THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

I get many readers emailing me asking me about how they should invest their money. Unfortunately, I cannot give investment advice on an individual basis since I don’t know the specifics of each of my readers financial situation. However, I can provide sample model portfolios to my readers as guidance for how to invest your money. (Be sure to read how to become a stock market millionaire as well.)

I get many readers emailing me asking me about how they should invest their money. Unfortunately, I cannot give investment advice on an individual basis since I don’t know the specifics of each of my readers financial situation. However, I can provide sample model portfolios to my readers as guidance for how to invest your money. (Be sure to read how to become a stock market millionaire as well.)

Before I lay out my sample model portfolios, I want to make it clear that everyone’s situation is different and that you need to sit down and assess your own risk tolerance, goals and objectives.

My sample model portfolios below will not cater to every reader. This is the same as any personal finance magazine you read or any talking head that recommends an investment. Just because they say XYZ stock is a buy doesn’t mean it is a buy for you. You need to have an investment plan and refer to your investment plan, goals and objectives to see if a particular investment has a place in your portfolio.

Table of Contents

Sample Model Portfolios – Background

I invest the majority of my money with 3 firms – Vanguard, Betterment, and Schwab. Because of this, I will be laying out model portfolios as if you were investing with two of these firms, Vanguard and Schwab. (Note that you can can build these model portfolios at other firms as well. Check out my online broker comparison chart to find one that meets your needs.)

I will not be detailing model portfolios for Betterment because when you start investing with them, you must identify the goal you are saving for – retirement, a house, college, etc. and they create a model portfolio for you. In fact, after you create your account, choose your goal and set up an automatic transfer you don’t have to do anything again. They take care of everything else for you. To read more on Betterment, read my full review.

Furthermore, I will be breaking out model portfolios for 3 investing groups:

- Young and Risk Tolerant

- Young and Risk Adverse

- Retired Income Seekers

For each group, I will lay out a model portfolio with both Vanguard and Schwab. As time progresses and if I feel a change needs to be made, I will update these model portfolios. These portfolios are ideal for those with $25,000 or more to invest. If you have less than this amount, further down I list another set of model portfolios for you.

One final note about the portfolios, I picked Vanguard Exchange Traded Funds (ETFs) over Vanguard mutual funds because you need $3,000 to invest in each Vanguard mutual fund. With Vanguard ETFs, there is no minimum investment. You only need to open a Vanguard Brokerage account. If you have less than $100,000 invested with Vanguard, there is a $20 annual fee you will pay. Trading Vanguard ETFs in your Vanguard Brokerage account is free.

The same logic applies to Schwab ETFs. They have super low management fees and no minimums. They are free to trade if you have a Schwab Brokerage account. There is no fee for having a Schwab account.

Sample Model Portfolios

Young and Risk Tolerant

You fall into this category if you have a long time horizon and you can accept a moderate amount of risk. While everyone’s appetite for risk varies, this is how most people in their 20’s, 30’s and 40’s should be investing their money. With that said, if you are scared of the stock market, then you should dial back some of the risk and invest in the Young and Risk Adverse portfolio I suggest. I also encourage you to learn more about investing so that you become more comfortable with it. Understanding the stock market helps to reduce some of the fear many new investors have and it also helps to curb your emotions when the market gets choppy.

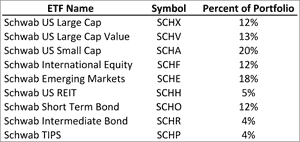

Schwab

Here is the Young and Risk Tolerant model portfolio if you choose to invest with Schwab:

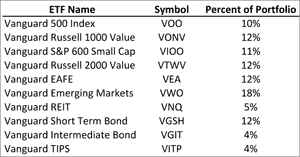

Vanguard

Here is the Young and Risk Tolerant model portfolio if you choose to invest with Vanguard:

Young And Risk Adverse

You fall into this category if you are young and are comfortable taking less risk when investing your money in stocks. As I mentioned above, I urge you to learn more about the stock market so that you can be more comfortable investing in stocks. While it is not necessary for you to get to a point where you are investing in the Young and Risk Tolerant portfolio, the more you know about investing, the better.

Ideally, these model portfolios are good for those in their 50’s and early 60’s. If you find yourself younger than this and not comfortable with the riskiness of the Young and Risk Tolerant portfolio above, you can invest in these model portfolios as well.

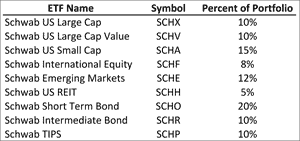

Schwab

Here is the Young and Risk Adverse model portfolio if you choose to invest with Schwab:

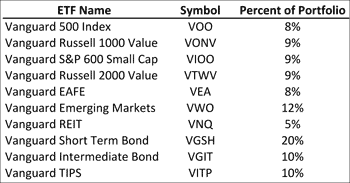

Vanguard

Here is the Young and Risk Adverse model portfolio if you choose to invest with Vanguard:

Retired Income Seekers

You fall into this category if you are retired and need your portfolio to last you during your retirement years. This model portfolio should only be used for retirees. If you are still working, you should be investing in one of the above model portfolios.

Some question why I suggest a 40% investment in stocks at this stage in life. The reason for this is two-fold. First, this isn’t 1989 when you can easily live off of income from bonds and certificates of deposit. You need to be investing in equities still and earning dividends through those investments. Second, we live much longer than we previously have. Before, a person might retire at 65 and pass away by the time they are in their mid-70’s. Now we tend to live well into our 80’s and for some of us, our 90’s. Because of this, we need our portfolio’s to continue to grow so that we don’t run out of money. If we invest 80% or more in bonds, there is a good chance that we will be running out of money towards the end of our lives.

Schwab

Here is the Retired Income Seekers model portfolio if you choose to invest with Schwab:

Vanguard

Here is the Retired Income Seekers model portfolio if you choose to invest with Vanguard:

More Model Portfolios

The above model portfolios are perfect for anyone with at least $25,000 to invest in the stock market. But what if you are just starting off and don’t have enough money to diversify with 9-10 ETFs? Below are model portfolios for those with less than $25,000 to invest. In fact, you could easily invest in the below portfolios and be successful for a long time.

While the model portfolios below only contain 3 ETFs each, they encompass the entire spectrum of the stock and bond markets. In other words, you are diversified by investing in these 3 ETFs.

Young and Risk Tolerant

This is where most everyone in their 20’s, 30’s and 40’s should be investing their money. With that said, it is OK to invest in the Young and Risk Adverse model portfolios instead.

Schwab

Here is the Young and Risk Tolerant model portfolio if you choose to invest with Schwab:

Vanguard

Here is the Young and Risk Tolerant model portfolio if you choose to invest with Vanguard:

Young And Risk Adverse

Again, this model portfolio is for those that want a little bit less risk when it comes to investing.

Schwab

Here is the Young and Risk Adverse model portfolio if you choose to invest with Schwab:

Vanguard

Here is the Young and Risk Adverse model portfolio if you choose to invest with Vanguard:

Retired Income Seekers

As stated above, these model portfolios are for those that are retired. If you are working, invest in either the Young and Risk Tolerant or Young and Risk Adverse model portfolios.

Schwab

Here is the Retired Income Seekers model portfolio if you choose to invest with Schwab:

Vanguard

Here is the Retired Income Seekers model portfolio if you choose to invest with Vanguard:

Final Thoughts

Overall, the model portfolios presented above will get you to where you want to go when it comes to investing. This assumes you create an investment plan, and stick to that plan. You can’t be investing in other random funds or stocks as well. If you have the urge to do so, keep those investments separate and in a “play account” where you are OK with losing the money.

Additionally, you have to stay invested in the stock market as well. You can’t be jumping ship when bad news occurs and the market tanks. It will tank. But it will also come back. Learn to tune out the noise and stay invested. We never make sound decisions when we are emotional, and selling out of a holding when the market drops is an emotional action.

Lastly, I know I presented both Vanguard and Schwab in this post, but I really encourage you to look into Betterment as well. They are top-notch and make everything effortless. Just set up an automatic transfer into your Betterment account and they take care of the rest.

The biggest benefits of following these model portfolios are that you are diversified and are paying minimal fees in the process. While one can easily expand on these model portfolios and add a few more investments, I am all for keeping things as simple as possible. These model portfolios do just that.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

There is some great material here – my portfolio looks a little different but I would say it’s the closest to the young and risk tolerant.

Thanks! As long as you are paying attention to fees and making sure your portfolio is diversified, you should be OK. Of course, that assumes you stay invested for the long term.

I use the 3 fund approach for the core of my portfolio and then with a smaller portion I invest in some individual stocks.

The 3 fund option is a simple, yet effective solution for many investors to use.

Great post for the American/Canadian readers. I am amazed at how many investment choices you all have over there..

Still an interesting read and thanks for the insight

Jef,

I’m not familiar with the investment options in Australia, how limited are your choices over there?

@Jon Dulin: We’re much smaller than you guys are.. If you are looking @ stocks there around 2200 listed stocks or shares as we call them here. Then there’s ETF’s as well and probably about 300 odd managed or what you would call mutual funds..

Sometimes less is more though right? 🙂

Hi Jon. Thanks for the great post and blog. What are your thoughts on Schwab and Vanguard target date funds in relation to your model portfolios? The target date funds purport to balance the major asset classes (domestic equity, international equity, and bond) and shift to bonds as the target date approaches. Thanks, Dave

I like and dislike target date funds. I do like the easiness of them. They take all of the guesswork out of investing for many people. But, most people I find don’t use them correctly. They buy a target date fund that gives them an ideal allocation, but then they go out and buy additional funds as well, which defeats the purpose of buying a target date fund in the first place. The Vanguard and Schwab target date funds specifically are decent funds. The Schwab target funds do have a fee higher than if you went with one of the 3 fund portfolios that I recommend. But, the fee isn’t a deal-breaker by any means.

I personally don’t invest in mutual funds or ETFs but I really like what Vanguard has to offer and have recommended it for my parents.

My parents are primarily invested with Vanguard as well. What are your “go-to” investments? Stocks?

@Jon Dulin: I really like Municipal bonds right now, I think they might get thrown out with the bath water here shortly but that is my next big play.