THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Do you try to save money but never seem able to get ahead?

Chances are you save money like most people.

You make it a point to save whatever you have left at the end of the month.

But this is backwards thinking.

If you really want to change your finances for the better, you need to flip your plan around.

You need to save first and spend what is left over.

You are probably thinking how tight money is and how there is no way you can save first and still pay your bills.

But you can save money.

And Qapital is here to help you.

By setting up an automated savings plan where you save your spare change and other micro amounts of money, you pay your bills and save money.

And don’t think for a minute saving your spare change won’t add up to anything.

The average Qapital user saves $1,500 a year!

In this Qapital review, I walk you through this powerful app and why you need to start using it so you can change your finances for the better.

Summary Qapital is the best choice for automating your savings. They make saving money effortless by allowing you to save your spare change. They also help you start investing and will be your primary bank as well, if you are interested. Click here to start saving with Qapital and put growing your wealth on autopilot!Qapital Review

Table of Contents

Your Complete Qapital Review | Automated Saving Plans To Reach Your Goals

What Is Qapital?

Qapital started out as an automated savings app and has grown into a full financial suite of products for people looking to take control of their finances.

Not only can you automate your savings, but you can also automate investing through micro investing and have a checking and savings account with Qapital as well.

In addition to these features, Qapital offers some great tools to give you insight into how you are spending your money and this in turn will help you become a better consumer.

But first, a little background.

Qapital was founded by George Friedman and Katherine Salisbury, who were consistently failing at saving money.

They grew frustrated that there wasn’t a product customized to the person trying to save and what their goals and motivations were.

So they decided to create it and Qapital was born.

Here is a brief overview of Qapital if you are short on time.

The app is available on both Apple and Android devices.

How Does Qapital Work?

When Qapital first started, it was simply an automatic savings app.

But as its user base grew and the founders wanted to offer better financial solutions to its users, it has evolved into something bigger.

Much bigger.

Qapital still offers automated savings, but it also offers investing accounts and spending accounts.

Let’s look at each of these in greater details.

Qapital Automated Savings

This is the reason why I first started using Qapital.

To be honest, I first started using Digit.

They were the first on the scene to offer an automatic way to save money and I loved everything about it.

Then one day out of blue, Digit announced it was going to start charging users a monthly fee.

I have nothing wrong with charging a fee, but the way Digit went about it left a lot of its users upset.

And many fled looking for something else.

I was one of these users and this is how I stumbled upon Qapital.

From the start, the savings feature blew all competitors out of the water, and still does.

Here is how savings works with Qapital.

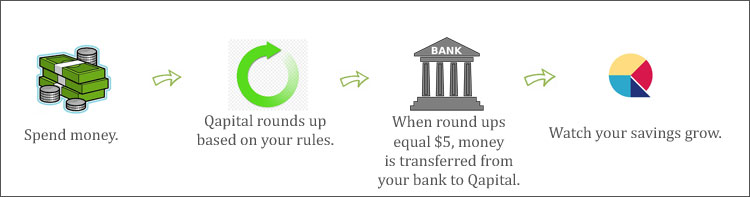

First, you link your checking account to Qapital. This is known as your funding account and is where money will be taken from to save.

You also link your credit cards and debit cards so Qapital can see all of your spending and make the appropriate transfers.

These are your spending accounts.

When you make a purchase from one of your spending accounts, Qapital rounds up the purchase and withdraws the amount from your funding account once the balance reaches $5.

The money is transferred over to Qapital and is put in an FDIC insured account for you.

Next, you set up the rule or rules you want Qapital to follow.

Here are the handful of rules you can choose from.

The Round Up Rule

Setting this rule has your purchases round up to the next dollar and then transfer over to Qapital when they total a minimum of $5.

For example, if you spend $8.45 on fast food, the purchase gets rounded up to $9 and Qapital will transfer $0.55.

Again, this transfer doesn’t happen until you reach a total of $5 in round ups.

You can customize this rule to round up to the nearest $2 or $3 as well to save more money.

Using our example above with the $2 round up rule, $2.55 would be transferred.

Sticking with the basic round up rule, Qapital users save on average $44 a month, or over $500 a year!

The Spend Less Rule

This rule is one of my favorites. If you typically spend a certain amount of money when grocery shopping, you can set up this rule to help you spend less and the difference is transferred.

For example, if your grocery trip usually costs $80, you set the rule for that amount. Then when you go shopping and spend $65, the $15 you saved is transferred to your Qapital account.

Set And Forget Rule

Using this rule allows you to set a specific savings amount to save every week.

So if you want to save $5 a week, set this rule and Qapital will automatically transfer $5 every week.

Guilty Pleasure Rule

When you activate this rule, you set a place as your guilty pleasure. When you spend money there, Qapital will make a transfer to your account based on the amount you set.

For example, if your guilty pleasure is Dairy Queen, you can set this rule to transfer $5 to Qapital every time you spend money at Dairy Queen.

Freelancer Rule

This one is perfect for people who work for themselves and are required to withhold taxes from their income.

When you make a deposit of $100 or more in your linked checking account, Qapital transfers a percentage to your Qapital account.

Now when your taxes are due, you have the money to pay them!

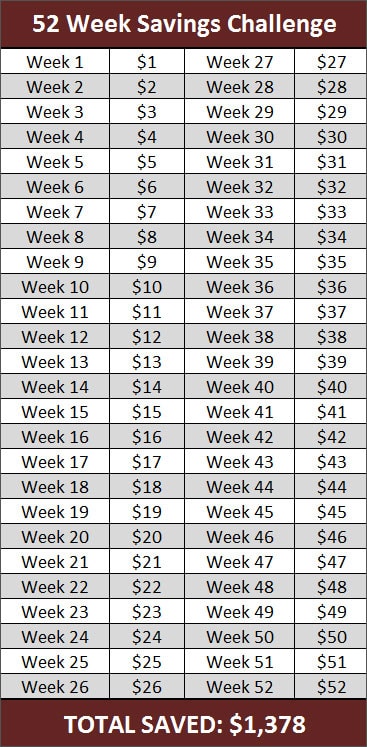

52 Week Rule

Another one of my favorites. This rule increases the amount of money transferred each week by $1.

So on week 1, you transfer $1 and on week 2, $2 is transferred. By the end of the year, you saved $1,378!

If This Than That (IFTTT)

If none of these rules interest you, you can create your own savings rule with the If This Than That protocol.

For example, if you spend way too much time on Twitter, you can link that app up using this rule and save money whenever you tweet.

Here are a few other novel ways to use this rule to save money:

- Save money every time your favorite team plays a game

- Save money every time it rains

- Save money when the temperature goes above or below a certain degree

- Save money when you go to the gym

- Save money when you hit your Fitbit daily goal

Basically if you can think of an interesting rule, you can most likely create it using IFTTT.

The great thing about these rules is you can use one or multiple ones at the same time.

At one point I was using the round up rule and the 52 week rule.

In addition to this, you can set up different rules for each of your savings goals.

For example, I was using Qapital to save for a vacation as well as to beef up my long term savings.

I had both accounts set up with the round up rule, but I also had the set and forget rule set up for my vacation savings too.

I even had different credit cards funding each savings goal.

The bottom line is the automated savings feature Qapital offers is very powerful.

There is no reason why you can’t grow your savings using this app.

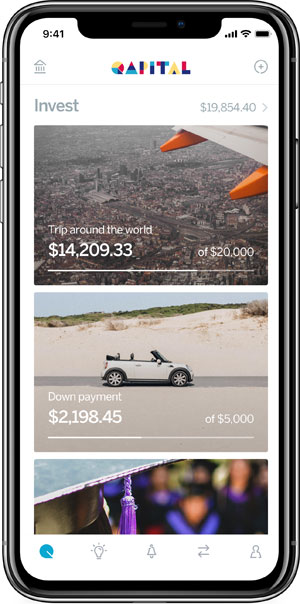

Qapital Invest

Qapital Invest takes the same idea they use for saving money and applies it to investing.

As a result, the investing feature is perfect for new investors just starting out and learning how investing works.

But it also is great for experienced investors too.

I have most of my money with other brokers, but I use Qapital Invest to invest smaller amounts on a regular basis.

To get started with Qapital Invest, you start out with the goal or goals you have for you money and your time horizon.

From there, you answer some questions so Qapital can assess your risk tolerance and put you in the right portfolio for you.

As with the savings feature, you can have multiple goals.

So you can invest for retirement and for a house down payment separately and be in different portfolios because of the varying time horizon of when you will need the money.

And you can set up many of the same rules with Qapital Invest as you can with Qapital Automated Savings.

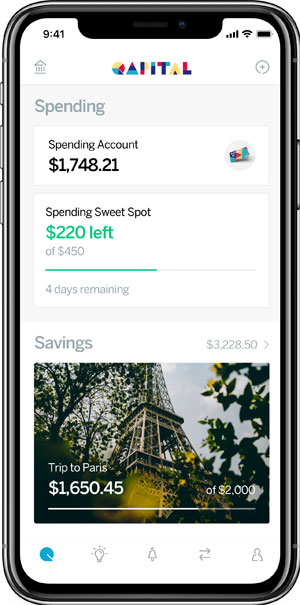

Qapital Spend

Qapital Spend is a new feature now being offered. It is simply a checking and savings account with Qapital along with a Visa debit card.

By offering these services, you can make transferring money between accounts and your savings and investing more easily.

It also allows Qapital to better track your money and offer better insights for you as well.

These accounts feature the following benefits:

- No minimum opening deposit

- FDIC insured

- No minimum deposit fees

- No overdraft fees

- No negative balance fees

- Free direct deposit

- Fraud monitoring

- Interest earning

As with the investing feature, you can use the same savings rules with the Qapital checking and savings accounts.

Additional Tools And Features

There are 3 additional tools and features that Qapital offers to users.

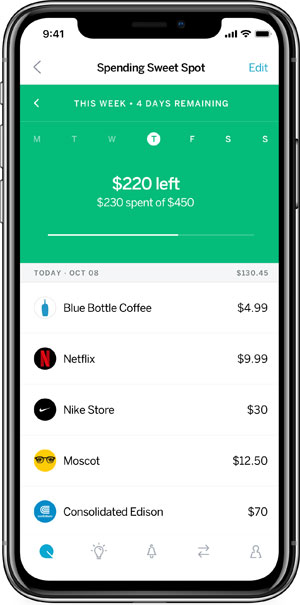

Spending Sweet Spot

Most people have a tough time creating and sticking to a monthly budget.

Qapital understands this and uses their Spending Sweet Spot instead.

This is a weekly budget to help you get a better understanding of how you spend your money and how you can limit overspending.

By breaking down a monthly budget into a weekly budget, you are more likely to succeed because it is much easier to stay on track for a week at a time versus an entire month.

Added to this, many times we have a tough time forecasting for an entire month.

For example, we see we have $500 in our checking account and think everything is fine.

But we are forgetting about a couple one-time bills that are due later in the month, so the reality is we don’t have as large of a cushion as we think.

Budgeting weekly with the Spending Sweet Spot feature solves this problem.

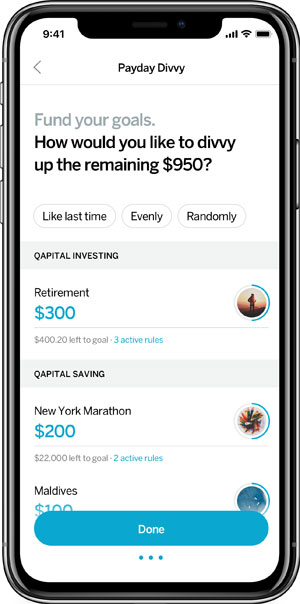

Payday Divvy

This feature allows you to split your paycheck when it hits your account.

You can choose to assign your income in any way you want.

For example, you can divide your paycheck so a percent goes into your emergency fund, a percent goes towards your investing account, and a percent goes towards your vacation savings.

Then the rest will go into your checking account to pay bills and cover everyday living expenses.

With Payday Divvy, it is easy to divvy up your paycheck so you reach your long term goals and build your wealth.

Money Missions

These are fun challenges created by behavioral economists designed to help you better understand yourself and what you value.

By accepting these missions, you learn why you spend money the way you do and get actionable tips and tricks to be smarter with your money.

The end result is a happier you because you are spending money on things that truly matter to you.

Qapital Fees

When Qapital first started out, it was free to automate your savings.

But the current version of Qapital is no longer free.

New users do get to try our Qapital for free for 30 days. After that, you have to select one of three monthly plans:

- Basic: This costs $3 a month and offers users the automated savings features and all of the rules listed above.

- Complete: This plan costs $6 a month and includes everything in the Basic plan as well as investing accounts, Qapital checking and savings accounts, Payday Divvy and Spending Sweet Spot.

- Master: This plan costs $12 and unlocks all of Qapital. It includes everything in the Basic and Complete plans as well as Money Missions, exclusive webinars, and first access to new features.

According to Qapital, here is how much the average user saves annually on each plan:

As you can see, regardless of the plan, users save a lot of money annually.

Advantages And Drawbacks

If you are short on time, here is a brief rundown of the areas where Qapital shines and a few wish list items.

Advantages

Easy Way To Save. Automating your savings is a guaranteed way to build your wealth over the long term.

Of all the services out there, Qapital is the most user friendly at an affordable price.

Tons Of Ways To Save. You have a lot of rules to play with in order to save the most money.

Save For Multiple Goals. You can save for a few goals at once and even have separate rules for each one.

Safety Measures. With their transfer rule in place for every user, you can rest assured Qapital will never cause your account to overdraft.

Drawbacks

Monthly Cost. This is only a drawback because the service used to be free. However, the fee is extremely low for the value Qapital adds and most all users will save a lot more money than they pay in monthly fees.

Linked Accounts Breaking. This only happens once in a while but it does happen. This is when Qapital loses access to your funding account.

You will need to relink your funding account with Qapital. The process takes less than a minute and has happened to me a few times over the years.

Lack Of Interest. Saving money is great. Unfortunately your savings don’t earn interest with Qapital unless you have a checking account with them.

Customer Service. Qapital customer service can be seen as a negative as well. There is no phone number to call and talk to a person.

Instead, you can chat or email the customer service team for help.

Smartphone Only. The only way you can access your Qapital account is with your phone. There is no web based platform for you to log into.

Frequently Asked Questions

Many people have questions about Qapital. This section is a summary of the most common questions.

Is Qapital legit?

Qapital was born in the US in 2015 and has since become one of the most downloaded apps. In fact, within 5 months of launching, they had users from all 50 states.

According to the Better Business Bureau, Qapital gets a rating of A-.

Is my personal information safe?

Qapital uses the latest SSL and TSL encryption standards and your account numbers are never stored on Qapital servers.

There are also added features like Remote Lock, Fingerprint ID, Passcode Access and Passcode Lock to further ensure you and your information is safe.

When it comes to your money, all accounts are FDIC insured up to $250,000.

In addition to the above protections, understand that Qapital does not sell any of your information to third parties.

This is how those companies make money. They sell your information or share it with advertisers.

Since Qapital makes money on a subscription model, there is no need to sell your information to third parties.

What do I need to open a Qapital account?

In order to open an account with Qapital, you need to be 18 years of age or older and have a US based checking account.

There is no minimum deposit required to open an account.

Also, you will need to have a smartphone as Qapital only works through an app and not on your computer.

How does the overdraft protection work?

Overdraft protection works by pausing all round ups and rules if your funding account is at $100 or less.

No round ups or rules will complete until the balance in your funding account rises above $100.

Is Qapital FDIC insured?

Yes.

The money in your Qapital accounts are held at Wells Fargo and are covered by standard FDIC Insurance.

Does Qapital pay interest?

Yes.

If you have a checking account, you will earn interest on your money.

The interest is compounded monthly and the rate is currently 0.01%.

If you don’t have a checking account with Qapital, you don’t earn any interest.

Here is how I overcome this.

I set up my savings goal with Qapital and once I hit my goal, I transfer the money back and then deposit it into my savings account at CIT Bank.

For longer term goals where I am saving a lot of money, I will make the transfer at set intervals, like every $500 so that I can take advantage of interest.

It isn’t ideal, but over time, the interest I earn adds up and makes a difference.

Does Qapital charge a fee?

Qapital does charge a monthly fee. The fee varies based on the level of features you want access to.

- Basic: $3 monthly fee

- Complete: $6 monthly fee

- Master: $12 monthly fee

You can get more information on what you get for each fee level in the Fees section of this review.

Which Qapital monthly plan is best?

Since no one’s financial situation is identical, this isn’t a question that is easy to answer.

With that said, most users start out with the Basic plan so they can take advantage of automated savings.

This will help you to build your savings and make saving money a habit.

If you are interested in investing your money, the Complete plan is a viable option as well.

There are other micro investing apps out there, like Acorns, that charges $1 a month for its investing service.

With Qapital you are paying $3 a month. But some people prefer to have their accounts streamlined in one place to make things less complicated.

As for the Master plan, it is good for people who are serious about taking complete control of their money and need assistance in doing so.

For example, I encourage you to understand your values when it comes to money so you can stop wasting money on things that don’t matter.

This is what the Master plan helps with as well. But it turns it into a game-like interaction which might be a benefit to some.

How do I get my money back from Qapital?

When your money is your savings account, you simply go into the app and set up a transfer back to your bank for the amount you specify.

Once you enter the transfer in the app, Qapital will process it and transfer the money.

How long does it take Qapital to transfer money?

If you are transferring money between your checking account and your Qapital savings account, transfers typically take 2-3 business days.

If you are transferring money from your Qapital Invest account, the transfer takes up to 5 business days because the assets need to be sold in your account first.

How does Qapital make money?

Qapital makes money a couple ways.

First is from the monthly fees it charges users.

The second way they make money is when you swipe your debit or credit card. The card brand, like Visa pays Qapital a small fee.

Alternatives To Qapital

There are a few competitors to Qapital.

The two biggest are Digit and Tip Yourself.

Below is a head-to-head comparison of each.

Qapital vs. Digit

Digit was the first automated saving plan app on the scene. They work much the same as Qapital does, but there are some important differences.

Mainly, Digit, analyzes your spending and makes small transfers to a savings account throughout the month based on this analysis.

Another difference is there is no app for Digit. You interact with the service mainly through text messaging on your phone.

Finally, Digit charges $5 a month for their service.

As of this writing, they offer no other features other than automating your savings.

This is why I prefer Qapital. You have more options for how you save your money and at a lower monthly cost.

Qapital vs. TipYourself

TipYourself works by tipping yourself or rewarding yourself when you do something good or avoid something bad.

The biggest issue with this app is it is entirely manual. There is no automated savings feature.

In other words, you physically have to go into the app and tip yourself every time you want to reward yourself.

The benefit here is it is completely free.

But in my opinion, I would rather pay a small monthly fee and have my savings automated.

Wrapping Up

At the end of the day, Qapital does exactly what it says and does it great.

Automating your savings has never been easier.

Within minutes you have your goals and rules set up and will start saving money on a regular basis, helping you to get ahead.

As with anything, there are some things I would love to see added, like interest paying accounts, but given the goal here is to simply get you to save money, I can’t knock Qapital.

If you want to start saving money effortlessly, I encourage you to look into Qapital.

You won’t be disappointed.

I have over 15 years experience in the financial services industry and 20 years investing in the stock market. I have both my undergrad and graduate degrees in Finance, and am FINRA Series 65 licensed and have a Certificate in Financial Planning.

Visit my About Me page to learn more about me and why I am your trusted personal finance expert.