THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

I’m a quote junkie.

I love reading quotes from others all of the time.

In fact, I’ve even used quotes to push me through a job I hated.

Every Sunday was a bad day.

Not because it was Sunday, but because I had to go to a job I hated the next day.

Think about that.

Having half of your weekend ruined because you hated your job.

Luckily I was able to find some quotes to change my outlook, keep me positive and push through that job.

Eventually, I found a job I loved.

If you are curious, here are many of the quotes I used to survive!

Why am I telling you this story?

Because when it comes to anything in life, you have to have a positive outlook and attitude if you want to succeed.

If you are negative about something, chances are you are going to put it off and ignore it as much as you can.

When it comes to investing, this is where many people fall.

They don’t understand the stock market or they got burnt in the past and think it’s rigged against them.

In reality, the stock market is easy to understand and it is not rigged against you.

You just have to learn the basics of investing.

Once you do this, you simply need to keep your emotions in check and keep investing.

To help you with this, I present 95 of my favorite investing quotes.

They are full of wisdom and will help you no matter where you are in your investing journey.

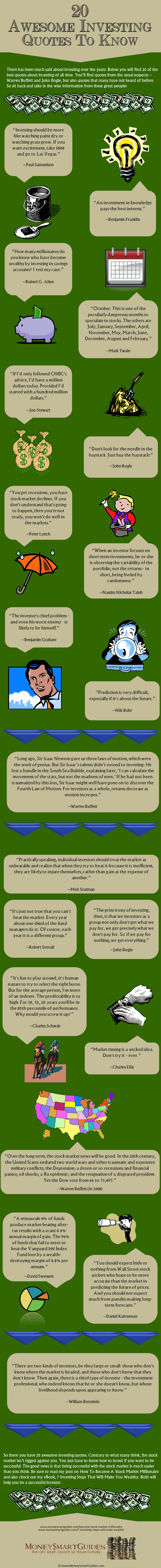

Below are the quotes followed by an infographic of the quotes as well.

Table of Contents

95 Investing Quotes To Live By

Stock Market Crash Quotes

#1. “Buy when everyone else is selling and hold when everyone else is buying. This is not merely a catchy slogan. It is the very essence of successful investments.” – J. Paul Getty

#2. “Stock market bubbles don’t grow out of thin air. They have a solid basis in reality, but reality as distorted by a misconception.” – George Soros

#3. “If you’re in a camp and a bear attacks, you don’t have to run faster than the bear, you only have to be faster than the slowest camper.” – Michael Ruppert

#4. “Tough times helped many commodities traders become lean and mean through consolidation, mergers and cost cutting. All that excess supply has been sopped up.” – Jim Rogers

#5. “I have found that when the market’s going down and you buy funds wisely, at some point in the future, you will be happy. You won’t get there by reading. Now is the time to buy.” – Peter Lynch

#6. “You get recessions, you get stock market declines. If you don’t understand that’s going to happen, then you are not ready and you will not do well in the markets.” – Peter Lynch

#7. “No price is too low for a bear or too high for a bull.” – Unknown

- Read now: Learn the basics of investing

- Read now: Click to learn how to be a successful investor

#8. “Rich people make money when the stock market goes up, rich people make even more money when the stock market goes down.” – Unknown

#9. “Bottoms in the investment world don’t end with four-year lows, they end with 10 or 15-year lows.” – Jim Rogers

#11. “If you can’t take a small loss, sooner or later you will take the mother of all losses.” – Ed Seykota

Investing Uncertainty Quotes

#12. “Commodities tend to zig, when the equity markets zag.” – Jim Rogers

#13. “Diversification is a protection against ignorance. It makes very little sense to those who know what they are doing.” – Warren Buffett

#14. “Markets can remain irrational longer than you can remain solvent.” – John Maynard Keynes

#15. “Risk comes from not knowing what you are doing.” – Warren Buffett

#16. “Searching for companies is like looking for grubs under rocks. If you turn over 10 rocks you’ll likely find one grub. If you turn over 20 rocks you’ll find two.” – Peter Lynch

#17. “Sometimes buying early on the way down looks like being wrong, but it isn’t.” – Seth Klarman

#18. “Spend each day trying to be a little wiser than you were when you woke up.” – Charlie Munger

#19. “Opportunities always look bigger after they have passed.” – Unknown

#20. “The stock market is a battlefield. Always remember to survive in the game first. Only those that survive the battle can enjoy the spoils of the war.” – Benjamin Lee

#21. “Stop trying to predict the direction of the stock market, the economy or the elections.” – Warren Buffett

- Read now: Discover the power of buy and hold investing

- Read now: Learn the difference between dollar cost averaging vs. lump sum investing

#22. “The art is not in making money, but in keeping it.” – Proverb

#23. “Individuals who cannot master their emotions are ill-suited to profit from the investment process.” – Benjamin Graham

#24. “It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.” – George Soros

#26. “Investors should always keep in mind that the most important metric is not the returns achieved but the returns weighed against the risks incurred. Ultimately, nothing should be more important to investors than the ability to sleep soundly at night.” – Seth Klarman

#27. “It’s never too late to learn.” – Malcolm Forbes

#28. “The secret recipe for success in stock market is simple. 30% in market analysis skills, 30% in risks management, 30% in emotion control, and 10% in luck.” – Benjamin Lee

#29. “The key to making money in stocks is not to get scared out of them.” – Peter Lynch

#30. “The markets generally are unpredictable, so that one has to have different scenarios. The idea that you can actually predict what’s going to happen contradicts my way of looking at the market.” – George Soros

Investing Quotes And Sayings

#31. “Accepting losses is the most important single investment device to ensure safety of capital.” – Gerald M. Loeb

#32. “Although it’s easy to forget sometimes, a share is not a lottery ticket. It’s part ownership of a business.” – Peter Lynch

#33. “Always start at the end before you begin. Professional investors always have an exit strategy before they invest. Knowing your exit strategy is an important investment fundamental.” – Robert Kiyosaki

#34. “As time goes on, I get more and more convinced that the right method of investment is to put fairly large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes.” – J.M. Keynes

#35. “Business and financial intelligence are not picked up within the four walls of school. You pick them up on the streets. In school, you are taught how to manage other people’s money. On the streets, you are taught how to make money.” – Ajaero Tony Martins

#36. “How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.” – Robert Allen

#37. “I believe in the discipline of mastering the best that other people have ever figured out. I don’t believe in just sitting down and trying to dream it all up yourself. Nobody’s that smart.” – Charlie Munger

#38. “The stock market clearly values companies that can deliver disruptive innovation.” – Steve Blank

#39. “To be a successful business owner and investor, you have to be emotionally neutral to winning and losing. Winning and losing are just part of the game.” – Robert Kiyosaki

#41. “When stocks are attractive, you buy them. Sure, they can go lower. I’ve bought stocks at $12 that went to $2 but then, they later go to $30. You just don’t know when you can find the bottom.” – Peter Lynch

#42. “Every few seconds it changes, up an eighth, down an eighth. It’s like playing a slot machine. I lose $20 million, I gain $20 million.” – Ted Turner

#43. “We don’t have to be smarter than the rest, we have to be more disciplined than the rest.” – Warren Buffett

#44. “When purchasing depressed stock in troubled companies, seek out the ones with the superior financial positions and avoid the ones with loads of bank debt.” – Peter Lynch

#45. “When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever.” – Warren Buffett

#46. “You can no longer buy commodities at Merrill Lynch. My guess is many analysts and even executives are too young to know how a hot commodities market can be. They will soon.” – Jim Rogers

#47. “Financial leverage is the advantage the rich have over the poor and middle class.” – Robert Kiyosaki

#49. “Everyone has the power to follow the stock market. If you made it through fifth grade math, you can do it.” – Peter Lynch

#50. “I think this is also a great time to invest in private equity, helping companies grow from the ground top.” – Jim Rogers

#51. “I think you have to learn that there’s a company behind every stock and there’s only one real reason why stocks go up. Companies go from doing poorly to doing well or small companies grow to large companies.” – Peter Lynch

#52. “Investment is most successful when it is most businesslike.” – Ben Graham

#53. “Many people rush into the game of investing thinking they are predators. When they get to the middle of the game, they then realize they are the prey and try to escape but it will be too late. Only the preys with a well defined exit strategy will escape, the rest will be slaughtered by the real predators.” – Ajaero Tony Martins

#54. “Men of means look at making money as a game which they love to play.” – J. Paul Getty

#55. “Money is not the only thing we invest. We must also be good investors of our time, energy, focus, & love. Our current life is a reflection of the wisdom of our past investments.” – Steve Burns

#56. “Never invest emergency savings in the stock market.” – Suze Orman

#57. “The best stock to buy is the one you already own.” – Peter Lynch

#58. “The ideal business is one that earns very high returns on capital and that keeps using lots of capital at those high returns. That becomes a compounding machine.” – Warren Buffett

#59. “The philosophy of the rich and the poor is this. The rich invest their money and spend what is left. The poor spend their money and invest what is left.” – Robert Kiyosaki

#60. “The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.” – Warren Buffett

#61. “The price of a commodity will never go to zero. When you invest in commodities futures, you are not buying a piece of paper that says you own an intangible of company that can go bankrupt.” – Jim Rogers

#62. “The rich invest in time, the poor invest in money.” – Warren Buffett

Investing Quotes About Patience

#63. “If you’re looking for a home run, a great investment for five years or 10 years or more, then the only way to beat this enormous fog that covers the future is to identify a long-term trend that will give a particular business some sort of edge.” – Ralph Wanger

#64. “In the short run, the market is a voting machine. But in the long run, it is a weighing machine.” – Ben Graham

#66. “Index investing outperforms active management year after year.” – Jim Rogers

- Read now: Learn the biggest index fund pros and cons

- Read now: Find out what target date funds are

#67. “All you need for a lifetime of successful investing is a few big winners, and the pluses from those will overwhelm the minuses from the stocks that don’t work out.” – Peter Lynch

#68. “I don’t think there is any other quality so essential to success of any kind as the quality of perseverance. It overcomes almost everything, even nature.” – John D. Rockefeller

#69. “Learn every day, but especially from the experiences of others. It’s cheaper!” – John Bogle

#71. “Do not but the hype from wall street and the press that stocks always go up. There are long periods when stocks do nothing and other investments are better.” – Jim Rogers

#72. “Even the intelligent investor is likely to need considerable willpower to keep from following the crowd.” – Benjamin Graham

#73. “Look at market fluctuations as your friend rather than your enemy. Profit from folly rather than participate in it.” – Warren Buffett

#74. “Luck is what happens when preparation meets opportunity.” – Lucius Annaeus Seneca

#75. “I never attempt to make money on the stock market. I buy on assumption they could close the market the next day and not re-open it for five years.” – Warren Buffett

#76. “The investor’s chief problem, even his worst enemy, is likely to be himself.” – Benjamin Graham

#77. “Historically, there has been a bull market in the commodities every 20 or 30 years.” – Jim Rogers

#78. “My two rules of investing: Rule number one: Never lose money. Rule number two: Never forget rule one.” – Warren Buffett

#79. “The individual investor should act consistently as an investor and not as a speculator. This means that he should be able to justify every purchase he makes and each price he pays by impersonal, objective reasoning that satisfies him that he is getting more than his money’s worth for his purchase.” – Benjamin Graham

Funny Investment Quotes

#80. “An investor without investment objectives is like a traveler without a destination.” – Ralph Seger

#81. “Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.” – John D. Rockefeller

#83. “Get inside information from the president and you will lose half of your money. If you get it from the chairman of the board, you will lose all your money.” – Jim Rogers

#84. “Go for a business any idiot can run because sooner or later, any idiot probably is going to run it.” – Peter Lynch

#85. “Go to the mouse you foolish investor and learn. A mouse never entrusts its life to only one hole.” – Ajaero Tony Martins

#86. “If you are bearish or bullish long enough, you will eventually be right.” – Unknown

#88. “Investors should purchase stocks like they purchase groceries, not like they purchase perfume.” – Ben Graham

#89. “The difference between playing the stock market and the horses is that one of the horses must win.” – Joey Adams

#90. “The secret to investing is to figure out the value of something and then pay a lot less.” – Joel Greenblatt

#91. “Value stocks are about as exciting as watching grass grow, but have you ever noticed just how much your grass grows in a week?” – Christopher Browne

#92. “One of the funny things about the stock market is that every time one person buys, another sells, and both think they are astute.” – William Feather

#93. “The wise man put all his eggs in one basket and watches the basket.” – Andrew Carnegie

#94. “If stock market experts were so expert, they would be buying stock, not selling advice.” – Norman Ralph Augustine

#95. “The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

Final Thoughts

There are 95 investing quotes you need to remember.

You can use these quotes however you like.

If the stock market is down and you feel nervous or scared, then look these quotes for reassurance everything will be OK in the long run.

If you are just starting out investing, use the wisdom in these quotes to help you be a smarter investor.

At the end of the day, the more knowledge you have about a topic and the more you can control your emotions, the better off you will be.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

I like the Jon Stewart quote the best, but these are all great!

What an awesome summary Jon! A great collection of investing wisdom that looks fantastic too!

It’s amazing how the common theme in most of these quotes is simplicity, and managing your own potentially destructive behaviours. No technical complexity, no secret formulas, just simplicity and common sense. This summary alone is a fantastic foundation for becoming a great investor and setting you up well to learn more about the world of investing.

That’s why I picked the quotes. Great, successful people showing you that it isn’t about picking the next hot stock, it’s about investing in low cost funds over the long term.

Love your work Jon, awesome quotes and the infographic is really great..

How do you put that together, is it time consuming/expensive/difficult?

Won’t hear much from me over the next 5 weeks, I’ll be on holidays without internet 🙂

It was time consuming because it was the first one I did. But I learned a lot doing it myself and have a few more planned.

Enjoy your time away!!

Awesome infographic Jon and great quotes! There are a few that really stand out to me, especially the one by Schwab, but my favorite is the Jon Stewart quote. Not only is it spot on, but it’s hysterical.

All great quotes and fun infographic. Thanks for sharing. The Twain quote is funny as media headlines always try and generate some “news” by fabricating stories saying “month x will be bad/good” or otherwise. Think about it…. the media came up with most of the stock market headline catchphrases… June Swoon, January Effect, Santa Claus Rally, Sell In May Go Away, etc. etc.

I like the first one the best. It took me several years to fully appreciate the knowledge held in this quote. Investing should not really be exciting, or you’re probably doing it wrong!

There’s some great and thought-provoking quotes there – thanks for posting 🙂

Great quotes and awesome infographic. I love the Nils Bohr one…

I love this info graphic!! Wonderful quotes and cool display. I hadn’t heard the Bernstein quote before.

Thanks Barbara!