THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Today is your lucky day.

This post will walk you through just about every possible scenario you can think of and all of the things you should take into consideration so that you make the best decision for you and your money.

Table of Contents

Answering The “Can You” Roll Over Into An IRA Comes Before The “Should You” Roll Over Question

Regarding rollovers, the “can” question must come before the “should” question. Most frequently the “can I / should I” rollover is asked about 401k accounts.

Profit seeking employers can offer 401k qualified defined contribution plans, and such plans are the most prevalent. Many people change jobs and thus are confronted with the question of what to do with assets held in 401k plan accounts with former employers.

However, these rollover questions affect many more people that just 401k retirement plan participants.

Many other workers have 403b plans (teachers, non-profit workers, etc.), 457 plans (government employees), and other types of defined contribution retirement plans.

These other workers also sometimes need to answer the “can I / should I” rollover questions.

This article addresses certain general concepts that might affect any workers contemplating a rollover, although you will need to do some research to understand the particulars of your own situation.

It also provides some useful observations about tax-advantaged retirement savings and investment planning for those deciding whether they should roll over their retirement savings into an IRA.

The myriad of US retirement plan programs and associated tax incentives for retirement savings and investing provide significant opportunities for individuals to prepare for their retirement. At the same time the complexity related to this multiplicity of plans and incentives is a national embarrassment.

It is difficult to find anyone, even financial professionals, who are not confused to some degree about the tangle of rules surrounding this mess.

Therefore, it is worth spending some time understanding what a rollover really is. Rollovers exist because there are multiple types of retirement plans.

Moreover, an individual might have multiple employer retirement plan accounts and multiple IRAs of differing flavors.

Without the ability to transfer, roll over, and sometimes consolidate retirement account assets, retirement assets would be locked into an increasing number of tax-advantaged retirement accounts over a lifetime.

When properly done, rollovers and transfers enable retirement account owners to maintain the tax-advantaged status of their retirement assets and avoid tax penalties.

Rollovers differ from transfers.

Transfers occur when funds are moved directly from one trustee to another trustee using the same type of plan. (A trustee is the financial organization that acts as custodian of the account.)

Such transfers usually are not subject to the typical one-year or longer waiting period that is required before doing a subsequent rollover. (Note that rollover waiting periods can be longer than one year. Also, there are other types of transfers related to divorce and inheritance.)

It is worth clarifying the difference between a rollover and a transfer. These are two direct quotes from page 22 of IRS Publication 590-A for the 2016 tax year:

- “Generally, a rollover is a tax-free distribution to you of cash or other assets from one retirement plan that you contribute to another retirement plan. The contribution to the second retirement plan is called a “rollover contribution.”

- “A transfer of funds in your traditional IRA from one trustee directly to another, either at your request or at the trustee’s request, is not a rollover. Because there is no distribution to you, the transfer is tax free. Because it is not a rollover, it is not affected by the 1-year waiting period required between rollovers.”

In many cases, all an individual wants to do is to move their tax-advantaged account assets from one trustee (financial custodian) to another trustee, while continuing to hold those assets in the same type of tax-advantaged account.

This can be achieved by a direct trustee to trustee transfer and does not require a rollover.

Because these transfers are direct, they do not involve any tax-free rollover distributions to individuals with subsequent rollover contributions within a limited time frame. In contrast to direct transfers, rollovers carry the added risk that these rollovers may not be accomplished properly and in a timely manner, which could subject the individual to substantial unwanted and irreversible taxes and penalties.

Individual Retirement Accounts (IRAs) effectively serve as the common denominators of the rollover process.

I use the plural here, because there are multiple possible rollovers, involving different retirement account types and differing rules.

Some rollovers can move assets between different account types, while some rollovers between certain account types are prohibited.

IRS Publication 590 Will Help You To Understand The Rules About Your Particular Retirement Plan Rollover

I will not attempt to detail this mess here, because IRS Publication 590-A, “Individual Retirement Arrangements (IRAs)” provides all the details in about eight pages and in a rollover chart.

Anyone contemplating a rollover or transfer of any kind should read the relevant parts of this document BEFOREHAND. By the way, be careful to make sure you end up at irs.gov, because irs.com and other “irs” websites are not the real US government tax website.

When you understand the tax rules, you are much more likely to achieve your goals of saving and investing for retirement. Be smart and understand your situation and the rules that apply to you by doing your own research.

Do not rely completely on financial institutions “to take care of everything” for you.

Furthermore, do not simply trust what you are told about recommended investments. Pushing overpriced securities with excessive investment management fees is a very widespread financial industry disease that can really hurt your retirement savings.

Because rollovers involve complexity, of course, you may need to get help from the retirement departments of financial organizations that you decide to deal with. Nevertheless, while there are some IRS protections against failures by financial intermediaries, ultimately you are the tax payer and could get left holding the bag with the taxes and penalties related to a failed rollover.

Even if you do not have to pay taxes or penalties, you might waste a lot of time cleaning up a botched rollover, so why not get it right the first time?

What you learn during the first time can help you to understand how future rollovers would work. Also, if you have other questions about how IRAs work, you might want to read this traditional IRA contribution limits and Roth IRA guide, which clarifies both the rules and the different strategies that people might use, depending upon their income and personal financial situation.

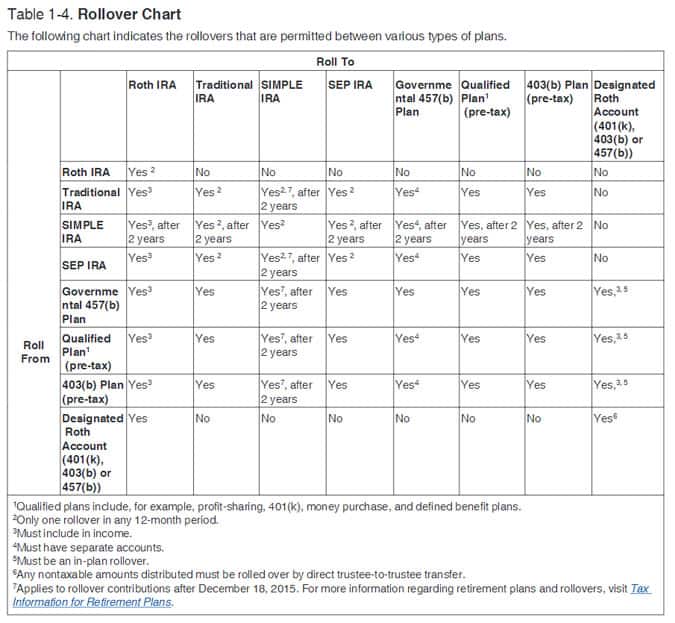

To give you a sense of why you should download and read IRS Publication 590-A, let me describe to you its “Table 1-4 Rollover Chart.”

This chart is an eight by eight matrix of “Roll From” and “Roll To” account types. The list of eight account types is the same for “Roll From” in the table rows and “Roll To” in the column headers. These eight account types are:

- Roth IRA

- Traditional IRA

- SIMPLE IRA

- SEP IRA

- 457b Plan

- Qualified Plan (pre-tax) (includes profit-sharing, 401k, money purchase, and defined benefit plans)

- 403b Plan (pre-tax)

- Designated Roth Account (401k, 403b or 457b)

This IRS publication chart indicates whether or not a rollover is allowable between the same or different types of accounts.

Since this is an eight by eight matrix, there are 64 potential “from and to” combinations. If every type of rollover between any type of account was allowed, there should be 64 “Yes” answers in this table.

However, there are only 43 table cells with “Yes” answers. “From and to” rollovers are prohibited with 21 of these potential combinations with “No” answers in the corresponding table cells.

Given that Roth IRA and Designated Roth Accounts (401k, 403b or 457b) have tax treatments that differ significantly from most other retirement account types, you would expect there to be prohibitions in rollovers between Roth accounts and other tax-advantaged retirement account types. Yet these Roth-related “No” boxes only account for 13 of the 21 rollover prohibitions.

While it would be tempting for me to identify these remaining prohibited transactions, instead I encourage you to download Pub 590-A from the IRS website and read the table for yourself.

I suggest this, because this table also has conditional information and footnotes related to 18 of the 43 “Yes” cells in the table.

Clearly, there are rules that you should understand before embarking on any permitted rollover, and many of these rollover situations can have special caveats.

Note that in certain cases, assets can be moved from other retirement plan types into Roth accounts, but current and sometime substantial tax payments usually are required and these transactions are called “Roth conversions” and are not rollovers.

The traditional IRA versus Roth IRA conversion decision can be quite complex and requires a model of one’s projected lifetime financial affairs that will help you to make an informed decision.

[Related: Learn how to invest in a Roth IRA even if you make too much money.]

Also, note that doing a rollover might be possible for someone who continues working for their current employer, although most rollovers happen after an employee ceases to work for an employer.

Such “in-service” rollovers for current employees are permitted under some employer plans. If allowed, of course, these in-service IRA rollovers into traditional IRAs must be done in accordance with IRS rules to maintain the tax-advantaged status of the retirement assets.

Get Your Retirement Account Rollover Done Within 60 Days Or Face Very Undesirable Consequences

By the way, any rollover should be done carefully, because if it is not done properly you could be subject to income taxes and penalties. Furthermore, with a failed rollover, you could find yourself with taxable assets that have lost the benefits associated with tax-advantaged retirement account assets.

For example, rollovers must be accomplished within a 60 day window and the IRS is not generous in granting exceptions. The IRS wants to enforce that 60 day window and will not be disappointed when it collects taxes and penalties on failed rollovers outside that window.

However, this 60 day window is not really solely a gotcha trap to get people to pay taxes and lose the tax-advantages of retirement assets.

Unfortunately, some people would abuse the rollover process without this limited rollover time frame. There are some exceptions to enforcing this 60 day window, if failing to waive that rule “would be against equity or good conscience, such as a casualty, disaster, or other even beyond your reasonable control.”

Pleading one’s case before the IRS regarding rollover tardiness might not always give you the result you would like. Therefore, whenever possible do a direct custodian-to-custodian (trustee-to-trustee) transfer and never accept a check for any retirement fund assets made out to a person.

Find out from the receiving trustee how the check should be made out and make sure the check is written directly from the current trustee to the new trustee.

If you must receive the check through snail mail, forward it immediately with properly completed paperwork, and pro-actively oversee the process to make sure that your transfer (or rollover) gets done in a timely manner.

You should note that in early 2014 the Federal Tax Court issued a ruling against a couple who attempted to do a chained series of rollovers, while claiming that each rollover was accomplished properly within a 60 day time frame.

Apparently, this couple attempted to game the system, but paid dearly through unanticipated taxes and penalties. More disturbingly, the tax court based its reasoning on a single allowable transfer within 365 days, which contradicted IRS Publication 590-A guidance that this 60 day rollover window applied on a per account basis.

As of the beginning of 2015 a person is now limited to a single (one) IRA to IRA rollover within an annual period. That is it. The Tax Court is the definitive arbitrator of the meaning of the law and its decisions dominate IRS rules and documents.

Despite the fact that for years the IRS allowed one rollover per traditional IRA account, regardless of how many separate IRA accounts a person might own, now individuals are restricted to just one rollover across their IRA accounts in any twelve-month period.

The IRS has updated its website to reflect this change, as well as IRS Publication 590-A, and its other related publications.

Of course, this means that every IRA owner should be cognizant of the rules and follow them carefully. Because an IRA owner can move funds between IRA accounts using the transfer method instead and there is no limitation on the number of transfers, this mechanism is the preferred route.

If, for some reason, you must use the rollover method and take interim possession of the funds, manage the process carefully. If you do not, very costly and very unpleasant consequences could ensue.

Another thing to note is that this one IRA rollover per year rule applies just to rollovers between traditional IRAs. The IRS website indicated in April of 2015 that this once per year frequency limitation does NOT apply to:

- rollovers from traditional IRAs to Roth IRAs (which are called conversions)

- trustee-to-trustee transfers to another IRA

- IRA-to-plan rollovers

- plan-to-IRA rollovers

- plan-to-plan rollovers

Note that “plan” refers to the wide array of retirement plans offered through employers, including self-employment retirement plans.

Should You Roll Over Your 401k, 403b, 457 Or Other Retirement Plan Assets Into An IRA?

The “should you roll over” retirement account assets question is no less complicated than the “can you” question, but you cannot rely up IRS publications and rules to help you to answer “should” questions. The IRS is not in the business of providing tax optimization advice, beyond clarifications of tax laws and rules.

If you need advice, you need a financial adviser and/or a tax adviser.

Unfortunately, you cannot rely on the financial services industry necessarily to give you an unbiased answer to “the should” question that is actually in your best interests. The remainder of this article will provide you with some thoughts and information for you to answer the should question for yourself.

Sadly, you cannot rely upon the US financial services industry to give you unbiased advice about rollovers. Certain segments of the securities industry have demonstrated a bias toward automatically recommending rollovers of employer sponsored retirement plan assets into rollover IRAs.

The reason is simple. If financial companies can induce you to rollover your assets, then they can get control of your retirement assets and can keep charging you high fees and commissions on your retirement savings.

Very often, they will recommend that you invest your money in securities that yield higher profits for them, which are more likely to lead to inferior net returns and a smaller asset accumulation after these unnecessarily high industry costs.

Excessive fees are a rampant disease associated with the profit-seeking financial securities industry, which lives off the assets of individual investors.

In December 2013, FINRA, the self-regulating, non-profit Financial Industry Regulatory Authority, issued Regulatory Notice 13-45 entitled “Rollovers to Individual Retirement Accounts,” which was also titled “FINRA reminds firms of their responsibilities concerning IRA rollovers.”

Footnote 6 in this regulatory notice quoted a U.S. Government Accountability Office’s (GAO) study of rollovers saying that “many experts indicate [much] of the information and assistance participants receive is through the marketing efforts of service providers touting the benefits of IRA rollovers and is not always objective.”

This FINRA Regulatory Notice 13-45 clarified that in addition to recommending rollovers into an IRA, retirement plan participants have 3 additional options and that rollovers and these three additional options may be used in combination.

FINRA clarified that it is the responsibility of brokers promoting IRA rollovers to also present these other alternatives in a “fair, balanced, and not misleading” manner.

In addition to a rollover into a rollover IRA account, retirement account plan owners have these 3 other alternatives.

- First, former employees could simply leave their accumulated retirement money in their former employer’s retirement plan, if that is permitted by the plan.

- Second, if their new employer has a retirement plan that permits this, they could roll their assets over from their former employer’s plan into their new employer’s plan.

- Third, they could cash out some or all of the account value and pay the necessary taxes and perhaps penalties.

The remainder of this article will provide some thoughts about these 4 options in this order:

- Cashing out some or all of the employer plan retirement account asset value

- Leaving accumulated retirement money in a former employer’s retirement plan

- Rolling over retirement savings from a former employer’s plan into a new employer’s plan

- Rolling over retirement assets into an IRA

Cashing Out Some Or All Of The Employer Plan Retirement Account Asset Value

I will deal with this choice first, because it is the easiest to dispatch. If you went through all the trouble to earn money and save it in a tax-advantaged retirement account, why give up those tax advantages and pay taxes due now?

Any cash out that you did not previously pay tax on will be added to your ordinary income and increase your taxes and perhaps push you into a higher state and/or federal marginal income tax bracket.

In addition, you might have to pay a 10% federal penalty if you are under 59 & 1/2 years old. Plus, a few states generously will tack on an additional early withdrawal penalty.

Note that you might not have to pay taxes on some Roth withdrawals, such as the original principal contributed. Additional Roth asset withdrawals might also be tax free, but you must be careful to conform to the applicable 5 year rules and be aware that early withdrawal penalties can apply.

However, even if you can take out Roth retirement account assets without paying taxes, you could be giving up some very significant future tax saving advantages related to the Roth tax-advantaged contributions that you have made before.

Once your money is in a Roth account, you and possibly even your direct heirs can avoid all future taxes on any asset appreciation in the account. That is a very significant advantage that you should not give away without careful thought.

Of course, sometimes people find themselves in dire financial straits where they need to cash out some or all of their retirement accounts for survival. Most often, this occurs with unanticipated and extended unemployment.

The only tarnished silver lining in those situations is that income tax rates tend to be much lower for the unemployed.

In the wake of the Great Recession financial crisis, too many people have had to cash out their employer sponsored retirement assets after a layoff and extended unemployment. These survival situations are entirely understandable.

Yet even in normal times many employees exiting a work situation will routinely cash out their retirement account, when they did not really need the cash to survive.

This is a sub-optimal practice that often leads both to excess current consumption and to inadequate savings for retirement.

Cashing out a retirement account without a very good reason is the least desirable alternative available for most people.

For example, cashing out retirement assets and paying higher taxes just to buy a new car might seem more satisfying in the short run. However, in the long-run the capital costs of that shiny new car could turn out to be a very expensive.

This is particularly true to those who might outlive their financial resources in retirement.

Leaving Accumulated Retirement Money In A Former Employer’s Retirement Plan

In many cases, a person can simply leave their retirement savings within their former employer’s retirement plan. Of course, doing this would need to be permitted by that particular plan.

Furthermore, many plans have some minimum account value, perhaps $5,000, below which you will not be allowed to continue in the plan, even if you could have continued with a higher balance.

Whether you decide to stay in your former employer’s plan can depend upon a variety of issues.

First, and foremost, what is the quality of the plan and the investment choices available? Would you have better choices available either in a rollover IRA account or in your new employer’s retirement plan, if you would be permitted to roll your retirement assets into that plan?

The first thing that employees should be aware of is that there is a wide range of quality between employer sponsored plans.

Under the Employee Retirement Income Security Act of 1974 (ERISA) legislation that governs employer retirement plans, the employer has a responsibility to act as a fiduciary and to put the interests of employees first.

However, this has been easier said than done. Some employers do a very good job and some seem completely clueless about what they should be doing for their employees.

Furthermore, until the implementation of recent, long overdue rules by the US Department of Labor, the financial industry was not obligated to clarify the actual costs of the retirement plans that they managed on the employer’s behalf.

The financial industry had no obligation to clarify these costs to either the individuals in the plans or to the companies themselves.

This means that companies had an obligation to take fiduciary care of their employee’s retirement savings, but the financial industry had no obligation to supply complete information so that employers could fulfill their legal obligations.

Employer plans are typically overseen by a company management committee composed of personnel who do not necessarily understand optimal investing practices. This is at the root of why some small company and even large company employer plans have been riddled with high cost investment funds, while providing few or no low cost index fund alternatives.

These plans have been very profitable for the financial industry, while bleeding away an unjustified portion of employees’ investment returns through excessive visible and hidden fees.

With the new US DOL rules now in effect, at least costs are now visible to both employees and company plan sponsors. Increasingly, more companies have woken up to just how much their employees have been paying for limited and biased investment selections within these plans.

[Related: You can use Personal Capital to see how much you are paying in fees with your retirement account. Learn more here.]

While investing seems very complex, in reality individual investors have one major lever of control to increase their net returns, reduce their investment risk exposure, and minimize investment taxes.

They can slash their investment costs to the bare minimum. The only practical avenue for doing this is to invest in very broadly diversified, very low cost, passively managed index mutual funds or similar very low fee diversified exchange-traded funds (ETFs).

If your employer’s defined contribution retirement plan does not offer a selection of low cost index mutual funds or ETFs, then you will be paying more than necessary to invest your retirement money.

To find lists of the lowest cost mutual funds and ETFs from various fund companies, look for these books, which were written and are updated regularly by the author of this article: Buyer’s Guide to the Lowest Cost No Load Mutual Funds and Investor Guide to the Lowest Cost ETFs.

[Related: You can find other highly recommended personal finance and investing books in the Recommended Resources Section.]

With these books you can easily to find all the lowest cost index funds that are available for direct purchase by individual investors.

With mutual funds, you should note that the index fund share class that you find in your employer’s retirement plan may differ from the direct purchase share classes listed in these low cost mutual funds and ETFs books.

Nevertheless, if the sponsoring mutual fund company and investment fund names are the same, it is very easy to check whether an index fund offered through your retirement fund is the same.

If your current, former, or new employer’s retirement plan offers a variety of very low cost index funds, that is to your great advantage. If not, then a rollover into an IRA where you can get access to low cost index funds is probably a much better move.

When you know which low cost index funds you want, you can just go directly to the fund company and set up a rollover IRA to buy them. Alternatively, if you prefer, buy the funds though a discount broker, but understand that there may be additional fees compared to buying directly from the fund.

Finally, note that some employer retirement plans have what is called a “brokerage window” that gives an employee access to additional investment options beyond the funds that are listed with the retirement plan.

There may be some additional transaction costs to gain access to the lowest cost index funds through the brokerage window. So understand any transactions charges and also find out what the charges will be for any reinvested dividends, if you invest in index funds through the brokerage window of a retirement plan.

So How Should An Employee Judge Whether An Employer Retirement Plan Is A Better Alternative Than Rolling Their Retirement Savings Over Into An IRA?

To cut to the chase, here is my opinion about some of the minimum requirements for a good quality employer sponsored retirement plan.

- First, all investment and administrative costs should be fully disclosed and rock bottom.

- Second, an employee must have the choice of at least one very low cost, broadly diversified, low turnover, passively managed index mutual fund in every major asset category.

- Third, at least he or she can compose a basic index oriented portfolio that would deliver the market return at minimal cost.

Employees need access to low cost investment funds in a variety of major asset classes so that they can implement a personally risk-adjusted investment asset allocation strategy.

The very minimum set of asset classes for these index funds would be the following:

- US total stock market

- total international stock market

- investment grade domestic government and corporate bonds

- money market fund with very low costs

- international bonds if available

Driving the financial industry’s excessive costs out of the equation is the single most effective strategy that individuals have to keep the highest net return for their investment risk exposure.

Too many employer sponsored retirement plans are littered with high cost, actively-managed investment funds, which will tend to do worse than low cost index funds the longer they are owned.

[Related: Learn how much investment fees are eating away at your retirement accounts.]

The excessive costs of actively-managed funds drag down net returns, and the financial damage is huge and cumulative.

A passive index investor in a retirement plan is more likely to have a higher account balance at retirement after decades of savings and investing through very low cost investment funds.

Furthermore, you can get an indication of plan quality depending upon how company stock is involved in any company retirement plan.

If the employer allows employees to purchase company stock within their retirement plan and particularly if there are no significant restrictions on how much company stock an employee can accumulate in their company retirement plan, this is a big red flag.

Across all of their investment assets (retirement accounts and otherwise) people should be very broadly diversified, and they should avoid all concentrated investment positions.

If an employee holds more than 10% of their assets in their employers stock, that is a red flag. If an employee holds more than 5% of their assets in their employers stock, that is a yellow flag.

The problem with investment concentration is that people can lose their jobs and their income, if something happens to the business of their employer.

If they also hold company stock in their retirement plan account, then they could be exposed to the awful double whammy of losing both their income and some or most of their retirement assets.

Investment concentration is highly undesirable, and should be avoided. If an employer encourages excessive accumulations of company stock by employees in retirement plans, then there are good reasons to question whether this plan is being managed in the best fiduciary interest of the employees.

Finally, if an employer sponsored retirement plan does not offer one or more rock bottom cost, broad market bond index fund, then that can be a real problem.

Higher bond fund investment management fees are completely and provably counter to employees’ best interests. Long term historical broad market bond returns have averaged about a compounded 2.75% annually in real dollar, constant purchasing power terms with inflation extracted.

If a bond fund charges about 1% in management fees, which is about the average across bond mutual funds, this means that these useless management fees are eating up more than one-third of an investor’s gross real dollar bond returns year after year.

There is zero justification for high bond fund fees, unless you work for the financial industry. High fees are certainly not in the best interests of employees, if they are not given a choice to avoid more expensive bond funds in retirement plans.

The failure to offer low cost bond index funds in an employer sponsored retirement plan can also prevent an employee from implementing a cost-effective asset tax location optimization strategy across all of that employee’s taxable and tax-advantaged investment accounts.

Asset tax location is the optimization of the entire portfolio with respect to taxes. Bonds and cash tend to generate more current taxable income that will be taxed at ordinary income tax rates.

Therefore, it is more optimal to hold bond investments and non-emergency cash in tax-advantaged retirement plan accounts.

Stock assets on the other hand may experience capital gains as a much greater portion of total return. Capital gains are only paid when there is a sale of the asset or dividends are paid. If held for a year or more, then these capital gains are taxed at lower federal long-term capital gains tax rates, as are qualified dividends.

Stock assets tend to be more optimally held in taxable accounts from a total portfolio tax optimization standpoint.

Therefore, regarding employer sponsored retirement plans, it is important that they have a full lineup of index mutual funds, but it is even more important that employees have the choice of a variety of very low cost bond index funds.

Roll Over Retirement Savings From A Former Employer’s Plan Into A New Employer’s Plan

Obviously, the same considerations discussed in an earlier section about staying in a former employer’s plan would apply to rolling those assets into the retirement plan of the new employer.

First, you need to check whether such rollovers are allowed. If they are, then consider whether the new employer plan is well managed and whether it offers rock bottom investment management mutual fund fees and very low administrative costs.

Does the new employer plan offer an attractive lineup for very low cost index mutual funds?

And finally, if you intend to implement a investment asset tax location optimization strategy across your entire portfolio does the new plan offer very low cost bond mutual funds? If not, then perhaps a rollover into an IRA that meets these decision criteria would be better.

Roll Over Retirement Assets Into An IRA

Now that you know the following “you can” scenarios:

- A) cash out (usually undesirable)

- B) perhaps keep your retirement assets in your former employer’s plan (if permitted, if low cost, if useful index fund choices)

- C) perhaps rollover your retirement assets into a new employer’s retirement plan (if permitted, if low cost, if useful index fund choices)

how might a rollover into an IRA stack up against these alternatives?

Many parts of the financial industry recommend rollovers and do not clarify the alternatives summarized above.

This is what is behind FINRA’s hand slap described earlier in this article. If you do not roll your money into a rollover IRA, then the industry cannot get access to your assets and charge you fees.

You may not be aware that the brokerage industry is subject to different regulations than those that apply to investment advisers.

Brokers do not have to act as fiduciaries and do not have to make your best interests their highest priority. Instead, they are governed by a much weaker “suitability” standard, which puts relatively weak constraints upon broker behaviors.

Brokers have muddied the waters about their responsibilities to clients by calling themselves “financial advisors.” The financial services industry is very powerful politically and as a result laws, regulations, and enforcement also tend to be weak.

However, when they begin to market biased recommendations to individuals about what to do with their retirement assets in employer plans governed by ERISA, they run smack into the more clear fiduciary/best interests requirement of ERISA.

So, should your roll over your retirement plan assets into a rollover IRA? Well, the answer depends upon whether that is the best choice you have available compared to cashing out, staying in your former investor’s plan or rolling into your new employer’s plan.

Almost any financial company may offer rollover IRA accounts. The question is whether they are desirable and many are not.

If you roll over your retirement plan assets into a high cost IRA, you are not doing yourself any favors, but you are doing a big favor for the industry.

If an investor cannot get access to very low cost index investment funds though an employer retirement plan, and they have the choice of rolling their retirement funds into a low cost rollover IRA, then they should do so.

However, they should resist industry marketing that says “hey lookie here, you can roll over your retirement assets into our swell mutual funds with lots of Morningstar stars and superior performance.”

The industry selectively markets its winners and ignores its losers, until the performance numbers change.

Persistence studies show that last period’s winning funds tell you nothing about whether those funds will win or lose in the future. Looking for superior recent performance is not the way to choose investment funds, but choosing very low cost funds is.

High performance is fleeting, but high costs just grind on year after year hollowing out your net returns.

Therefore, if you are going to roll over your retirement assets into a rollover IRA look around for a very low cost vendor.

You can go directly to mutual fund companies and set up a rollover IRA account. You can also go to discount brokers to set up a rollover IRA account. Look at the mutual fund companies and ETF vendors with the lowest costs and roll over into an IRA account that gives cost effective access to these funds.

Remember that there is not a lot of profit per invested dollar in index funds, and index fund vendors compete on efficiency. Compared to higher cost financial companies, index fund companies do much less advertising. You have to go looking for low cost index funds, but they are not that hard to find.

If you see any ad from a mutual fund or ETF management company that is bragging about their fund performance, you should keep looking for a lower cost vendor. This is especially true, if the company advertises their four and five star investment funds.

Almost all these advertisements are a selective presentation of only the fund company’s random winners, while information about their mediocre funds and loser funds will be conveniently ignored in the ads.

These star and performance touting fund companies will be more than happy to set up a rollover IRA account for you and sell you their higher cost funds. However, they will never give you a warranty that they will keep delivering superior performance in the future.

Only you can protect your retirement money (and any of your other investments) from high and unwarranted investment costs. Ignore the stars. Ignore historical performance that does not last. Buy the lowest cost index funds and get on with enjoying your life.

Early Retirement, Rollovers, And Long-Term Tax Optimization

Those planning early retirement should note a few things. A person retiring at age 55 or after, but before age 59 and 1/2 could be subject to a 10% tax penalty on early withdrawals from a rollover IRA.

And bless their hearts, several states, including California, add an additional penalty. However, if those same rollover assets had been left in an employer sponsored 401k or 403b plan, for example, an ex-employee can withdraw funds without the penalties after age 55.

Obviously, ordinary income taxes would be paid on withdrawals, but without the penalties. Total taxes would probably be assessed at lower federal and state marginal income tax rates, depending upon the amounts withdrawn and other ordinary income that a person might have.

While this is discussed elsewhere, you should note that a very important Social Security and retirement tax optimization strategy for most healthy people is to delay accepting Social Security retirement payments until age 70.

At the same time to delay Social Security payments until age 70, a retiree obviously needs to have other taxable and tax-advantaged account assets to pay the bills up to age 70.

While it might seem counter-intuitive, it is usually more beneficial to spend down IRA and other traditional tax-advantaged retirement assets during those interim years.

Doing so reduces total assets in traditional retirement accounts that would be taxed at ordinary income tax rates after age 70 and 1/2, when required minimum distributions (RMDs) also kick in.

These RMDs get added on top of Social Security income, which drives up tax rates. In contrast, after early retirement (or even normal retirement) and before Social Security payments would begin at age 70, tax rates would be lower, when expenses are funded through a combination of withdrawals from taxable and traditional tax-advantaged accounts.

There is one more consideration that an early retiree should take into account, if they retire willingly or unwillingly before age 65, the age when Medicare coverage becomes available.

The Affordable Care Act provides health insurance subsidies for lower income persons, and many early retirees would have relatively low income and may qualify for these subsidies.

Income ranges for subsidies under the ACA are higher than one might expect, currently for single persons ($11,490 to $45,960) and for a family of four ($23,550 to $94,320). Qualifying for a subsidy is based upon your modified adjusted gross income (MAGI). Your MAGI for a tax year is defined as wages, salary, interest, dividends, Social Security benefits, and foreign income.

Thus, an early retiree needs to be careful to balance these various factors. After early retirement and up to age 65 one needs health insurance and ACA subsidies could be quite valuable depending upon one’s MAGI.

Meeting expenses through a combination of taxable account assets and tax-advantaged account assets could be more optimal. Each person needs to set the balance and avoid pushing their MAGI too high, if it would reduce their ACA subsidy.

It would be important to determine this balance before the end of any particular tax, because exceeding various MAGI breakpoints can reduce ACA subsidies significantly.

Once Medicare is available after age 65, these ACA subsidies are not a consideration, and one could withdraw more heavily from traditional tax-advantaged accounts to pay expenses up to age 70.

This makes ages 65 to 70 more opportune years to draw down traditional tax-advantaged accounts more heavily to meet living expenses, since ACA subsidies would not be of concern.

Final Thoughts

Overall, the thought of rolling over one’s retirement plan can be complicated. But it really boils down to a few options. Do you cash out your plan, leave it at your old employer or roll it over to your new employer?

There are decisions to be made regarding each option, so take the time to make the best decision for you and your money.

At the very least, check out Personal Capital so you know exactly how much you are paying in fees and how that money eats away at your account balance.

If you do decide to roll over your retirement plan, consider Betterment. They offer low cost ETFs and a model portfolio to help you continue to grow your money and not have fees eat away at it.

Author Bio: The author of this IRA rollover decisions article is Larry Russell, Managing Director of The Pasadena Financial Planner, an independent California Registered Investment Adviser firm.

Larry has published many personal financial planning articles and books and has developed customizable financial planning worksheet software for use at home. This article is solely for informational and educational purposes. It does not constitute or provide financial or investment advice, and there are no warranties expressed or implied related to the information in this article.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

I usually roll a 401(k) into the new plan when I change jobs. Our employer changed at the beginning of this year (they ended an outsourcing agreement and hired us direct, so my job is the same), and now I have to decide what to do. I could just leave it, I could roll it over, or I could move it to an IRA as you say here. Lot to think about, thanks for the informative article.

It is a lot to think about. The main reason I haven’t rolled over my 401k into an IRA is because my wife and I make backdoor Roth contributions. If I had my 401k rolled into an IRA, I’d have to take that into account when looking to do the back door Roth.

I’ve always rolled my old 401k’s over into an IRA. Mostly because I’ve had less than the 5k limit both times I’ve changed jobs, but also because I like the wider range of investment choices in an IRA and I’d much rather the simplicity of only having a few accounts, rather than multiple 401k’s scattered around.

When I left my old job, I was able to roll my 401k into my new employers 401k plan. For me, it was an easy choice – very low fees and with a custodian that had thousands of investment options. Now that I am on my own, I still have my old 401k at that firm. I’ll probably roll it over within the next year or so.

Well thought out post this. I’d been meaning to learn about your pension system over in the states, this has helped a whole bunch! Thanks

When I was in my 20’s, I really didn’t take advantage of employer’s 401(k) plans. However, the one time I did, the company went under in less than a year, so I cashed it out instead of rolling it. Now, I work for a school district. If I were to ever quit, I think I’d leave my money in my pension instead of rolling it over. Though, I’d have to give it some serious thought and research.

I worked a job in college that allowed part timers to contribute to a 401k. I never did, though I wish I had looking back on things now.

Wow, quite a well-researched post. Personally, I have not rolled over my last 401(k). That being said, it has a good variety of options, and this included a lower-cost index fund.

Should I transfer my $8,000 IRA (rolled over from a previous employer retirement plan) into my State of NJ Deferred Comp plan? With the IRA I am paying a $40 yearly fee and being charged on investments made with growing assets.

There isn’t enough information to say one way or the other. Where is the IRA invested and what fund(s) is/are it invested in?

Helpful article . For what it’s worth if others a IRS W-2 , my kids found a template version here http://goo.gl/WnGQQU