THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

A stock market correction can be a scary time for investors.

When stock prices suffer a significant drop, and it can seem like not only is the world is coming to an end, but all your money will be gone too.

However, if you know what to expect during a correction, you can survive it with minimal damage.

In this post, I discuss how you can survive a stock market correction and how to protect your investments during this fearful time.

Table of Contents

How To Survive A Stock Market Correction

What Is A Stock Market Correction?

Before I get into the ways to handle the volatility of a wild stock market, we first need to understand what a correction actually is.

The traditional definition of a correction is defined as a fall of at least 10% from a recent high in the stock market.

This big drop does not happen in a single day.

It happens over a period of trading days.

What many investors don’t realize is that these events are rather common.

In fact, the frequency of market corrections happens on average every 2 years.

Understand that stock market downturns are called different things depending on the drop.

You will hear people say things like a correction, a pullback, or stock market crashes.

These are different things, but each mean high levels of market volatility.

- Read now: Learn 13 times for investing in a volatile stock market

- Read now: Discover the investing risks you need to know

They can be a scary time for investors, as prices can move rapidly lower and it may seem like your money is disappearing before your eyes.

However, if you know what to expect and have a plan in place, you can survive them.

#1. Don’t Panic Sell

When stocks start to drop, don’t make the big mistake of panic selling.

Many individual investors make this mistake.

They don’t like the pain they are feeling and think the best solution is to just sell.

On the surface this makes sense.

No one like losing money.

So by selling, you protect what you have and you rationalize that when the market is in a better position, you will invest again.

The problem with this plan is twofold.

First, you don’t know when things will improve.

Many times, the market swings back just a few days later.

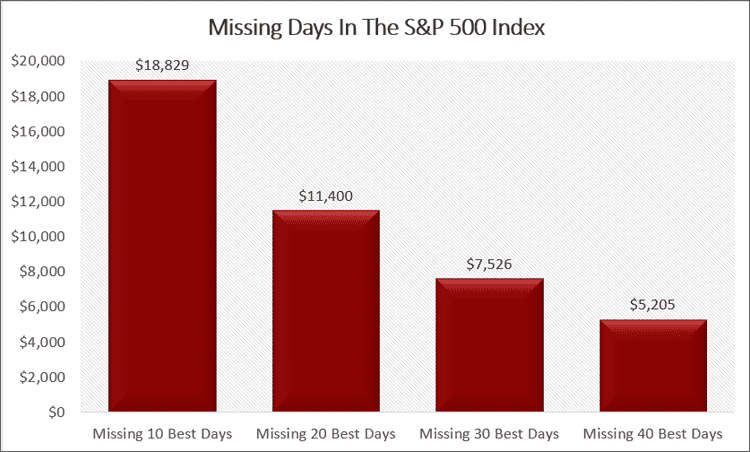

And when you miss out on these large moves, you drastically reduce your long term returns.

Second, most investors that use this plan never reinvest the money.

For example, after the great recession in 2008, there were millions of people who never invested back in the stock market.

Those people missed out on an average annual return of over 13% a year.

At the end of the day, when the stock market drops, don’t panic sell.

#2. Review Your Financial Plan

What you should do is take the time to review your financial plan.

Look over why you are investing in the first place.

What are your long term financial goals? Your short term financial goals?

Is your money invested accordingly? Is your asset allocation correct or has it become misaligned?

Do you have a diversified portfolio?

- Read now: See the importance of a diversified portfolio

- Read now: Click here to understand your ideal asset allocation

By looking over your plan, you will remember the reasons why you are investing and this can help you to tune out some of the craziness.

While not everyone needs to have a financial advisor manage their money, this is where they come in handy.

They are a rational voice during periods of turbulence and can help you to stay invested for the long term.

#3. Understand What Is Happening

One smart thing you should do is to understand what is happening in the market.

Put another way, what type of volatility is the market experiencing?

Is economic growth slowing?

If so, the recent sell-off could remain for the foreseeable future until the economy improves.

On the other hand, if nothing bad is happening and the market is just taking a break after a recent run up, this could be a perfect opportunity to invest more in the market.

By knowing what is happening, you can get a better understanding of why the pullback is happening and what you next moves should be as a long-term investor.

#4. Ignore The Market

One of the best ways to get through a stock market correction is to ignore the market entirely.

The media is great at getting us emotionally tied into the situation.

And there is good reason for this.

The more people they having watching their programs or reading their articles, the more money they can make.

So they purposely make stories emotional.

They play ominous sounding music.

They show pictures of peoples faces in despair.

They even use the color red psychologically.

And let’s not forget when you trade, the brokerage firms make money.

While you might not pay a fee to trade, the brokers make money on the bid/ask spread.

By turning off the news, you take yourself away from the talking heads and people predicting doom and gloom.

And this makes it less likely to make a bad investment decision, like selling what you own and regretting it later.

#5. Review Your Risk Tolerance

As you review your financial plan, you should also take the time to review your risk tolerance.

Chances are when you created your investment plan, you weren’t in the process of losing money in a down market.

But now that you are, you can reassess how it feels to lose money.

Does losing a small amount of money scare you? Or are you OK with it?

Doing this exercise can help you get the perfect amount of risk you are willing to take so that when the next correction or worse, a stock market crash happens, you will be able to ride it out.

#6. Don’t Get Caught In The Moment

One of the worst things you can do is get caught up in the commotion.

In other words, you need to take a longer term view of things.

Don’t focus on falling stock prices, but instead the companies you are invested in.

Are they solid companies that can withstand the troubled times?

For example, if you invest in Target, chances are slim the company will go out of business during this time.

Because of this, the stock price won’t drop to zero and you won’t lose everything.

On the other hand, if you have money in a small startup, there is a higher chance, though still small, that they won’t be able to survive.

By looking at things through this perspective, you can more easily handle current events.

#7. Understand The Facts

When we get emotional, facts go out the window.

An irrational thought enters our mind and we keep compounding that thought into the worst possible scenario.

Before long, we scared ourselves even more than before.

To combat this, you need the facts. Here are the facts you need to keep in mind.

- Corrections happen on regular intervals, usually every 2 years

- They can last from a few days to a few months

- The drop is anywhere from 10% up to 20%

- They are healthy for the market

Yes, you read that last point right.

Stock corrections are a good thing.

The market can’t simply always go up.

Usually corrections happen after a period of increasing prices, making many stocks unaffordable to investors.

To offset this, the market drops, making prices more affordable.

Another way to look at it is a correction gets things back to normal again.

One final point here, don’t think that every time major indexes hit all time highs, the market is going to drop and enter into correction territory.

Investing doesn’t work this way.

The market can continue hitting all time highs for a while before a correction occurs.

#8. Journal

This might sound crazy, but another great way to handle the emotional stress of corrections is to journal.

Take some time to write about what you are feeling and the things you did to cope.

Also write down if you rode out the drop and what happened afterwards.

Not only can journaling help you in the moment by not making any rash decisions, but it can also help you the next time there is a significant decline.

You can look back and see the emotions you felt and how you handled things.

#9. Create An Opportunity Fund

One of the best things you can do for yourself is prepare ahead of time.

While having an investment plan is great, you need to go one step further.

You need to have an opportunity fund.

This is very similar to your emergency fund.

The main difference is the money in this fund isn’t to cover unexpected expenses.

It is to buy more stocks when the market is down.

- Read now: See the impact of investing $250 a month

Remember the key to building wealth in the stock market is to buy low.

So when the market is falling and others are panic selling, you jump in and buy at a discount.

Then as prices rise over time, you earn a higher than average return.

You might be questioning who is buying when the market is dropping?

The answer is a lot of people.

When you sell stock, there is a person at the other end buying.

This isn’t to say you are making a mistake whenever you sell, as there are valid reasons to sell.

The point is, there are people buying stocks in a falling market and you need to be one of them.

#10. Consider Dollar Cost Averaging

So how do you buy when the market is falling?

This is where dollar cost averaging comes in.

With a dollar cost averaging investment strategy, or DCA, you invest a small amount on a regular basis.

For example, maybe you invest $50 every month.

The reason this works during times of high market fluctuations is you never know where the bottom is.

As I mentioned earlier, many times the market will drop, only to swing back the other way very quickly.

By investing on a regular basis, you improve your odds of buying more when the market is down.

And you eliminate the urge of market timing and trying to predict what the market will do next.

Final Thoughts

There is everything you need to know about how to survive a stock market correction.

Going through a bear market is never enjoyable. But you don’t need to be scared when they happen if you follow my plan.

By not panic selling and having cash reserves to invest when the market is down, you will see higher returns over time.

And this only increases the odds of reaching all of your financial goals.

- Read now: Learn why you should ignore Dave Ramsey’s investing advice

- Read now: Click here for Jack Bogles investing rules

- Read now: Here are the best medium risk investments to invest in

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.