

Let’s talk about this chart. As you can see there are some differences and similarities between ETFs and mutual funds. We start off with the things they have in common:

- Basket of Investments: Both ETFs and mutual funds are an investment that has many underlying securities. When you buy a share of an ETF or mutual fund, you are buying many stocks at once. This helps you to be diversified from the start.

- Professional Management: Regardless if you are an active or passive investor, either an ETF or mutual fund offers professional management. You aren’t stuck trying to pick securities or need to watch the market. The ETF or mutual fund management will do that for you.

That is where the similarities stop between the two types of investments. We now turn our attention to the differences, and this is where you will decide which is the right investment for you.

Liquidity

Trading an ETF or mutual fund varies. With an ETF, you can buy or sell shares at any point during the day and get the price you see. With a mutual fund, it only gets priced after the market closes. This means that no matter what happens in the market on a given day, all investors buy and sell at the exact same price.

Should This Matter To You? Not really. If you are a long-term investor, the fact that you can buy or sell throughout the day shouldn’t really matter. You could argue that being able to buy an ETF at 10am might provide you with an emotional reaction, but again, in the long run, getting the closing price versus the intraday price won’t matter much.

Fees

This is a big issue with both investments. When looking at ETFs, you have to pay a management fee each year. The good news is that typically the management fee with ETFs is rather low since most ETFs are index tracking investments. But the fees don’t stop there. You also pay a trading fee with an ETF. This typically runs about $10 if you invest with Schwab or Fidelity. But, you can avoid this fee by purchasing certain ETFs from certain providers.

For example, at Fidelity, you won’t pay a trading fee if you invest in iShares. With Schwab, you would pay the fee, but Schwab offers other ETFs that don’t charge a trading fee. Note that even if you don’t pay a trading fee, you will pay a management fee.

When it comes to mutual funds, there are all sorts of fees you could pay. Luckily, most can be avoided. You can easily avoid loads and 12b-1 fees by simply investing in funds that don’t charge this fee.

But like an ETF, you will pay a management fee. Since mutual funds have both active and passive investments, management fees vary widely. You could pay as little at 0.08% to as high as 3%. Unlike with other areas of life, the higher fee does not mean better quality. You want to pay as small a management fee as possible.

Lastly, with mutual funds, you won’t be charged a trading fee most of the time. The only time you might be is if you bought a certain mutual fund from a discount broker. For example, Schwab charges you $50 to invest in Vanguard mutual funds. You can easily avoid this fee though by investing directly with Vanguard, which doesn’t charge the trading fee.

Should This Matter To You? Yes! Fees eat away at your investments more than you realize. (If you ever wanted to know just how much, check out Personal Capital. You’ll be shocked at what you see.) Bottom line is that you have to pay attention to fees and select investments with low fees.

Taxes

Ah taxes…wait, don’t run! If you want to pay the least in taxes, you’ll want to read this section too. I’ll do my best to keep it short. When deciding between ETF or mutual fund, the better choice tax-wise is an ETF. Here is why: with a mutual fund, you are buying and selling shares with the fund itself. This means that if you sell a share of your mutual fund, the fund manager has to go out and sell the shares of the underlying stock that are tied to your mutual fund share.

On the surface this doesn’t seem like an issue. But it is and here is why. Let’s say you don’t sell any shares but I do. Since you still own your shares, any gain or loss from me selling my shares gets passed along to you as well. If it was a gain, you have to pay tax on that gain, even though you never sold.

With an ETF, this is not an issue since the ETF trades on an exchange and any shares that are bought or sold don’t affect the underlying assets. While this might sound confusing, what you should focus on is that with an ETF, you have greater control over capital gains whereas with a mutual fund, you don’t.

Should This Matter To You? Yes and no. If you are in a high tax bracket, it might make sense to look more at ETFs than mutual funds for this reason. But for most investors, the issue isn’t a huge deal. This is because capital gains tend to be reasonable in amount and as of this writing, the IRS taxes long-term capital gains at a lower tax rate. Additionally, mutual fund managers are well aware of this and do their best to limit capital gains as much as possible. But there are times when their hands are tied. Lastly, know that there are some tax-managed mutual funds out there that work to keep capital gains at a minimum.

Automatic Investing

When it comes to automatic investing, mutual funds win, hands down. You can set up an automatic investing plan with just about any mutual fund you want. Just pick a dollar amount and then choose how often you want to invest – weekly, monthly, quarterly, etc. – the options are almost limitless.

With ETFs, you really don’t have the option to invest automatically, unless you invest with a firm like Betterment. Otherwise, you are going to have to manually buy shares every time you transfer money.

Should This Matter To You? Yes! One of the key principles I talk about in my how to become a stock market millionaire post is to invest on a continuous basis. Invest regardless what the stock market is doing. The easiest way to do this is by setting up an automatic investing plan. By doing this, you guarantee you will invest every month. You can’t let your emotions talk you out of it and you can’t “forget” about it this month because you are so busy. If you really want to be financially successful, you need to embrace automatic transfers.

Investment Minimums

This is another big difference between ETFs and mutual funds. With an ETF, you only need enough money to buy 1 share. If the share price is $50, then you only need $50. With mutual funds, it is different. To start, there is an initial minimum investment. These vary by mutual fund. Some, like Schwab, have a minimum of $100, while others, like Vanguard, have a minimum of $3,000. There are many in between these two amounts as well.

From there, you have subsequent minimum investment. For the most part, it is usually around $100. But, if you set up an automatic investment plan, this can drop to as low as $25. Others, like Schwab, have subsequent investments of just $1, regardless if you set up an automatic investing plan or not. See all of the differences between the top brokers with my online broker comparison chart.

Should This Matter To You? Not really. It all comes down to how much you have to invest that will be the ultimate factor. Read this post on other options for investing with a small amount of money.

Wrapping Up ETF or Mutual Fund Comparison

In the end, there are lots of things to consider when choosing between an ETF or mutual fund. If I had to pick between the two, I would lean more towards a mutual fund. But this is because of how I weigh the differences between the two choices.

For me, the biggest factor is the automatic investing. I want to set it up and forget about it. Mutual funds let me do this with the most ease. (This isn’t to say I don’t love my Betterment account that automatically invests in ETFs for me, but there are a lot more choices for automatic investing when it comes to mutual funds. Plus, I know what I am looking for in terms of mutual funds. The fact that there are over 8,000 doesn’t discourage me.)

You might weigh the factors mentioned above differently and come to a different conclusion than me. That is fine. Just make sure you start investing and that you pay attention to fees!

- Read now: Learn the basics of mutual funds

- Read now: Understand what target date funds are

- Read now: Click here to see the biggest index funds pro and cons

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

I believe ETFs have lower fees and are more tax-efficient, although brokerage commissions can cut into your return if you’re making frequent trades. More importantly, I heard from my financial advisor that ETFs are also more accessible for smaller investors because they don’t require an initial upfront investment like many mutual funds do. So I think choosing between an ETF or mutual fund will largely depend on how much capital you have.

All good points Jayson. It all does come down to the individual investor and what makes the most sense for him/her. If coming up with a decent sized opening amount for a mutual fund. an ETF might be a better choice. But as you said, just be sure to take into account the commissions for trading.

That’s a great breakdown for investors. I actually didn’t know the tax differences between mutual funds and ETF’s, but I guess that may be part of the reason the management fees are typically higher with mutual funds.

I basically sold off all of my mutual funds a long time ago when I realized how much I was paying in management fees. Now I only have a few index funds because of the low fees associated with them. I keep checking on how they do compare to the funds I used to be invested in and I’m glad I made the switch.

Great jib taking the initiative. If only others would realize how much they are paying in fees and how much more of their money they could keep if they just switched to lower expense funds and/or ETFs.