THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Target date funds have become popular recently for the fact that they make investing a lot simpler for the average investor.

But just because they are popular doesn’t mean they are right for you.

Before you start putting your money into these investment vehicles, you need to understand if they fit with your investment strategy, including your retirement plans.

In this post, I walk you through 10 target date funds pros and cons you need to consider before investing.

By understanding more about these investments, you can make a smarter choice for your finances, helping you to reach your financial goals.

And one quick note, these investments go by many different names.

Here is a list of the common ways people talk about them, so you don’t get confused.

- Life cycle funds

- Target date retirement funds

- Age based funds

Table of Contents

Target Date Funds Pros And Cons You Need To Know

5 Target Date Funds Pros

There are many advantages of target dates funds. Here are the biggest to know.

#1.Simplicity

Hands down one of the biggest benefits to target date funds is their simplicity.

You pick your target retirement date and you are done.

This is because as you age, the investment will automatically rebalance to a more conservative allocation.

For example, when you are young, you will typically have a higher exposure to equity investments, specifically aggressive investments, because you can handle the risk.

But as you near retirement, you want conservative investments so you can protect the money you have made over the years.

Because of this, they are completely hands off investment management.

Once you select your investment, you are done.

#2. Easy Retirement Investing

Most employer sponsored 401k plans offer target date funds for plan participants.

And many times, there is a default investment option based on your age and expected retirement date.

This makes saving for retirement simple.

Before these investments were offered, you had to pick from a list of fund options that you knew nothing about.

And many times there wasn’t much help to assist you in making the right choice either.

The individuals in the benefits department could only answer basic, plan related questions, not the type of fund you should invest in.

For this, all you had was a basic quiz that many times skewed your answers and had you take a more aggressive investment strategy.

Now you can simply do the math when you plan to retire, pick the corresponding investment and start making contributions.

#3. Categorized By Risk Tolerance

Another nice thing about target date funds is the choices you can make.

I mentioned above how when you are young you tend to take on more investment risk.

While this is true for many investors, it is not true for all investors.

Even some young investors have a low risk tolerance and want to invest in a safer investment vehicle.

With target funds, you can do this.

Many investment companies, like Vanguard, T Rowe Price, Fidelity, and others offer many types of target funds with different investment objectives.

- Read now: Click here to learn mutual fund basics

They all have a variety of asset classes that make up the funds, so you can find the perfect one for you.

This means you have choices. You aren’t stuck investing in one or two funds.

You can even pick a different retirement date fund if you like.

For example, let’s say you plan to retire in 25 years, so the natural pick would be the “Retirement 2045” fund.

But you find the asset mix is too risky for you.

Instead you could invest in the “Retirement 2030” fund which would have an asset mix that you would be more comfortable with.

And once you do reach retirement, most firms offer a fund after retirement which is designed to invest in conservative assets and provide a monthly income stream for you.

#4. Instant Diversification

With most target dates funds, the fund is essentially a fund of funds.

What does this mean?

It means that the age based funds are made up of other mutual funds the mutual fund company offers.

For example, the age based fund might be made up of 30% their S&P 500 fund, 25% of their dividend fund, 20% of their small cap fund, 15% of their international fund, and 10% of their bond fund.

Another way to look at it is like a variety pack.

Instead of buying one bag of regular potato chips, you could buy the variety pack instead.

This way you get regular chips, BBQ chips, sour cream chips, salt and vinegar chips, etc.

And each of these bags is smaller than a regular bag.

If you chose to invest in other mutual funds, you would have to purchase a few different funds to be diversified.

But with a target date fund, you only need a single fund.

#5. Automatic Rebalancing

One of the hardest things to do as an investor is to reallocate your money.

As the markets move, your investments will grow and fall in value.

And in time, what started out as a 60% stock allocation, 40% bond allocation portfolio might look like an 80% stock allocation, 20% bond allocation portfolio in a few years.

This change can have a massive impact on your future wealth.

This is because in this case, you are taking on more risk that you are comfortable with.

And when market downturns happen, you are going to lose a lot of money because of your high equity exposure.

With the reverse, when your bond allocation grows too large, you aren’t taking on enough risk and might not be able to reach your financial goals, even if there is a prolonged bull market.

As a result, you have to fine tune your investments every year or so.

But with target date funds, you don’t have to.

They will automatically rebalance for you, so there is nothing for you to do.

This simplicity is what draws many DIY investors to this type of investment.

5 Cons Of Target Date Funds

While there are a number of drawbacks to target dates funds, these are the important ones you need to know about.

#1. Higher Cost

One of the biggest disadvantages of target date funds historically have been the cost.

Since you are investing in a single fund made up of other funds, the management fees usually get passed along.

Why does the expense ratio matter?

The higher this is, the more money you are paying in fees.

And the more money you pay in fees, the less money there is for it to grow and compound in your favor.

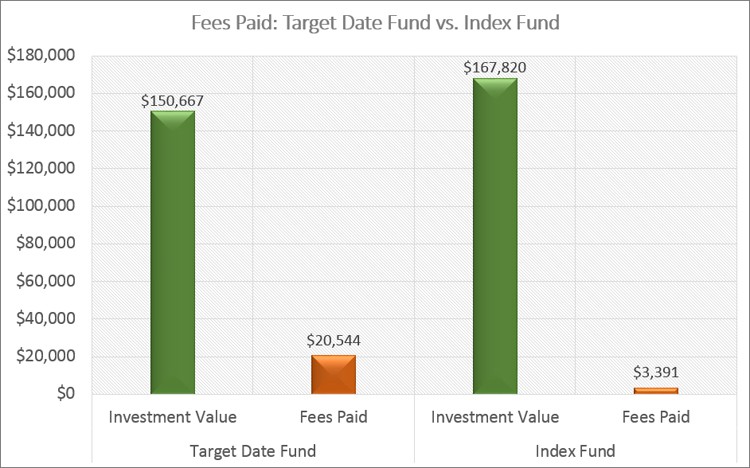

Let’s look at an example to drive this point home.

The average expense ratio for these investments is 0.51% annually.

The average expense ratio for a passive index fund is 0.08%.

If you have $25,000 invested in each fund and they both earn 8% annually for 25 years, how much money do you end up with?

With the target date investment you have $150,667 and you paid over $20,000 in fees.

With the passive index investment, you end up with $167,820 and paid close to $3,400 in fees.

That is a difference of over $17,000!

You could have that money simply by making a different choice.

I will say that for some life cycle funds, the expense ratio has come way down, making them more attractive to individual investors.

But they still cost more than a simple passive index fund.

#2. Many Funds Are Different

A common misconception is that a target retirement fund 2045 would be the same regardless which mutual fund company you choose.

But this isn’t the case.

Not only will the equity and bond percentages differ, but so too will the makeup of the equities.

Here is an example to make this clear.

The Fidelity Freedom 2045 is made up of 51% domestic stock, 41% international stock, 6% bonds, and 2% in cash.

The Vanguard Target Retirement 2045 is made up of 54% domestic stock, 36% international stock, and 10% bonds.

Because of this, the performance returns for each vary.

The point is, don’t think that all retirement 2045 funds, or any fund with the same target date are the same.

They all have a different asset allocation model and you need to make sure you are comfortable with this before you invest.

#3. Tax Efficiency

Another big downside to these investments is taxes.

To understand this, you need to know that the IRS treats investment income differently.

Income from dividends and capital gains is taxed at a lower rate than the income you earn from your job.

But the interest you earn from bond funds is taxed at ordinary income rates, which is the same rate as your job.

So when you invest in these investments, you are best served putting them inside a tax advantaged account like a 401k plan, Traditional IRA, or a Roth IRA.

By doing this, you avoid paying taxes on the income from these retirement investments every year because for tax purposes, you defer the gains.

If you were to invest in a taxable account, you would be paying a lot more in taxes than you should be, especially as you approach retirement and more of your money is allocated towards fixed income.

#4. Risk Tolerance Ignored

As nice as it is to have an investment you can essentially forget about, there is an issue at play that many people don’t think about.

You might be someone who is more comfortable with risk and as a result, don’t want a greater percentage of bond holdings as you age.

For example, the Vanguard Target Retirement 2030 fund has 32% of its assets in bonds.

If you are 10 years away from retirement, you might want only 15% or 20% in bonds.

With these investments, you don’t have a choice.

So if you think you want to change your asset allocation yourself, you would be better served with a different investment vehicle.

Additionally, we are all well aware that life happens.

We might start out with the goal to retire in 2045 but end up deciding we want to retire sooner.

Or maybe you get divorced and have to start over financially.

These situations and many others have a major impact on your finances now and your financial plan, including retirement.

With a target fund, it is a lot harder to change things on the fly as opposed to investing in ETFs and other mutual funds.

#5. All Money With One Company

Finally, since age based funds are typically made up of other funds from the same fund family, all your money is with a single fund family.

If that company goes under, you are putting your wealth at risk.

Or if a scandal breaks, other investors might flee, forcing the fund to sell a lot of its holdings.

This could result in massive capital gains and taxes for you.

On the other hand, if you invest in individual mutual funds, you can spread your investment dollars around and not have as much risk.

While the risk of this happening is slim, it is something to consider.

Final Thoughts

At the end of the day, target date funds are a good choice for investors.

But not all investors.

You just have to know all there is about them before you invest so there aren’t many surprises.

Remember, it is your money and no one cares about it as much as you do.

You worked hard for it, so make sure you take the time to make the best investments for you and your goals.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.