THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

We all have an idea in our head regarding how much we are spending each year. The problem is that we are usually wrong. In fact, we typically underestimate how much we spend. For example, when I worked for a high net worth financial planning firm, I would collect all of our client’s financial information and build an investment plan around their financial goals.

As part of constructing this plan, we needed to know how much they spent. When we would ask them, they would throw out a number. Usually it was pretty low. When I then started working on putting the plan together, I couldn’t get the math to add up.

I would usually give them a call and we would run through a basic budget I created so I could get a better sense of what they were spending. When I did this, their true spending number would reveal itself and it was always higher than their estimate – many times much higher. (In the times when they didn’t want to talk to me about their spending, I would have them send me their bank statements so I could get an idea of their real spending.)

Unfortunately, I can’t give each of you a phone call to run through a basic budget to get a rough idea of what you are spending each year. But I have a little math formula that we can use instead.

By the time we are done doing the math, you will get a better idea of just how much money you spent last year. You can use this as a guide to how much you are spending each year since in most cases, it is an accurate representation of your income and expenses.

All you need is your tax return, the tax tables, a pen, paper, a calculator and 15 minutes. Trust me, the math is basic. Do you dare find out how much you spent last year?

Table of Contents

How Much Money You Are Spending Each Year In 8 Steps

Step 1: Determine Your Adjusted Gross Income

Your adjusted gross income is all of the money you earned last year minus various deductions.

Pull out your tax return and look at your adjusted gross income on line 37 (end of page 1). Write this number down somewhere. (We will walk through an example below for you to follow along.)

Step 2: Write Down Your Itemized or Standard Deductions

On page 2 of your tax return (line 40) you want to write down your standard deductions underneath your gross income from the previous step. In the chance you don’t take the standard deduction, then use your itemized deductions, which is also on the same line. Write this number down as well.

Step 3: Note Your Exemptions

On line 42, you have any exemptions you have taken. On your piece of paper, place this number underneath your itemized/standard deduction.

Step 4: Note Your 401k Savings And Other Tax-Free Savings

You won’t find the amount you put into your 401k plan on your 1040 so you will either have to look on your W2 from your employer or your final pay stub of the year. If you have any other tax-free savings, like health savings accounts or flexible spending accounts, you want to take note of this number as well.

The key here is just to look at tax-free savings. One catch here is to not include any IRA savings. We will account for this money later.

For most people, the ones I listed above will be all you have.

Once you have all of this information, total them up and list them underneath your exemptions.

Step 5: Do Some Basic Math

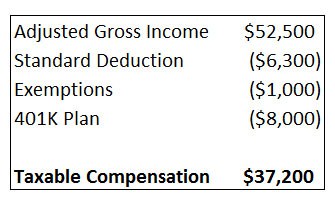

On your sheet of paper where you have listed everything from above, you should have something that looks like this:

We have an adjusted gross income of $52,500. We are filing single and are taking the standard deduction which is $6,300. Our exemptions total $1,000 for student loan interest paid. Finally, we saved $8,000 in our 401k plan.

Now it is time to do some quick math. Take your adjusted gross income and subtract all of the other numbers to arrive at your taxable compensation. See the picture below for an example.

Step 6: Use The Tax Table

You can find the current tax tables here. Following this guide can be a little tricky at first so take your time.

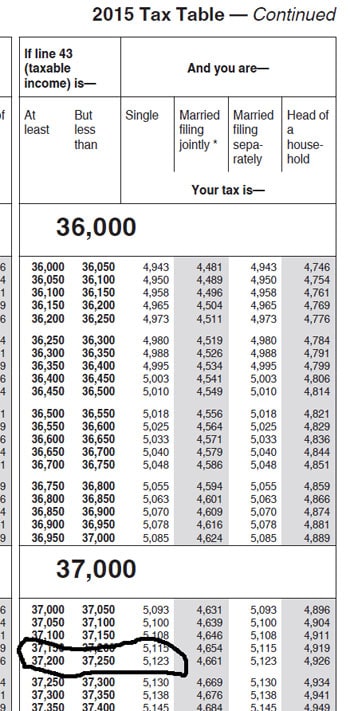

Based on our taxable income of $37,200 we can do some math to come up with the amount of taxes we pay. Since we are single, the amount of our taxes is $5,123. You can see this in the picture below. It is also on page 81 of the tax tables linked to above.

We take this number and write it down.

Step 7: Determine Your Savings

Now it is time to look at how much money you saved for the year. You will want to look at all saving vehicles except for your 401k plan since we accounted for that in step 4.

Be sure to include savings from:

- Bank accounts

- Bank CD’s

- Investment accounts (including IRAs)

- Savings bonds

- Money stashed under your mattress

Don’t take the interest you earned, or any gains, just take the total amount you actually saved for the year.

Once you total all of this up, put it on the sheet under your tax. For our example, we saved $5,000.

Step 8: Adding It All Up

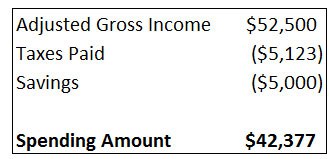

This is the final step. Take your adjusted gross income from the first step ($52,500) and subtract your taxes ($5,123) and savings ($5,000) from this number. Here is what our example ends up with:

Our number is $42,377. What does this tell us exactly? It tells us how much we spent last year. This is the best rough estimate to figuring out how much you actually spend. Take away the money you save and the taxes you pay and what is left is what you live off of. You spend what you don’t save and if you saved any of your income, you accounted for it in this equation.

You spending includes discretionary spending – things like eating out, clothes, etc. as well as other spending like mortgage, rent, gas, groceries, student loans, etc.

You might be surprised by this number. This is more common than you think. I am no psychology expert, but for some reason we always underestimate how much we spend. Whatever you think you spend, odds are you spend 10-15% more in reality.

Making Some Changes

So if the number you arrive at shocks you, what are you to do? The answer is to save more money! Luckily there are some easy ways you can go about doing this:

- Set up an automatic transfer to savings using Digit

- Reach out human resources at work and increase your 401k contributions by 1% or more

- Find a discount broker and put away a little money each month in an investment account

These are just 3 simple things you can do and will take you hardly any time at all. Most likely you are in the same boat as others, where you save what is left at the end the month. Most times, this is nothing since we spend everything. By using the 3 ideas above, you save first and guarantee you are saving more money.

Of course, you should also look at your expenses too. What are you spending each year that is a waste? Do you have a gym membership but never go? Have you shopped around for auto insurance? Take a few minutes to look over where you are spending your money and figure out ways to cut some of your monthly expenses. To do this, look through some monthly bank statements or credit card bills. You will find a trend rather quickly.

Understand you don’t have to eliminate a bunch of spending here, just take an honest look at where you are spending and figure out some ways to cut back. You can even play a fun game to see if you can live on $1,000 a month. That will get you really think about spending and where you can cut back.

You might even just look at one expense each month. Take dining out for example. Challenge yourself to not eat out for one month. Not never again, just one month. Every time you want to eat out, find something at home to eat instead. Then jump online and make a transfer from your checking account to your saving account for what you would have spent if you had eaten out. Do this every time for one month.

The next month, pick some other area to cut back on spending. Maybe it is groceries. When you go shopping, only buy what you need. If you are tempted to buy some junk food, put it back but note how much it costs. When you get home, transfer that amount to your savings account.

In both these cases you don’t have to quit cold turkey, just be more aware of your spending and try to spend less and then save the difference.

Of course, the biggest savings come from recurring bills. This would be things like the gym, your cell phone, insurance, etc. If you can figure out a way to cut this expense down or completely out of your spending, it will pay off more since it is not a one time deal. Therefore, take some time to focus on these expenses.

Don’t make the mistake of thinking you need to earn more money. While earning a higher income is great, you won’t suddenly start saving more money because of a higher salary. You will spend that extra money. You can see this by thinking back to the last time you received a raise. Did you save all of that extra income each and every month? Probably not. You increased your spending because you had more money to spend. So increasing your income here is going to get you the same result.

Alternative Way To Determine Your Spending Each Year

If you don’t want to do the math and pull out your tax return, you can use another method to figure out what you are spending each year. It won’t be as accurate, but will still give you an idea.

Take you net income for the year, which you can get from your W2. This is what you bring home after you pay taxes and save for retirement.

Next, add up all of the money you saved throughout the year, again looking at bank accounts, investment accounts, etc. Be sure not to count 401k contributions since that was accounted for in your net income on your W2.

Once you have your savings tallied, subtract that from your net income. The number will be a little higher than in the detailed process outlined in this post, but it will still give you a good idea of just how much money you are spending each year.

Final Thoughts

Knowing how much you truly spend every year is critical to your long term finances. Think of it this way: if you just guess you spend $30,000 a year but really spend $50,000 a year, over the next 25 years that is $500,000! Wouldn’t it be nice to save some of that money for retirement or an awesome vacation one day?

Take the 10 minutes to figure out what you are spending each year so that you can have a better idea of where you stand financially. If you can cut this number down just a little bit, it will pay off in the future.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.

Wow! Taking some minutes to know the real amount of expenses each year is definitely worthwhile. I am so excited about seeing how much I spend on a yearly basis. I know I would have some realization that can help me cut less of my expenses to save much more.

For many years I just cared about monthly income, expenses and budgets. And it really makes a lot more sense to look at your money annually. It really opens your eyes. Small expenses add up so much, it’s scary.